High Performance Pigments Market Size, Share & Industry Analysis, By Type (Organic, Inorganic, and Hybrid), By Application (Coatings, Plastics, Inks, Cosmetics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

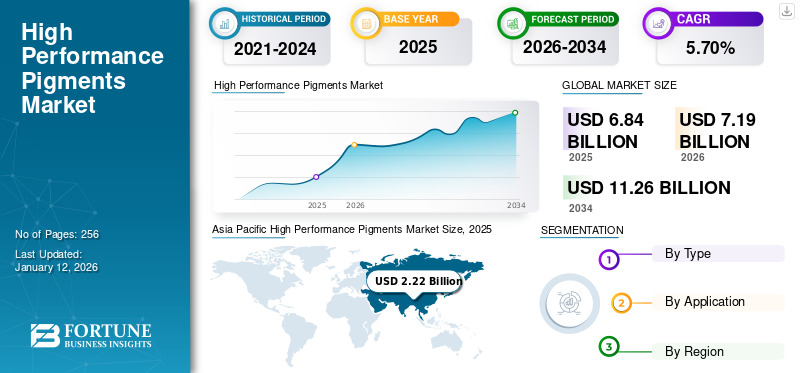

The global high-performance pigments market size was valued at USD 6.84 billion in 2025. The market is projected to grow from USD 7.19 billion in 2026 to USD 11.26 billion by 2034 at a CAGR of 5.70% during the forecast period of 2026-2034. Asia Pacific dominated the high-performance pigments market with a market share of 32% in 2025.

High Performance Pigments (HPPs) are a class of organic and inorganic pigments distinguished by their superior durability, heat stability, weather resistance, lightfastness, and chemical inertness compared to conventional pigments. Engineered for demanding environments, they retain color strength and brilliance under harsh conditions. Applications span automotive coatings, industrial paints, plastics, inks, and high-end packaging, where long-lasting color, gloss retention, and resistance to fading or degradation are critical. HPPs are also increasingly used in electronics and specialty decorative products. BASF, DIC CORPORATION, Heubach GmbH, LANXESS, and Sudarshan Chemical Industries Limited are the key players operating in the market.

GLOBAL HIGH PERFORMANCE PIGMENTS MARKET TAKEAWAYS

Market Size & Forecast:

- 2025 Market Size: USD 6.84 billion

- 2026 Market Size: USD 7.19 billion

- 2034 Forecast Market Size: USD 11.26 billion

- CAGR: 5.7% from 2026–2033

Market Share:

- Asia Pacific led in 2025 with a 32% share, rising from USD 2.22 billion in 2025 to USD 2.36 billion in 2026.

- By type: Inorganic pigments dominated due to durability, heat resistance, and chemical stability.

- By end-use: Coatings held the largest share, driven by automotive, construction, and industrial applications.

Key Country Highlights:

- China: Rapid industrialization boosts plastics and inks applications.

- India: Growth in automotive and construction sectors drives coatings demand.

- U.S.: Focus on sustainable, vibrant coatings for automotive and consumer goods.

- Germany: Emphasis on eco-friendly pigments for automotive and architectural coatings.

- Japan: Rising demand in cosmetics and electronics supports specialty pigments.

High Performance Pigments Market Trends

Technological Advancement & Energy Efficiency Needs Propel Adoption of Smart HPPs

Globally, rapid advancements in pigment technology coupled with a need for energy-efficient solutions are driving the adoption of smart pigments in the market. Innovations such as IR-reflective and thermochromic pigments are gaining prominence, as they reflect infrared light to minimize heat absorption in buildings and vehicles, addressing rising energy costs and environmental concerns.

- Asia Pacific witnessed a growth from USD 2.22 billion in 2025 to USD 2.36 billion in 2026.

These smart pigments provide advanced functionality, such as temperature regulation, while retaining the durability and vibrancy HPPs are known for, making them highly sought across various industries. Consequently, sectors such as construction and automotive are increasingly incorporating smart high-performance pigments into energy-efficient coatings to enhance sustainability and meet regulatory standards.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Global Automotive Industry Expansion Fuels Market Growth

The global automotive industry’s rapid expansion, particularly with the exponential rise in electric vehicles (EVs), is significantly driving demand. A total of 17.3 million electric cars were produced globally in 2024, according to the International Energy Agency. Manufacturers require advanced coatings that deliver exceptional durability, weather resistance, and vibrant aesthetics to enhance vehicle appeal and ensure long-term performance. High performance pigments, renowned for their superior lightfastness, heat stability, and chemical resistance, are perfectly suited for automotive paints, ensuring finishes withstand harsh environmental conditions while maintaining color integrity over extended periods.

The market is witnessing a notable rise in demand, as automotive companies increasingly prioritize high-quality, sustainable pigments to meet stringent consumer expectations and comply with global regulatory standards. This trend is particularly pronounced in key regions such as Asia Pacific and North America, where EV production is accelerating rapidly, prompting HPP manufacturers to innovate and expand their Type portfolios to cater to this fast-growing sector.

Market Restraints

High Production Costs and Regulatory Pressures Impede the Market Growth

The HPPs market is constrained by high production costs, as their complex manufacturing processes and specialized raw materials make them far pricier than conventional pigments. This cost barrier limits their adoption in price-sensitive industries such as textiles, hindering market expansion despite demand in premium sectors such as automotive coatings.

Moreover, stringent global environmental regulations on emissions and toxicity add further challenges. Manufacturers must invest significantly in eco-friendly technologies to meet standards set by regulatory bodies in regions such as Europe and North America. These compliance expenses strain finances, especially profitability and slowing innovations, which ultimately restrict the high performance pigments market growth potential.

Market Opportunities

Adoption of High-Performance Pigments in Industrial and Building Materials will Create Significant Growth Opportunities

The integration of type additives into Industrial and building materials presents significant growth opportunities in the industry. The pandemic has increased awareness of the necessity for hygiene in both public and private spaces. These additives can help minimize the spread of bacteria, viruses, and fungi, making environments safer for occupants. They can be incorporated into various materials, such as paints, coatings, flooring, countertops, door handles, and HVAC systems, providing long-lasting protection against pathogens.

Homeowners are increasingly looking for materials that promote a healthier living environment. Performance Pigments in countertops, flooring, and wall paints are becoming popular choices in residential and Industrial settings. Additionally, property developers and managers in the commercial real estate sector are using antimicrobial materials to attract tenants and buyers who prioritize health and safety. Industrial companies and material suppliers are also incorporating antimicrobial properties as a value-added feature to differentiate their products in the market.

Market Challenges

Increase in Production Costs Could Lead to Several Market Challenges

The high production costs associated with high performance pigments can affect pricing strategies and profit margins. The primary raw materials used, such as silver, copper, and zinc, are expensive and subject to price fluctuations. These fluctuations can significantly affect the final cost of type additives, making them less competitive in the market.

Despite their excellent antimicrobial properties, silver-based additives are particularly costly. The high production costs of these additives increase the overall production cost, impacting manufacturers' profit margins and limiting their use in various applications.

Segmentation Analysis

By Type

Inorganic Segment Dominated Market Owing to Increasing Use in Automotive & Transportation Industry

Based on type, the market is classified into organic, inorganic, and hybrid.

The inorganic segment held the largest high performance pigments market with a share of 59.53% in 2026 and is expected to experience substantial growth in the coming years. Inorganic high performance pigments, derived from mineral compounds, are celebrated for their durability, heat resistance, and chemical stability, making them vital for automotive coatings, industrial coatings, and construction materials. Growth is supported by ongoing research enhancing color quality and weather resilience, but environmental concerns over certain heavy metals spark regulatory attention.

The organic segment is projected to experience significant growth in the coming years. Organic high performance pigments, crafted from carbon-based compounds, shine with their vibrant colors, strong tinting ability, and eco-friendly nature, gaining favor in sustainable uses such as coatings and cosmetics. Opportunities emerge from innovation in bio-based options and growing demand for green types in regions prioritizing sustainability, through their sensitivity to heat and light demands for further development.

By Application

To know how our report can help streamline your business, Speak to Analyst

Coatings Segment to Dominate Market Owing to Its Extensive Applications

Based on application, the market is classified into coatings, plastics, inks, cosmetics, and others.

The coatings segment is projected to dominate the market with a share of 55.35% in 2026, due to its extensive applications. Dominating the market, the coatings segment thrives in high-performance pigments’ ability to resist weather, retain color, and gloss, serving automotive, industrial, and decorative needs. Global infrastructure and vehicle production trends fuel growth, though fluctuating raw material costs and strict emission rules pose hurdles.

The plastics segment flourishes with high-performance pigments enhancing aesthetic and functional qualities, ideal for packaging, consumer goods, and automotive parts, supported by their heat stability. Growth remains steady, but regulations on heavy metals in food-contact applications push toward organic alternatives, raising costs. The plastics segment is expected to hold a 20% share in 2024.

High Performance Pigments Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific High Performance Pigments Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market and was valued at USD 2.36 billion in 2026. Asia Pacific stands as the fastest-growing region, propelled by rapid industrialization and urbanization, especially in China and India. The construction and automotive sectors drive demand for cost-effective, high-durability coatings, while the packaging and electronics industries boost plastics and inks applications. A large consumer base and rising disposable incomes fuel cosmetics growth, particularly in South Korea and Japan, where aesthetic trends are strong. The Japan market is anticipated to reach USD 0.29 billion by 2026, the China market is set to expand to USD 1.23 billion by 2026, and the India market is estimated to reach USD 0.41 billion by 2026.

- In China, the plastics segment is estimated to hold a 20.8% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

North America

The North America high performance pigments market is characterized by a strong emphasis on innovation and sustainability, driven by advanced industrial and consumer sectors. The region benefits from a robust automotive industry, particularly in the U.S., where high-performance coatings are in demand for vehicle finishes, alongside a thriving cosmetics market favoring vibrant and safe pigments. Regulatory pressures, especially around environmental standards, push manufacturers toward organic and hybrid pigments, though inorganic types remain prevalent due to their durability in construction and industrial applications. The U.S. market is projected to reach USD 1.26 billion by 2026.

Europe

Europe leads with a mature and highly regulated HPP market, where sustainability and quality are paramount. The automotive and architectural coatings sectors, particularly in Germany and France, rely heavily on durable, weather-resistant pigments, while the cosmetics industry, notably in the UK and Italy, seeks natural and safe options. Growth is fueled by a shift toward eco-friendly solutions and premium packaging inks, with opportunities in green building materials and luxury goods. The UK market is expected to grow to USD 0.52 billion by 2026, and the Germany market is forecast to reach USD 0.74 billion by 2026.

Latin America

The Latin America HPP market is emerging, with growth centered around construction and automotive sectors, notably in Brazil and Mexico. Coatings dominate due to infrastructure development and vehicle production, while plastics gain traction in packaging and consumer goods. Opportunities lie in expanding industrial bases and rising consumer demand for cosmetics, particularly in urban areas, though investment in advanced production technologies remains a key factor.

Middle East & Africa

The Middle East & Africa region is driven by construction and industrial growth, with Saudi Arabia and South Africa leading demand for high-performance coatings in infrastructure projects. Plastic applications are growing in packaging and construction materials, supported by population growth and urbanization. Opportunities emerge in oil and gas-related coatings and agricultural applications, with potential for hybrid pigments to meet diverse needs.

Competitive Landscape

Key Market Players

Strategic Expansions and Sustainability Initiatives Drive Innovation & Global Growth

Key players in the market are focusing on expanding their global presence, enhancing type portfolios, and developing eco-friendly, sustainable pigment solutions. Strategies include acquisition, research and development investments, and collaboration to strengthen market positioning. Many companies are introducing low-carbon and high-quality pigments to meet growing demand in the coatings, inks, and plastics industry. BASF, DIC CORPORATION, Heubach GmbH, LANXESS, and Sudarshan Chemical Industries Limited are the major players in this market.

List of Top High Performance Pigment Companies Profiled

- BASF (Germany)

- Ferro SA (South Africa)

- Heubach GmbH (Germany)

- LANXESS (Germany)

- Pidilite Pigment (India)

- Atul Ltd (India)

- Sudarshan Chemical Industries Limited. (India)

- Venator Materials PLC. (UK)

- DIC CORPORATION (Singapore)

- The Chemours Company (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Sudarshan Chemical acquired Germany’s Heubach Group, creating a global high-performance pigments leader with 19 sites worldwide. The deal strengthens R&D, expands market presence, and enhances its specialty portfolio across coatings, plastics, and inks sectors.

- February 2025: LANXESS introduced a new Scopeblue Bayferrox iron oxide yellow pigment for coatings, offering the same quality but with a roughly 35% lower carbon footprint, certified by TUV and ISCC plus.

- January 2024: Pidilite Industries collaborated with Italy’s Syn-Bios to expand the supply of advanced leather chemicals. This collaboration combines a strong regional network with Syn-Bios’s R&D expertise to offer an eco-friendly, high-performance solution for the growing South Asian leather industry.

- January 2022: Clariant sold its pigment business to Huebach and SK Capital, retaining a 20% stake. The move sharpens Clariant’s focus on specialty chemicals while strengthening Huebach’s global position in the pigments industry.

- June 2021: DIC Corporation finalized the acquisition of BASF’s Colors & Effects (BCE) pigments business, significantly expanding its global pigment portfolio. The move enhances DIC’s market presence, innovation capacity, and competitiveness in specialty pigments.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, types, and applications. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 5.70% from 2026 to 2034 |

|

Segmentation |

By Type · Organic · Inorganic · Hybrid |

|

By Application · Coatings · Plastics · Inks · Cosmetics · Others |

|

|

By Region · North America (By Type, By Application, and By Country) · U.S. (By Application) · Canada (By Application) · Europe (By Type, By Application, and By Country) o Germany (By Application) o France (By Application) o U.K. (By Application o Italy (By Application) o Rest of Europe (By Application) · Asia Pacific (By Type, By Application, and By Country) o China (By Application) o India (By Application) o Japan (By Application) o South Korea (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Type, By Application, and By Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Type, By Application, and By Country) o Saudi Arabia (By Application) o South Africa (By Application) o Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 6.84 billion in 2025 and is projected to record a valuation of USD 11.26 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 2.22 billion.

Recording a CAGR of 5.70%, the market will exhibit steady growth during the forecast period of 2026-2034.

By application, the coatings segment is expected to lead the market in the coming years.

Global automotive industry expansion is a key factor driving the growth of the market.

Asia Pacific held the highest market with a share of 32% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us