Organic Pigments Market Size, Share & Industry Analysis, By Source (Natural and Synthetic), By Type (Azo Pigments, Phthalocyanine Pigments, High-Performance Pigments, and Others), By Application (Printing Ink, Paints & Coatings, Plastics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

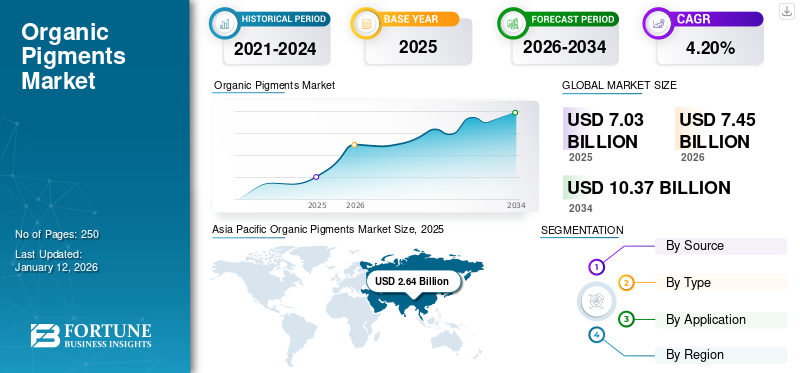

The global organic pigments market size was valued at USD 7.03 billion in 2025. The market is projected to grow from USD 7.45 billion in 2026 to USD 10.37 billion by 2034, exhibiting a CAGR of 4.20% during the forecast period. Asia Pacific dominated the organic pigments market with a market share of 38% in 2025.

Organic pigments are widely used across various industries, including paints and coatings, plastics, textiles, printing inks, cosmetics, and automotive applications, due to their superior color strength, brightness, and environmental benefits compared to inorganic pigments. These pigments are derived from natural sources or synthesized through complex chemical processes, typically involving petroleum-based raw materials. Key types include azo pigments, phthalocyanine pigments, quinacridone pigments, and high-performance pigments, each offering distinct properties in terms of stability, solubility, and color vibrancy.

The increasing demand for sustainable and eco-friendly coloring solutions is significantly driving market growth, with stringent environmental regulations promoting the adoption of non-toxic and heavy-metal-free pigments. The growth of end-use industries, particularly in emerging economies, is a major driving factor for market expansion, as sectors such as packaging, construction, and automotive continue to seek high-quality, durable, and environmentally responsible coloring solutions. Additionally, advancements in nanotechnology and pigment dispersion techniques are further enhancing the performance of organic pigments, making them more resistant to heat, chemicals, and light exposure.

Sudarshan Chemical Industries Ltd, DIC Corporation, Huntsman Corporation, Sun Chemical, and Heubach GmbH are among the key players operating in the industry.

GLOBAL ORGANIC PIGMENTS MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 7.03 billion

- 2026 Market Size: USD 7.45 billion

- 2034 Forecast Market Size: USD 10.37 billion

- CAGR: 4.20% from 2026–2034

Market Share:

- Asia Pacific led the market in 2025 with a 38% share, rising from USD 2.64 billion in 2025 to USD 2.82 billion in 2026.

- By source, natural pigments dominated in 2024 due to increasing environmental concerns and rising demand in food coloring and cosmetics.

- By type, azo pigments held the largest share owing to their affordability, vivid color range, and usage in inks, coatings, and packaging.

- By application, printing ink remained the leading segment, fueled by demand in flexible packaging and digital printing.

- Technological innovations like nanostructured pigments and improved dispersion methods are improving performance across applications.

Key Country Highlights:

- China: Major hub for paints, plastics, and inks production; "Made in China 2025" fuels pigment demand.

- India: Booming construction, packaging, and textiles sectors support organic pigment consumption.

- United States: Environmental concerns drive demand in paints, plastics, and automotive sectors.

- Germany: Regulatory shifts and automotive coatings drive adoption of sustainable pigments.

- Brazil: Packaging and automotive sectors boost pigment usage, supported by eco-regulations.

- UAE & South Africa: Infrastructure growth and sustainable product focus drive regional demand.

MARKET DYNAMICS

ORGANIC PIGMENTS MARKET TRENDS:

Expansion in Emerging Markets and Diverse Applications Drive the Market Growth

The global market is witnessing substantial growth in emerging economies in Asia Pacific, Latin America, and parts of the Middle East and Africa. This expansion is fueled by rapid industrialization, urban development, and rising consumer demand for colored products in these regions. Countries such as China, India, Brazil, and Indonesia are investing heavily in infrastructure, automotive production, and consumer goods manufacturing sectors that are key consumers of organic pigments.

- Asia Pacific witnessed a organic pigments market growth from USD 2.31 billion in 2023 to USD 2.47 billion in 2024.

- For instance, China has become a global hub for the production of paints and coatings, plastics, and printing inks, which are the primary end-use industries for organic pigments. The country’s “Made in China 2025” initiative emphasizes the development of advanced manufacturing, indirectly boosting demand for high-quality pigments. Similarly, India’s construction boom, growing packaging industry, and expanding textile sector are driving the consumption of organic pigments for decorative paints, synthetic fibers, and flexible packaging materials.

MARKET DRIVERS:

Increasing Preference for Eco-Friendly and Sustainable Pigments to Drive Market Growth

Environmental concerns and stringent regulations governing the use of hazardous substances in coloring agents are driving the shift toward organic pigments. Consumers and industries alike are seeking eco-friendly alternatives, leading to a growing demand for non-toxic and heavy-metal-free organic pigments. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) have imposed strict guidelines restricting the use of harmful inorganic pigments such as lead chromates, pushing industries to adopt safer organic alternatives. For example, the packaging industry, particularly in food and beverage applications, prefers organic pigments due to their safety profile and regulatory compliance.

- Companies such as BASF SE and Clariant have responded to this trend by developing bio-based and sustainable organic pigments that minimize environmental impact.

- Additionally, initiatives such as the European Green Deal and increasing consumer awareness of eco-friendly products are accelerating the transition to sustainable pigments, making this a key growth driver for the market.

MARKET RESTRAINTS:

High Costs and Complex Manufacturing Processes May Hamper Market Growth

Organic pigments require intricate chemical synthesis involving multiple steps, specialized equipment, and expensive raw materials such as petroleum-based derivatives. These complexities result in higher production costs, making them more expensive for end-users in industries such as paints, coatings, and printing inks. For instance, phthalocyanine and quinacridone pigments, which offer excellent color strength and stability and involves sophisticated synthesis routes that require strict control over reaction conditions and purification steps, increasing both costs and production time. Additionally, organic pigment production generates byproducts that require proper disposal or recycling, adding to operational expenses.

- For instance, in July 2024, the European Union imposed tariffs of up to 39.7% on Chinese imports of titanium dioxide (TiO₂), a crucial raw material for pigments. These tariffs have raised concerns among EU paint manufacturers about increased costs and potential factory closures.

Fluctuating raw material prices further exacerbate cost-related challenges, as the organic pigments industry relies on petroleum-based intermediates, which are subject to global supply chain disruptions and price volatility.

- For instance, the rising cost of crude oil directly impacts the price of key precursors used in organic pigment synthesis, making cost management difficult for manufacturers. Companies such as BASF and Clariant have faced profitability concerns due to raw material inflation, prompting them to invest in cost-efficient production methods and sustainable alternatives.

MARKET OPPORTUNITIES:

Technological Advancements in Pigment Manufacturing to Create Lucrative Opportunities in the Market

Advancements in pigment manufacturing processes, including nanotechnology and improved dispersion techniques, are significantly enhancing the performance of organic pigments, driving the organic pigments market growth. Innovations in nanostructured pigments have led to improved color strength, weather resistance, and heat stability, making them more competitive against their inorganic counterparts. For instance, nanotechnology is being leveraged to develop high-performance pigments that exhibit superior lightfastness and chemical resistance, benefiting applications in automotive coatings, high-end plastics, and specialty inks.

The growing demand for water-based inks and high-performance coatings which require finely dispersed organic pigments has led to the adoption of advanced pigment dispersion techniques, ensuring better stability and color consistency. These technological advancements are making organic pigments more versatile and efficient, further driving their global demand.

- Companies such as Sun Chemical and DIC Corporation are investing heavily in research and development to create advanced pigment formulations that cater to the evolving needs of industries. They are particularly focusing on sustainable solutions and innovative applications across various industries, including coatings, cosmetics, and plastics.

MARKET CHALLENGES:

Intense Competition from Inorganic Pigments and Alternative Technologies Pose Challenge to the Market

Despite their vibrant colors and environmental appeal, organic pigments face stiff competition from both inorganic pigments and emerging colorant technologies. Inorganic pigments, such as titanium dioxide, iron oxides, and ultramarine blue, offer superior opacity, heat resistance, and UV stability, traits that are crucial in demanding applications such as exterior coatings, automotive finishes, and industrial paints. They are also generally less expensive to produce and more chemically stable, making them the preferred choice for applications where durability and performance outweigh aesthetic vibrancy. Additionally, inorganic pigments often require fewer additives or stabilizers, reducing the complexity and cost of formulations. Hence, preference for substitutes from end-users pose a challenge to product adoption.

Download Free sample to learn more about this report.

Segmentation Analysis

By Source

Natural Segment Held the Dominant Market Share Due to Increasing Environmental Concerns

Based on source, the market is segmented into natural and synthetic.

The natural grade segment accounted for the largest market share in 2024, driven by the rising demand for eco-friendly and sustainable products. They are commonly used in niche markets such as cosmetics, food coloring, and high-end art materials, supported by a growing preference for natural and sustainable alternatives. Increasing environmental concerns have also fueled the usage of natural pigments in intelligent food packaging.

The synthetic segment is expected to grow significantly during the forecast period. These pigments offer higher durability, better gloss, and high lightfastness compared to natural pigments. They are produced through chemical processes, allowing for consistent quality and provide a wide range of customizable colors for various industrial applications.

By Type

Azo Pigments Segment Held the Dominant Share Due to its Properties

Based on type, the market is segmented into azo pigments, phthalocyanine pigments, high-performance pigments, and others.

The azo pigments segment held the largest global organic pigments market share in 2024 due to their cost-effectiveness, vibrant color range, and widespread application across industries such as printing inks, coatings, and plastics. Their high tinting strength and good lightfastness make them a preferred choice for packaging and commercial printing. Additionally, the rising demand for eco-friendly and non-toxic colorants in food packaging and textiles is further driving the segment’s growth.

The phthalocyanine pigments segment is set to witness significant growth during the forecast period, driven by the increasing demand for durable and weather-resistant pigments in automotive and industrial coatings.

The growth of the high-performance pigments segment is attributed to the rising preference for high-end, long-lasting color solutions in luxury goods, high-tech coatings, and high-quality printing.

By Application

Printing Ink Segment Led the Market Due to Product’s High Utilization

Based on application, the market is segmented into printing ink, paints & coatings, plastics, and others.

The printing ink segment held the largest global market share in 2024, driven by the growing packaging industry, particularly flexible packaging, which relies heavily on high-quality, vibrant, and durable inks. The shift from traditional printing methods to digital and inkjet printing has further boosted the need for organic pigments due to their superior color strength, dispersion properties, and environmental benefits.

The paints & coatings segment is expected to grow significantly during the forecast period due to the rising demand for eco-friendly and non-toxic coatings, particularly in architectural, automotive, and industrial applications. The expanding construction industry, coupled with increasing automotive production in emerging economies, further drives the demand.

The plastics segment is set to witness significant growth during the forecast period, driven by the growing demand for brightly colored and aesthetically appealing plastic products in consumer goods, automotive components, and packaging. This trend has significantly boosted the adoption of organic pigments in the plastic industry.

Organic Pigments Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific:

Asia Pacific Organic Pigments Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest market share in 2024, generating revenue of USD 2.47 billion. The market growth is attributed to rapid industrialization, urbanization, and a growing emphasis on sustainability. Countries such as China and India are major contributors, with China benefiting from advanced manufacturing technologies and a robust plastics and packaging industry. India’s rich availability of natural colorant sources and cost-effective labor makes it an attractive hub for organic pigment production.

North America:

Organic pigments market in North America is expected to grow significantly during the forecast period, driven by stringent environmental regulations and a strong emphasis on sustainability. The region’s thriving automotive, packaging, and textiles industries, coupled with increasing consumer preference for eco-friendly products, contribute to market expansion.

The growth of the market in the U.S. is driven by increasing demand across various industries, such as paints and coatings, plastics, printing inks, and textiles. This growth is attributed to the rising environmental sustainability concerns, leading to a shift from heavy metal-based inorganic pigments to eco-friendly organic alternatives. Organic pigments offer vibrant and stable color options, making them essential in manufacturing colored products.

Europe:

Europe is projected to be the second-largest in the global market, driven by stringent regulations favoring organic pigments over synthetic alternatives. The region’s well-established automotive sector and growing demand for sustainable packaging solutions further boost market prospects.

Latin America:

The Latin American market is expected to grow moderately, driven by the region’s expanding automotive and packaging sectors. The growing emphasis on sustainable practices and regulations favoring eco-friendly products are expected to drive the adoption of organic pigments in various applications.

Middle East & Africa:

The Middle East & Africa region is witnessing steady demand due to expanding construction activities and a rising focus on infrastructure development. Countries such as Saudi Arabia and South Africa are leading markets, with the UAE is expected to register the fastest growth within the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on R&D Efforts to Provide Enhanced Features

The major players operating in the market are Sudarshan Chemical Industries Ltd, DIC Corporation, Huntsman Corporation, Sun Chemical, and Heubach GmbH.

Market participants face intense competition from regional and international players with large distribution networks and good supplier and regulatory expertise. Major market players are engaged in research and development to produce superior-quality colors to provide enhanced features. Furthermore, the companies are now promoting strategic partnerships to improve their R&D efforts. The businesses put great emphasis on increasing the area of service to increase market share and boost revenue growth. The industry comprises a mix of large multinationals and small producers, many of whom operate with high volumes of production. Companies are dedicated to introducing new goods to align with the evolving consumer preferences.

LIST OF KEYORGANIC PIGMENTS COMPANIES PROFILED:

- Sudarshan Chemical Industries Ltd (India)

- DIC Corporation (Japan)

- Huntsman Corporation (U.S.)

- Sun Chemical (U.S.)

- Dainichiseika Colour & Chemicals Mfg Co Ltd (Japan)

- Ferro Corporation (U.S.)

- Heubach GmbH (Germany)

- Atul Ltd (India)

- Trust Chem (China)

- Toyocolor Co., Ltd (Japan)

- Lanxess (Germany)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Sun Chemical launched two new stir-in pigment preparations for the coatings market, which is eXpand! Yellow ST 1018 and eXpand! Black ST 9005. eXpand! Yellow ST 1018 combines intense chroma with reduced scattering and high transparency, which enables the formulation of a new generation of stylings in automotive coatings. The eXpand! Black ST 9005 stir-in solution delivers outstanding jetness and a unique black shade due to reduced scattering.

- January 2022: The Heubach Group and SK Capital Partners completed the acquisition of Clariant’s global colorants business, operating under the Heubach brand and creating a global pigment technology leader.

- July 2021: DIC Corporation and Debut Biotech entered a joint development agreement to develop a new method for synthesizing natural pigments, achieving significantly higher titers than traditional fermentation methods.

- June 2021: Sun Chemical and DIC Corporation acquired BASF’s global pigments business. This acquisition would extend DIC's portfolio as a global manufacturer of pigments for various applications such as electronic displays, cosmetics, coatings, paints, and inks.

- December 2020: Asahi Songwon Colors began commercial operations at the Dahej plant of Asahi Tennants Color, its 51:49 joint venture with Tennants Textile Colours Limited (TTC) in the U.K. This acquisition would widen Asahi’s presence as a global pigments supplier.

REPORT COVERAGE

The global market research report provides detailed market analysis and focuses on crucial aspects such as leading companies, types, and applications. Additionally, the report offers insights into market trends and highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) & Volume (Kiloton) |

|

Growth Rate |

CAGR of 4.20% during 2026-2034 |

|

Segmentation |

By Source, By Type, By Application, and Region |

|

By Source |

|

|

By Type |

|

|

By Application |

|

|

By Geography |

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 7.03 billion in 2025 and is projected to reach USD 10.37 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 2.64 billion.

The market is expected to exhibit a CAGR of4.20% during the forecast period.

The printing ink segment led the market by application.

Increasing preference for eco-friendly and sustainable pigments are key factors driving market growth.

Sudarshan Chemical Industries Ltd, DIC Corporation, Huntsman Corporation, Sun Chemical, and Heubach GmbH are the top players in the market.

Asia Pacific dominated the market in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us