India Cloud Computing Market Size, Share & Analysis, By Type (Public Cloud, Private Cloud, and Hybrid Cloud), By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT and Telecommunications, Government, Consumer Goods and Retail, Healthcare, Manufacturing, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

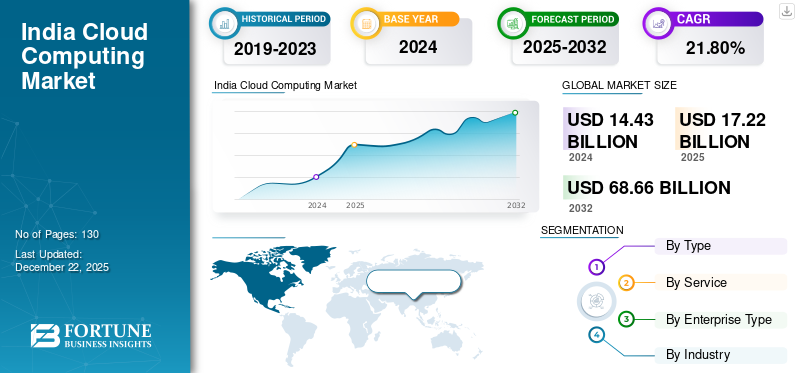

India cloud computing market size was valued at USD 14.43 billion in 2024. The market is projected to grow from USD 17.22 billion in 2025 to USD 68.66 billion by 2032, exhibiting a CAGR of 21.80% over the forecast period.

India’s cloud computing landscape is changing rapidly. This shift is fueled by an increase in digital-first businesses, a push for modernization in the public sector, and a population that understands technology. Unlike in more developed markets, India is skipping traditional infrastructure and embracing cloud-native solutions on a large scale. Cloud platforms support fintech innovations, digital governance, and outreach in rural areas, becoming essential to the digital economy. Through local innovation and partnerships with global companies, India is not only adopting the cloud; it is transforming how it addresses both local and global challenges.

- According to IBEF, by 2026, cloud technology is expected to contribute 8% to India’s GDP.

India Cloud Computing Market Trends

Government Driven Digital Initiatives to be Key Driver for Market Growth

The Indian government is increasing cloud use with programs such as Digital India, IndiaAI, and the National E-Governance Plan. These initiatives promote digital services, improve public service delivery, and support AI development, all driven by cloud technology. They also focus on data security and sovereignty, encouraging investment in local data centers. This builds a solid foundation for broader cloud adoption across the country.

Key takeaways

- The India Cloud Computing Market is projected to be worth USD 68.66 billion in 2032.

- In by type segmentation, public cloud accounted for around 59.4% of the India Cloud Computing Market in 2024.

- In the by service segmentation, Infrastructure as a Service (IaaS) is projected to grow at a CAGR of 23.0% in the forecast period.

- In the enterprise type segmentation, Large Enterprises accounted for around 50.40% of the market in 2024.

India Cloud Computing Growth Factors

Growing Mobile and Internet Penetration to Boost Market Growth

India has witnessed a significant increase in smartphone users with millions of people coming online every year. Internet access is also spreading quickly, reaching not only big cities but also smaller towns and rural areas. This growing connectivity drives higher demand for cloud-based applications and services as people increasingly depend on their smartphones for communication, entertainment, education, and business activities.

Cloud computing allows users to access their data and applications anytime and anywhere without needing powerful devices or large storage locally. This convenience supports India’s mobile-first approach and encourages companies to develop cloud-enabled solutions that can reach a wider and more diverse audience.

- According to Data for India, India has over one billion active SIM cards for a population of about 1.4 billion, with 81 mobile connections per 100 people.

India Cloud Computing Market Restraints

Connectivity and Infrastructure Limitations Limits Market Growth

India has experienced rapid growth in internet access, but high-speed connectivity remains uneven, especially in rural and semi-urban areas. Many regions suffer from slow or unreliable internet, which impacts the performance and reliability of cloud services that require fast and stable connections.

India's power infrastructure also struggles to meet the high energy demands of data centers. Frequent power outages and voltage fluctuations can disrupt the availability of cloud services and raise operational costs, as providers depend on backup power solutions.

These connectivity and power challenges hinder the scalability and use of cloud computing across the country, particularly outside major urban centers.

India Cloud Computing Market Segmentation Analysis

By Type

Based on type, the market is divided into public cloud, private cloud, and hybrid cloud.

The public cloud holds a majority share of the market in India, especially among startups and mid-sized firms, due to its low cost, quick deployment, and scalability. However, the hybrid cloud is growing quickly as organizations want more control over sensitive data while still taking advantage of the cloud's flexibility. With increasing regulatory demands and data security concerns, hybrid setups are becoming the preferred option for sectors such as finance, healthcare, and government.

- According to ET Telecom, in India, nearly three-quarters of enterprise cloud decision-makers adopt multiple cloud deployment models, and a significant 85% engage with two or more public cloud providers to meet their business needs.

By Service

Based on service, the market is trifurcated into infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS).

Software as a service (SaaS) is expected to hold a majority in the market. Companies are seeking flexible solutions to speed up application development and boost productivity. Many organizations choose cloud-based software to avoid steep upfront costs and lessen IT management tasks.

At the same time, infrastructure as a service (IaaS) is expected to grow with the highest CAGR. Businesses, especially in areas such as e-commerce, banking, and IT services, need scalable and adaptable infrastructure to handle increasing data volumes and complex computing requirements. This trend shows India's commitment to cloud adoption, which promotes innovation and cost savings across various industries.

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

Large companies hold a majority in the India cloud computing market share. They use cloud technologies to improve efficiency, scalability, and innovation in sectors such as IT, finance, and manufacturing. At the same time, small and medium-sized enterprises (SMEs) are projected to show the fastest growth in the next few years. Drawn by the low cost, flexibility, and simplicity of cloud adoption, SMEs are increasingly investing in cloud solutions to support their digital transformation and business growth.

- According to an IDC study, nearly 40% of organizations in India are expected to implement cloud services in some capacity by 2024.

By Industry

Based on industry, the market is segmented into BFSI, IT and telecommunications, government, consumer goods, healthcare, manufacturing, and others.

In India, the IT and telecommunication industries lead the cloud computing market, using cloud services to improve connectivity, manage data better, and support digital innovations. These sectors take advantage of the cloud’s ability to handle large operations and changing technology needs.

Meanwhile, the healthcare industry is quickly becoming the fastest-growing adopter. This shift is driven by a greater focus on digital health solutions, remote care, and AI-based medical technologies. Other sectors, such as manufacturing and logistics, are also adopting cloud tools to simplify operations and increase efficiency, which supports the overall India cloud computing market growth services.

List of Key Companies in India Cloud Computing Market

In India’s fast-growing cloud computing market, homegrown tech leaders such as TCS, Infosys, Wipro, LTIMindtree, and Persistent Systems are key in speeding up adoption across different industries. These companies offer a full range of cloud services, including migration, infrastructure, AI integration, and cybersecurity, while helping to build India’s digital backbone with secure and compliant solutions.

TCS is notable for its large-scale deployments and emphasis on sovereign and industry-specific cloud platforms. Infosys, with its Cobalt platform, helps enterprises shift to digital with cloud-native innovations. Wipro excels in hybrid cloud and managed service market. LTIMindtree provides flexible cloud strategies designed for changing business needs. Persistent Systems is recognized for its strong product engineering skills, assisting businesses in creating cloud-first architectures focused on data, AI, and modern applications.

LIST OF KEY COMPANIES STUDIED

- HCL Technologies Limited (India)

- LTIMindtree (India)

- Mphasis (India)

- Freshworks, Inc. (India)

- Persistent Systems (India)

- Airtel India (India)

- TATA Consultancy Services Limited (India)

- Infosys Limited (India)

- Wipro (India)

- Tech Mahindra Ltd (India)

- Happiest Minds (India)

KEY INDUSTRY DEVELOPMENTS

- July 2025: TCS and C-DAC have signed an MoU to build India’s sovereign cloud, aiming to ensure full data localization and strengthen technological self-reliance. The initiative will establish a secure, AI-ready cloud infrastructure within India to support public and private sector digital services.

- February 2025: Altium has partnered with AWS India to launch a new curriculum combining electronics design and cloud computing skills for Indian engineering students. Part of AWS’s Skills to Jobs Tech Alliance, the program includes hands-on training through four AWS modules, covering cloud fundamentals, networking, and IoT. It will be rolled out across 100+ institutions, with added training for educators and industry-focused learning experience.

REPORT COVERAGE

India’s cloud computing market is growing quickly as organizations focus on digital transformation with secure and scalable cloud solutions. There is an increasing preference for hybrid and multi-cloud environments. This shift is driven by the need for operational flexibility and better data control. Regulatory frameworks regarding data privacy and localization are significantly influencing cloud strategies. Key sectors such as banking, healthcare, and manufacturing are using cloud technology to make operations more efficient and encourage innovation. Moreover, strong government initiatives and rising partnerships between technology providers are boosting the creation of new cloud services, preparing India for a strong and future-ready digital ecosystem. The report also covers strategic collaborations, government-led initiatives, and the emergence of innovative cloud-based services that are shaping the next chapter of India’s digital economy.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 21.80% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Public Cloud · Private Cloud · Hybrid Cloud |

|

By Service · Infrastructure as a Service (IaaS) · Platform as a Service (PaaS) · Software as a Service (SaaS) |

|

|

By Enterprise Type · SMEs · Large Enterprises |

|

|

By Industry · BFSI · IT and Telecommunications · Government · Consumer Goods and Retail · Healthcare · Manufacturing · Others |

Frequently Asked Questions

Fortune Business Insights says that the market was worth USD 14.43 billion in 2024.

The market is expected to exhibit a CAGR of 21.80% during the forecast period.

By industry, the IT and telecommunications industry is set to lead the market.

TCS, Infosys, WIPRO, and Persistent Systems are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us