Industrial Noise Control Market Size, Share & Industry Analysis, By Product Type (Flexible, Rigid, and Vibration Isolation), By Application (Internal Noise Control and External Noise Control), and By End-Use Industries (Automotive, Food and Beverages, Machinery, Metals and Mining, Power Generation, Construction Materials Manufacturing, Electronics and Electrical, and Others), and Regional Forecast, 2026 – 2034

INDUSTRIAL NOISE CONTROL MARKET SIZE & FUTURE OUTLOOK

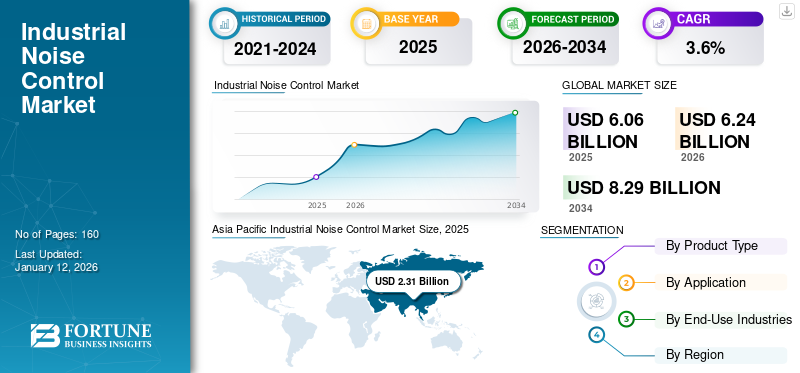

The global industrial noise control market size was valued at USD 6.06 billion in 2025 and is projected to grow from USD 6.24 billion in 2026 to USD 8.29 billion by 2034, exhibiting a CAGR of 3.6% during the forecast period. Asia Pacific dominated the industrial noise control market with a share of 38.1% in 2025.

Industrial noise control market is witnessing steady growth owing to industrial expansion and the growing demand for sustainable and eco-friendly solutions. High demand for soundproofing solutions, expansion of the construction industry, and rising awareness about noise pollution are few prominent factors propelling market growth. Additionally, rapid industrialization and the implementation of stricter safety regulations to further bolster the market. Noise from fans, motors, and compressors attached to the exterior of industrial buildings can disrupt the lives of residents living near loud manufacturing facilities. The development of manufacturing plants, internal noise absorption, and vibration damping technology, is essential for meeting regulatory standards and enhancing worker comfort.

Growing several manufacturing processes and expanding industrial activities across sectors such as oil and gas, pharmaceuticals, automotive, and other industries would propel the market in coming years. Industrial machines and utility systems frequently generate high noise levels with strong reverberations, especially in metal warehouses and factories. Different types of materials are used in industrial soundproofing such as soundproofing panels and blankets, acoustic foam, and absorbent materials. End users are increasingly demanding noise control solutions owing to stringent regulations and policies. For instance, Indian government statutory norms regulate industrial noise levels up to 75 dB during day time and 70 dB during the night.

The COVID-19 pandemic resulted in a temporary shutdown of manufacturing facilities, which had to comply with permissible noise limits. Increasing awareness about workforce health and safety bolster the demand for effective noise control solutions. Pandemic-related restrictions have impacted a large number of manufacturing facilities. Key players in the market are collaborating with end users to develop advanced noise control solutions. Companies such as Durr Group offer a wide range of noise control solutions to several end-user segments including food and beverages, machinery, metal, mining, and others.

Growing Trend of Sustainability

Rising Awareness of Sustainable Practices is a Key Industry Trend

Increasing industry awareness of sustainable practices, along with rapid technological advancements and the development of innovative noise solutions, is significantly boosting the market for noise control equipment. Key players are expanding their product offerings to include industrial noise control solutions made from recycled materials. For instance, in February 2025 BASF introduced Basotect EcoBalanced melamine resin foam, which has a reduced carbon footprint and high sound absorbing quality. Industries such as automotive, metal, and mining are seeking to minimize their carbon footprint by integrating noise control solutions with sustainable initiatives. Emerging technologies and advanced materials are expected to gain popularity in industrial noise control solutions.

MARKET DYNAMICS

Industrial Noise Control Market Trends

Stringent Regulatory Policies and Technology Advancements to Boost Growth

The introduction of stringent regulations and industrial noise standards aims to minimize and regulate equipment noise across industries. Several countries have implemented regulations aimed at controlling industrial noise to protect the environment and public health. These regulations often involve establishing allowable noise levels, mandating the use of soundproofing technologies in industrial settings, enforcing zoning restrictions, and conducting regular noise assessments. For instance, Central Pollution and Control Board, in February 2025, mandated noise levels for industrial zones up to 75 dB during the day and 70 dB during the night. Industrial noise control systems and solutions integrated with Internet of Things are also contributing to market growth. IoT-based devices help in noise level tracking and equipment performance in order to create factories with quieter and safer workspaces.

Download Free sample to learn more about this report.

Market Drivers

Growing Manufacturing Activities and Worker Safety to Boost Market Growth

Industrialization, growing construction activities, and rising health awareness among the workforce are some of the prominent factors propelling industrial noise control market growth. Emerging countries including Egypt and Poland are enhancing their manufacturing sectors owing to factors such as strategic investment, infrastructure development, and resource abundance. The availability of a cost-efficient workforce and favorable geographic locations are further strengthening their manufacturing sector, particularly in industries such as automotive and food. Infrastructure development, strategic investments in digitalization, and a shift toward green technologies, along with government financial strategies, are set to fuel economic expansion. For instance, the Indian Central Government has proposed an investment of about USD 133.3 billion in infrastructure development for the fiscal year 2024-25. Furthermore, the government has reduced corporate tax rates to 15% for new manufacturing units starting in March 2024.

Workforce safety has remained a major concern across all industry sectors owing to health-related issues and decreased productivity. As industries prioritize health and safety, there is an increasing trend toward creating noise-compliant work environments. Governments worldwide have implemented strict regulations regarding workplace safety, such as the Occupational Safety and Health Administration (OSHA) standards.

Market Challenges

High Initial Cost to Limit the Growth of Industrial Noise Control

Advanced noise control systems and specialized soundproof enclosures require significant financial investment. Several medium and small-scale companies are resistant to adopting noise control solutions owing to operational procedures and disruptions in existing workflows. Limited awareness about advanced industrial noise control solutions further hinders market growth.

Market Opportunities

Artificial Intelligence and Smart Manufacturing to Present Strong Market Opportunities

The integration of IoT and Artificial Intelligence (AI) presents a strong opportunity to enhance industrial noise control market share. These innovative technologies enable real-time monitoring, predictive maintenance, and improved efficiency, significantly boosting market growth. Expanding manufacturing sectors, improved production capacities, and urbanization trends are some of the other factors fueling the growth of the market. The rise in production capacities and the use of heavy machinery in industrial facilities have increased noise levels, creating a need for the implementation of advanced noise control systems.

SEGMENTATION ANALYSIS

By Product Type

Flexible Segment to Lead Owing to its Extensive Use in Industrial Facilities

By product type, the market is divided into flexible, rigid, and vibration isolation.

Flexible noise control is further segmented into sound curtains, acoustic foam and blankets, and others. Rigid industrial noise control is further diversified into market segments that include enclosures, silencers, and others (ceiling baffles).

The flexible segment is expected to account for the highest market share during the forecast period. Flexible noise control solutions such as sound curtains, acoustic foam, blankets, and sound absorbers are widely used for sound absorption and noise reduction in industrial facilities owing to cost effective solutions for industries. In addition, ease of installation and environmental compliance are propelling the market growth for flexible noise control solutions. The segment is predicted to attain 49.04% of the market share in 2026.

Acoustic foam and wall blankets for industrial noise control are designed to transform noisy factories, manufacturing plants, and industrial facilities into productive, safe, and healthy work environments by reducing exposure to extreme sounds.

Rigid noise control solutions such as enclosures, silencers, and ceiling baffles, are used to manage noise from varied industrial sources such as ventilation systems, compressors, fans, turbines, and exhaust systems. The integration of enclosures, silencers, and vibration isolators aids in companies to with environmental regulations while providing a safer and more comfortable working environment for the workforce by reducing occupational noise exposure.

The vibration isolation segment is likely to grow with a considerable CAGR of 4.10% during the forecast period (2025-2032).

By Application

Internal Noise Control to Dominate the Market Revenue Share to Prevent Health Hazards and Ensure Workplace Safety

Based on application, the market is classified into internal noise control and external noise control.

Internal noise control dominates the market due to the effectiveness of sound-blocking solutions. Internal noise control solutions, such as soundproofing barriers, panels, and vibration isolators, are widely used in industries such as automotive, electronics, machinery, and others. Internal noise control solutions ensure workplace safety and prevent health hazards such as hearing loss and fatigue. This segment is poised to gain 64.26% of the market share in 2026.

External noise control to witness the highest growth rate owing to stringent regulations and the expansion of industry sectors. This segment is expected to grow with a substantial CAGR of 3.80% during the forecast period (2025-2032).

By End-Use Industries

Machinery Sector Lead the Market Owing to Rising Noise Levels in Industrial Facilities

Based on end-use industries, the market is classified into automotive, food and beverages, machinery, metals and mining, power generation, construction materials manufacturing, electronics and electrical, and others. Others include paper and textile manufacturing.

The machinery end-use industry accounts for the highest market share. The growth of the segment is fueled by the growing noise levels in industrial facilities due to increased production and the widespread use of heavy machinery. As the machinery sector expands and noise levels rise, the demand for noise control solutions is surging, paving the way for substantial market growth in the years ahead. The segment gained 30.29% of the market share in 2026.

Contributing significantly to this market's expansion are the ongoing development and growth of power generation. Several governments are significantly investing in renewable energy and power sector to further propelling the growth of noise control solutions in semiconductor manufacturing. The electronics and electrical segment is likely to witness strong growth during the forecast period. Increasing manufacturing for electronics and electrical appliances, and supportive government policies to fuel the market growth. For instance, Kilig a Bangalore-based appliance manufacturer has announced expansion of its product offerings in February 2023.

To know how our report can help streamline your business, Speak to Analyst

INDUSTRIAL NOISE CONTROL MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Industrial Noise Control Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 2.31 billion in 2025 and USD 2.42 billion in 2026. Asia Pacific to dominate the market for industrial noise control owing to stringent environmental regulations and growing manufacturing sector. Manufacturers in the sector are adapting by developing innovative and cost-effective materials, along with high performance acoustic technologies. These advancements address the growing demand for reliable noise reduction systems that comply with strict environmental and industry-specific regulations.

As industries broaden their global presence, the need for noise control solutions expand beyond regulatory compliance to support sustainable operations and promotes worker well-being. The booming manufacturing sectors and increased workforce safety have further boosted the growth of the market. India is projected to acquire USD 0.37 billion in 2026, while Japan is set to gain USD 0.24 billion in the same year.

As a leader in manufacturing hub, including electronics, chemicals, and machinery, China faces growing concerns over industrial noise. Rapid urbanization and increasing industrial activities have enhanced the need for effective noise control systems. As cities grow and industries expand, the demand for noise management solutions will continue to rise, ensuring compliance with regulations while promoting worker well-being. China is poised to be valued at USD 1.11 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is the third largest market projected to reach USD 1.54 billion in 2026. In North America, stringent regulatory policies, expanding manufacturing facilities, and increasing awareness about employee health are boosting the demand for noise control solutions. Industry manufacturers are adapting by developing innovative, cost-efficient materials, and advanced acoustic technologies. These improvements address the increasing need for dependable noise reduction systems that comply with rigorous environmental standards and industry- specific noise regulations. U.S. to dominate the market in North American market as a result of increasing industrial machinery, and construction activities. The U.S. market is predicted to be valued at USD 1.20 billion in 2026.

Europe

Europe is the second leading region expected to hold USD 1.76 billion in 2026, exhibiting a CAGR of 2.10% during the forecast period (2025-2032). The expansion of industrial and manufacturing facilities in emerging economies, along with stringent governmental regulations aimed at mitigating industrial noise pollution, is a primary factor for the market growth in Europe. The U.K. market is poised to reach a value of USD 0.33 billion in 2026. Additionally, growing concerns regarding workplace safety and the adverse effects of noise pollution are further bolstering the demand for industrial noise control systems. Germany is foreseen to reach a market value of USD 0.44 billion in 2026, while France is expected to be worth USD 0.28 billion in 2025.

South America

South America is the fourth leading region set to grow with a value of USD 0.36 billion in 2025. The rise of industrialization, coupled with workplace safety and sustainable practices, is driving the demand from sectors such as manufacturing, energy, and transportation, which, in turn, propelled the need for noise control solutions. Furthermore, advancements in noise control technologies and a growing investment in green buildings are contributing to market growth. The trend toward sustainable industrial practices further encourage the adoption of noise control systems, thereby playing a significant role in the expansion of the market.

Middle East & Africa

The region is witnessing strong growth in the manufacturing sector, driving demand for industrial noise control solutions. Rapidly expanding manufacturing facilities and emerging economies are further boosting market growth. Additionally, significant investments and supportive government initiatives are reinforcing the need for noise control solutions. The GCC market is expected to stand at USD 0.09 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players are Adopting Strategic Collaborations to Enhance their Product Offerings

The industrial noise control market is highly fragmented due to the presence of numerous players, including many medium and small-scale manufacturers. Technological advancements, along with the integration of IoT and Artificial Intelligence, are significantly enhancing noise control systems within the rapidly evolving smart manufacturing sector. To broaden their product offerings, manufacturers are increasingly engaging in mergers and acquisitions with local and smaller enterprises. Additionally, to strengthen their geographic reach, market participants are pursuing various strategies such as partnerships.

List of Industrial Noise Control Companies Profiled:

- NetWell Noise Control (U.S.)

- DDS Acoustical Specialties (U.S.)

- Eckel Noise Control Technologies (U.S.)

- Isotech Inc. (U.S.)

- Kinetics Noise Control Inc. (U.S.)

- ACFM Corporation (U.S.)

- American Micro Industries Inc. (U.S.)

- Technicon Acoustics (U.S.)

- ARK Noise Control (India)

- Acoustical Surfaces (U.S.)

- MECART (U.S.)

- BBM Akustik Technologie GmbH (Germany)

- The Durr Group (Germany)

- Envirotech Systems Limited (India)

- Ecotone Acoustics Pvt. Ltd. (India)

- Saint Gobain (France)

- Owens Corning (U.S.)

- MMT Acoustix (India)

- Stopson Italiana (Italy)

- Shenzhen Vinco Soundproofing materials Co.,Ltd (China)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: KPS Capital Partners has reached an agreement to acquire Catalyst Acoustics Group, a prominent designer of acoustical solutions that includes well-known brands such as IAC Acoustics and Kinetics Noise Control. The transaction is anticipated to be finalized in the fourth quarter of 2024.

- September 2023: Kinetics Noise Control, a Catalyst Acoustics Group has launched KSR 3.0 vibration isolation rail with full or partial assembly.

- November 2022: Sound Seal offers a range of colorful, exterior-grade aerial baffles, banners, noise barriers, and sound curtains that enhance visual appeal while maintaining exceptional acoustic performance for both indoor and outdoor applications.

- March 2022: Sound Seal introduced Timber-Stix acoustical panels, which feature a wood-veneer facing and a backing made from recycled plastic P.E.T. felt. These panels offer stylish and sustainable and eco friendly solutions for quick installations on walls or ceilings.

- February 2022: Merford launched a new production line in Gorinchem for its Akoestikon sound-absorbing systems.

- January 2020: Kinetics Noise Control, Inc. acquired The Stephens Group, LLC to expand its portfolio of noise control solutions.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading end-use industries. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.6% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Application

By End-Use Industries

By Region

|

|

Key Market Players Profiled in the Report |

NetWell Noise Control (U.S.), DDS Acoustical Specialties (U.S.), Eckel Noise Control Technologies (U.S.), ACFM Corporation (U.S.), American Micro Industries Inc. (U.S.), Technicon Acoustics (U.S.), Kinetics Noise Control Inc. (U.S.), BBM Akustik Technologie GmbH (Germany), The Durr Group (Germany), and Envirotech Systems Limited (India) |

Frequently Asked Questions

The market is projected to reach USD 8.29 billion by 2034.

In 2025, the market was valued at USD 6.06 billion.

The market is projected to grow at a CAGR of 3.6% during the forecast period.

The flexible segment is likely to dominate the market in terms of share.

Growing manufacturing activities and worker safety is a key factor driving the market growth.

The Durr Group, Envirotech Systems Limited, and Kinetics Noise Control Inc. are few of the top players in the market.

Asia Pacific to lead the market demand catering highest revenue market share 38.1 in 2025

By end-use industries, the electronics and electrical segment is expected to witness highest growth during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us