Automotive Heat Shield Market Size, Share & Industry Analysis, By Material Type (Aluminum Heat Shields, Stainless Steel Heat Shields, and Composite & Multilayer Materials), By Vehicle Type (Hatchback/Sedan, SUV, Light Duty Vehicle, and Heavy Duty Vehicle), By Application (Exhaust Heat Shields, Engine Compartment Heat Shields, Underbody Heat Shields, Turbocharger Heat Shields, and Battery & EV Component Shields), By Product (Single-Shell Heat Shields, Double-Shell Heat Shields, and Sandwich-Type Heat Shields), By Propulsion (ICE and EV), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

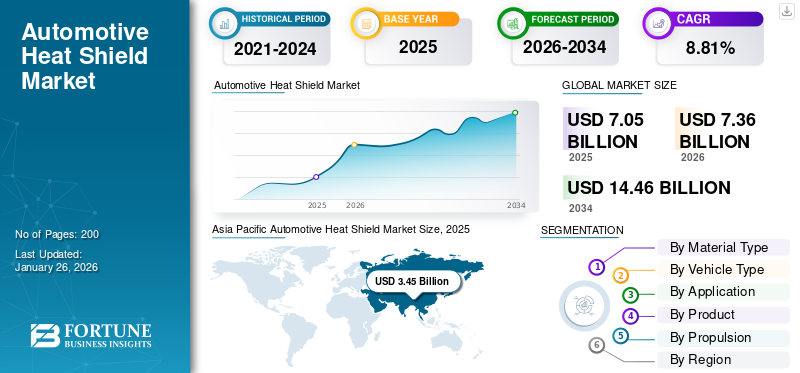

The global automotive heat shield market size was valued at USD 7.05 billion in 2025 and is projected to grow from USD 7.36 billion in 2026 to USD 14.46 billion by 2034, exhibiting a CAGR of 8.81% during the forecast period. Asia Pacific dominated the global market with a share of 48.94% in 2025.

The automotive heat shield refers to the design, production, and sale of components that protect vehicle parts and occupants from excessive heat generated by the engine, exhaust system, turbochargers, and other high-temperature sources. Automotive heat shields are typically made from materials such as aluminum, stainless steel, composites, or multilayer laminates, and are engineered to absorb, reflect, or dissipate heat.

Modern vehicles generate higher thermal loads due to turbocharged engines, advanced exhaust after-treatment systems, and the integration of hybrid and electric powertrains. This has expanded the application scope of heat shields from traditional engine compartments and underbodies to battery packs, fuel cells, and electronic control units.

The market is further characterized by growing demand for lightweight heat shield materials, innovative multilayer designs, and integration of noise-dampening features, aligning with broader automotive trends such as electrification, downsizing of engines, and stringent environmental regulations.

The market is moderately consolidated, with global Tier-1 suppliers and specialized manufacturers dominating. Key players include Dana Incorporated, Tenneco Inc., ElringKlinger AG, Autoneum Holding AG, Lydall Inc., Morgan Advanced Materials, Sumitomo Riko Company Limited, Happich GmbH, Talbros Automotive Components Limited, and Zircotec Ltd.

MARKET DYNAMICS

MARKET DRIVERS

Electrification of Vehicles and Battery Thermal Protection Accelerates Demand for Advanced Heat Shield Solutions

The rapid shift toward electric mobility is emerging as a major driver for the automotive heat shield market growth. Electric vehicles (EVs) and hybrid electric vehicles (HEVs) depend on high-capacity lithium-ion batteries, fuel cells, inverters, and power electronics, all of which generate substantial heat during operation and rapid DC fast charging. Effective thermal management is critical to ensure battery safety, prevent overheating, and extend component lifespan, making advanced heat shields indispensable. OEMs and Tier-1 suppliers are investing in lightweight composite and multilayer insulation materials specifically designed for EV battery packs and underbody applications.

- For instance, in 2024, ElringKlinger AG introduced customized battery thermal insulation modules to support major EV manufacturers in Europe, offering superior protection against thermal runaway and external heat exposure. With global EV sales projected to surpass 30 million units annually by 2030, the demand for specialized heat shields in electrified powertrains is expected to accelerate significantly.

MARKET RESTRAINTS

Raw Material Price Volatility May Limit Market Growth

One of the key restraints for the market is the high volatility in raw material prices, particularly aluminum, stainless steel, and advanced composites that are widely used in heat shield manufacturing. Since OEMs demand lightweight yet durable vehicle thermal protection solutions, suppliers rely heavily on these materials, making production costs highly sensitive to global commodity price fluctuations. For instance, the global aluminum price index experienced a sharp rise of over 25% between 2021 and 2022 due to supply chain disruptions, energy cost hikes, and geopolitical tensions, which significantly increased input costs for automotive suppliers. This volatility hampers the large-scale adoption of an advanced heat shield.

MARKET OPPORTUNITIES

Growth of Lightweight and Sustainable Materials to Create Lucrative Growth Opportunities

The increasing focus on vehicle lightweighting and sustainability is creating significant opportunities for the market. Automakers are under pressure to reduce overall vehicle weight to meet stringent fuel efficiency and emission targets, while also adopting eco-friendly materials to align with global sustainability goals. Heat shields made from lightweight aluminum, advanced composites, and multilayer laminates not only enhance automotive thermal insulation but also contribute to improved vehicle efficiency. Additionally, the growing emphasis on recyclability is driving demand for sustainable materials that minimize environmental impact without compromising performance. This development drives the market growth.

- For instance, in March 2025, Autoneum Holding AG developed lightweight fiber-based heat shields that provide excellent thermal and acoustic insulation while offering recyclability, making them suitable for both ICE and electric vehicle heat shields.

AUTOMOTIVE HEAT SHIELD MARKET TRENDS

Integration with Advanced Thermal Management Systems is One of the Significant Market Trends

The growing integration of shielding solutions with advanced thermal management systems. Modern vehicles, especially EVs and hybrids, require holistic thermal strategies to manage heat generated by batteries, power electronics, turbochargers, and exhaust after-treatment units. Instead of being standalone barriers, heat shields are increasingly designed to work in combination with liquid cooling, phase-change materials, and advanced thermal coatings, offering system-level efficiency. This trend is being driven by OEMs’ demand for compact, lightweight, and multifunctional thermal protection that enhances both safety and performance.

- For instance, Dana Incorporated developed integrated thermal management modules where heat shields complement cooling plates and thermal interface materials for EV batteries. Such integration reduces design complexity, improves energy efficiency, and extends component lifespan.

Download Free sample to learn more about this report.

MARKET CHALLENGES

Competition from Alternative Thermal Management Solutions is a Challenging Factor for Market

One of the major challenges for the market is the increasing adoption of alternative thermal management technologies by OEMs. Traditionally, metal or composite heat shields have been the primary solution to protect vehicle components from excessive heat. However, with the transition toward electrification and high-performance vehicles, automakers are exploring advanced methods such as liquid cooling systems, Thermal Interface Materials (TIMs), ceramic heat shield coatings, and phase-change materials to manage heat more effectively. These technologies often offer higher precision, lower weight, and integration advantages, making them attractive alternatives to conventional heat shields. This may hamper the market growth.

Segmentation Analysis

By Material Type

Aluminum Heat Shields Dominate Market Owing to Superior Performance and Cost Efficiency

On the basis of material type, the market is classified into aluminum heat shields, stainless steel heat shields, and composite & multilayer materials.

Aluminum heat shields hold the largest market share of 50.97% in 2026 primarily due to their combination of thermal, mechanical, and economic advantages. Aluminum has heat reflectivity, corrosion resistance, and high thermal conductivity, making it highly effective in deflecting and dissipating heat generated by engines, exhaust systems, and turbochargers. Additionally, aluminum is cost-effective and widely available, allowing for mass production of single-shell, double-shell, and sandwich-type heat shields at competitive costs. Furthermore, the material’s lightweight nature contributes to overall vehicle weight reduction, supporting fuel efficiency and emission compliance. With the growing demand for high-performance and turbocharged engines across passenger and commercial vehicles.

To know how our report can help streamline your business, Speak to Analyst

By Vehicle Type

Rising Consumer Preference for Advanced Safety Features and Higher Ground Clearance Fueled Demand for SUVs

In terms of vehicle type, the market is categorized into hatchback/sedan, SUV, light duty vehicle, and heavy duty vehicle.

The SUV segment dominated the market share of 41.36% in 2026, primarily driven by the rising global popularity of sport utility vehicles. The segmental growth is attributed to consumer preference for higher ground clearance, spacious interiors, and advanced safety features, which have significantly boosted the production and sales of SUVs worldwide. This surge in SUV manufacturing directly fuels the demand for automotive heat shields, as these vehicles typically require multiple and larger heat shield components to manage higher heat loads generated by powerful engines, exhaust systems, and turbochargers compared to smaller vehicle types.

By Application

Increasing Safety, Emission Control, and Performance of Vehicles Fosters Adoption of Exhaust Heat Shields

Based on application type, the market is segmented into exhaust heat shields, engine compartment heat shields, underbody heat shields, turbocharger heat shields, and battery & EV component shields.

The exhaust heat shields segment holds the leading market share. The exhaust system of the vehicle generates more heat compared to other components, reaching temperatures above 900°C in turbocharged engines and catalytic converters. Exhaust heat shields also maintain the optimal operating temperature of devices such as catalytic converters and diesel particulate filters, which is essential for global emission standards. However, the rising adoption of turbocharged engines, hybrid systems, and performance-oriented vehicles has intensified the requirement for advanced, multilayer exhaust heat shields.

By Product

Single-Shell Heat Shields Led Market Owing to Their Cost-effectiveness

Based on product type, the market is segmented into single-shell heat shields, double-shell heat shields, and sandwich-type heat shields.

Single-shell heat shields held the largest market share of 54.31% in 2026, owing to their cost-effectiveness, simplicity in design, and broad application across vehicle types. These heat shields are manufactured from stamped aluminum or stainless steel sheets, providing reliable thermal protection for exhaust systems, engine bays, and underbody components at a relatively low production cost. Their lightweight property supports OEMs’ objectives to improve fuel efficiency, while their ease of manufacturing allows for large-scale adoption, particularly in mass-produced passenger cars and SUVs.

By Propulsion

ICE Propulsion Dominated Market Due to Its High Thermal Output and Emission Compliance

Based on propulsion, the market is segmented into ICE and EV.

The ICE segment held the leading market share of 75.64% in 2026. Internal combustion engines generate intense heat in the engine bay, exhaust system, turbochargers, and after-treatment units. Manufacturers/OEMs introduced advanced catalytic converters and diesel particulate filters, both of which operate at elevated temperatures to meet stringent emission regulations. This has increased the dependence on robust, multiyear heat shields to protect critical components, improve vehicle performance, and ensure passenger safety. Thus, the ICE segment continues to demand the largest share of thermal protection solutions in the market.

Automotive Heat Shield Market Regional Outlook

By region, the market is categorized into Europe, North America, Asia Pacific, and the Rest of the World

Asia Pacific

Asia Pacific Automotive Heat Shield Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the dominating region in the market. This region dominates due to the high volume of vehicle production and sales in countries such as China, India, Japan, and South Korea. The region is a manufacturing hub for leading OEMs and component suppliers, creating strong demand for passenger car heat shields and commercial vehicle heat shields. Rapid urbanization, rising disposable incomes, and growing SUV adoption are driving market growth. The Japan market is projected to reach USD 0.51 billion by 2026, the China market is projected to reach USD 2.11 billion by 2026, and the India market is projected to reach USD 0.33 billion by 2026.

Other regions, including North America, Europe, and the rest of the world, are expanding steadily.

North America

North America is driven by the strong popularity of SUVs and pickup trucks, coupled with stringent fuel efficiency and emission standards in the U.S. and Canada, which increase the demand for advanced thermal management solutions. The U.S. market is projected to reach USD 1.13 billion by 2026.

Europe

Europe holds a significant automotive heat shield market share, supported by the presence of premium automakers and a strong regulatory framework, which accelerates the adoption of lightweight, multilayer, and noise-reducing heat shields. The UK market is projected to reach USD 0.25 billion by 2026, while the Germany market is projected to reach USD 0.36 billion by 2026.

Rest of the world

The rest of the world includes the Middle East and Latin America. The growth is attributed to rising automotive production in Brazil and Mexico and demand for automotive heat management systems.

COMPETITIVE LANDSCAPE

Key Industry Players

Strong Tier-1 Supplier Presence and Strategic Partnerships Driving Market Leadership

The automotive heat shield market is largely driven by Tier-1 suppliers such as Dana Incorporated, Tenneco Inc., ElringKlinger AG, Autoneum Holding AG, and Sumitomo Riko Co. Ltd., which maintain strong partnerships with global OEMs. These companies invest heavily in lightweight aluminum, composite, and multilayer heat shields to meet manufacturer requirements for fuel efficiency and emission compliance.

Industry players are increasingly aligning their strategies with the electrification trend by developing heat shields for EV batteries, fuel cells, and power electronics. Collaborations with EV-focused OEMs, acquisitions of thermal technology firms, and expansion into Asia Pacific markets.

LIST OF KEY AUTOMOTIVE HEAT SHIELD COMPANIES PROFILED

- Dana Incorporated (U.S.)

- Tenneco Inc. (U.S.)

- ElringKlinger AG (Germany)

- Autoneum Holding AG (Switzerland)

- Sumitomo Riko Co. Ltd. (Japan)

- Lydall Inc. (U.S.)

- Morgan Advanced Materials (U.K.)

- Zircotec Ltd. (U.K.)

- Talbros Automotive Components Ltd. (India)

- Happich GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS

- In September 2025, Zircotec unveiled a new range of ceramic coatings enabling lighter EV battery/cooling plate designs and advanced heat-shield products that support the substitution of heavy steel with coated aluminum/composites.

- In May 2025, Freudenberg announced new materials & component solutions for rapid charging and battery thermal management (materials that are integrated into battery shields/insulation layers) demo at Battery Show Europe 2025.

- In May 2025, Tenneco’s Systems Protection business (sleeving/shielding) received supplier awards and continues to win in protection & shielding categories — signaling supplier traction and validated capability in complex protection systems.

- In December 2024, FORVIA introduced thermal and electrification modules (power electronics, thermal management) and announced technology demos, driving demand for integrated shielding/thermal solutioning at the OEM level.

- In October 2024, Valeo strengthened its partnership with TotalEnergies to develop immersive fluids/thermal approaches for next-generation EV battery thermal management. This raises OEM spend on battery thermal subsystems and complementary shielding.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.81% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material Type, By Vehicle Type, By Application, By Product, By Propulsion, and By Region |

|

By Material Type |

· Aluminum Heat Shields · Stainless Steel Heat Shields · Composite & Multilayer Materials |

|

By Vehicle Type |

· Hatchback/Sedan · SUV · Light Duty Vehicle · Heavy Duty Vehicle |

|

By Application |

· Exhaust Heat Shields · Engine Compartment Heat Shields · Underbody Heat Shields · Turbocharger Heat Shields · Battery & EV Component Shields |

|

By Product |

· Single-Shell Heat Shields · Double-Shell Heat Shields · Sandwich-Type Heat Shields |

|

By Propulsion |

· ICE · EV |

|

By Region |

· North America (By Material Type, By Vehicle Type, By Application, By Product, By Propulsion, and By Country) o U.S. (By Vehicle Type) o Canada (By Vehicle Type) o Mexico (By Vehicle Type) · Europe (By Material Type, By Vehicle Type, By Application, By Product, By Propulsion, and By Country) o Germany (By Vehicle Type) o U.K. (By Vehicle Type) o France (By Vehicle Type) o Rest of Europe (By Vehicle Type) · Asia Pacific (By Material Type, By Vehicle Type, By Application, By Product, By Propulsion, and By Country) o China (By Vehicle Type) o Japan (By Vehicle Type) o India (By Vehicle Type) o Rest of Asia Pacific (By Vehicle Type) · Rest of the World (By Material Type, By Vehicle Type, By Application, By Product, By Propulsion, and By Country) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 7.36 billion in 2026 and is projected to reach USD 14.46 billion by 2034.

In 2025, the market value stood at USD 3.45 billion.

The market is expected to exhibit a CAGR of 8.81% during the forecast period of 2026-2034.

The SUV segment led the market by vehicle type.

Electrification of vehicles and battery thermal protection accelerate demand for advanced automotive heat shield solutions.

Dana Incorporated, Tenneco Inc., ElringKlinger AG, Autoneum Holding AG, and Sumitomo Riko Co., Ltd., are the top players in the market

Asia Pacific dominated the global market with a share of 48.94% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us