Current Transducer Market Size, Share & Industry Analysis, By Type (Flux Gate, DC Current Transducers, AC Current Transducers, Magnetic Probes, and Others), By Loop Type (Open-loop and Closed-loop), By Technology (Isolated and Non-Isolated), By Application (Building Automation Systems, Energy Monitoring & Management, Motor Status & Control, Industrial Processes & Manufacturing, and Others), By End-User (Utility, Industrial, Automotive, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

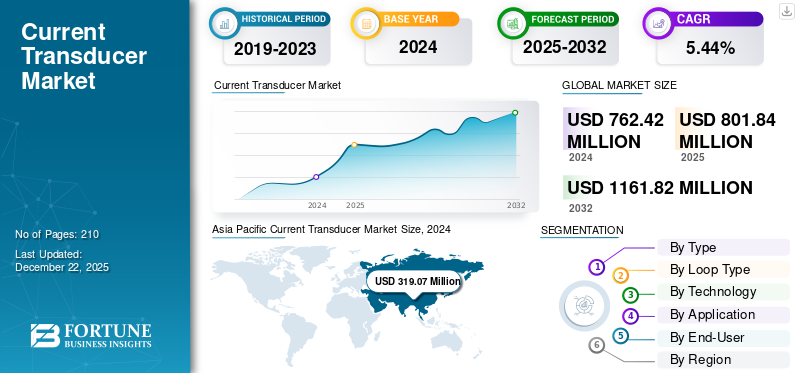

The global current transducer market size was valued at 8,01,835.17 thousand in 2025. The market is projected to grow from 8,43,740.57 thousand in 2026 to 12,58,543.73 USD 1,161.82 thousand by 2034, exhibiting a CAGR of 5.44% during the forecast period. Asia Pacific dominated the global market with a share of 42.09% in 2025.

Current transducers are electrical devices used to convert current, AC or DC, into a proportional standardized electrical signal that is equivalent to the current or voltage. These devices are widely used by control boards or instruments for metering, monitoring, and control systems. These devices have gained huge popularity in power electronics & distribution, industrial automation, renewable energy systems, and others. For instance, in renewable energy systems, these devices are used to monitor & measure electric current, efficient energy storage, optimize for power generation, and enhance grid stability. Wind and solar power devices are used to monitor the flow of current within photovoltaic arrays or wind turbines. These factors are anticipated to drive the current transducer market during the forecast period.

ABB is a leading market player and provider of a DCSA Series loop-powered, linear output current transducer that provides an output which is directly proportional to the RMS AC passing through the LCSC10T12 sensor. The current transducers provided by ABB offer high accuracy, robustness, and linearity, owing to which they are mainly used in high-voltage railways and substations. In February 2023, ABB launched the latest current transducer that will be mainly used for automotive (EV) test benches and battery testing & evaluation systems.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Energy-Efficient Solutions in Automotive Industry Drives Market Growth

The current transducers have gained huge popularity in the automotive industry, which is used to measure & monitor the electrical current and manage power flow in EV powertrains, charging stations, and battery systems to ensure efficient & safe operations of automotive vehicles. For instance, in Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs), current transducers are used to monitor the energy flow between the battery and motor for efficient power delivery.

Further, they are used to safeguard automotive components from overloads by providing precise current measurements and enabling real-time data adjustments. Some other applications of current transducers in the automotive sector include fuel cell current control, standard battery monitoring, DC/DC converters and AC/AC inverters, electric compressors for air conditioning, and others. An increase in demand for electric vehicles and advanced vehicle technologies has driven the current sensors market share in recent years. For instance, the electric car industry has showcased robust growth in 2023, recording sales of approximately 14 million. China recorded the highest number of electric cars sold in 2024, followed by Europe, the U.S., and the rest of the world.

Rising Product Adoption in Power Distribution, Power Quality, and Other Power Infrastructure Drive Market Growth

In power systems & infrastructure, the current transducers are mainly used to measure & monitor the current flow in power grids, substations, and generators. They prevent disruptions to the power supply and ensure high power quality. They are also used in electrical meters in residential and commercial buildings to monitor the current flow during power interruptions. They are used in inverters, motor control systems, and Variable Frequency Drives (VFDs) to monitor the flow of current and detect early detection of overload, short circuit, or other faults.

The development of smart grids has led to a positive impact on the current transducer market growth. These devices are widely used in smart grids as they play a key role in monitoring and controlling current levels, facilitate automated grid balancing & energy distribution, optimize energy usage, and reduce energy waste. Additionally, these transducers monitor the charge & discharge cycle of batteries, prevent overcharging or discharging, and extend the battery lifecycle by increasing the overall reliability of the system. The International Energy Agency (IEA) has stated that investments in smart grids by different regions and countries, including the European Union, Japan, India, China, Canada, and others, contribute to the growing demand for current transducers.

MARKET RESTRAINTS

High Cost, Potential for Drift and Aging Components Hamper Market Growth

The current transducers face certain limitations owing to their high cost as compared to traditional current transformers. The high cost of current transducers is mainly attributed to technological complexity and reduced bandwidth or accuracy. Few current transducers rely on an intrinsic electrical current being measured and the sensing circuit. In such cases, the isolation amplifiers are required to achieve electrical isolation, which increases the overall cost. Also, the current transducers require frequent calibration checks compared to traditional transformers, which adds to their complexity. These factors are anticipated to hamper the transducer market trends in the coming years.

MARKET OPPORTUNITIES

Rising Adoption of Current Transducers in Renewable Energy Sector is Anticipated to Generate Developmental Prospects

In the renewable energy sector, the current transducers are mainly used to measure & monitor the flow of electricity in solar and wind power systems accurately. By measuring the flow of electricity, these devices ensure efficient use of energy by making sure that it is available for immediate consumption or storage, providing sustainable energy usage. Current transducers optimize the performance of renewable energy systems by offering better control of power converters and inverters.

The current transducers are used to track the performance of solar panels in the solar energy system. In renewable energy systems, these transducers offer real-time monitoring & control, facilitate Maximum Power Point Tracking (MPPT), and ensure safety & system protection. The International Energy Agency (IEA) has stated that renewable electricity generation is anticipated to reach 17,000 terawatt-hours (TWh) by 2030. In 2025, the share of renewable electricity generation is set to overtake coal-fired generation, and in 2026, renewable electricity generation is anticipated to surpass nuclear power generation. Solar PV technology is on track with the Net Zero Emissions (NZE) by 2050. Thus, an increase in the prevalence of renewable energy systems is anticipated to increase the current transducer market size, which is crucial for accurate current measurement & monitoring systems.

MARKET CHALLENGES

Integration Challenges and Environmental Conditions Pose Significant Challenges for Emerging Players

The current transducers face significant challenges, as integrating the transducers into existing systems is complex. These challenges are related to space constraints, high-speed requirements, and Electromagnetic Interference (EMI) concerns, owing to which the integration of bulky current sensing components is difficult. In addition, the environmental conditions, such as humidity, high temperature, and exposure to contaminants, impact the transformer's reading & performance. In addition, exposing these devices to hazardous environments can affect the functionality and accuracy of the current sensing devices. These factors pose significant challenges for the current transducer companies.

CURRENT TRANSDUCER MARKET TRENDS

Launch of Digital Current Transducers Enhances Network Connectivity

The current digital transducers are being developed globally and are equipped with data analytics and enhanced network connectivity. Digital current transducers have enhanced network connectivity, which offers real-time connectivity & control for smart grid applications & automated industrial processes. Also, these current digital transducers have real-time data analytics and wireless communication features, and hence, they are used in several emerging applications. For instance, in May 2024, the DC-CT brand introduced an innovative zero-flux AC/DC transducer that utilizes Platiše Flux Sensor technology. This device provides enhanced bandwidth, precision, stability, and reduced energy usage.

The zero-flux AC/DC transducer relies on Current Controlled Variable Reluctance (CCVR). This closed-loop method constantly monitors the remaining magnetic flux in the core and modifies the current in a compensation winding to maintain a zero-flux equilibrium. DC-CT sensors are capable of measuring both AC and DC currents, making them appropriate for uses such as DC/AC residual current sensors in class B+.

Download Free sample to learn more about this report.

IMPACT OF TARIFF

The tariffs by U.S. President Donald Trump will have a significant effect on the current transducer industry, causing disruptions to the supply chain as the majority of the essential electronics components are sourced from China. Thus, imposing tariffs will affect the cost of importing these components, thereby increasing the production cost for the manufacturers.

The heavy tariffs on imports will lead to reconsideration of supply chain strategies by the companies, owing to which they will explore alternative sourcing options or relocate their manufacturing facilities to mitigate the impact. However, relocating the manufacturing base incurs significant investments that could lead to operational inefficiencies and production delays. Thus, the effect of tariffs is anticipated to have a negative impact on the current transducer market growth during the forecast period.

SEGMENTATION ANALYSIS

By Type

Flux Gate Current Transducers Dominate Due to High Accuracy, Low Noise, and Wide Bandwidth

Based on type, the market is classified into flux gate, DC current transducers, AC current transducers, magnetic probes, and others.

Among these, flux gate current transducers accounted for the dominant market share, representing 15.12% of the market in 2026. It has gained significant popularity in recent years as they offer higher accuracy and lower noise, which makes them suitable for precise measurement. They are used in applications that require high stability and low-current detection. Fluxgate technologies offer low offset & offset drift due to the presence of a magnetic core that is cycled throughout its B-H loop, suppressing any magnetic offset in the fluxgate core. The flux gate current transducers have higher sensitivity compared to other technologies, which helps in the measurement of low Ampere turns.

In addition, the dynamic range of fluxgate current sensors helps in measuring both small & large currents with the same transducer. There are various types of fluxgate sensors, namely standard fluxgate sensor, C-type fluxgate sensor, IT-type fluxgate, and low-frequency fluxgate, which help in the measurement of both small & large currents within the same transducers.

DC current transducers convert a DC current into a proportional DC voltage or current signal, often for monitoring, control, or protection purposes. They are essential in various applications, including battery management, renewable energy systems, electric vehicle charging, and industrial automation. DC current transducers offer high accuracy in current measurement, which is crucial for applications where precise current monitoring is needed.

To know how our report can help streamline your business, Speak to Analyst

By Loop Type

Closed-loop Type Leads Owing to Their Higher Acceleration and Efficiency

Based on loop type, the market is majorly classified into open-loop and closed-loop.

The closed-loop segment dominated the global current transducer market, accounting for a 25.71% market share in 2026. These transducers are widely preferred as they offer higher accuracy, noise immunity, and superior stability compared to open-loop current transducers. The enhanced accuracy and stability of the closed-loop is provided by the feedback loop that actively adjusts the secondary current to maintain a net-zero magnetic field at the sensing element and to reduce the errors caused by temperature fluctuations or environmental factors.

For instance, the closed-loop current transducers offered by VACUUMSCHMELZE have the highest accuracy of 0.4% to 0.7%, with no temperature drift over the full temperature scale, low rise time, and a frequency range DC to 200 kHz. One of the key features of the closed-loop current transducer is the presence of a negative feedback loop, due to which the output signal of the sensor is compensated and calibrated with the input signal via a negative feedback mechanism. The negative feedback mechanism eliminates the error and drift, offering accurate and reliable measurements of power systems.

The benefit of the closed-loop current transducer is the lack of eddy currents and higher bandwidth. The output can be modeled as a current source with the current proportional to the primary current in a ratio determined by the secondary winding count. The closed-loop current transducers offer easy scalability and can quickly respond to changes in the measured current, which facilitates real-time monitoring of the current.

Open-loop current transducers measure current by detecting the magnetic field generated by the current and converting it into a proportional voltage or current output. They are commonly used in applications requiring current measurement with electrical isolation and are known for their simplicity and cost-effectiveness.

By Technology

Isolated Technology Leads Due to Safety Considerations and Flexible Circuit Design

Based on technology, the market is broadly segmented into isolated and non-isolated.

Isolated current transducers accounted for the highest market share, as they create a barrier between the primary and secondary circuits, preventing voltages from reaching the output, accounting for a 27.47% market share in 2026. For instance, these transducers are used in medical equipment and systems powered by high-voltage AC mains. The isolated current transducers eliminate the ground loops by breaking the physical connection between input and output.

The isolated current transducers are not tied to any specific ground potential, which allows them to float. This flexibility enables easier inversion, level shifting, and other circuit manipulations. In addition, accuracy and scalability are some other features that have led to an increase in demand for isolated current transducers.

By Application

Industrial Processes & Manufacturing Applications Lead Due to High Requirement for Reliable Operations by Current Transducers

Based on application, the market is classified into building automation systems, energy monitoring & management, motor status & control, industrial processes & manufacturing, and others.

The industrial processes & manufacturing segment accounted for the major market revenue. The current transducers used in industrial processes & manufacturing sector help in measuring & monitoring the current safely and reliably. These transducers are used to monitor and control the current in industrial processes, which is crucial for ensuring safe & reliable operation and preventing overloads. Further, these transducers help in analyzing the energy consumption in manufacturing processes to ensure equipment reliability and reduce expensive downtime. Additionally, the signals produced by these devices can be transmitted over longer distances, owing to their use in the industrial sector contributing to safety, efficiency, and reliability.

Current transducers play a crucial role in Building Automation Systems (BAS) by measuring electrical current and converting it into a usable signal for monitoring and control. They are essential for energy management, motor status monitoring (e.g., pumps, fans), and overall system efficiency. Current transducers are used in sub metering applications to track energy consumption of specific areas or equipment within a building.

By End-User

Utility is the Leading End-user as Current Transducer Facilitates Efficient Power Management

Based on end-user, the market is classified into utility, industrial, automotive, and others.

The utility segment accounted for the dominant market share. Current transducers are widely used in the utility sector owing to their ability to reliably & accurately monitor the current, which is crucial for grid functions. These transducers are used to monitor the current in high-voltage power systems, and measure the primary current to a lower, measurable current in the secondary winding using a magnetic core. Current transducers help the utilities to manage power during peak demand periods and to monitor energy distribution.

In the utility sector, the current transducers are used in various applications such as electricity distribution, heating & cooling systems, gas supply, water distribution, and others. By automating utility networks with transducers, reliability, efficiency, and lower operating costs can be achieved. Additionally, these transducers help in detecting faults such as overloads and short circuits.

CURRENT TRANSDUCER MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Current Transducer Market Size, 2025 (USD Thousand)

To get more information on the regional analysis of this market, Download Free sample

Rapid Growth in Industrial Processes & Manufacturing Sector Drives Current Transducer Market Across Region

Asia Pacific is anticipated to dominate the market due to strong adoption in industrial processes and the manufacturing sector where these solutions are used for equipment monitoring, process control, and predictive maintenance with the regional market size reaching 337,495.88 thousand in 2025. These transducers measure the current consumption of equipment & machinery, which enables efficient control & optimization of industrial processes. Additionally, they detect abnormalities & potential failures in equipment, which prevents costly downtime and maintenance. Rapid industrialization and the growth of the manufacturing sector in China, India, Japan, and other countries, drive the demand for the current transducer industry. The Japan market is projected to reach USD 45,082.30 thousands by 2026, and the India market is projected to reach USD 59,754.82 thousands by 2026.

China

Growth in Manufacturing Sector Drives Demand for Current Transducers

China is anticipated to have a significant share in Asia Pacific region. China is a global manufacturing powerhouse with leading manufacturing industries such as steel, automotive, electronics, cement, and others. According to the insights provided by ChinaPower, in 2023, China's Manufacturing Value Added (MVA) accounted for USD 4.66 trillion, which was 29% of the global MVA. The influx of foreign investment, labor availability, and reduced trade barriers significantly contributed to China's manufacturing output. In the manufacturing sector, these transducers are used to monitor current consumption, detect abnormalities, and in devices such as power electronics, control inverters, and other equipment. The China market is projected to reach USD 1,51,763.94 thousands by 2026

Europe

Integration of Renewable Energy Systems Drives Market Growth in Europe

Europe is anticipated to grow gradually over the forecast period and is actively integrating renewable energy systems to become a climate-neutral economy by 2050. To achieve this goal, various strategies are being adopted, which include investments in infrastructure, electrification, promoting clean fuels, and others. Additionally, by 2030, Europe aims to increase the share of renewables by 42.5%. Initiatives such as the EU strategy for Energy System Integration, REPowerEU Plan, Renewable Energy Directive, adoption of smart grids, energy efficiency & circularity goals, and others have become quite popular. The Germany market is projected to reach USD 52,041.48 thousands by 2026.

U.K.

Growing Renewable Energy Contribution Boosts Market Opportunities Across the U.K.

The U.K. expected to dominate the market share in Europe. The U.K. accounted for a 37% share of low-carbon renewables in 2024, accounting for 103 TWh of electricity generation, overtaking fossil fuels, which accounted for 35% (97 TWh) for the first time. The integration of renewable energy sources necessitates advanced storage solutions and grid management to maintain grid stability and the intermittency of renewable energy resources. The use of current transducers in energy management helps in identifying excessive power consumption along with targeted adjustments that lead to lower utility costs without compromising productivity. Additionally, these systems detect irregularities in the current flow, which extends the equipment's lifespan. The UK market is projected to reach USD 30,276.36 thousands by 2026.

North America

Growing Usage of Current Transducers in Building Automation Systems (BAS) Drives Market Share in North America

The region is anticipated to grow steadily over the coming years. In North America, the current transducers are widely used in BAS for digital signaling. In BAS, these transducers send digital signals to detect the motor status, including the operation of fans and pumps. Additionally, BAS is used for analog signaling, which is used to measure electrical usage by different components such as HVAC equipment, lighting systems, and others. For instance, Johnson Controls is a leading provider of building automation solutions, including security, HVAC, fire suppression systems, and others. Carrier is another leading provider of HVAC solutions and building automation systems. These factors are driving the North America current transducers market growth. The U.S. market is projected to reach USD 1,36,614.06 thousands by 2026.

U.S.

Industrial Transition and Modernization to Boost Adoption of Current Transducers

The current transducer market in the U.S. is experiencing steady growth, driven by the country’s increasing focus on power quality, energy efficiency, and electrification. The industries transition toward automation and renewable integration, is leading to the demand for reliable current measurement and monitoring equipment. The deployment of smart grid infrastructure, electric vehicle charging stations, and battery energy storage systems is significantly boosting the adoption of high-precision current transducers. The Smart Grid Grants program allocates up to USD 3 billion over five years (2022–2026) to support large-scale deployment of grid resilience technologies. Open to U.S.-based institutions, businesses, governments, and tribal nations, projects must show potential for broad market adoption.

Middle East & Africa

Growing Usage of Current Transducers in Energy Monitoring & Power Quality Across the Middle East & Africa Boosts Market Size

The Middle East & Africa account for a significant share of current transducers as these devices are used for energy consumption tracking, real-time monitoring, accurate current measurement, and other applications. For instance, in energy consumption tracking, these transducers are used to identify inefficiencies, track energy usage, and reduce energy consumption. Additionally, these transducers are used in industrial automation, power electronics, power distribution, and other sectors for efficient energy usage in the Middle East & Africa region.

Latin America

Growing Demand from Power Electronics to Boost Current Transducers Demand

Latin America is anticipated to grow gradually over the coming years. The power electronics sector is experiencing significant growth in Latin America, driven by rising investments in automotive, renewable energy, and other sectors. Brazil, Argentina, and Chile are rapidly investing in energy-efficient devices, along with the expansion of the industrial automation sector. Modernization of power infrastructure, telecommunication infrastructure, and others has led to an increase in demand for current transducers in this region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Product Development and Technological Advancements Present Significant Growth Opportunities for Market Players

The current global transducer market is characterized by intense competition driven by rapid product development and technological advancements, which are driving their adoption across various industries. Major players such as ABB, Texas Instruments Inc., Johnson Controls Inc., Siemens AG, and others are competing through advanced product development, comprehensive product portfolios, and collaboration. For instance, the current transducers offered by LEM International SA offer high accuracy, linearity, wide frequency bandwidth, low-temperature drift, and many other features. These transducers are used in several applications, such as feedback elements in high-performance gradient amplifiers for MRI, power supplies, medical equipment, calibration units, and energy measurement.

List of Key Current Transducer Companies Profiled

- ABB (Switzerland)

- Texas Instruments Inc. (U.S.)

- Johnson Controls Inc. (U.S.)

- Topstek Inc. (Taiwan)

- Veris Industries (U.S.)

- NK Technologies (U.S.)

- CR Magnetic (U.S.)

- Siemens AG (Germany)

- Hobart (U.S.)

- Phoenix Contact (Germany)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Allegro MicroSystems introduced three new solutions that aim to improve motor drives, motor control, and thermal management performance in applications related to e-mobility and industrial automation. The ACS37035 and ACS37630 current sensors, along with the A89347 automotive-grade fan driver IC, deliver enhanced features for a diverse range of uses.

- March 2025: Danisense aims to assist engineers in optimizing lab testing procedures with the introduction of a new Transducer Electronic Datasheet (TEDS) feature in its current-sense transducers. This TEDS functionality simplifies setup and enhances measurement accuracy in laboratory settings.

- March 2025: Diodes Incorporated (Diodes) unveiled its inaugural series of advanced InSb Hall element sensors, engineered for detecting rotation speed and measuring current in consumer devices such as laptops, mobile phones, joysticks, and motors used in various household appliances. These sensors focus on industrial operations and are suitable for position encoders and commutation in brushless motors and fans. The creation of these devices responds to the industry's need for enhanced accessibility of high-sensitivity InSb Hall sensors available in the standard 4-pin SOT23-4 and SIP-4 packages.

- December 2024: NOVOSENSE Microelectronics has introduced a new line of automotive-grade, high-bandwidth current sensors that operate without the need for any external isolation components. The NSM211x series from the company is intended for use in various applications, including onboard chargers/DC-DC converters, PTCs, automotive motor control, charging-station current detection, fuel-cell systems, and others.

- October 2024: The research study published by Wiley introduced an integrated quantum diamond sensor aimed at enabling precise, wide-range current measurements. This design utilized optical fiber and directional Microwave (MW) antennas to operate the diamond sensor, which considerably minimized size and power requirements on the high-voltage side. Remote control and demodulation systems are located over 10 meters away from the low-voltage side. This method achieved zero power consumption on the high-voltage side and ensured effective signal transmission.

Investment Analysis and Opportunities

The investments in the current transducers industry are growing significantly owing to growth in the renewable energy sector, integration of smart grids, and emphasis on safety requirements in electrical systems.

- In January 2025, HD Hyundai Electric Co., a South Korean electric power equipment company, planned to invest about half of its 2024 operating profit, estimated at 720 billion won (USD 493 million), in expanding the production capacity of transformer plants by almost 30% of its plants in Alabama, U.S. and Ulsan, Korea.

- In July 2024, Ritz Instrument Transformers, Inc. has announced the construction of new manufacturing facility in the Georgia, U.S. that will be focusing on the development of high-voltage instrument transformers. The investment in this facility is slated at USD 28 million.

- In March 2025, Lindsey Systems launched a new series of Low-Energy Analog (LEA) voltage and current sensors to enhance its current collection of sensors designed for underground, pad-mount, and metal-clad uses. The new sensors come with RJ-45-style connectors and can be used with protective relays that have LEA inputs.

- In November 2024, ABLIC, a subsidiary of MinebeaMitsumi Inc., officially introduced the S-5611A linear Hall effect integrated circuit designed for general-purpose devices. The utilization of renewable energy sources, such as solar and wind power, has been steadily increasing, driven by a desire to harness and optimize these forms of energy while minimizing their environmental footprint.

REPORT COVERAGE

The global current transducer report provides a detailed market analysis. It focuses on key aspects such as key players, leading technology, type, application, and end-User. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.13% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

By Loop Type

By Technology

By Application

By End-User

By Region

|

Frequently Asked Questions

As per Fortune Business Insights study, the market size was 8,01,835.17 million in 2025.

The market is likely to grow at a CAGR of 5.13% over the forecast period (2026-2034).

Based on type, the flux gate segment accounted for the leading share of the market.

The market size stood at 3,37,495.88 thousand in 2025.

Rapid investments in industrial processes, manufacturing, and the renewable energy sector are driving market growth.

Some of the key players operating in the market are ABB, Texas Instruments Inc., Johnson Controls Inc., Topstek Inc., and others.

The global market size is expected to reach 12,58,543.73 thousand by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us