Learning Management System (LMS) Market Size, Share & Industry Analysis, By Component (Solutions and Services), By Deployment (On-Premise and Cloud), By End-user (Academic and Corporate), By Enterprise Type (Small and Medium Enterprises (SMEs) and Large Enterprises, By Delivery Mode (Distance Learning, Instructor-led Training, and Blended Training) and Regional Forecast, 2026 - 2034

Learning Management System (LMS) Market Size

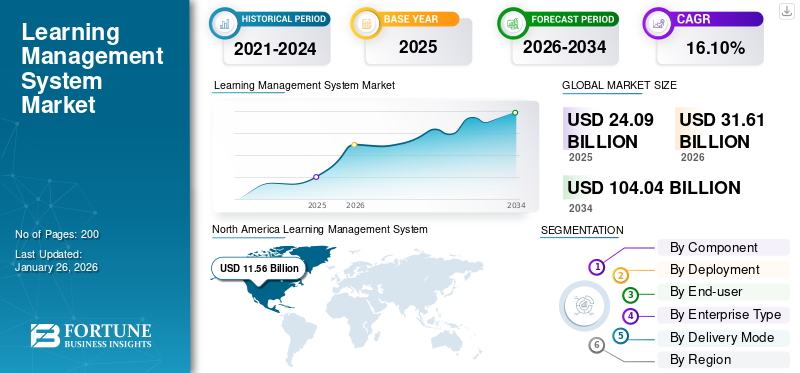

The global learning management system (LMS) market size was valued at USD 24.09 billion in 2025 and is projected to grow from USD 31.61 billion in 2026 to USD 104.04 billion by 2034, exhibiting a CAGR of 16.10% during the forecast period. North America dominated the global learning management system market, accounting for a 42.70% share in 2025. Additionally, the U.S. learning management system market is projected to grow significantly, reaching an estimated value of USD 26,712.1 million by 2032.

The demand for interactive and smart learning platforms, such as mobile education, open online courses, online tutorials, and electronic learning (e-learning), is notably escalating with the rising preference for learning and training sessions. Educational institutions are implementing solutions to enhance and support teaching and learning efficacies. This factor is likely to fuel the need for a learning management system (LMS). The emergence of 5G technology and the growing usage of smartphones and other communication devices are key factors driving the adoption of online education for learning and progress evaluation.

The global novel COVID-19 pandemic caused the temporary closure of schools, colleges, and other educational institutions. The pandemic changed the education ecosystem, escalating the demand for online learning platforms. For instance, the government of China instructed education providers to leverage online learning platforms to continue the students' learning process. This factor boosted the demand for the adoption of LMS systems during the COVID-19 pandemic.

Impact of AI

Integration of AI with LMS Improves the Efficiency of the Organizations to Drive Market Growth

Integration of artificial intelligence (AI) with enterprise learning can offer automated and personalized learning, changing the way of learning across the education system. An AI-powered LMS provides a personalized learning environment with content and also improves the quality of your courses. The integration of AI technology with the LMS system makes learning personal and relevant, with insights that are based on user behavior, data, and other preferences. It helps to optimize business operations and makes learning more effective, efficient, and engaging to deliver a better experience. AI-based LMS usually comes with a virtual assistant or chatbot to provide real-time assistance to the user, supporting learners and ensuring user engagement to provide a comprehensive learning experience to the user. For instance, the University of British Columbia already used an AI-powered avatar called Language Chatsim to help students practice speaking German in a virtual environment.

Similarly, AI-based LMS helps enhance content accessibility, which provides various learning opportunities to visually impaired people to improve their learning process. Duolingo, Cerego, Coursera, Knewton, and ALEKS are different AI-powered LMS platforms that help to optimize the content and aim to enhance the users' learning experience. According to an analyst survey, 83% of companies are adopting LMS for providing personalized learning. In comparison, 81% of employees believe that integration with artificial intelligence (AI) will boost their performance and enable them to make data-driven decisions at work. AI-based learning management systems can automate workflows and detect and prevent fraudulent activities, delivering personalized experiences to users present globally.

Thus, the integration of AI with LMS will boost the efficiency and productivity of organizations shortly, aiming to drive the growth of the market.

Learning Management System (LMS) Market Trends

Multichannel Learning Trend Promotes Learning to Augment Market Growth

Millennials make up a large portion of the global workforce. According to a research survey, in 2022, 74% of the Millennial and Gen Z population was planning to quit and find new jobs in 2023 due to lack of skills. This arrival of the millennial generation has changed the approach to employee training. Against this background, noticeable changes in learning and training are observed when using e-learning tools. The ability of employees to deliver advanced application-oriented skills more quickly is expected to drive the learning management system market growth.

This platform offers flexibility to access training and learning content at any time, making it a suitable learning tool in the corporate sector. The state-of-the-art multichannel learning management platform provides a flexible, comprehensive, and user-friendly ecosystem that increases industry attractiveness. Multichannel learning increases flexibility by providing channel independence and customized training sessions.

It helps organizations to adopt the fast-paced and changing work culture that is expected to drive demand during the forecast period.

Download Free sample to learn more about this report.

Learning Management System (LMS) Market Growth Factors

Rising Demand for Online Learning in Higher Education to Boost Market Growth

Educational institutions are increasingly turning to interactive online learning methods to gain a competitive advantage. As the internet and cloud gain popularity, learning management models provide easy-to-use solutions for content creation and distribution across websites, mobile devices, and social platforms. The platform also helps to administer, report, track, and automate the process of online learning courses with the help of virtual and augmented reality techniques to deliver a better customer experience. Thus, numerous educational organizations are shifting toward collaborative online learning methods using AR and VR techniques. Integrated LMS with AR and VR technology aims to provide guidance and support for learners and educators by creating immersive and interactive environments.

The education sector is increasingly adopting online teaching and learning methods to increase student engagement and improve the learning experience. Therefore, the growing popularity in universities is expected to drive the growth of this market.

RESTRAINING FACTORS

Traditional Educational Training to Hinder Market Growth

Learning management systems support teachers and educators during learning sessions. It complements lessons and aids in communication and content recording. Many organizations use these tools to deliver lessons in traditional classrooms. However, according to various studies, the effects and final results of traditional education are often considered more effective.

However, as per industry professionals, learning management systems cannot be used for labs or hands-on learning sessions. They can only enhance the learning experience and do not replace traditional systems. These factors may pose challenges to market growth in the coming years.

Learning Management System (LMS) Market Segmentation Analysis

By Component Analysis

Growing Demand for Adopting E-learning Solutions to Drive Solutions Segment

Based on components, the market is divided into solutions and services.

The solutions segment is projected to dominate the market in terms of revenue share 52.43% in 2026. This is due to the increasing demand for e-learning solutions catering to different needs in corporate and academic institutes.

The services sector is expected to grow at a high growth rate during the forecast period. This segment is further divided into implementation, consulting, and support services. The advanced LMS systems offer integration as a service, reducing implementation time and complexity.

Meanwhile, the consulting services sub-segment is expected to lead the LMS market as they are estimated to enable better collaboration and communication between trainers and learners.

By Deployment Analysis

Flexible Pricing and Low Maintenance Standards to Propel Cloud Segment Growth

Based on deployment, the market is segmented into on-premise and cloud.

The on-premises segment dominated the market due to its internal security features. However, smaller organizations and educational institutions are drawn to cloud-based deployment models due to flexible pricing options.

By End-user Analysis

Growing Demand for Effective Learning Tools in K-12 to Fuel Growth of Academic Segment

Based on end-user, the market is categorized into academic and corporate.

The academic segment is projected to account for the major learning management system market share during the forecast period due to the rising need for effective learning tools for training students. The segment is further divided into K-12 and higher education, wherein the K-12 sub-segment dominates the higher education sub-segment. The rapid surge in the adoption of LMS across K-12 is expected to drive the market during the forecast period.

Similarly, the corporate segment is expected to grow rapidly as it provides flexibility for companies to efficiently conduct meetings, training, and entrepreneurship programs irrespective of distance. Flexible environments for online training are becoming increasingly popular in the healthcare, BFSI, IT, and telecommunications industries. Retailers are turning to e-learning to provide sales training and provide product insights to employees. For example, Gekko launched a digital learning solution for retail stores to improve staff, brand, and product knowledge. Such initiatives are expected to increase the demand for learning management systems.

To know how our report can help streamline your business, Speak to Analyst

By Enterprise Type Analysis

Large Enterprise Segment to Lead Supported by Escalating Product Demand

Based on enterprise type, the market is divided into large enterprises and small & medium enterprises (SMEs).

The large enterprises segment will dominate the market during the anticipated period due to the early adoption of the solutions.

Furthermore, the small & medium enterprises segment is predicted to witness an average growth rate during the forecast period. This is owing to the increasing demand for learning management systems for SMEs in developing regions such as the Middle East & Africa, South America, and Asia Pacific.

By Delivery Mode Analysis

Rising Demand for Virtual Classrooms to Gain Convenient Education Boost Growth of Distance Learning Segment

On the basis of delivery mode, the market is segregated into distance learning, instructor-led training, and blended training.

Among these, the distance learning segment dominated the market with the highest market share in 2024. This is due to the growing demand for virtual classrooms and mobile learning among students due to the rising penetration of the internet.

Furthermore, the instructor-led training (ILT) segment is estimated to grow with the highest CAGR during the forecast period. The instructor-led training mode energizes discussion and interaction between instructors and learners, conveying a consistent learning involvement. The demand for LMS in academics has exceeded, as it manages online course organization, educational content, and work assessment.

REGIONAL INSIGHTS

The market is geographically fragmented into five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America. They are further categorized into countries.

North America Learning Management System (LMS) Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America is expected to dominate the LMS market due to the increasing edtech activities in the region. With many universities and educational institutions, there is a significant opportunity for players to expand their business in the country. The rise in digital technology adoption and the growing usage of BYOD helps businesses concentrate on implementing LMS on smartphones to provide integrated employment training to employees present across the region. In April 2023, eLeaP, a U.S.-based learning management systems provider, deployed new skills and competency management features in its LMS platform to revolutionize how organizations manage employee training and improve workforce planning, along with rising employee engagement. The U.S. market is projected to reach USD 10.3 billion by 2026.

Similarly, the implementation of an open-source learning management system has been extended in Europe. As per the 2021 European Ed-Tech Funding Report published by Brighteye Advisors, the Ed-Tech funding in Europe increased from USD 651 million in 2019 to USD 711 million in 2020. Online learning has a mounting demand across the corporate sector and European education.The UK market is projected to reach USD 2.22 billion by 2026, while the Germany market is projected to reach USD 2.55 billion by 2026.

Asia Pacific region is expected to witness robust growth during the forecast period. Australia, China, Japan, India, Singapore, Malaysia, and other developing countries in the region are focusing on funding platforms to facilitate online training, education, and courses. For instance, in June 2023, D2L, a Canada-based transnational learning technology provider company, expanded its presence in India across the educational market by providing UGC (University Grants Commission) and NEP (National Education Policy) compliant LMS to the Indian market. This factor is considered a driving force that boosts the demand for LMS solutions in Asia Pacific.The Japan market is projected to reach USD 1.14 billion by 2026, the China market is projected to reach USD 2.54 billion by 2026, and the India market is projected to reach USD 1.17 billion by 2026.

The government in Latin America focused on developing the education sector. For example, in April 2021, the University of New Mexico selected Canvas to expand its academic LMS. The Middle East & Africa is expected to see healthy growth due to increased internet penetration and smartphone usage. Similarly, the demand for e-learning in Saudi Arabia, the UAE, and Qatar is growing due to the rising tech-savvy population across these countries.

Key Companies in Learning Management System Market

Key Players Offer Strong Product Portfolios to Expand Market Opportunity

The key market players are forming partnerships to bring innovation in advanced analytics in order to enhance their supply chain operations. Major players are focusing on the continuous development of their product portfolio with advanced technologies. Advancements to the product portfolio are helping major players to maintain their competitive edge. These companies are also engaging in strategic partnerships, acquisitions, product launches, and collaborations to expand their business and distribution network to maintain their market growth.

LIST OF KEY COMPANIES PROFILED:

- McGraw Hill (U.S.)

- D2L Corporation (Canada)

- SAP SE (Germany)

- Saba Software (U.S.)

- Absorb LMS Software Inc. (Canada)

- Blackboard Inc. (U.S.)

- Cornerstone OnDemand, Inc. (U.S.)

- Oracle Corporation (U.S.)

- IBM Corporation (U.S.)

- Paradiso Solutions LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: OpenLMS, an open-source learning management system, entered into a partnership with Ease Learning to integrate with Skillways, a skills assessment platform, to resolve learning and teaching challenges and strengthen skills-based learning outcomes.

- February 2023: GSoft acquired Didacte, a corporate learning management system provider. The company expanded its product portfolio to deliver comprehensive employee experience solutions to provide a better customer experience.

- August 2023: LMS365, an AI-powered learning platform, completed the acquisition of Weekly10, a U.K.-based performance and engagement management company, to expand its performance and learning capabilities and enhance customer experience.

- September 2023: Intellek, a leading learning management solution provider, partnered with Litera, a provider of legal tech solutions, to enhance the power of Intellek’s learning management solutions across the globe.

- December 2022: Francisco Partners (FP), a global investment firm, completed the acquisition of Litmos from SAP. This acquisition helped accelerate the growth of the Litmos team by enhancing product development to deliver strong value to customers.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report highlights key regions across the globe for better user understanding. In addition, it provides an overview of the latest industry and market trends and analyzes the technologies being rapidly adopted worldwide. Furthermore, it highlights growth-stimulating factors and constraints, aiding the reader in obtaining in-depth knowledge of the market.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 16.10% from 2026 to 2034 |

|

Segmentation |

By Component, Deployment, End-user, Enterprise Type, Delivery Mode, and Region |

|

Segmentation |

By Component

By Deployment

By End-user

By Enterprise Type

By Delivery Mode

By Region

|

Frequently Asked Questions

According to Fortune Business insights, the market is projected to reach USD 104.04 billion by 2034.

In 2025, the market stood at USD 24.09 billion.

The market is projected to grow at a CAGR of 16.10% during the forecast period.

By component, the solutions segment is likely to lead the market.

The rising demand for online learning in higher education is the key factor driving market growth.

McGraw Hill, D2L Corporation, SAP SE, Saba Software, Absorb LMS Software Inc., Blackboard Inc., Cornerstone OnDemand, Inc., Oracle Corporation, and IBM Corporation are the top players in the market.

North America is expected to hold the highest market share.

By end-user, the academic segment is expected to grow at the highest CAGR.

Related Reports

- EdTech and Smart Classroom Market

- Anti-Plagiarism for the Education Sector Market

- Higher Education Market

- Adaptive Learning Software Market

- E-Learning Compliance Corporate Training market

- Smart Education and Learning Market

- Virtual Reality in Education Market

- Loyalty Management Market

- E – Learning Services Market

- Human Capital Management (HCM) Market

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us