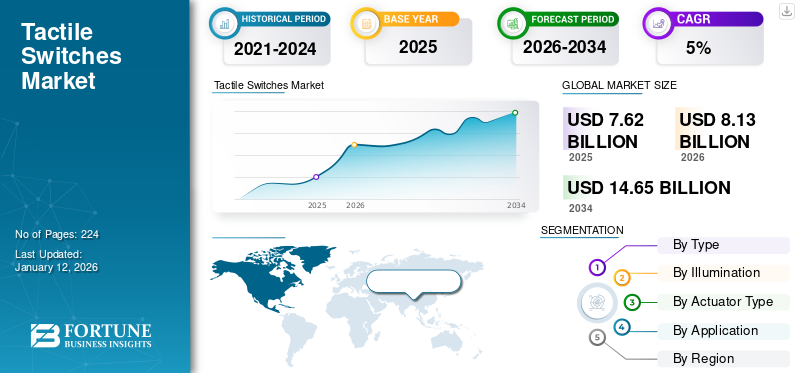

Tactile Switches Market Size, Share & Industry Analysis, By Type (Standard, Sealed), By Illumination (Illuminated, Non-illuminated), By Actuator Type (Square, Rectangular, Plunger, Round, Others), By Application (Automotive, Medical, Electronic Devices, Others), and Regional Forecast, 2026-2034

Tactile Switches Market Size and Future Outlook

The global tactile switches market size was valued at USD 7.62 billion in 2025. The market is projected to grow from USD 8.13 billion in 2026 to USD 14.65 billion by 2034, exhibiting a CAGR of 8.79% during the forecast period. Asia Pacific dominated the tactile switches market with a market share of 41.53% in 2025.

Tactile switches are used in everyday electronics such as TV remotes, keyboards, gaming consoles, calculators, audio equipment, wearables, and smart home products. The global e-sports and gaming market is driving demand for mechanical keyboards and game controllers that rely on tactile feedback for better control and user experience. All these factors thus drives the tactile switches market size.

- In May 2025, Littelfuse, Inc., an industrial technology firm with a focus on developing a more sustainable, connected, and secure environment, highlighted the TLSM Series, surface-mount technology (SMT) tactile switches. With a remarkable lifespan of up to 2 million cycles, the TLSM series is among the most robust switches on the market. Due to its durability, it works well in settings with high traffic. With a small 3.45mm high profile and Single Pole Double Throw (SPDT) configuration, the switch provides superior performance.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Expansion of Consumer Electronics Industry to Drive Market Growth

Consumer electronics such as smartphones, tablets, laptops, cameras, wearables, gaming consoles, and smart TVs sell billions of units every year. Virtually every gadget has several tactile switches (power, volume, reset, mode, gaming buttons, and others) embedded in it; therefore, more sales of devices mean more demand for switches.

- In July 2025, Littelfuse, Inc., a company that creates industrial technology that helps the world become more sustainable, connected, and safer, announced that it upgraded and is reintroducing its PTS647 Series Surface-Mounted Tactile Switch, which is used in consumer electronics products. The main features that the company highlighted in the announcement are noise performance, durability, and dust resistance.

MARKET RESTRAINTS

High Pricing Pressure and Low Margins to Hinder Market Growth

The market for such switches is characterized by a large number of suppliers, especially those located in the Asia Pacific region, which makes it highly competitive. OEMs in the consumer electronics, automotive, and medical sectors continually require component suppliers to achieve cost savings, which puts severe pricing pressure on the component manufacturers.

High pricing pressure and low margins create a cycle of weak revenue, low innovation, and supplier consolidation, which prevents the market from realizing its full growth potential. Rising input costs, combined with limited ability to raise selling prices, squeeze supplier margins, and discourage investment, restraining the overall market growth.

MARKET OPPORTUNITIES

Rise in Automotive Applications to Drive Market Growth

Automotive applications drive tactile switches market growth as cars are becoming more electronic, more connected, and more user-interface dependent. Each of these trends increases the quantity, quality, and value of tactile switches required.

- In March 2025, UltraSense Systems, a leader in innovative smart surfaces technology, revolutionized the automotive industry with the launch of UltraSwitch, the world's first solid-state Pillar Switch for doors. This groundbreaking product supersedes traditional mechanical door switches, offering automotive manufacturers an opportunity to upgrade their vehicle designs while enhancing user experience through sleek, handle-free interfaces.

Modern cars integrate infotainment, navigation, ADAS (advanced driver assistance), HVAC, lighting, and steering wheel controls. Each of these requires reliable switches for safe and intuitive operation.

TACTILE SWITCHES MARKET TRENDS

Growing Demand for Sealed and Durable Switches to Drive Market Trends

The rising demand for such switches that are both sealed and durable is becoming a significant trend that is impacting the global market. Manufacturers are switching to switches that provide greater resistance to the harsh conditions in which electronic devices are being used more and more, such as in the automotive, industrial, medical, and outdoor industries.

Modern applications often require components that can withstand dust, water, moisture, chemicals, and temperature fluctuations. Traditional open-structure tactile switches are prone to failure in such environments.

- For instance, in June 2025, Panasonic, a global leader in Electromechanical Products, announced the addition of new models to the EVP-BL Series SMD Tactile Switches. These new Switches have a long lifespan and a minimum operating cycle of 300,000 cycles for the 0.7N Operation Force Type.

MARKET CHALLENGES

Rising Competition from Alternative Interface Technologies to Hamper Market Growth

The increasing use of alternative interface technologies, such as capacitive touch sensors, touchscreens, membrane keypads, and voice-activated controls, is becoming a major threat to the market. These technologies are being more and more integrated into industrial gear, automobile systems, and consumer electronics, sometimes taking the place of conventional mechanical input components such as tactile switches in specific applications.

Capacitive touch keys are simple to clean, have a sleek, contemporary design, and have no mechanical wear, which extends their lifespan when compared to conventional mechanical switches. The number of mechanical switches in many household appliances is decreasing as they switch from tactile buttons to flat capacitive panels, such as washing machines, microwaves, HVAC systems, and lighting controls.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Expanding Consumer Electronics Production to Drive Segment Growth

On the basis of the segmentation of type, the market is classified into standard and sealed.

The standard holds the largest market share and is expected to dominate with a 64.21% share over the forecast period, due to its widespread applicability, low cost, and reliability. These switches are manufactured in large volumes and are primarily used in consumer electronics (remote control, calculator, gaming devices, wearables, and household appliances) that have a strong demand and high volumes.

In April 2025, Littelfuse, Inc., a diversified industrial technology manufacturing firm that promotes a more sustainable, connected, and secure environment, showcased the KSC XA Series Soft Sound Tactile Switches, a crucial solution for applications that need calm, dependable tactile feedback.

By Illumination

Wide Use in Industrial and Utility Applications to Drive Segment Growth

Based on illumination, the market is segmented into illuminated and non-illuminated.

Non-Illuminated held the largest share in the product market, accounting for 74.78% in 2026. The segment for non-illuminated switches has the largest market share due to their popularity and cost-effectiveness. Non-illuminated tactile switches are easier to design and therefore cheaper to manufacture and use in electronic products than illuminated switches. Non-Illuminated accounted for a CAGR of 6.80%.

- In October 2025, the K5V Series illuminated tactile switch line from Littelfuse, Inc. was expanded with the introduction of the K5V4 versions, which are offered in Gull Wing (GH) and 2.1 mm Pin-in-Paste (PIP) variants. Due to their compatibility with reflow soldering, both versions are perfect for producers who are switching from wave soldering to surface mount assembly.

The illuminated switches market segmentation is experiencing expansion, driven by the growing desire for aesthetics, visibility, and versatility in new-age electronics.

- For example, OMRON’s B3W-9 line is a compact illuminated tactile switch (10×10×11 mm or 12×12×11 mm) with two LEDs (for multi-color) and options for different actuation forces (1.57 N standard, or a higher-force 2.26 N variant).

By Actuator Type

Round Tactile Switches Segment Growing Due to Wide Application Versatility and Aesthetic Appeal

Based on actuator type, the market is segmented into square, rectangular, plunger, round, and others.

The round segment holds the largest share in the market and is expected to dominate with a 35.06% share in 2026. The round tactile switches segment holds the largest share due to their widespread use, simple design, and low cost. The round segment accounted for a CAGR of 6.85%.

- For instance, in June 2022, the industry leader and authority in mechanical keyboard switches, CHERRY MX, is adding a tactile version without an audible click to its MX Ultra Low Profile (ULP) range. As a result, the maker of cutting-edge switches now provides end consumers with an alternative option in the categories of "high-end laptop keyboards" and "ultra-thin desktop keyboards."

Square actuators can be more amenable to grid layout alignment on printed circuit boards (PCBs). This can facilitate the PCB design, routing, and solder pad alignment process, especially with tight tube spacing.

By Application

Proliferation of Smart Electronic Devices and IoT to Drive Segment Growth

Based on application, the market is segmented into automotive, medical, electronic devices, and others.

The electronic devices segment holds the largest share in the market and is anticipated to dominate with 51.41% share in 2026. The market has the largest share found in the electronic devices segment due to the size and diversity of consumer electronics and portable electronics that utilize tactile switches.

As the automotive industry begins to integrate more electronics and smart features, the demand for these switches in automobiles is increasing. New cars have more electronic controls on dashboards, steering columns, center consoles, and infotainment systems. These need switches that give some physical feedback and can withstand vibration, temperature, and harsh conditions.

To know how our report can help streamline your business, Speak to Analyst

Tactile Switches Market Regional Outlook

By region, the market is categorized into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

The Asia Pacific held the dominant tactile switches market share in 2026 valuing at USD 3.41 billion and also took the leading share in 2026 with 41.53%. The Asia Pacific market is growing rapidly as the region is the world’s largest hub for consumer electronics and automotive production, with countries such as China, Japan, South Korea, and Taiwan leading global manufacturing of smartphones, laptops, gaming devices, and electric vehicles. Devices such as smartphones tablets are driving market growth as they need precise, compact, and reliable physical input. The Japan market is projected to reach USD 0.7 billion by 2026, the China market is projected to reach USD 1.22 billion by 2026, and the India market is projected to reach USD 0.43 billion by 2026.

- In March 2021, Alps Alpine Co., Ltd. expanded its SPVQ8 Series lineup of compact switches for use in detecting the opening and closing of vehicle doors and has newly introduced the SPVQ8H Series.

North America

North America was valued at USD 1.84 billion in 2025. North America has a strong market for gaming, wearables, and smart devices, even though most manufacturing is offshore. U.S. brands (Apple, Microsoft, Google, HP, and Dell) design devices that rely heavily on such switches for power buttons, keyboards, remotes, and controllers. The U.S. market is projected to reach USD 1.46 billion by 2026.

Europe

Other regions, such as Europe and Latin America, are anticipated to witness a notable growth in the coming years. During the forecast period, the European region is the third highest amongst all the regions and touches the valuation of USD 1.57 billion in 2026. Europe boasts world-renowned automotive manufacturers (Volkswagen, BMW, Mercedes-Benz, Ford, Stellantis, Renault, and Volvo). UK market is projected to reach USD 0.24 billion by 2026, while the German market is projected to reach USD 0.41 billion by 2026.

With over 13 million cars produced in Europe in 2023 (OICA), the automotive industry is a leading consumer of tactile switches. The shift to EVs is accelerating demand: the EU registered 3.2 million EVs in 2023, ~21% of all new car sales, each packed with electronic controls that rely on tactile switches.

Latin America and Middle East & Africa

Over the forecast period, the Latin America and the Middle East & Africa regions would witness a moderate growth in this market. The market in Latin America is growing due to rising demand for consumer electronics, increased automotive production, and greater industrial automation in the region.

- In September 2024, TE Connectivity (TE), a global leader in connectors and sensors, will have finished acquiring Sense Eletrônica Ltda (Sense), a top manufacturer of factory and process automation sensors in Brazil. This acquisition gives TE a wide range of inductive and capacitive position sensors, photoelectric sensors, valve automation products, and connectivity solutions for the factory and process automation markets.

The market in the Middle East & Africa is growing as the region is witnessing a steady rise in consumer electronics adoption, automotive production, and industrial development.

COMPETITIVE LANDSCAPE

Key Industry Players:

Vendors Expanding Product Portfolios to Address Diverse Application Needs and Enhance Competitiveness

Particularly in the standard and industrial-grade sectors, Panasonic and Knitter-Switch are frequently highlighted as leading competitors in the tactile switch industry. Their supremacy stems from a combination of high product quality, large portfolios, global supply chains, and long-standing partnerships with OEMs in major sectors such as consumer electronics, the automobile industry, and industrial machinery.

In September 2025, Panasonic expanded its EVP-BB Series Tactile Switch lineup with the new EVP-BB5AHE000, featuring a 3.0N operating force, 500K cycle life, and IP67 dust/water resistance. Measuring just 2.6 × 1.6 × 0.57 mm, it is among the industry’s smallest switches, offering designers more flexibility against accidental activations.

LIST OF KEY TACTILE SWITCHES COMPANIES PROFILED:

- Panasonic Corporation (Japan)

- Knitter-Switch (Germany)

- Marquardt Management SE (Germany)

- Biwin Technologies Co., Ltd. (China)

- OMRON Corporation (Japan)

- C&K Switches (U.K.)

- CTS Corporation (U.S.)

- TE Connectivity (Ireland)

- Alps Alpine (Japan)

- Mitsumi Electric Co., Ltd. (Japan)

- E-Switch, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In June 2025, Panasonic expanded its EVP-BL Series SMD Tactile Switches, offering a long life of up to 300,000 cycles for the 0.7N type. With a compact 2.8 × 1.9 mm size, ultra-low profile, and IP67 dust/water resistance via laser welding, these switches ensure durability and reliable performance in compact designs.

- In June 2025, Knitter-Switch, one of the top switch manufacturers in Europe, expanded its product line of Tactile Switches. With the TSSE 512 and the TSSE 521 series, Knitter-Switch offers two tactile switches with silent action and clear tactile feedback.

- In May 2025, OMRON Electronic Components expanded its D2EW Series of sealed ultra-subminiature switches, introducing new models with varied configurations. Designed for compactness and durability, the updated lineup enhances space efficiency, reliability, and offers IP67-level protection, making it ideal for demanding environments and diverse application needs.

- In March 2025, CTS Corporation introduced the Series 229 pushbutton switch; its first pushbutton line designed for harsh environments. Featuring a rugged structure and optional IP67 protection, it ensures reliable performance in outdoor, dusty, and humid conditions.

- In December 2024, Littelfuse, Inc. introduced the C&K EITS Series right-angle illuminated tactile switches, offered in SMT PIP and through-hole versions. With customizable caps and multiple LED color options, they provide versatile solutions for telecom, data centers, and professional AV equipment.

REPORT COVERAGE

The global tactile switches market analysis provides an in-depth study of market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The industrial burner market research report also encompasses a detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| ATTRIBUTE | DETAILS |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Period | 2021-2024 |

| Growth Rate | CAGR of 8.79% from 2026-2034 |

| Unit | Value (USD Billion) |

| Segmentation | By Type, Operating Temperature, Application, and Region |

| By Type |

|

| By Illumination |

|

| By Actuator Type |

|

| By Application |

|

| By Region |

|

Frequently Asked Questions

A study by Fortune Business Insights states that the global market was USD 7.62 Billion in 2025.

In 2025, the region stood at USD 3.16 billion.

Registering a CAGR of 8.79%, the market is projected to exhibit staggering growth during the forecast period (2026-2034).

The standard segment under the type category is anticipated to hold the leading share in this market during the forecast period.

Increasing utilization of switches in vehicles produced worldwide and using tactile switches in commercial equipment and industrial machinery operations are some of the major factors driving the market growth.

Panasonic, Omron, TE Connectivity, and C&K are among the key players operating across the industry.

Asia Pacific dominated the market in terms of share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us