Thermal Energy Storage Market Size, Share & Industry Analysis by Technology (Sensible Heat, Latent Heat, and Thermochemical), By Material (Water, Molten Salt, Phase Change Materials (PCM), and Others), By Application (District Heating and Cooling Systems, Process Heating and Cooling, and Power Generation), By End-User (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

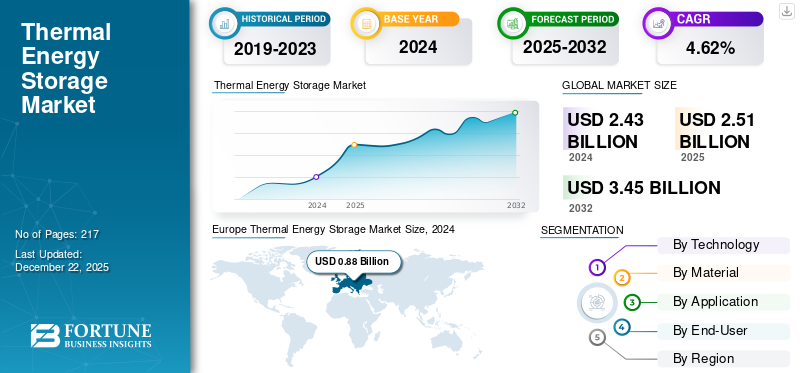

The global thermal energy storage market size was valued at USD 2.51 billion in 2025. The market is projected to grow from USD 2.61 billion in 2026 to reach USD 3.63 billion by 2034, exhibiting a CAGR of 4.2% during the forecast period. Europe dominated the thermal energy storage market with a market share of 36.29% in 2025.

Solar energy is plentiful during the day, but demand often peaks in the evening. Thermal energy storage (TES) keeps excess energy, either as heat or cold, when it is available and releases when needed. According to the International Energy Agency, heat plays a dominant role in the energy system, making up half of the global final energy consumption and generating about 40% of total CO₂ emissions on an average. The industrial sector is the largest user, accounting for around half of the global heat demand, while buildings represent another 46%, mainly for space and water heating. Renewables generate electricity, but most applications demand thermal energy. TES permits the direct storage of thermal energy, making it more effective than converting electricity to heat, storing it, and then converting it back.

Thermal energy storage (TES) solutions show application in power generation, district heating cooling, and commercial and industrial buildings. The technology is obtaining traction as a cost effective solution as it permits off-peak energy to be stored as cold or heat and used during peak demand. The storage of thermal energy is increasing in the energy generation sector as it improves the efficiency and reliability of renewable power plants. Thus, all these factors are anticipated to drive the market.

CALMAC, Evapco, and Dunham-Bush, some of the key players, are seeing growth in the market. This increase is driven by market demand, the energy transition, and their technology strengths. The growth of the commercial real estate and urban infrastructure supports the rise in their market share.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Urbanization and Infrastructure Growth to Drive Market Expansion

Urbanization leads to the development of more high-rise buildings, offices, malls, hospitals, and data centers. Furthermore, it increases the usage of air conditioning, heating, and cooling systems, usually at the time of peak load when demand peaks as well.

Thermal energy storage (TES) allows thermal energy to be stored in the off-peak hours when electricity is cheaper and released when electricity demand is higher. This helps lower costs and relieves the load on the grid. The power grids of congested metropolitan cities often face challenges from peak load stress, costly infrastructure enhancements, and blackouts. TES will shift thermal energy loads and relieve the grid from costly power plant and grid expansions, which improve energy reliability and defer or avoid costs.

- In March 2025, The Riverie, a two-tower residential development at 1 Java St., unveiled plans to implement a vertical "closed-loop geoexchange system" harnessing the Earth's temperature to heat and cool each of its 834 units, developers. The entire city-block-long project will use a geo-exchange system using 300 bored holes drilled deep into the Earth, up to 500 feet, to harness the thermal energy to warm the facility's rooftop pool and run the gym, as well as provide heating and air conditioning to individual apartment units in the 37- and 20-story towers.

Rising Renewable Energy Integration to Boost the Market Growth

The ongoing expansion of solar and wind renewable energy is fueling the thermal energy storage market growth. Renewable energy is clean and emission-free. However, renewable energy is also intermittent and variable, which makes it difficult to balance supply and demand.

TES systems can ease balancing issues by capturing and storing surplus renewable energy in the form of either heat or cold, which may be made available to consumers at a later time during high demand and low generation times. In November 2024, a 100 MW thermal solar and molten salt energy storage plant based in Xinjiang, China, was completed and connected to the grid as part of a renewable energy project. The plant has also installed traditional solar PV. The project will include 900 MW of traditional solar PV and the construction of a 100 MW thermal solar energy storage facility. The total investment was around USD 840 million.

MARKET RESTRAINTS

High Initial Capital Costs to Restrain Market Growth

TES systems such as molten salt tanks, chilled water storage, or underground boreholes require specialized materials and equipment, custom engineering and design, site preparation, and installation. These components significantly increase project costs up to millions, especially for large-scale or long-duration storage. In developing areas, these TES systems are frequently deemed too expensive or complicated to consider as a priority, given that energy infrastructure is still in development. A large-scale molten salt TES system for solar thermal plants can cost over USD 30–50 million for construction. In contrast, even commercial ice storage systems for buildings may be valued in hundreds of thousands of dollars, which does not include integration with HVAC systems.

MARKET OPPORTUNITIES

Technological Innovations and Modularization to Create Growth Opportunities

New materials, including Phase Change Materials (PCMs) and thermochemical storage media, increase the ability of TES systems to store more energy in smaller volumes, provide a greater range of temperatures at which they can operate, and provide faster charge/discharge cycles. These new materials make TES systems smaller, more efficient, and flexible for both big and small applications.

New modular TES systems are pre-engineered and pre-fabricated. They are easy to transport and install as a containerized system, modular TES systems can easily be integrated and relocated, and they are applicable for retrofit and distributed energy systems. Such systems reduce the time and cost of installation, making TES systems more applicable for commercial buildings, industrial users, and remote applications. In September 2024, Exergy3, a clean heat technology firm, raised financing to support its innovative ultra-high temperature thermal energy storage system. The investor invested around USD 13.24 million pre-seed funding round and was supported by the University of Edinburgh’s venture investment fund, Old College Capital (OCC).

MARKET CHALLENGES

Low Awareness and Lack of Standards to Restrain the Market Growth

Many building owners, facility managers, and energy planners are not familiar with TES technology and the advantages it offers, including cost savings through load shifting, peak demand reduction, and improved renewable integration. This unfamiliarity leads to missed opportunities during design and retrofits, undervaluation of TES in smart energy projects, and a preference for more familiar solutions such as batteries. TES technologies often do not have consistent performance benchmarks such as efficiencies, life expectancies, and safety certifications. These factors are likely to create challenges for market expansion.

Download Free sample to learn more about this report.

THERMAL ENERGY STORAGE MARKET TRENDS

Increased Focus on Industrial Applications to Lead the Market Growth

Industries such as chemical, food processing, textiles, cement, and pharmaceuticals burn a lot of thermal energy for process heating, steam generation, cooling, and refrigeration. Thermal energy storage (TES) allows industries to charge up when demand or energy costs are low and discharge at peak, improving efficiency, lowering operating costs, and enhancing energy resiliency.

Moreover, these industries face growing pressures to lower greenhouse gas emissions driven by compliance regulations and sustainability commitments. TES allows better integration of renewable sources of heat (such as solar thermal, biomass), a more efficacious realized use of waste heat recovery systems, and an easier transition from fossil fuels tempered by the storage of thermal energy.

IMPACT OF TARIFFS ON THE THERMAL ENERGY STORAGE MARKET

Import tariffs could increase battery costs for U.S. utility-scale energy storage installations by more than 50% and make the U.S. the most expensive solar market in the world. Prices for four-hour battery systems have already increased 56% to 69% since January 2025 and it is expected that they will continue to be volatile. U.S. energy storage developers will probably rely on imports for some time, while domestic manufacturing capacity grows from 6% of current demand to 40% of the expected 2030 demand.

The rapid and significant tariff increases have injected considerable market uncertainty and led developers and financiers to defer or reconsider investments in TES projects. Installations are forecasted to take a dramatic downturn post-2025, especially merchant-scale BESS and thermal energy storage projects that have no power purchase agreements signed (PPAs). The anode materials that were most impacted, most sourced from China, are particularly important for lithium-ion technologies such as LFP, which dominate stationary energy storage.

SEGMENTATION ANALYSIS

By Technology

Optimal Heat Collection Ability for Large-Scale Renewable Integration to Push the Sensible Heat Segment Growth

Based on technology, the market is segmented into sensible heat, latent heat, and thermochemical.

The sensible heat segment holds the largest market share of 42.66% in 2026 and is expected to dominate over the forecast period. Sensible heat systems accumulate energy by changing the temperature of a medium (such as water, molten salt, or rocks) without a change of phase. Sensible heat is the most basic system to comprehend and operate and it has been widely used for a long time in district heating/cooling systems, industrial process heating, and concentrating solar power (CSP) plants. These factors drive segment growth.

The latent heat segment is the fastest growing segment in the market and is anticipated to exhibit a CAGR of 5.21% over the forecast period. Latent heat storage uses phase change materials (PCMs), which absorb or release large amounts of heat when undergoing phase change (e.g., solid-liquid). These embodiments store between 2 to 10 times more energy per unit volume than sensible heat systems. Thus, these systems can be quite useful in limited-volume situations such as buildings or when placed into vehicles.

By Material

High Thermal Stability Feature to Fuel Molten Salt Segment Growth

By material, the market is segmented into water, molten salt, phase change materials (PCM), and others.

The molten salt segment dominates the global thermal energy storage market share, holding 40% share in 2026. Due to its high thermal stability, low cost, and excellent heat retention, molten salt commands the market, making it particularly useful for large-scale energy storage applications such as concentrated solar power (CSP) plants.

The phase change materials (PCM) segment is growing at the fastest rate and is anticipated to depict a CAGR of 5.63% over the forecast period. The demand for phase change materials (PCMs) for thermal energy storage is expanding due to their high energy density and effective, stable temperature management within compact space-saving systems.

By Application

Rising Need for Grid Stability and Renewable Energy Integration to Propel Power Generation Growth

Based on application, the market is segmented into district heating and cooling systems, process heating and cooling, and power generation.

The power generation segment is the dominating segment in the market, holding 46.46% in 2026. Power generation, which is a majorly contributing sector, is dependent on large-scale, reliable, and efficient thermal energy storage solutions to better balance supply and demand, particularly as the integration of renewable energy sources increases.

The district heating and cooling systems segment is growing significantly in the market and is expected to depict a CAGR of 4.89% over the forecast period. This is due to efficient large-scale energy management, reduction in peak energy demand, and sustainable urban infrastructure development.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Rising Demand for Energy Cost Savings and Process Efficiency to Push Industrial Segment Growth

Based on end-user, the market is segmented into residential, commercial, and industrial.

The industrial segment is the dominating segment and held a market share of 51.53% in 2024. The segment is growing due to improving energy efficiencies and decreasing operational costs in energy-intensive processes. Additionally, in the industrial sector, TES is mainly used to manage high-temperature process heat, improve energy efficiency, and reduce reliance on fossil fuels by integrating with renewable or electrified heat sources. Many industries, such as chemicals, cement, food processing, and metallurgy, require continuous high-temperature heat, which makes thermal energy storage valuable for balancing fluctuating energy supply and ensuring stable operations.

The residential segment is growing at a notable rate in the market and is anticipated to experience a CAGR of 4.86% over the forecast period. The growth of the segment is driven by consumer demand and advancements in technology, favorable policies, rising energy costs, and increasing desire to lead a sustainable lifestyle. These reasons combined are what make TES systems attractive for homeowners wanting to maximize energy savings and mitigate their environmental impact.

THERMAL ENERGY STORAGE MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Thermal Energy Storage Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with 36.29% share in 2025 and is the fastest-growing region in the market. Europe’s thermal energy storage (TES) infrastructure is rapidly expanding as abundant renewable energy capacity enhances the continent’s energy supply, unprecedented decarbonization policies (the Green Deal and most recently REPowerEU), volatile prices of fossil fuels, and resilient heating, cooling, and industrial systems. As wind and solar sources are adding much-needed supply to fuel the continent, TES effectively manages inefficient forms of intermittent generation, allowing excess supply to be stored and used at peak demand. The European Green Deal, REPowerEU, and national strategies are all stimulating the deployment of TES (with regulatory frameworks and funding) into emerging uses more quickly than other forms of energy storage. The market for the U.K., Germany, and France have been estimated to be USD 0.11 billion, USD 0.19 billion in 2026 and 0.12 billion in 2025.

North America

North America is the second leading market, generating a revenue of USD 0.57 billion in 2026. The increased usage of thermal energy storage in North America is being driven by the need for energy efficiency, with support from technology, policies, and renewable energy sources. The U.S. Inflation Reduction Act and tax incentives for renewable energy projects have helped stimulate investments in TES systems and technology. Incentives are an important element when it comes to deploying TES, as these provide support to mitigate upfront installation costs in terms of incentivizing customers and businesses to engage with TES. By allowing homes or businesses to restore heating and cooling loads during a grid fault or peak demand period through load shedding, TES systems are able to add resilience to energy systems. Systems can facilitate load shifting and support cost reduction by providing stored energy in a higher-demand period.

The U.S. market has been valued at USD 0.5 billion in 2026. Thermal energy storage ("TES") is rapidly increasing in the U.S. for several reasons that comprise its usefulness in integrating increasing amounts of renewable energy and the effects of federal and state policies. Additional factors influencing industry expansion comprise incentives to develop this energy resource, the desire for increased resiliency as energy costs rise, and demand in commercial and district heating applications.

Asia Pacific

Asia Pacific is the third-leading region in the market with an estimated revenue of USD 0.45 billion in 2026. The market is anticipated to witness a CAGR of 4.88% over the forecast period. The expansion of thermal energy storage (TES) in the Asia Pacific region continues rapidly with rising energy demand from ongoing industrialization, urbanization, increasing integration of renewable energy, supportive government policies, and the need to maintain reliability, flexibility, and cost-effective heating and cooling, continues to drive the adoption of TES. Increasing energy demand from developing economies in locations such as China, India, Australia, Japan, and South Korea is driving the demand for flexibility, reliability, and energy storage. For 2026, the market valuation for countries, including China, India, and Japan, is estimated to be USD 0.32 billion, USD 0.04 billion, and USD 0.06 billion, respectively.

Middle East & Africa

The market in the Middle East & Africa is growing significantly and has been valued at USD 0.37 billion in 2026. The growth is mainly attributed to the rapid installation of solar CSP (concentrated solar power) plants, enabling government policies, and ongoing demand for reliable, clean energy in warm, sun-soaked regions. CSP plants with thermal storage, such as those built with molten salt such as the Noor Ouarzazate complex in Morocco, and the Karoshoek plant in South Africa, are the core of near-term regional deployment given that they are able to deliver stable power after the sun goes down. The market for GCC nations has been valued at USD 0.23 billion in 2025.

Latin America

Thermal energy storage is on the rise in Latin America. The region is rapidly accelerating its renewable energy capacity, particularly in solar and wind, and increasing investment toward improving grid resilience. The region also records system optimization with AI-driven technology and the deployment of TES solutions for industrial, commercial, and off-grid applications. As countries such as Brazil, Chile, and Argentina increase solar and wind generation, the use of thermal energy storage will support their needs for intermittency and provide balance to the grid. The deployment of TES solutions is a strategic benefit to large-scale utility-scale projects already deployed in Latin America, such as Chile's solar thermal plants, including Cerro Dominador and the Copiapó Solar Project.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Industry Players Emphasize Advanced Energy Storage Technologies and Innovation to Lead the Market

The global market is mostly fragmented, with key players operating in the industry. The global thermal energy storage companies are active in the market through various developments such as product launches, business expansion, and other initiatives. For instance, in February 2025, Fafco appointed Pure Thermal as its sole Sales & Technical Partner/Distributor for the territories of the U.K. and Ireland. With over 1,400 IceBat systems existing in Europe, Fafco delivers outstanding Cold Thermal Energy Storage technology to the U.K. in view of a rising demand for cooling solutions that are both cost-effective and resilient.

List of Key Thermal Energy Storage Companies Profiled

- ABENGOA (Spain)

- Man Energy Solutions (Germany)

- Analog Devices (U.S.)

- Caldwell Energy (U.S.)

- Evapco (U.S.)

- Calmac (U.K.)

- Dunham Bush (Malaysia)

- Baltimore Aircoil Company (U.S.)

- Burns and McDonnell (U.S.)

- Cristopia Energy (France)

- Lime Micromobility (U.S.)

- FAFCO (U.S.)

- MCDermott (U.S.)

- Vogtice (U.S.)

- Steffes Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In August 2025, SGS launched the first AI-powered automated system for thermal runaway testing designed for energy storage batteries. The solution was developed with Chongqing Energy College (CEC) to help with fire safety concerns with the fast global growth of battery energy storage systems (BESS) at commercial, industrial, and residential levels.

- In July 2025, Echogen Power Systems shared that its strategic partner, Westinghouse Electric Company, officially signed a MoU (Memorandum of Understanding) with Vodohospodárska Výstavba (VVB). Together, they are gearing up toward the development of Europe’s very first grid-scale PTES (pumped thermal energy storage) system in Slovakia.

- In April 2025, MGA Thermal declared the completion of the world's first industrial steam-heat energy storage demonstration project. The demonstration project, operated by MGA Thermal's ETES, stored 5 MWh of energy at a rated thermal power dispatch of 500 kW, delivering continuous thermal superheated steam for 24 hours.

- In March 2025, Voltanova, which operates from Bengaluru, innovated an affordable thermal energy storage system for a textile manufacturing facility. The system represents an IISc Bangalore development that transforms renewable energy into industrial process heat and power, thereby replacing the requirement for fossil fuel consumption.

- In January 2025, Technology Company Hyme Energy, along with potential client Arla Foods, is on the hunt for EU funding to kick off a massive 200MW thermal energy storage system project, which they proudly claim is the largest of its kind in the world. This ambitious 200MWh project will utilize Hyme Energy’s unique molten salt-based thermal energy storage technology at a milk powder facility in Denmark that belongs to Arla Foods, the fifth largest dairy producer on the planet.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Market players are also diving into the thermal energy storage sector, eager to tap into its potential for integrating renewables, providing cost-effective energy storage, and driving industrial decarbonization.

In April 2025, the U.S. energy storage sector made a groundbreaking pledge to invest a whopping USD 100 billion in the development and purchase of American-made grid batteries. This massive investment is set to create around 350,000 jobs in the battery energy storage and thermal energy storage field and position the U.S. as a frontrunner in the global battery manufacturing and energy storage sectors.

REPORT COVERAGE

The global market report delivers a detailed insight into the market. It focuses on key aspects such as leading companies and their operations. Besides, the report offers insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.2% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology · Sensible Heat · Latent Heat · Thermochemical |

|

By Material · Water · Molten Salt · Phase Change Materials (PCM) · Others |

|

|

By Application · District Heating and Cooling Systems · Process Heating and Cooling · Power Generation |

|

|

By End-User · Residential · Commercial · Industrial |

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size stood at USD 2.51 billion in 2025.

The market is likely to grow at a CAGR of 4.2% over the forecast period (2026-2034).

By end-user, the industrial segment is the leading segment in the market over the forecast period.

The Europe market size stood at USD 0.91 billion in 2025.

Increasing urbanization and infrastructure growth are key factors anticipated to drive market expansion.

ABENGOA, McDermott, Evapco, and others are some of the top players in the market.

The global market size is expected to reach USD 3.63 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us