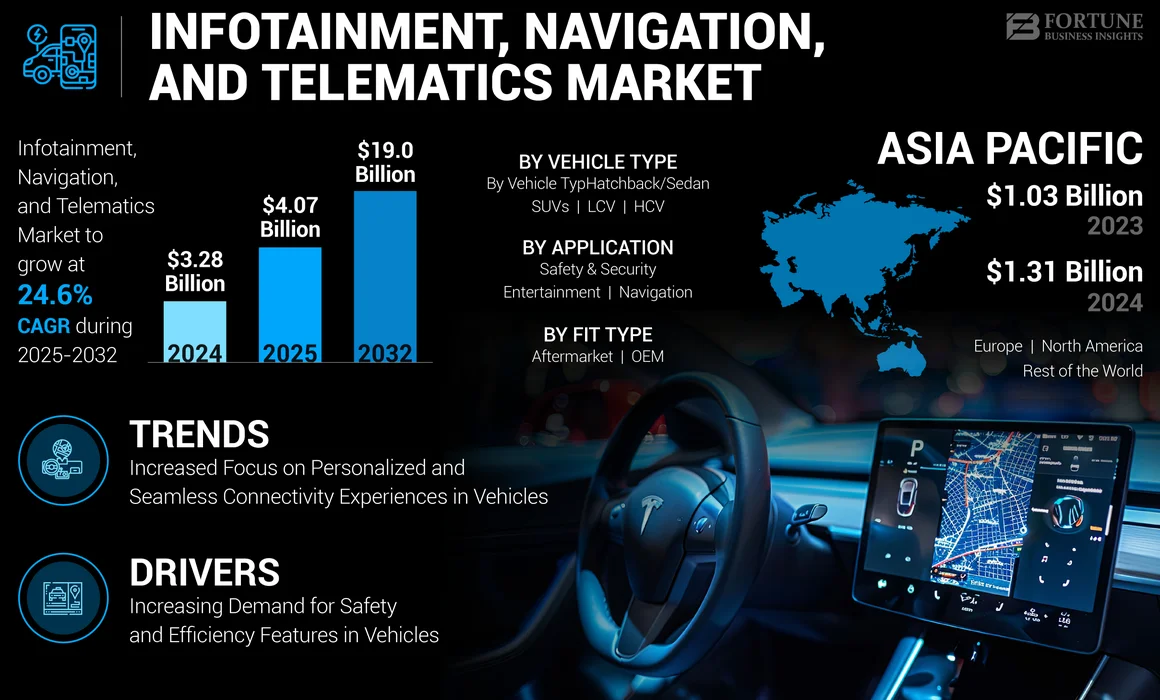

Infotainment, Navigation, and Telematics Market Size, Share & Industry Analysis, By Vehicle Type (Hatchback/Sedan, SUVs, LCV, and HCV), By Fit Type (OEM and Aftermarket), By Application (Entertainment, Navigation, and Safety and Security), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global infotainment, navigation, and telematics market size was valued at USD 3.28 billion in 2024 and is projected to grow from USD 4.07 billion in 2025 to USD 19.0 billion by 2032, exhibiting a CAGR of 24.6% during the forecast period. Asia Pacific dominated the global market with a share of 39.94% in 2024.

The automotive infotainment, navigation, and telematics industry refers to integrated systems that provide entertainment, navigation, and connectivity services within vehicles. Infotainment systems offer features such as audio/video playback, smartphone mirroring, and internet access. Navigation systems utilize GPS for route optimization and real-time traffic updates. Telematics involves vehicle tracking, remote diagnostics, and safety services, enhancing vehicle efficiency and safety through the integration of telecommunications and informatics.

The global infotainment, navigation, and telematics market is driven by technological advancements and growing consumer demand for enhanced driving experiences. The integration of advanced software and hardware supports seamless connectivity, personalized entertainment, and improved safety features. Key players, including Harman International Industries Inc. (U.S. ), Panasonic Corporation (Japan), and Continental AG (Germany), are investing in innovative technologies such as voice recognition and smartphone integration, while governments support the development of intelligent transportation systems. This market is crucial for the automotive industry as it enhances vehicle functionality and user experience.

The COVID-19 pandemic initially disrupted the market by affecting supply chains and halting manufacturing activities. However, as economies began to recover, the market rebounded due to rising demand for connected vehicles and enhanced safety features. The pandemic also accelerated the adoption of digital technologies, placing more emphasis on remote vehicle diagnostics and contactless services. This shift has driven innovation in integrated telematics and infotainment systems, further enhancing user safety and convenience.

Infotainment, Navigation, and Telematics Market Trends

Increased Focus on Personalized and Seamless Connectivity Experiences in Vehicles is a Key Market Trend

The growing trend toward smart and connected in-vehicle technology is driven by consumer demand for integrated systems that offer navigation, media streaming, and real-time communication. For instance, Harman International's Ready Upgrade program allows customers to enhance their existing infotainment systems with advanced software updates and features, providing personalized in-vehicle technology solutions.

Technological advancements include the integration of smartphone platforms such as Apple CarPlay and Android Auto, which enable users to access navigation, communication, and entertainment apps directly from their passenger cars and commercial vehicles. Additionally, advancements in voice recognition technology are transforming how users interact with infotainment systems, prioritizing hands-free and safer controls. Government regulations promoting driver safety and energy efficiency also support this trend by incentivizing the adoption of advanced infotainment systems. Furthermore, partnerships such as the joint venture between LG Electronics and Magna International are driving innovation in next-generation infotainment systems, featuring advanced displays and AI-powered functionalities.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Increasing Demand for Safety and Efficiency Features in Vehicles is Driving Market Growth

Government regulations and consumer preferences for enhanced driving experiences are fuelling increased demand for safety features. For instance, governments worldwide are implementing stricter safety standards, such as the European Union's Euro NCAP, which mandates advanced safety features such as lane departure warning systems and automatic emergency braking, often integrated with infotainment and telematics systems.

Technological innovations supporting this trend include the integration of Artificial Intelligence (AI) and Machine Learning (ML) to enhance safety features and personalize the user experiences. Companies such as Harman International and Panasonic Corporation are at the forefront of these innovations, developing systems that can predict and prevent accidents. Additionally, 5G connectivity advancements enable faster data transmission, supporting real-time vehicle-to-infrastructure communication, which enhances safety and efficiency. Government initiatives, such as the U.S. Department of Transportation's push for vehicle-to-everything (V2X) communication, further drive the adoption of these technologies.

Moreover, the Internet of Things (IoT) plays a crucial role in enabling the collection and analysis of real-time data for predictive maintenance and personalized user experiences. The European Union's General Safety Regulation also mandates the installation of advanced safety features in new vehicles, many of which rely on infotainment and telematics systems. The growing popularity of Electric Vehicles (EVs), which typically come equipped with advanced infotainment and telematics systems, is contributing significantly to market growth. Governments globally are incentivizing EV adoption through subsidies and tax credits, further boosting demand for infotainment, navigation, and telematics, and related technologies.

Market Restraints

Complex Integration Challenges Associated with New Technologies are Restraining Market Growth

A key restraining factor for the global infotainment, navigation, and telematics market growth is the complex integration challenges associated with new technologies. Many vehicles, especially older models, are not designed to accommodate advanced infotainment and telematics systems, making retrofitting difficult and costly. This complexity can deter manufacturers from adopting these systems, particularly in price-sensitive markets. For example, manufacturers such as Harman International and Panasonic Corporation are investing heavily in R&D to create more adaptable systems.

However, the integration of these technologies often requires significant changes to existing vehicle architectures, which can lead to increased production costs and time delays. Government regulations can further exacerbate integration efforts. For instance, the European Union's General Safety Regulation mandates the inclusion of specific safety features in new vehicles. Compliance with such regulations often necessitates substantial modifications to existing systems, complicating integration efforts. In addition, the rise of electric vehicles (EVs) has introduced new architectures that may not be compatible with traditional infotainment systems. As manufacturers shift toward EVs, they face the added challenge of ensuring that telematics and infotainment systems are seamlessly integrated into these innovative platforms.

Market Opportunities

Rapid Integration of Advanced Connectivity, AI, and 5G Technologies in Vehicles to Propel Market Opportunities Across Globe

A major opportunity for the global automotive infotainment, navigation, and telematics market is the rapid integration of advanced connectivity, AI, and 5G technologies, which are transforming in-car experiences and safety features. The market is driven by rising consumer demand for seamless connectivity, real-time updates, and personalized services. Leading manufacturers such as HARMAN International and Continental AG are launching next-generation infotainment systems with AI-driven voice assistants, gesture controls, and over-the-air (OTA) updates, enabling features such as predictive navigation and adaptive music recommendations.

Technological advancements such as Qualcomm’s Snapdragon Automotive Cockpit Platforms and Nvidia’s Drive IX are setting new benchmarks in processing power and integration for infotainment and telematics. The rollout of 5G networks is accelerating vehicle-to-everything (V2X) communication, enhancing real-time traffic management and emergency alerts. Governments are supporting this shift; for example, the EU’s General Data Protection Regulation (GDPR) mandates secure handling of user data, while China’s C-V2X policies promote interoperable telematics solutions. The convergence of these innovations and regulations is positioning infotainment, navigation, and telematics as central to the future of smart, connected vehicles.

Segmentation Analysis

By Vehicle Type

SUVs Lead the Market due to Their Increasing Popularity

By vehicle type, the global market is segmented into hatchback/sedan, SUVs, LCV (light commercial vehicles), and HCV (heavy commercial vehicles).

SUVs dominate the market due to their increasing popularity globally, which often come equipped with advanced infotainment systems. For instance, companies such as Harman International and Visteon Corporation are focusing on developing high-end infotainment systems for SUVs, enhancing their appeal to tech-savvy consumers. Technological advancements in this segment include the integration of 5G connectivity, enabling real-time navigation and entertainment services. Governments have also implemented regulations such as the European Union's Euro NCAP, which mandates safety features that are often integrated with infotainment systems in SUVs and other vehicles.

By Fit Type

Reliable Functionality and Performance Make OEM Dominate the Segment

By fit type, the market is segmented into OEM (Original Equipment Manufacturer) and Aftermarket. The OEM segment dominates the market due to its reliability and performance, with major players such as Robert Bosch GmbH and LG Electronics offering high-quality systems.

The aftermarket segment is growing rapidly as consumers seek affordable alternatives that offer performance comparable to OEM. Recent developments include the introduction of AI-powered infotainment systems by OEMs, aimed at enhancing user experiences. Governments have also implemented regulations supporting OEM integration, such as vehicle safety standards that require advanced infotainment features.

By Application

Navigation Segment Leads Due to Its Extensive Usage in Vehicles

By application, the market is segmented into entertainment, navigation, and safety and security. The navigation segment dominates the market due to its widespread use in vehicles, providing essential traffic and direction data.

The safety and security segment is the fastest-growing sector, driven by government regulations such as the U.S. Department of Transportation's V2X communication standards. These standards enhance vehicle safety by enabling real-time data exchange for fleet operators and fleet management systems. Technological advancements include the integration of Machine Learning (ML) for predictive safety features and 5G connectivity for real-time navigation updates. Companies such as TomTom International B.V. are innovating in navigation, while Bosch Limited focuses on safety features.

Infotainment, Navigation, and Telematics Market Regional Outlook

By region, the market is studied across Asia Pacific, North America, Europe, and the Rest of the World.

Asia Pacific

Asia Pacific Infotainment, Navigation, and Telematics Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the global infotainment, navigation, and telematics market share due to the high production rate of automotive vehicles and parts in countries such as China and Japan. Market growth in the region is driven by rapid urbanization and government initiatives promoting smart cities and intelligent transportation systems, and technological advancements such as in-vehicle payment systems and real-time navigation updates.

North America

North America is a significant region in the global market, driven by a strong automotive manufacturing base and high adoption rates of advanced automotive technologies. The region's growth is fueled by supportive government regulations and initiatives aimed at enhancing vehicle safety and efficiency. Companies such as Harman International and Visteon Corporation are major players in this market, focusing on integrating advanced infotainment systems with features such as 5G connectivity and AI-powered interfaces. The U.S. automotive infotainment, navigation, and telematics market is marked by rapid technological advancement and strong consumer demand for connected, personalized in-car experiences.

Leading automakers and suppliers are integrating advanced features such as AI-driven voice assistants, real-time navigation, and seamless smartphone connectivity, with over-the-air (OTA) updates now standard in many models. The market is further shaped by the adoption of 5G networks, IoT-enabled vehicle systems, and a growing emphasis on safety, comfort, and driver convenience. Government regulations, including data privacy and cybersecurity standards, also influence system development and deployment.

Europe

Europe holds a substantial market share, driven by the adoption of connected vehicle technologies and a strong automotive industry presence. The region's growth is steady, supported by the integration of advanced safety features mandated by regulations such as the European Union's Euro NCAP. Major automotive companies in Europe are investing in R&D to enhance vehicle-to-infrastructure connectivity and offer innovative infotainment solutions.

Rest of the World

The Rest of the World, including Latin America and the Middle East & Africa, is expected to follow the growth trends of major regions. European companies expanding their manufacturing operations in Africa are likely to drive regional growth. The increasing adoption of advanced infotainment systems is due to rising consumer demand for connected vehicles and enhanced driving experiences.

Competitive Landscape

Key Market Players

Key Players Focus on Providing Advanced Infotainment Solutions to Gain a Competitive Edge

Harman International is a leading player in the global market, holding a strong market position due to its extensive portfolio of advanced infotainment solutions, strong relationships with OEMs, and continuous innovation in connected car technologies. Harman's offerings include connected car solutions, navigation systems, and in-car audio systems. The company's ability to integrate these technologies seamlessly into modern vehicle designs, coupled with strong brand recognition and technical expertise, positions it at the forefront of the industry. By working closely with top car brands, the company ensures its telematics solutions align with market trends and customer preferences, further solidifying its market position.

Continental AG is another player in this market, recognized for its strong investments in R&D to stay ahead of emerging trends and technologies in infotainment. Continental offers integrated solutions with connectivity features, navigation solutions, and advanced human-machine interface technologies that enhance the overall in-car experience. These offerings, combined with its strong presence in the automotive industry, make Continental a major competitor in the global infotainment market. Continental's focus on innovation and integration of advanced technologies into vehicle systems supports its position as a leading market player.

LIST OF KEY INFOTAINMENT, NAVIGATION, AND TELEMATICS COMPANIES PROFILED:

- Harman International Industries Inc. (U.S. )

- Panasonic Corporation (Japan)

- Continental AG (Germany)

- Robert Bosch GmbH (Germany)

- Denso Corporation (Japan)

- Alps Alpine Co Ltd (Japan)

- Visteon Corporation (U.S. )

- Garmin Ltd. (U.S.)

- TomTom Telematics B.V. (Netherlands)

- Geotab (Canada)

KEY INDUSTRY DEVELOPMENTS

- January 2025- LG Electronics (LG), working with Qualcomm Technologies, Inc., introduced the groundbreaking Cross Domain Controller (xDC) platform for vehicles at CES 2025. Based on Qualcomm Technologies' Snapdragon Ride, Flex System-on-Chip (SoC), which pre-integrates Snapdragon Ride's automated driving stack and computer vision, this cutting-edge solution incorporates LG's In-Vehicle Infotainment (IVI) System and Advanced Driver Assistance System (ADAS) into a single controller. The xDC platform is set to redefine vehicle performance and elevate the mobility experience.

- January 2025- u-blox launched its first automotive-grade Wi-Fi 7 module, enabling OEMs to enhance the user experience of in-vehicle infotainment and telematics. The RUBY-W2 brings multiple benefits of Wi-Fi 7 to the automotive market, including higher throughput, support for more concurrent users, and lower latency, resulting in better network availability and user experience for various in-vehicle applications.

- November 2024- Skyworks Solutions, Inc. (Nasdaq: SWKS) achieved IATF 16949 automotive certification at its facilities in Newbury Park, Calif. Skyworks is a major global supplier of high-performance, analog, and mixed-signal solutions for the automotive industry, with its RF front-end modules for V2X, in-vehicle infotainment, keyless entry, satellite navigation, and 5G automotive telematics.

- September 2023- Taisys India launched the iConnect platform, a product that aims to transform the automotive connectivity landscape in India. The iConnect platform is a result of Taisys India's collaboration with Lumax Ituran Telematics Pvt. Ltd, a global automotive telematics solution provider for OEMs.

- January 2023 - The NIA (New India Assurance) allowed insurance companies to launch telematics-based motor insurance cover, named “Pay as You Drive". This allowed vehicle owners to control and reduce their spending on insurance. This policy features coverage beyond distance limits, roadside help, and advanced protection.

REPORT COVERAGE

The global infotainment, navigation, and telematics market report provides detailed market analysis and focuses on key aspects such as leading companies, vehicle types, design, and technology advances. Besides this, the report offers insights into the latest market trends and highlights key automotive industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 24.6% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Vehicle Type

By Fit Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says the market was valued at USD 3.28 billion in 2024 and is projected to reach USD 19.0 billion by 2032.

The market is expected to register a CAGR of 24.6% during the forecast period of 2025-2032.

Increasing demand for safety and efficiency features in vehicles is a key factor expected to drive market growth.

Asia Pacific leads the market.

Harman International Industries Inc, Panasonic Corporation, Continental AG, Robert Bosch GmbH, and Denso Corporation are among the leading key players in the market.

Rapid integration of advanced connectivity, AI, and 5G technologies in vehicles.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us