Interactive Tables Market Size, Share & Industry Analysis, By Touch Technology (Capacitive Touch, Infrared Touch, Optical Imaging, and Resistive Touch), By Screen Size (32 to 65 Inches and Above 65 Inches), By Application (Education, Museums & Exhibition, Retail, Real Estate, Corporate, Hospitality, Healthcare, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

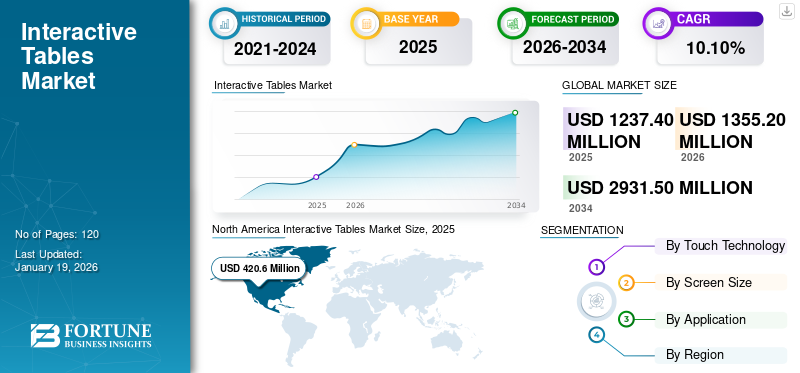

The global interactive tables market size was valued at USD 1,237.40 million in 2025. The market is projected to grow from USD 1,355.20 million in 2026 to USD 2,931.50 million by 2034, exhibiting a CAGR of 10.10% during the forecast period. North America dominated the global market with a share of 34.00% in 2025.

The demand for interactive tables is experiencing strong growth, due to a surge in adoption across education, museums, corporate collaboration spaces, retail showrooms, and healthcare environments. These tables offer multi-user, touch-enabled, and immersive digital experiences that facilitate interactive learning, collaborative presentations, product exploration, and real-time information sharing.

Key players, including SMART, Digital Touch Systems, and TableConnect, are designing interactive tables with software and features tailored for specific sectors such as education, museums, corporate, retail, real estate, and healthcare. These players are also expanding distribution networks and targeting untapped or emerging markets.

IMPACT OF GENERATIVE AI

The integration of generative AI with interactive tables is enabling a shift from static or pre-programmed interactions to dynamic, personalized, and adaptive user experiences. Interactive tables with Gen AI capabilities are able to generate content, interpret user behavior, and deliver context-aware responses in real-time, rather than just visual engagement. Generative AI enhances the touchscreen tables in many ways. For instance, in retail, interactive tables equipped with AI generate personalized product recommendations, promotional visuals, or even virtual assistants, boosting conversion rates by 20%–25% over traditional touchscreen catalogs.

As AI continues to evolve, these digital tables are positioned to become not just tools for interaction but intelligent environments capable of co-creating, conversing, and adapting.

IMPACT OF RECIPROCAL TARIFF

The impact of reciprocal tariffs on the market is significant due to its globally interdependent supply chain. Most digital table hardware components, such as LCD panels, LED modules, semiconductors, and control boards, are manufactured in the Asia Pacific, especially China, South Korea, Japan, and Taiwan. When countries such as the U.S. or the EU impose tariffs on display imports or key components from these countries, affected nations often respond with their own countermeasures, disrupting trade flows and increasing procurement costs. These tariffs result in higher landed costs for finished displays and display components, directly affecting display manufacturers and system integrators in importing countries.

INTERACTIVE TABLES Market Trends

Popularity of Experiential Marketing to Accelerate Market Growth

The popularity of experiential marketing is significantly accelerating the demand for interactive technologies such as interactive tables, as brands shift from traditional advertising to immersive, engagement-driven campaigns. Experiential marketing focuses on creating memorable brand experiences through real-time interaction, personalization, and emotional connection. According to Event Marketer's 2024 report, 91% of consumers said they are more likely to purchase a brand after participating in a branded experience, and 70% become repeat customers following such engagements.

Interactive tables are increasingly being deployed in flagship stores, product launches, and pop-up events to enable gamification, augmented reality try-ons, interactive product configurators, and live data-driven feedback. For instance, auto manufacturers are using touchscreen tables at expos to let customers explore car interiors and customize features virtually. The rising need for brand differentiation, measurable engagement metrics, and data capture at events is convincing enterprises to adopt interactive, tech-enabled formats, making experiential marketing not just a creative initiative, but a strategic growth lever.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Advancements in Touchscreen and Display Technology to Boost Market Growth

Advancements in touchscreen and display technology have significantly boosted the adoption of digital tables across industries by enhancing performance, usability, and visual appeal. Innovations such as capacitive multi-touch panels, 4K UHD resolution, anti-glare coatings, and haptic feedback systems have made interactive tables more responsive, durable, and immersive. The evolution from resistive touch to projected capacitive touch technologies allows for 10-point or even 32-point touch, enabling multi-user collaboration ideal for education, retail, hospitality, exhibitions, and trade shows.

The increasing availability of large-format interactive flat panels (55" to 100"+), combined with falling hardware costs and rising production efficiency in OLED, MicroLED, and In-Cell Touch Display technologies, is making touchscreen tables more commercially viable. Furthermore, integration with IoT and AI capabilities has transformed these displays into smart interfaces capable of gathering and analyzing data in real time, further expanding their use in environments such as smart classrooms, collaborative workspaces, and experience centers.

Market Restraints

High Initial Cost to Hamper Market Growth

High costs restrict the widespread adoption of interactive tables, particularly among small and mid-sized businesses and institutions. These tables incorporate advanced technologies such as multi-touch displays, 4K/8K resolution panels, ruggedized surfaces, and integrated sensors, all of which contribute to high production and procurement costs. Additionally, businesses often need to invest in custom software development, system integration, and backend infrastructure to enable real-time data processing and user interaction, hampering the interactive tables market growth.

Market Opportunities

Popularity of Interactive Tables Across Museums and Cultural Institutions to Create Opportunities for Market Players

Museums and cultural institutions are increasingly adopting digital tables to create engaging, educational, and inclusive experiences for visitors, creating a strong opportunity for interactive table providers. These digital tables allow institutions to present complex historical, artistic, or scientific content in a visually rich and intuitive manner, enhancing audience engagement through multi-touch, multilingual, and multimedia interfaces. For example, visitors can explore 3D reconstructions, interactive timelines, or multilingual story overlays, catering to diverse age groups and nationalities.

With increasing demand for immersive, contactless, and personalized experiences, interactive tables are becoming essential tools in the cultural sector. Furthermore, these tables are being integrated into smart tourism ecosystems, aligning with the government’s push for digital heritage preservation and accessibility. As a result, opportunities for market players are growing, with providers focusing on offering customizable, durable, and content-compatible solutions, opening up possibilities for partnerships with exhibit designers, public institutions, and tourism boards globally.

SEGMENTATION ANALYSIS

By Touch Technology

Capacitive Touch Segment Dominated the Market Owing to its Performance and Multi-touch Capabilities

Based on touch technology, the market is segmented into capacitive touch, infrared touch, optical imaging, and resistive touch.

The capacitive touch segment dominated the market with a share of 41.80% in 2026, due to its superior performance, durability, responsiveness, and multi-touch capabilities, especially in interactive and commercial applications. Capacitive touch provides a seamless, glass-like interface with high optical clarity and multi-touch gesture recognition, allowing pinch, zoom, rotate, and swipe functionalities.

The infrared touch segment is estimated to grow with the highest CAGR during the forecast period, due to its durability, scalability, and compatibility with large-format interactive displays. Unlike resistive or capacitive touchscreens, infrared systems use invisible light beams projected across the surface of the display, detecting touch when beams are interrupted.

By Screen Size

Above 65 Inches Segment Led the Market Due to its Multi-user Interaction

By screen size, the interactive tables market is segmented into 32 to 65 inches and above 65 inches.

Above 65 inches dominated the market in 2026 with a share of 70.59%, and is estimated to grow with the highest CAGR during the forecast period. Larger screens facilitate simultaneous multi-user interaction, making them ideal for classrooms, boardrooms, museums, control rooms, and public spaces. With the shift toward interactive, collaborative learning and business environments, larger tables allow more people to engage at once, boosting productivity and engagement.

By Application

To know how our report can help streamline your business, Speak to Analyst

Hospitality Segment Dominated as Interactive Tables Provide Personalized Digital Experience

By application, the market is segmented into education, museums & exhibition, retail, real estate, corporate, hospitality, healthcare, and others.

The hospitality segment accounted for the largest interactive tables market share of 26.64% in 2026 and is estimated to grow with the highest CAGR during the forecast period. Interactive tables allow hotels and restaurants to provide personalized digital experiences such as multilingual menus, entertainment content, and local information. Guests can browse offerings, customize orders, and even explore local attractions in an engaging, self-guided format. According to industry experts, around 57% of travelers prefer personalized experiences, and interactive technology is becoming central to delivering those services effectively.

Healthcare is estimated to grow significantly as hospitals, clinics, and rehabilitation centers integrate digital technologies to enhance patient care, streamline workflows, and support staff training. These tables are increasingly being adopted for patient education, therapy, diagnostics, and operational efficiency, transforming the way healthcare services are delivered and experienced.

INTERACTIVE TABLES MARKET REGIONAL OUTLOOK

By geography, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

North America

North America Interactive Tables Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 420.6 million in 2025 and USD 451.2 million in 2026. The demand for digital tablets in North America is witnessing a strong surge, fueled by digital transformation across sectors such as education, healthcare, retail, hospitality, and corporate environments. The region’s high digital literacy, early technology adoption, and strong investments in smart infrastructure are key contributors to this growth.

In the U.S., the market is expected to experience strong growth during the forecast period owing to rapid adoption of interactive technologies in hospitality, retail, and corporate sectors, coupled with improvements in customer engagement solutions and increasing investments digital transformation. According to the National Center for Education Statistics (NCES), 94% of U.S. public schools had internet access in classrooms by 2024, and over 68% have adopted interactive devices, including multi-user tables. The U.S. market is projected to reach USD 353.7 million by 2026.

Asia Pacific

The Asia Pacific region is expected to grow with the highest CAGR during the forecast period. Hospitals in countries such as Japan, South Korea, Singapore, and India are deploying interactive tables for digital patient interfaces, rehabilitation support, and nursing information systems to enhance operational efficiency and patient satisfaction. In Japan, around 35% of leading hospitals use interactive digital tools for patient interaction and therapy, especially in geriatrics and cognitive rehabilitation. The Japan market is projected to reach USD 82.3 million by 2026, the China market is projected to reach USD 146.1 million by 2026, and the India market is projected to reach USD 45.8 million by 2026.

Europe

Europe is estimated to witness significant growth in the coming years. European governments and educational institutions are modernizing infrastructure through EU-backed digitization programs. Touchscreen tables are increasingly used in K-12, higher education, and special education to facilitate group learning, gamified education, and real-time collaboration. The UK market is projected to reach USD 45.9 million by 2026, while the Germany market is projected to reach USD 54.6 million by 2026.

Middle East & Africa

The region is estimated to witness robust growth as governments are investing heavily in smart cities development, infrastructure modernization, and expansion of the retail and hospitality sectors. Airports, malls, stadiums, and hospitality complexes in cities such as Dubai, Riyadh, and Doha have become major deployment zones for high-resolution interactive tables.

South America

The region is expected to witness steady growth. As tourism rebounds post-pandemic, museums, cultural heritage sites, and visitor centers across South America are integrating interactive tables to enhance storytelling and engage multilingual visitors.

Competitive Landscape

Key Industry Players

Market Players Focus on Investing in R&D to Expand Their Presence

Players in the market are investing significantly in R&D to deliver advanced features such as ultra-HD 4K displays, multi-touch support (up to 20 points), capacitive touch for seamless glass interfaces, and rugged anti-scratch surfaces suitable for public use. These enhancements improve user experience, enabling applications such as pinch-to-zoom and gesture recognition, which are especially vital in education and retail environments. Another key strategy is vertical-specific customization, where vendors tailor interactive table solutions for sector-specific needs. In education, for instance, tables are integrated with learning management systems and multilingual content, while in retail, they support product catalogs and self-checkout.

Long List of Interactive Tables Companies Studied

- SMART Technologies (Canada)

- Promethean (U.S.)

- Ideum (U.S.)

- TableConnect (Austria)

- PQ Labs (U.S.)

- Zytronic (U.K.)

- Digital Touch Systems (U.S.)

- TableConnect GmbH (Austria)

- DigaliX (Spain)

- MARVEL TECHNOLOGY (U.S.)

- Boxlight (U.S.)

- LG Electronics (South Korea)

… and more

KEY INDUSTRY DEVELOPMENTS

- September 2024 – Ideum entered into a collaboration with Clark Planetrium for showcasing touch tables paired with their engaging and popular multi-user exhibits.

- August 2024: Ideum launched an interactive touch table bundled with Wine Experience Software known as the Tasting table, which is designed for enhancing wine tastings.

- July 2024 – Zytronics introduced a round display module that incorporates Zytronics ZYX500 multitouch projected capacitive technology. The module allows seamless integration of induction phone chargers, floating glass buttons, and tactile controls, offering designers greater flexibility for immersive user experiences.

- July 2024 – BenQ launched the BenQ Board RE04 Series, a next-generation interactive flat panel. The BenQ Board is certified under the Google Enterprise Devices Licensing Agreement.

- May 2024 – Zytronics introduced the 55’’ 4K high-brightness LCD interactive table. The introduction of these tables marks a notable milestone in the advancement of retail and interactive environments.

- January 2025 – Sharp NEC Display Solutions Europe introduced a comprehensive range of Large Format Displays at Integrated System Europe (ISE) 2025.

REPORT COVERAGE

The interactive tables market report provides a detailed market analysis. It focuses on key points, such as leading companies, offerings, and applications. Besides this, it offers an understanding of the latest market trends and highlights key industry developments. In addition to the above-mentioned factors, it contains several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.10% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Touch Technology

By Screen Size

By Application

By Region

|

|

Companies Profiled in the Report |

• SMART Technologies (Canada) • Promethean (U.S.) • Ideum (U.S.) • TableConnect (Austria) • PQ Labs (U.S.) • Zytronic (U.K.) • Digital Touch Systems (U.S.) • TableConnect GmbH (Austria) • DigaliX (Spain) • MARVEL TECHNOLOGY (U.S.) |

Frequently Asked Questions

The market is projected to record a valuation of USD 2,931.50 million by 2034.

In 2025, the market was valued at USD 1,237.40 million.

The market is projected to grow at a CAGR of 10.10% during the forecast period (2026-2034).

The capacitive touch segment led the market in terms of share.

Advancements in touchscreen and display technology are a key factor driving market growth.

SMART Technologies, Ideum, Digalix, PQ Labs, and Promethean are the top players in the market.

North America held the highest market share.

By application, the hospitality segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us