IT Asset Disposition Market Size, Share & Industry Analysis, By Service (De-Manufacturing and Recycling, Remarketing and Value Recovery, Data Destruction, Lease Return Services, and Others), By Asset Type (Desktop & Laptops, Mobile Devices, Servers, Storage Devices, and Peripherals (Printers, Scanners)), By Type (Data Center and Enterprises), By Industry (BFSI, IT & Telecom, Government, Healthcare, Media & Entertainment, Energy & Utilities, and Others), and Regional Forecast, 2026 – 2034

IT ASSET DISPOSITION MARKET SIZE AND FUTURE OUTLOOK

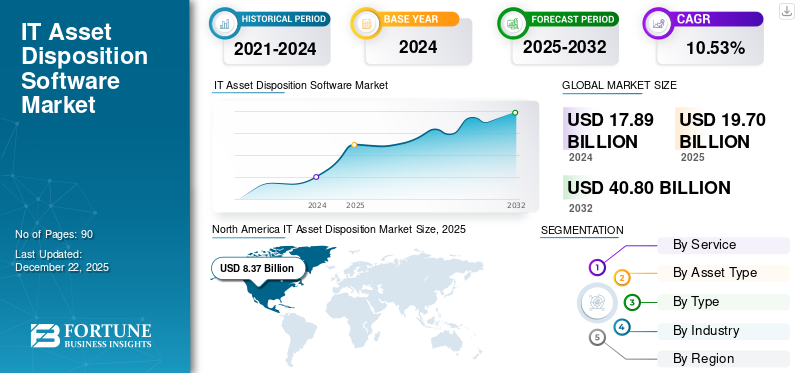

The global IT asset disposition market size was valued at USD 19.70 billion in 2025 and is projected to grow from USD 21.77 billion in 2026 to USD 48.48 billion by 2034, exhibiting a CAGR of 10.53% during the forecast period. North America dominated the market with a share of 42.50% in 2025.

IT Asset Disposition (ITAD) is described as a process of appropriately disposing of obsolete, surplus, or end-of-life IT equipment in an environmentally secure, responsible, and cost-effective manner. This process includes multiple activities aimed at handling the lifecycle of IT assets from incorporation to disposal while ensuring regulatory compliance, data security, and maximizing value recovery.

ITAD helps organizations comply with data protection regulations, such as the GDPR (General Data Protection Regulation), HIPAA (Health Insurance Portability and Accountability Act), and the California Consumer Privacy Act (CCPA), by ensuring that all data stored on decommissioned equipment is securely destroyed.

As a part of their growth strategy, companies such as Iron Mountain, Inc., Sims Lifecycle Services, and Evernex aim to engage in mergers, partnerships, and acquisitions activities to expand their business and geographical footprint.

IMPACT OF TARIFF RECIPROCAL

Tariffs can significantly impact IT Asset Disposition (ITAD) by raising costs for both refurbished and new hardware, potentially leading to decreased demand for desktop, mobile devices, and servers and impacting international trade in used equipment. The ITAD industry relies on a global network of sellers and buyers for surplus hardware, including resale in international markets. For instance,

- On 8th April 2025, the CLSA report stated that the U.S. has implemented tariffs ranging from 25% to 54% on electronics imports from China, Vietnam, and Mexico, which together accounted for 51% of U.S. electronics imports.

MARKET DYNAMICS

Market Drivers

Increased Volume of Electronic Waste and an Intensified Awareness of Environmental Conservation to Drive Market Expansion

The growing volume of e-waste has become a universal concern, requiring a comprehensive and secure plan for the disposal of electronic waste and obsolete IT equipment. Several federal and state regulations denoting data security, environmental protection, and privacy have been framed to ensure proper e-waste disposal. For instance,

- As per Global E-waste Monitor 2024, 62 million tons of e-waste was created in 2022, an increase of 82% from 2010; it is also forecasted to grow by an additional 32% to 82 million tons by 2030.

Moreover, rising environmental awareness among businesses and individuals is also fostering the adoption of e-waste disposal methods.

Market Restraints

Lack of Safe Disposal of IT Assets Can Restrict Market Growth

Inherited IT systems often contain hazardous materials, such as mercury, lead, or certain chemicals, causing environmental risks. Disposing of these aging IT assets improperly can contribute to Electronic Waste issues (E-waste) and ecological contamination. As companies improve their technology, the disposal of legacy assets becomes a critical consideration in the IT Asset Disposition (ITAD lifecycle). Unlike modern equipment designed with environmental considerations and recycling in mind, outdated technologies may lack the same eco-friendly features. ITAD service providers must employ dedicated expertise to manage and identify hazardous materials within the older technologies.

Market Opportunities

Advancements in Automated Technology Will Lead to Value Recovery and Expand Market Growth

Advancements in automated technology are significantly impacting ITAD by enhancing efficiency, data security, and sustainability efforts. Automation, AI, and blockchain are streamlining hardware dismantling, data destruction, and asset tracking, leading to a more eco-friendly and cost-effective ITAD process. For instance,

- ARCOA adopted the latest advancements in automated technology, including automated sorting systems that simplify the asset disposition process while improving accuracy and efficiency. By exploiting automation, users can ensure precise processing and sorting of IT assets, resulting in better value recovery and reduced environmental impact.

IT ASSET DISPOSITION MARKET TRENDS

Regulatory Policies for Environment Security and Data Safety is a Significant Market Trend

Companies are required to regularly check their IT equipment management activities exceeding due to compliance with different regulations, including HIPAA / Hitech and NIST. The lack of safety and order to remove outdated computer devices can also make it difficult to detect fraud and theft. Therefore, the appropriate removal of computers, laptops, and electronics is adjusted by a number of environmental standards and the security of nations and federal, and the failure to do so can lead to significant penalties, fines, and audits. Due to the increasing risk of data violations, the U.S. Securities and Exchange Commission (SEC) has increased the voice of cybersecurity measures that businesses implement.

SEGMENTATION ANALYSIS

By Service

Data Destruction Dominated Owing to Rise in Data Centers and Data Breaches

Based on service, the market is divided into de-manufacturing and recycling, remarketing and value recovery, data destruction, lease return services, and others.

Data destruction captured the largest market share in 2024 by 30.64% and is anticipated to grow at the highest CAGR during the forecast period. Major factors promoting growth include the rising volume of data stored and generated, the need for companies to follow international regulations, and surging incidences of data breaches. Further, the increasing obsolescence of IT equipment and the surge in data centers also propel the demand for data destruction. For instance,

- As per industry analysis 2025, global demand for data center capacity will grow at an annual rate of between 19% in 2023 to 22% by 2030 to reach a yearly demand of 171 to 219 gigawatts.

By Asset Type

Advancements in Technology Propelled Need for Server Assets Among Industries

Based on asset type, the market is analyzed into desktop & laptops, mobile devices, servers, storage devices, and peripherals (printers, scanners).

Servers captured the largest market share in 2024, owing to technological advancements and a growing number of companies that are changing to cloud-based services. Several businesses follow a reliable schedule of modernizing their data centers with server upgrades every three to four years. Servers segment is anticipated to capture 23.39% of the market share in 2025.

Storage devices are anticipated to grow at a prominent CAGR of 13.68% during the forecast period, owing to the rising adoption of renewable energy sources. For instance,

- According to a report by global energy think tank Ember 2024, renewables have grown from 19% to 30% of global electricity, which is driven by a surge in wind and solar from 0.2% in 2000 to a recorded 13.4% in 2023.

By Type

Stringent Environmental Regulations for Disposal of E-Waste Contributed to Data Center Segment Growth

Based on type, the market is studied in terms of data center and enterprises.

Among these, data center segment captured the largest IT asset disposition market share in 2024. Strict environmental regulations for e-waste disposition are a major growth factor for the data center IT asset disposition sector. Increasing demand for ITAD-compliant disposal techniques is contributing to the market growth. Data center segment is likely to capture 60.73% of the market share in 2025. For instance,

- In March 2023, the Basel Convention launched a Plastic Waste Amendment. This modification aims to regulate plastic waste advocates and promote sustainable management.

Enterprises are anticipated to grow at a prominent CAGR of 12.03% during the forecast period owing to increased demand for data storage in major countries, including the U.S., China, and GCC countries.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Rising Number of Internet Users to Contribute IT Asset Disposition in IT & Telecom Industry

Based on industry, the market is analyzed into BFSI, IT & telecom, government, healthcare, media & entertainment, energy & utilities, and others (manufacturing, etc.)

IT & telecom is projected to hold 24.70% of the market share in 2025, owing to the growth of the telecommunication sector, which has been substantial since the number of internet users has improved. For instance,

- According to The World Bank Group, 99% of Denmark's and 91% of the German population accessed the Internet.

The rising number of internet users has driven the need for properties such as telecom towers, switches, fiber optic cables, and routers, among others. This augmented usage of IT assets has increased wastage, contributing to the growth of the IT & telecom segment.

The healthcare sector is anticipated to grow at the highest CAGR of 25.39% during the coming years, owing to the rising adoption of ITAD services in healthcare institutions such as clinics, hospitals, and other healthcare companies. The HIPAA security rule requires the privacy of Electronically Protected Health Information (ePHI) to be confirmed through appropriate administrative, physical, and technical protections.

IT ASSET DISPOSITION MARKET REGIONAL OUTLOOK

By region, the market is categorized into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America

North America IT Asset Disposition Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America IT asset disposition market held major share in 2024 owing to the expanding number of cloud data center services and the booming IT market in the region. The presence of numerous ITAD service providers and the extensive acceptance of cloud-based technologies will also help to accelerate market expansion. North America’s market value stood for USD 9.29 billion in 2026, and USD 8.37 billion in 2025.

Download Free sample to learn more about this report.

The U.S. is projected to hold the largest value of USD 4.86 billion in 2026 in the North American market, owing to the rapid evolution of technology, including cloud computing and data center consolidation. This leads to the need for ITAD services as businesses update their equipment and embrace BYOD policies. For instance,

- As per industry analysis, the average size of a US data center will grow from 40 MW to 60 MW by 2028.

Europe

Europe is expected to be the third-largest country with the value of USD 4.65 billion in 2026. European countries hold a strong point on promoting circular economy principles and environmental sustainability. ITAD services play a major role in responsible electronic waste management, including reusing and recycling components to minimize ecological impact. The U.K. market is anticipated to hit USD 1.16 billion, the German market is likely to reach USD 0.71 billion and France is projected to stand at USD 0.84 billion in 2025.

Asia Pacific

Asia Pacific’s market size is likely to hold USD 4.76 billion in 2026 as the second-largest market, and is set to grow at the highest CAGR of 21.62% during the forecast period owing to strict regulations in China, India, and Japan, which compels businesses to adopt ITAD services. For instance,

- The Government of India introduced the e-waste management rule, charting restricted use of hazardous substances, prolonged range of electronic goods, and the obligation for producers of electronic assets to ensure the recycling of 60% of electronic waste.

The market in India is estimated to be USD 0.98 billion in 2026. On the other hand, the market in China is expected to be USD 1.78 billion and Japan is likely to hit USD 1.14 billion.

Middle East & Africa

The Middle East & Africa is the fourth-largest market, anticipating a value of USD 1.78 billion in 2026, and witnessing considerable demand for IT asset disposition services. Companies in this region are looking to maximize the value of their IT assets by remarketing and recycling them, which contributes to the Middle East & Africa’s IT asset disposition market growth. The GCC market size is projecting to be USD 0.75 billion in 2025.

South America

The South American market is driven by businesses that migrate to cloud services and consolidate data centers, which help to generate a significant amount of decommissioned IT assets that require proper disposition.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Broader Service Portfolio & Product Expansion among Key Players to Propel Market Growth

Key players in the ITAD industry are focusing on strategic partnerships, acquisitions, and developing comprehensive ITAD services to grow their market share. These strategies include enhancing data security and compliance, offering broader service portfolios, and expanding into new markets.

List of Key IT Asset Disposition Companies Profiled

- Iron Mountain, Inc. (U.S.)

- Sims Lifecycle Services (U.S.)

- Evernex (France)

- Arrow Electronics (U.S.)

- HPE (U.S.)

- IBM Corporation (U.S.)

- SpiceWork (U.S.)

- 3stepIT (Finland)

- CSI Leasing, Inc. (U.S.)

- TBS Industries, Inc. (U.S.)

- Cxtec, Inc. (U.S.)

- Relu Tech (U.S.)

- Tier1 (U.K.)

- Atea (Norway)

- Total IT Global (U.K.)

- CHG-MERIDIAN (Germany)

- Inrego AB (Sweden)

- Ingram Micro (U.S.)

- LifeSpan International, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In May 2024, Iron Mountain Incorporated partnered with Carahsoft Technology Corp. This partnership gets Carahsoft’s capability to work with system integrators and resellers together with Iron Mountain’s extensive solutions.

- In April 2024, CTL acquired ITAD provider 3R Technology of Kent, Washington. The acquisition will help extend CTL’s IT lifecycle services to enterprise customers.

- In January 2024, Iron Mountain acquired Regency Technologies, a U.S.-based provider of IT asset disposition services. This will help to enhance environmental sustainability and boost value retrieval at the end of the IT asset lifecycle.

- In August 2023, Cyxtera collaborated with Hewlett Packard Enterprise (HPE) to offer Asset Upcycling Services. This will allow companies to recover value sustainably and securely from retired hardware.

- In March 2023, Redington Limited (India) entered into a partnership with Dell Inc. (U.S.) to support sustainability initiatives in India. Through this partnership, Redington will offer Dell's Asset Resale and Recycling Services to assist industries sustainably and securely manage legacy IT equipment.

INVESTMENT ANALYSIS AND OPPORTUNITIES

An investment analysis of IT asset disposition should consider the growing market expansion, regulatory pressures, and potential for value recovery through resale or repurposing. ITAD involves the secure and responsible disposal, reuse, or recycling of IT assets, addressing concerns such as data security, environmental impact, and regulatory compliance. In conclusion, an investment in ITAD offers significant opportunities for value recovery and growth, driven by regulatory pressures, increasing demand, and the need for responsible IT asset management. However, a thorough analysis of the regulatory landscape, market dynamics, and the competitive landscape is vital for making informed investment decisions.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications of the service. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.53% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Service, Asset Type, Type, Industry, and Region |

|

Segmentation |

By Service

By Asset Type

By Type

By Industry

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is projected to reach USD 48.48 billion by 2034.

In 2025, the market was valued at USD 19.70 billion.

The market is projected to grow at a CAGR of 10.53% during the forecast period.

By industry, the IT & telecom segment leads the market.

Increased volume of electronic waste and awareness of environmental conservation drive the market growth.

Iron Mountain, Inc., Sims Lifecycle Services, and Evernex are the top players in the market.

North America is expected to hold the highest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us