IT Services Market Size, Share & Industry Analysis, By Service Type (Managed Services, Cloud Services, Network Services, Software Development and Maintenance, Security Services, and Consulting Services), By Enterprise Type (Large Enterprises and Small and Medium-sized Enterprises), By Industry (BFSI, Government, Healthcare, Retail, IT & Telecom, Manufacturing, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

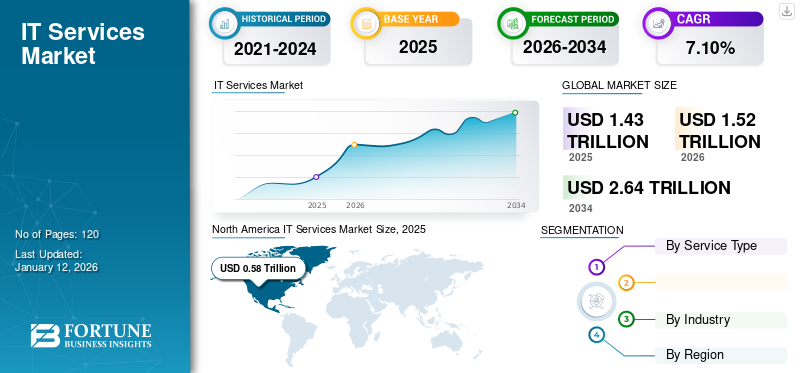

The global IT services market size was valued at USD 1.43 trillion in 2025 and is projected to grow from USD 1.52 trillion in 2026 to USD 2.64 trillion by 2034, exhibiting a CAGR of 7.10% during the forecast period. North America dominated the market with a share of 41% in 2025.

Businesses across industries are adopting digital transformation initiatives that involve automation and shifting to digital platforms. This creates a demand for specialized IT services to manage, implement, and optimize these technologies. As per the VrinSoft Survey, in 2025, 9 of 10 organizations are expected to increase their IT budgets.

As cyberattacks become more sophisticated, organizations are adopting advanced cybersecurity services to protect sensitive information and maintain customer trust. This has led to a surge in demand for IT services that focus on security. According to a VrinSoft survey, around 77% of organizations will increase their cybersecurity budgets in response to rising threats.

Key players including Accenture, Google, IBM, Infosys, Oracle and others are focusing on offering value-based managed services for enterprises aiming at IT cost optimization and are adopting strategies including acquisitions and partnerships to expand digital, cloud and cybersecurity capabilities.

IMPACT OF GENERATIVE AI

Generative AI has transformed the way businesses innovate, operate, and deliver solutions. Generative AI helps IT service companies automate routine and repetitive tasks, including software testing, system monitoring, troubleshooting, and coding. Generative AI assists in software development by automating code writing, generating documentation, and fixing bugs, significantly speeding up the development cycle.

Integration of generative AI into IT services is reshaping workforce dynamics. While it automates certain tasks, it also necessitates upskilling employees to work alongside AI systems, focusing on higher-value activities such as decision-making and strategic planning. This shift emphasizes the importance of continuous learning and adaptation within the workforce.

IT Services Market Trends

Ongoing Trend of Green IT Services to Aid Market Growth

The IT sector accounts for 2%-4% of global CO₂ emissions and as per IEA, in 2023, IT data centers alone consumed about 1% of global electricity and this is expected to triple by 2030. Therefore, the demand for green IT services is increasing. The primary objective of Green IT is to minimize the environmental impact of Information and Communication Technology (ICT) systems through sustainable practices and the use of energy-efficient hardware and resources.

Green services aim to develop cleaner products and solutions while enhancing underlying processes by effectively utilizing advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI). Many organizations have committed to achieving net-zero emissions by 2030 or 2050. By adopting green IT services, such as renewable-powered data centers and low-carbon cloud solutions, companies can reach these targets while continuing to support digital growth.

Thus, the ongoing trend of green IT is expected to drive IT services market growth.

MARKET DYNAMICS

Market Drivers

Increasing Adoption of Cloud Computing to Boost Market Growth

Cloud computing is transforming the way organizations operate. It simplifies business processes and helps overcome various challenges. The demand for cloud computing is increasing significantly across industries, as organizations can manage their operations online without making substantial investments. According to industry experts, by 2028, cloud computing will be an essential component for maintaining business competitiveness.

Cloud computing is highly reliable and provides excellent disaster recovery management. It helps organizations maintain complex hardware in their cloud environment while ensuring smooth operations. From hosting and storage to backup services, Software as a Service (SaaS), and hybrid and multi-cloud solutions, cloud computing offers a variety of services to organizations. The adoption of hybrid and multi-cloud environments is also expected to grow as these approaches enable higher operational efficiency and cost optimization. Therefore, an increasing adoption of cloud computing is boosting the IT services market share.

Market Restraints

High Implementation and Maintenance Cost Hampers Market Growth

Different IT solutions, especially enterprise-scale systems and custom services, require significant investment in hardware, software, infrastructure, and skilled personnel, and maintaining an IT system involves continuous expenses such as infrastructure scaling and optimization, software updates and patches, technical support, and troubleshooting. These recurring costs can put an increased strain on operational budgets. Thus, high implementation and maintenance costs hampers market growth.

Market Opportunities

Evolving 5G Technology Advancements in Cloud Dependent Regions is Expected to Generate Opportunities

The present industry trend is focused on virtualizing IT and network platforms. The virtualization of IT platforms is implemented using PaaS, IaaS, or SaaS solutions. It provides a virtualized platform, separate virtualized infrastructure, and virtualized software to a set of tenants using the shared physical hardware and storage. With 5G, the virtualization of network functionality will aid the private/public operators in sharing their network functionality and cloud spectrum, thereby minimizing cost.

The combination of 5G and cloud technologies is set to enhance the capacity, functionality, and flexibility of various industries, particularly those relying on cloud services. Many companies are integrating 5G with cloud offerings to deliver faster speeds, lower latency, and increased capacity. For example, Ericsson has over 230 customers for its cloud infrastructure around the globe. Some of the prominent service providers that use Ericsson’s services include Swisscom, Telkomsel, Telefonica, Far EasTone, XL Axiata, and others. The company offers a telco-grade cloud platform known as Ericsson NFVI, which incorporates both 5G and cloud functionalities. This platform supports telecom operations, as well as IT and IoT applications, running on cloud computing models such as SaaS, PaaS, and IaaS, all with quick deployment of 5G core technologies.

Intel Corporation is incorporating 5G and cloudification in its network using key technologies such as software-defined networking, virtualization, network slicing, and self-managed networks. Furthermore, Intel Corporation partners with Communications Service Providers (CoSPs) and Telecom Equipment Manufacturers (TEMs) to provide cloud-ready networks (SaaS, IaaS, PaaS, and as-a-service platforms) and ease the deployment of 5G solutions and services.

Therefore, the adoption of 5G will provide a lucrative opportunity for the players in the market.

As per GSMA, the adoption of 5G in 2025 is expected to witness growth in developed countries in Asia Pacific, following North America.

SEGMENTATION ANALYSIS

By Service Type

Adoption of Managed Services to Streamline Operations is Driving Segmental Growth

Based on service type, the market is segmented into managed services, cloud services, network services, software development and maintenance, security services, and consulting services.

Among these, managed services dominated the market in 2026 by 22.97%, as they help enterprises streamline their IT operations and improve overall efficiency. According to a survey by Jumpcloud, around 60% of large enterprises globally use managed services to streamline their IT and cloud services.

Consulting services are estimated to grow with the highest CAGR during the forecast period. Consulting services help organizations optimize processes, identify inefficiencies in IT infrastructure, and reduce operational costs through automation and smarter technology investments. Also, as the data and IT regulations are frequently changing, organizations are seeking help from consulting firms to ensure compliance and avoid penalties.

By Enterprise Type Analysis

Rapid Adoption of IT Services by Large Enterprises to Stay Competitive Boosted Segment Growth

Based on enterprise type, the market is bifurcated into large enterprises and small and medium-sized enterprises.

Large enterprises captured a leading market share in 2024. Large enterprises are investing in digital transformation, cloud services, and cybersecurity services to stay competitive in the market and to streamline operations. As per industry experts, over 85% of large enterprises will adopt the cloud-first principle by 2025. Large enterprises segment is anticipated to capture a 55.76% market share in 2026.

Small and medium-sized enterprises are expected to register the highest CAGR of 8.69% during the forecast period. SMEs are able to adopt IT services without any upfront investments as the players in the market have introduced subscription-based models. According to Techaisle, in 2023, around 80% of SMEs across the globe adopted cloud services.

By Industry Analysis

Healthcare to Lead Market Owing to Rising Adoption of IT Services for Improving Patient Care

The industry has been segmented into BFSI, government, healthcare, retail, IT & Telecom, manufacturing, and others.

Healthcare is estimated to grow with the highest CAGR of 11.95% during the forecast period as this industry is undergoing significant digital transformation. The surge in remote patient monitoring, telehealth, and digital health platforms has increased the need for services in the sector. According to industry experts, the adoption of telehealth post-pandemic has surged by 3X times the pre-pandemic levels.

Among these, IT & telecom dominated the market in 2024, as this industry is undergoing rapid transformation, driven by evolving technologies, the need for operational efficiency, and a surge in data consumption. As a result, the demand for IT services is increasing in the sector. IT & telecom segment is estimated to capture a 18.05% market share in 2026.

To know how our report can help streamline your business, Speak to Analyst

IT SERVICES MARKET REGIONAL OUTLOOK

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

North America

North America market size for 2026 was USD 0.62 trillion, and USD 0.58 trillion in 2025. North America dominated the market by capturing the maximum share in 2024, as IT service providers are setting up new IT delivery centers in the region. North American locations accounted for more than one-third of new delivery sites established by service providers in 2016.

North America IT Services Market Size, 2025 (USD Trillion)

To get more information on the regional analysis of this market, Download Free sample

In the U.S., the market is expected to experience a strong growth rate during the forecast period, as the country remains a global technology leader and companies across industries are adopting digital technologies to stay competitive. The U.S. witnesses a high volume of cyber threats, and due to this, the demand for managed cybersecurity services is increasing. According to IBM’s 2023 report, the U.S. has the highest average cost of data breaches globally, which is USD 9.48 million per incident. The U.S. market size is estimated to be USD 0.41 trillion in 2026.

Remote working is one of the major reasons for market growth in the U.S. and this shift is driving the demand for IT services to manage secure remote access, cloud collaboration tools, and remote device management.

Download Free sample to learn more about this report.

Asia Pacific

The Asia Pacific market is the third-largest region, expected to be USD 0.31 trillion in 2025 and grow with the highest CAGR during the forecast period. Governments across the region are launching national-level programs to digitize services, modernize public infrastructure and improve connectivity. Initiatives, including Singapore’s Smart Nation, China’s 14th Five-Year Plan, and India’s Digital India, have been introduced by governments to strengthen the digital economy. These initiatives are surging the market demand in the region. The market in India is estimated to be USD 0.04 trillion, Japan likely to be USD 0.07 trillion and Chinese market to be projected at USD 0.11 trillion in 2026.

Europe

Europe is projected to be the second-largest market with a value of USD 0.33 trillion in 2025 and is expected to showcase significant CAGR of 6.24% during the forecast period. Businesses across Europe are investing heavily in digital infrastructure. According to the EU Commission, EU countries are expected to invest around USD 274 billion in digital transformation by 2030. Due to this, the demand for the market is likely to increase in the region. The market in U.K. is estimated to be USD 0.05 trillion, Germany is likely to be USD 0.06 trillion in 2026 and France market to be projected at USD 0.07 trillion in 2025.

Middle East & Africa

The Middle East & Africa are anticipated to grow at a healthy rate over the forecast period, owing to increasing digitalization, government initiatives such as Vision 2030, and growing adoption of AI and automation. The Middle East & Africa market is expected to hit USD 0.11 trillion in 2025, and GCC countries are projected to hit USD 0.05 billion in 2025.

South America

The South American market is likely to register a steady growth rate over the forecast period. Rising investment in digital transformation across South American countries such as Brazil and Argentina is driving market growth.

Competitive Landscape

Key Industry Players

Market Players Opt for Merger & Acquisition Strategies to Expand Their Presence

Key players in the market are entering into strategic partnerships and acquisitions with other players. Significant players have implemented this strategy to integrate services with advanced technologies. Also, through business strategies, the companies are expanding their business and gaining expertise by reaching a mass customer base. Various companies collaborate to enhance their product offerings. Market players aim to develop their products based on emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), Cloud, Internet of Things (IoT), and others to resolve the challenges faced by the companies.

List of IT Services Companies Studied:

- Amazon Web Services (U.S.)

- IBM Corporation (U.S.)

- Avaya (U.S.)

- Cisco (U.S.)

- Fortinet (U.S.)

- HPE (U.S.)

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- Accenture Plc (Ireland)

- Capgemini SE (France)

- Cognizant (U.S.)

- TCS (India)

- Infosys (India)

- Wipro Ltd (India)

- Dell Technologies (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2025 – Accenture and Crowdstrike entered into a collaboration agreement for mitigating cyber threats, transforming security operations, and reducing costs with AI-native solutions.

- March 2025 – AWS released multi-agent collaboration for Amazon Bedrock, allowing developers to create networks of specialized AI agents that collaborate under the guidance of a supervising agent.

- March 2025 – Fortinet has added advanced features in its OT security platform for protecting industrial sites and critical infrastructure from evolving cyber threats.

- February 2025 – Accenture acquired IQT Group for large infrastructure projects based in Italy. Accenture acquired IQT Group to combine Accenture’s generative AI capabilities with IQT’s infrastructure projects expertise to help clients plan, execute, and manage net-zero infrastructure projects.

- February 2025 – TCS entered into a partnership with UPM for modernizing its IT landscape. The aim of the partnership was to strengthen UPM's enterprise IT value chain by deploying TCS’s platform Ignio.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Companies are increasingly investing in IT services such as cloud computing, cybersecurity, and managed services. Recently, the managed services sector has experienced a surge in Mergers and Acquisitions (M&A) activity as strategic players seek to acquire new capabilities and clients while expanding their global presence. By enhancing their service offerings, companies can create significant synergies that make potential acquisition targets more attractive. Mid-sized Managed Service Providers (MSPs) are especially appealing investments for private equity firms, which often pursue multiple roll-ups of small to mid-sized companies to strengthen the scale and reach of the combined business entities.

REPORT COVERAGE

The market research report provides a detailed market analysis. It focuses on key points, such as leading companies, offerings, and applications. Besides this, it offers an understanding of the latest market trends and highlights key industry developments. In addition to the above-mentioned factors, it contains several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.10% from 2026 to 2034 |

|

Unit |

Value (USD Trillion) |

|

Segmentation |

Service Type, Enterprise Type, Industry, and Region |

|

Segmentation |

By Service Type

By Enterprise Type

By Industry

By Region

|

|

Companies Profiled in the Report |

• Amazon Web Services (U.S.) • IBM Corporation (U.S.) • Avaya (U.S.) • Cisco (U.S.) • Fortinet (U.S.) • HPE (U.S.) • Microsoft Corporation (U.S.) • Oracle Corporation (U.S.) • Accenture Plc (Ireland) • Capgemini SE (France) |

Frequently Asked Questions

The market is projected to record a valuation of USD 2.64 trillion by 2034.

In 2025, the market was valued at USD 1.43 trillion.

The market is projected to grow at a CAGR of 7.10% during the forecast period of 2026-2034.

The managed services are expected to lead the market in terms of share.

The increasing adoption of cloud computing is expected to boost market growth.

IBM Corporation, Cisco, Microsoft, Avaya, AWS, Fortinet, and Accenture are the top players in the market.

North America is expected to hold the highest market share.

By industry, the healthcare sector is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us