Japan Artificial Intelligence Market Size, Share & Industry Analysis, By Component (Hardware, Software, & Services), By Deployment (On-premise & Cloud), By Enterprise Type (Large, Small & Medium-sized Enterprises), By Technology (Machine Learning, NLP, Computer Vision, Robotics & Automation, & Expert Systems), By Function (HR, Marketing & Sales, Product/Service Deployment, Service Operation, Risk, & Supply-chain Management), By Industry (Healthcare, Automotive, BFSI, Retail, Manufacturing, Agriculture, Government, IT & Telecom, Energy & Utilities, & Education), & Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

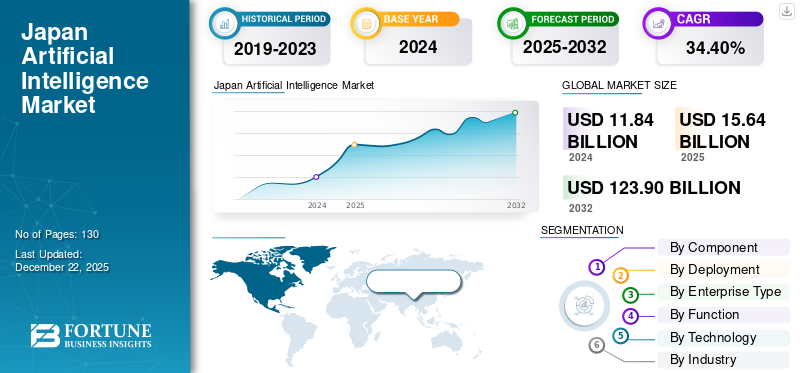

Japan Artificial Intelligence market size was valued at USD 11.84 billion in 2024. The market is projected to grow from USD 15.64 billion in 2025 to USD 123.90 billion by 2032, exhibiting a growth at a CAGR of 34.40% during the forecast period.

As of 2025, Japan's artificial intelligence market is fast becoming a strong global player due to its historical advantages in robotics, electronics, and automation. Now, Japan has moved beyond research-based initiatives, into a new era of AI applying its capabilities economically and qualitatively across several major areas such as healthcare, finance, mobility, and advanced manufacturing. With national strategies and policy consistency, Japan’s AI ecosystem is steadily evolving. Strong academic foundations and increasing public-private collaborations are further supporting this growth. The ecosystem is maturing beyond technology for the sake of technology. It is now creating and deploying solutions defined by practical, impactful deployment, fast-cycle iterations of innovation, and reliability and replicability of scale.

Impact of Generative AI

Generative AI is gaining traction in Japan's AI market, revolutionizing automation and creativity across industries. In design and manufacturing, Generative AI is enabling rapid prototyping and product customizations. In education and media, it plays a role in interactive content creation, developing language learning tools, and creating exciting immersive experiences.

Generative models are helping Japanese firms improve internal productivity through code generation, document summarization, and advancements in knowledge management.

- For instance, nearly 60% of Japanese companies are already leveraging generative AI, according to a survey by Dod.

Impact of Reciprocal Tariffs

Reciprocal tariffs can have a significant impact on the artificial intelligence ecosystem in Japan by raising costs and reducing access to key technologies. A tariff on key imports such as advanced semiconductors or AI computing hardware adds time and cost for companies that would be developing or deploying artificial intelligence.

- For instance, a Japanese firm developing autonomous systems may find it difficult to purchase key components at acceptable prices if supply chains are disrupted.

Japan Artificial Intelligence Market Trends

Rise of AI Startups and Innovation Hubs to be Key Driver for Market Growth

One of the prominent market trends in the market is the rise of AI startups and innovation hubs, which is significantly reshaping the national tech ecosystem. These startups are bringing fresh ideas, agile development approaches, and specialized solutions that address sector-specific needs such as robotics, healthcare diagnostics, fintech, and smart mobility.

- In May 2025, Tokyo-based EdgeCortix received USD 21 million from Japan’s NEDO to develop energy-efficient edge AI chips. The startup plans to produce its next-gen "NovaEdge" chiplet at a TSMC-run facility in Kumamoto by 2027.

Supported by a growing number of innovation centers, tech accelerators, and public–private partnerships, these young companies benefit from access to infrastructure, funding, and collaborative opportunities.

Key takeaways· The Japan Artificial Intelligence Market is projected to be worth USD 123.90 billion in 2032. · In the by component segmentation, Software accounted for around 47.5% of the Japan Artificial Intelligence Market in 2024. · In the by deployment segmentation, Cloud is projected to grow at a CAGR of 36.0% in the forecast period. · In the by enterprise type segmentation, Large Enterprises accounted for around 60.2% of the market in 2024. · In the by function segmentation, Risk is projected to grow at a CAGR of 37.2% in the forecast period. · In the by technology, Machine Learning accounted for around 41.0% of the market in 2024. · In the by industry segmentation, Healthcare is projected to grow at a CAGR of 41.8% in the forecast period. |

Japan Artificial Intelligence Growth Factors

Increasing Use of AI in Cybersecurity to Boost Market Growth

As cyber threats continue to become more complex and more frequent, traditional security measures are often insufficient to track the evolving landscape of risk. The proliferation of AI-based cybersecurity solutions is indicative of their growing acceptance in the cybersecurity field, as they provide a level of detection, reaction, and predictive capabilities traditionally absent from conventional cybersecurity tools.

- In January 2025, Japan and the U.S. will start joint research on AI-powered cyberattacks, beginning early in Japan’s fiscal year in April. Japan’s National Institute of Information and Communications Technology (NICT) will open a research facility in Washington, D.C. to support the collaboration.

For many organizations, AI is one of the first instances in which a machine can analyze vast amounts of virus/malware and attack data quickly enough to detect unusual behavior (in the case of a cyberattack) and permit action before damage is done.

Japan Artificial Intelligence Market Restraints

Acute Talent Shortage Hinder Market Growth

Japan's AI market is severely limited by a lack of skilled people, particularly in the fields of machine learning, data science, and software engineering. This leads to a shortage of talent for the development, deployment, and scaling of AI solutions for national and global industries.

- According to the Linux Foundation, over 70% of Japanese organizations report talent shortages in critical areas such as cloud computing, significantly higher than the 47% witnessed in other regions.

The growing and aging workforce exacerbates this talent shortage, further reducing the available talent pool impacting the speed of digital transformation. With a limited pipeline of AI talent from local educational institutions and international partnerships, Japan will struggle to remain competitive in AI in a global marketplace.

Japan Artificial Intelligence Market Segmentation Analysis

By Component

Based on component, the market is divided into hardware, software, and services.

In Japan’s AI market, software remains the largest segment, primarily due to the essential component it plays in creating AI models, analytics platforms, and application software focused on the needs of certain industries. By focusing on software innovations, organizations can utilize applications that drive operational efficiency and improve the customer experience.

Hardware is expected to have the fastest Japan artificial intelligence market growth rate due to the increasing investments in AI processors, sensors, and edge computing devices. As AI strengthens its position in domains such as manufacturing, transportation, and healthcare and moves toward real-time applications, there is a growing demand for capable and high-performance hardware.

- For instance, in August 2025, RIKEN, Fujitsu, and NVIDIA are collaborating on FugakuNEXT, Japan's next supercomputer, set to launch around 2030. The AI-HPC platform will integrate AI and simulation capabilities, targeting 100x performance improvements over Fugaku. By combining NVIDIA GPUs and Fujitsu CPUs, the project aims to boost Japan's competitiveness in AI and high-performance computing.

By Deployment

Based on deployment, the market is bifurcated into on-premise and cloud.

Cloud is positioned as the largest growth share and projected to grow at the fastest CAGR in Japan's AI market as businesses continue to pursue cloud-based solutions for added scalability, flexibility, and reduced upfront spending. There will be growing demand for real-time data processing with seamless AI integration, and cloud platforms will become the architecture for deploying AI across industries such as healthcare, finance, and manufacturing. The rapid rise of AI-as-a-Service and developments in cloud infrastructure continue to drive the speed of adoption, making cloud deployments the leading section of the market, as well as the fastest growing section.

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

Large enterprises hold a majority in the market due to bigger budgets, stronger infrastructure, and their commitment to digital transformation. These enterprises are using AI to increase efficiency, automate complicated workflows, and develop greater business analysis at scale.

At the same time, SMEs are predicted to have the highest CAGR due to cloud solutions and inexpensive AI-as-a-Service. With growing recognition of AI's potential to improve productivity and competitiveness, small and medium enterprises are quickly retrieving AI to leverage it to work smarter, not harder. This will also create new ways to engage customers and differentiate themselves from competitors.

By Function

Based on function, the market is segmented into human resources, marketing & sales, product/service deployment, service operation, risk, supply-chain management, and others.

Service-related functions have the largest Japan artificial intelligence market share with companies increasingly using AI to optimize engagement with customers, drive efficiency in operations, and enhance decision making. These applications have developed since and generate measurable business value; as a result, they are a significant focus area in multiple industries.

Risk-focused AI functions are emerging as the fastest-growing segment, due to the growing climate of concerns about fraud, cyber threats, and regulatory compliance. As organizations continue to deal with complex and ambiguous risk environments, they are turning to AI in a preventative capacity to identify anomalies, monitor vulnerabilities, and ultimately grow resilience.

By Technology

Based on technology, the market is segmented into machine learning, natural language processing, computer vision, robotics and automation, and expert systems.

Machine learning has the largest share and is expected to grow at the highest CAGR within Japan's AI ecosystem, as it underpins and enables many use cases, such as predictive analytics, natural language processing, and intelligent automation. Its inherent ability to learn and custody from data makes it indispensable within healthcare, finance, manufacturing, and retail. Growth in available data, ongoing substantial research in the field, and growing real world use cases firmly establish machine learning as a contributing factor to Japan's ongoing and future growth and adoption of AI.

By Industry

Based on industry, the market is segmented into healthcare, automotive, retail, BFSI, manufacturing, agriculture, government and public sector, IT & telecom, energy & utilities, and education.

The BFSI sector holds the majority share in Japan’s AI market, as financial institutions lead in adopting AI for fraud detection, risk management, customer personalization, and automated financial services. The sector’s early investment in digital transformation and data-driven decision-making has made it a frontrunner in AI integration.

Healthcare, however, is expected to grow at the highest CAGR, driven by increasing demand for AI-powered diagnostics, medical imaging, drug discovery, and patient care solutions. As Japan faces an aging population and rising healthcare costs, AI is playing a crucial role in enhancing efficiency, accuracy, and accessibility in medical services.

List of Key Companies in Japan Artificial Intelligence Market

The Japanese AI landscape is propelled by innovative companies such as Preferred Networks, which is advancing AI infrastructure through the development of its proprietary MN-Core chips and collaborating with industry leaders to establish a sustainable, Japan-made AI ecosystem. ABEJA is revolutionizing enterprise AI adoption by offering a comprehensive platform that integrates deep learning, IoT, and big data analytics, enabling businesses to scale AI solutions across various sectors. LeapMind focuses on democratizing AI by providing ultra-low power AI inference accelerators and tools that simplify deep learning model deployment, making AI accessible even in resource-constrained environments. Morpho specializes in image and video processing technologies, offering AI-powered solutions for tasks such as facial recognition and image quality enhancement, catering to diverse industrial applications.

LIST OF KEY COMPANIES PROFILED

- Preferred Networks, Inc. (Japan)

- ABEJA, Inc. (Japan)

- io (Japan)

- WACUL, Inc. (Japan)

- Cross Compass, Ltd. (Japan)

- Eartheyes (Japan)

- Rist Inc. (Japan)

- IR Alt, Inc. (Japan)

- BAP Software (Japan)

- Morpho, Inc. (Japan)

- Autify (Japan)

- Sakana AI (Japan)

KEY INDUSTRY DEVELOPMENTS

- February 2025: SoftBank and OpenAI launched a USD 3 billion-a-year joint venture, "SB OpenAI Japan," to bring OpenAI’s tools to major Japanese firms. The deal includes access to ChatGPT Enterprise, custom models, and the new Cristal Intelligence suite. SoftBank aims to boost productivity and lead AI adoption, with CEO Masayoshi Son predicting AGI within 10 years.

- April 2024: Microsoft will invest USD 2.9 billion over two years to expand its AI and cloud infrastructure in Japan, marking its largest-ever investment in the country. The initiative includes building hyperscale data centers, training 3 million people in AI skills, opening a new Microsoft Research Asia lab in Tokyo, and strengthening cybersecurity partnerships with the Japanese government.

REPORT COVERAGE

This report provides a comprehensive analysis of the Japan artificial intelligence (AI) market, examining the current state and future potential across key sectors such as manufacturing, healthcare, finance, and transportation. It covers advancements in core AI technology, including machine learning, robotics, and edge AI, and assesses their impact on productivity and competitiveness. The study evaluates the roles of startups, established technology companies, and leading research institutions in shaping Japan’s AI landscape. Additionally, the report explores government policies and initiatives focused on ethical AI development, funding programs, and workforce development. Through detailed market segmentation, trend analysis, and strategic insights, the report aims to deliver a holistic understanding of Japan’s AI ecosystem and its trajectory on the global stage.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 34.40% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component · Hardware · Processors (GPU, FPGA, ASIC and CPU) · Memory Systems · Storage Devices · Software · Services · AI Strategy Advisory/Consulting Services · System Integration and Deployment · AI Model Development · Process Automation and Optimization · AI Training · AI-powered Customer Experience · Support & Maintenance |

|

By Deployment · On-premise · Cloud · Public Cloud · Private Cloud · Hybrid Cloud |

|

|

By Enterprise Type · Large Enterprises · Small and Mid-sized Enterprises (SMEs) |

|

|

By Technology · Machine Learning · Supervised Learning · Unsupervised Learning · Reinforcement Learning · Deep Learning · Natural Language Processing (NLP) · Speech Recognition · Text Analytics · Language Translation · Computer Vision · Image Recognition · Object Detection · Robotics and Automation · Expert Systems · Rule-based Expert System · Knowledge-based System |

|

|

By Function · Human Resources · Marketing & Sales · Product/Service Deployment · Service Operation · Risk · Supply-Chain Management · Others (Strategy and Corporate Finance) |

|

|

By Industry · Healthcare · Diagnostic AI · Clinical AI · Hospital Management System · Automotive · Autonomous Vehicle · AI in Mobility-as-a-Service · BFSI · Fraud Detection · Risk Management · Algorithmic Trading · Retail · Customer Analytics · AI-powered Marketing and Sales · Supply Chain Automation · Manufacturing · Predictive Maintenance · AI-driven Robotics and Automation · Quality Control · Agriculture · Smart Farming · Yield Monitoring and Optimization · Crop Disease Detection · Government and Public Sector · Smart City Initiatives · Law Enforcement AI · Disaster Management · IT & Telecom · Network Optimization · AI Chatbots · Intelligent Call Routing · Energy & Utilities · Grid Management · AI in Renewable Energy Management · Education · Adaptive Learning Platform · AI-assisted Learning Tools |

Frequently Asked Questions

Fortune Business Insights says that the Japan Artificial Intelligence market was worth USD 11.84 billion in 2024.

The market is expected to exhibit a CAGR of 34.40% during the forecast period.

By industry, the BFSI segment is set to lead the market.

Preferred Networks, ABEJA, and Leapmind are the key players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us