Ceramic Package Market Size, Share & Industry Analysis, By Material (Alumina Ceramics, Aluminum Nitride Ceramics, and Others), By End Use (Electrical & Electronics, Automotive, Aerospace & Defence, Medical Devices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

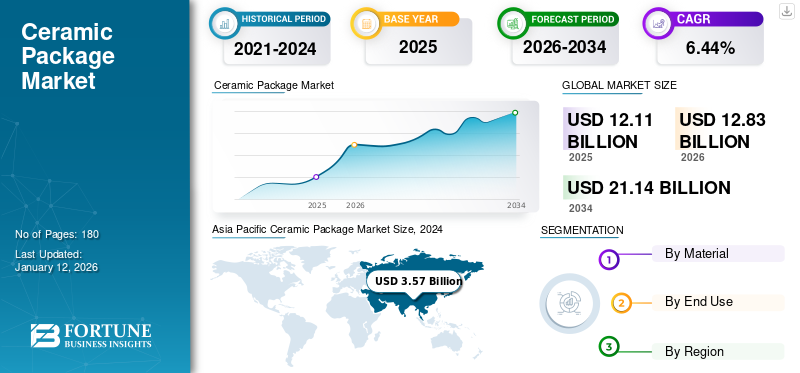

The global ceramic package market size was valued at USD 12.11 billion in 2025. It is projected to be worth USD 12.83 billion in 2026 and reach USD 21.14 billion by 2034, exhibiting a CAGR of 6.44% during the forecast period. Asia Pacific dominated the ceramic package market with a market share of 31.54% in 2025.

Electronic devices such as smartphones, LEDs/LDs, MEMS, and others require several electronic components, electrical wiring, and other parts, including substrates, lids, and sealants. Ceramics are utilized as part of the material for each component, and the packaging is called a ceramic package. The propelling demand for such packages from the automotive and electronics sectors drives market growth.

Schott AG and Kyocera Corporation are the leading manufacturers, accounting for the largest market share.

GLOBAL CERAMIC PACKAGE MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 12.11 billion

- 2026 Market Size: USD 12.83 billion

- 2034 Forecast Market Size: USD 21.14 billion

- CAGR: 6.44% from 2026–2034

Market Share:

- Asia Pacific dominated the market in 2024 with a 31.18% share, rising from USD 3.53 billion in 2023 to USD 3.57 billion in 2024.

- By material, alumina ceramics led the market due to high thermal conductivity, corrosion resistance, and superior insulation performance.

- By end use, electrical & electronics held the largest share, projected at 32.94% in 2024, driven by rising demand in smartphones, sensors, and power modules.

- Automotive was the second-largest end-use segment, leveraging ceramics for their wear resistance and thermal stability.

- Key players include Schott AG and Kyocera Corporation, together accounting for the largest market share.

Key Country Highlights:

- China: Leads global production of consumer electronics; demand for ceramic packages bolstered by advanced semiconductor manufacturing and innovation.

- United States: Strong presence of aerospace, defense, and semiconductor industries drives demand; USD 50.2 billion invested in semiconductor R&D in 2021.

- Germany: Major market for medical devices in Europe (USD 33.8 billion in 2022), supporting ceramic package demand in healthcare applications.

- Brazil & Mexico: Represent 70% of Latin America’s EV demand, boosting ceramic package usage in EV electronics.

- UAE: Growth in medical device and pharmaceutical industries supports regional ceramic packaging demand.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Utilization of Ceramic Packaging Solutions in the Electronics Industry Propels Market Growth

The massive demand for advanced electronic components has created a need for superior packaging solutions, which ceramic packaging solutions can provide. The growth of the global electronics market is propelling the sales of these packages. There is an augmenting demand for electronic components in several sectors, which has led to an increased focus on developing lightweight packages for more efficient & reliable operations. Ceramic package materials offer superior shielding protection compared to plastic or any other material, making them ideal for various electronic components and boosting the market growth.

Significant Benefits Offered by Ceramic Packaging Solutions to Enhance Market Growth

As the scale of integrated circuit design increases, the package design becomes more complicated. The general package can’t meet the electrical, mechanical, and reliability requirements, and the demand for package customization has become increasingly obvious. The frequently used package materials are resins and ceramics. Ceramic packages have been increasingly widely used due to their advantages of good air tightness, multi-layer wiring, high insulation impedance, thermal expansion coefficient, and proximity to chips.

Ceramics have excellent physical properties, such as high strength, heat resistance, corrosion resistance, insulation, and thermal conductivity. These unique properties make the packaged product more durable and stable. Ceramics can have superior electrical properties, such as high dielectric constant, low dielectric loss, high electrical insulation strength, and others. These excellent electrical properties help to improve the signal transmission quality and performance indicators of the product. Such features thus contribute to the global ceramic package market growth.

MARKET RESTRAINTS

Lack of Tensile Strength and High Upfront Costs Hamper Market Growth

While ceramics often have high compressive strength, their tensile strength is comparatively low. It thus makes them prone to cracking or breaking when subjected to tension. Ceramics are inherently brittle , which thus makes them less suitable for applications requiring high-impact resistance and flexibility. The manufacturing process of ceramic packaging is complex and costly, which can be a barrier to widespread adoption, especially in cost-sensitive applications. It often requires advanced manufacturing techniques such as sintering, which is time-consuming and costly. Such factors impede the market growth.

MARKET OPPORTUNITIES

Utilization of Ceramic Packaging in Numerous Sectors Will Generate Growth Opportunities

The aerospace and defense sectors contribute significantly to the market expansion. Ceramic materials are highly resistant to extreme temperatures and radiation, making them ideal for packaging sensitive components used in missiles, satellites, and avionics. As the automotive and defense sectors prioritize reliability & performance in challenging environments, ceramic packaging is gaining traction for protecting electronic systems critical to the functioning of aerospace and defense technologies. It thus generates profitable growth opportunities.

MARKET CHALLENGES

Environmental Sensitivity Caused by Ceramics Challenges Market Growth

Reducing the environmental impact of ceramics is a major challenge, thus negatively impacting the market growth. They don't decompose as polymers and epoxies do. Moreover, its chemical bonding doesn't suffer from heat & UV radiation such as organics. Some ceramics can be sensitive to environmental conditions, such as moisture, that lead to degradation over time. For instance, certain ceramics can absorb water, causing weakening or swelling. These factors are analyzed to challenge the market growth.

Download Free sample to learn more about this report.

CERAMIC PACKAGE MARKET TRENDS

Augmenting Demand for Ceramic Packaging in IoT Applications Emerges as Key Trend

Ceramic packages are used in the Internet of Things (IoT) to help connect devices wirelessly in a digital network. The augmenting demand for IoT and cloud-based applications has enabled industries to use advanced electronic components that are more consistent. With the use of advanced electronic components, the need for packaging solutions that protect these components is increasing. The low cost of accelerated aging tests is providing manufacturers with more cost-effective options for production. Such factors are thus emerging as a key trend for the market growth. Additionally, the trend toward smaller, more compact devices has increased the product demand that can accommodate high-density integration while ensuring reliability. Asia Pacific witnessed a ceramic package market growth from USD 3.53 billion in 2023 to USD 3.57 billion in 2024.

IMPACT OF COVID-19

Global events, such as the COVID-19 pandemic, disrupted supply chains, affecting the availability of raw materials and components necessary for ceramic package production. The slowed down of the manufacturing of electronics, automotive, and electrical products during the emergence of the novel coronavirus hampered market growth.

SEGMENTATION ANALYSIS

By Material

Significant Benefits Offered by Alumina Ceramics Boost Segmental Growth

Based on the material, the market is segmented into alumina ceramics, aluminum nitride ceramics, and others.

Aluminum ceramics is the dominating material segment and is expected to experience noteworthy growth in the forthcoming years. The material dominates the market due to its excellent thermal and electrical insulation properties. The material offers high thermal conductivity, resistance to corrosion, insulating capability, high melting point, and extreme hardness, further boosting its demand. Aluminum ceramics can be utilized as insulators in electrical components, circuit boards, and high-voltage insulating materials. The segment held the largest market share of 58.09% in 2026.

Aluminum nitride ceramics are the second-dominating material segment. The demand for aluminum nitride ceramics due to their high-temperature-resistant and low-coefficient-of-thermal-expansion properties drives the segment’s growth.

By End Use

To know how our report can help streamline your business, Speak to Analyst

Augmenting Demand for Ceramic Packaging in Electrical & Electronics Sector Propels Segmental Growth

Based on the end use, the market is segmented into electrical & electronics, automotive, aerospace & defence, medical devices, and others.

Electrical & electronics is the dominating end use segment as the product is highly utilized in sensors, control units, and power modules in automotive electronics. The rapid growth of consumer electronics and the rising demand for advanced packaging solutions are boosting the segment’s growth. The demand for ceramic packaging components in consumer electronics, including laptops, tablet computers, smartphones, and portable gaming devices, has increased considerably in the past few years, further driving segmental growth. The segment is set to capture 33.45% of the market share in 2026.

Automotive is the second-dominating end use segment. Ceramic packaging can withstand high temperatures as it resists wear and corrosion, thus boosting its usage in the automotive sector. This segment is anticipated to register a significant CAGR of 6.54% during the forecast period (2025-2032).

CERAMIC PACKAGE MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Ceramic Package Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Burgeoning Product Demand from the Electronics Sector Boosts Market Growth in Asia Pacific

Asia Pacific dominated the global ceramic package market share with a valuation of USD 3.35 billion in 2023 and USD 3.82 billion in 2025. Given their dominance in electronics manufacturing, countries such as China, South Korea, Japan, and Taiwan are major contributors. China is set to reach USD 1.24 billion in 2025. These countries are home to the world’s largest manufacturers of integrated circuits, semiconductors, and other electronic components that majorly rely on ceramic packaging for enhanced thermal management, electrical insulation, and structural integrity.

- According to the Ministry of Industry and Information Technology, China ranks first globally in the production & sales of consumer electronics owing to the country's improved product innovation and brand-building capacity.

India is estimated to reach a value of USD 1.11 billion in 2026, while Japan is likely to be worth USD 0.78 billion in the same year.

North America

Well-established Semiconductor Industry Drives Market Growth in North America

North America is the second-leading region expected to hit USD 2.98 billion in 2025, exhibiting a CAGR of 6.39% during the forecast period (2025-2032). The ceramic packaging market in the U.S. is growing due to its well-established advanced electronics, aerospace & defence sectors, which rely on ceramic materials for heat resistance, durability, and insulation properties. The U.S. has a strong semiconductor manufacturing sector. Rising investments in the semiconductor industries in the country also contribute to the market growth. The U.S. market is likely to hold USD 2.55 billion in 2026.

According to the Semiconductor Industry Association, in 2022, the U.S. semiconductor companies invested roughly one-fifth of annual revenue in R&D, amounting to a record USD 50.2 billion in 2021, to turbocharge chip advancements.

Europe

Growing Product Demand from the Medical Device Sector Enhances Europe’s Market Growth

Europe is the third leading region anticipated to gain USD 2.56 billion in 2026. The European region demands innovative packaging solutions, such as ceramic packaging, to ensure the reliability and longevity of medical devices in harsh environments. The U.K. market is expanding, projected to reach a market value of USD 0.47 billion in 2026. The growing demand for ceramic packaging from the growing medical devices sector in the region propels the market expansion.

- According to MedTech Europe, Europe is the second-largest medical device market, accounting for 27.3% of the global market after the U.S., based on manufacturer prices. The largest markets for medical devices in Europe in 2022 were Germany (USD 33.8 billion), France (USD 19.9 billion), and followed by the U.K. (USD 18.8 billion).

Germany is estimated to be worth USD 0.56 billion in 2026, while France is projected to be valued at USD 0.38 billion in 2025.

Latin America

Rapid Expansion of the Electric Vehicle Sector to Register Steady Growth in Latin America

Latin America is the fourth leading region set to grow with the valuation of USD 1.77 billion in 2026. The region majorly demands consumer electronics, such as laptops, smartphones, and home appliances, all of which need advanced packaging materials for chips and circuits. The growing demand for the electric vehicle sector boosts regional growth.

According to CleanTechnica, Latin America’s electric vehicle market amounts to some 5 million vehicles a year, 70% of which corresponds to only two countries (Brazil and Mexico), with another 20% belonging to four countries (Argentina, Chile, Colombia, and Peru).

Middle East & Africa

Increasing Demand for Ceramic Packaging in Medical Devices Industries Aids Market Growth

Middle East region is anticipated to experience significant growth in the projected period. The rising demand for ceramic packaging from medical devices drives market growth.

- The United Arab Emirates (UAE) has emerged as a global hub for various industries, and the medical devices and pharmaceutical sector is no exception. With its strategic location, supportive infrastructure, and conducive business environment, the UAE has become an ideal destination for pharmaceutical and medical device companies.

Saudi Arabia is likely to be worth USD 0.39 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The global ceramic package market is highly fragmented and competitive. A few significant players are dominating the market by offering innovative packaging solutions in the packaging industry. These major market players constantly focus on expanding their customer base across regions by innovating their existing range of products. The market report also highlights the key developments by the manufacturers.

Major players in the industry include Schott AG, AMETEK, Kyocera Corporation, Egide Group, NTK Ceramic Co. Ltd., Materion Corporation., and others. Numerous other companies operating in the market are focused on market scenarios and delivering advanced packaging solutions.

Some of the Key Ceramic Package Companies Profiled in the Report

- Schott AG (Germany)

- AMETEK (U.S.)

- Kyocera Corporation (Japan)

- Egide Group (France)

- NTK Ceramic Co., Ltd. (Japan)

- Materion Corporation (U.S.)

- NGK Insulators Ltd. (Japan)

- Remtec, Inc. (U.S.)

- Aptasic SA (Switzerland)

- AGC Group (Japan)

- StratEdge (U.S.)

- Morgan Advanced Materials (U.K.)

- AdTech Ceramics (U.S.)

- KOA Corporation (Japan)

- Maruwa (Japan)

KEY INDUSTRY DEVELOPMENTS

- In October 2024, CeramTec, the high-performance ceramics specialist, introduced a BNT-BT-based piezo ceramic that performs similarly to conventional PZT piezo ceramics for several applications as it does not contain lead. The company showcased its lead-free piezo ceramic solutions from Enlit Europe in Milan.

- In October 2024, RAK Ceramics, the world’s leading lifestyle solutions provider in the ceramics industry, declared the signing of a framework agreement with Sobha Constructions LLC, a leading multinational construction company. With this agreement, RAK Ceramics will be the exclusive partner offering premium ceramics and porcelain tiles for Sobha’s future projects.

- In August 2024, Kyocera Corporation held a groundbreaking ceremony to commence construction of its innovative production facility at the Minami Isahaya Industrial Park in Isahaya City, Nagasaki Prefecture. The company acquired about 150,000 square meters of land for factory construction in the industrial park area.

- In December 2023, Kyocera declared the launch of a new ceramic packaging for LiDAR applications. It offers the high-heat dissipation, multi-layer structure, and miniaturization required to overcome the hurdles facing engineers developing LiDAR technology.

- In June 2021, Coesia acquired 100% ownership of the System Ceramics. The move enabled Coesia to consolidate its investment in the ceramic machinery sector, an industry in which System Ceramic is a crucial player and international leader in technological advancements and innovation.

REPORT COVERAGE

The market research report provides a detailed market analysis. The ceramic package market overview also focuses on key aspects, such as top key players, competitive landscape, product/service types, market segments, Porter’s five forces analysis, and leading segments of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the abovementioned factors, it encompasses several factors that have contributed to the market intelligence & growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.44% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By End Use

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the market size was USD 12.11 billion in 2025.

The market is likely to grow at a CAGR of 6.44% during the forecast period of 2026-2034.

Based on end use, the electrical & electronics segment leads the market.

The Asia Pacific market size stood at USD 3.82 billion in 2025.

The key market drivers are the increasing utilization of ceramic packaging solutions in the electronics industry and their significant benefits.

Some of the top players in the market are Schott AG, AMETEK, Kyocera Corporation, Egide Group, NTK Ceramic Co. Ltd., Materion Corporation., and others.

The global market size is expected to record a valuation of USD 21.14 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us