Lab-based IVD Market Size, Share & Industry Analysis, By Product Type (Instruments, Reagents & Consumables), By Technique (Immunodiagnostics [Enzyme-Linked Immunosorbent Assay, Fluorescence Immunoassay, Rapid Test], Clinical Chemistry [Electrolyte Panel, Basic & Comprehensive Metabolic Panels, Liver Tests], Molecular Diagnostics [PCR, In Situ Hybridization], Hematology), By Sample Type (Blood, Urine, Saliva, Tissue), By Application (Infectious Diseases, Cardiology, Oncology), By End-user (Hospitals, Clinical Laboratories), & Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

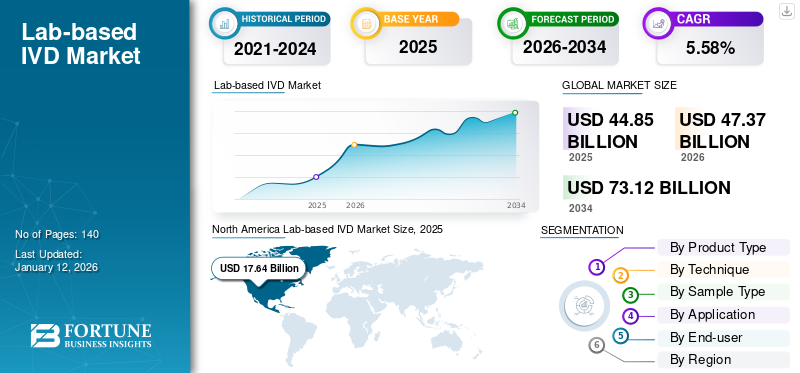

The global lab-based IVD market size was valued at USD 44.85 billion in 2025. The market is projected to grow from USD 47.37 billion in 2026 to USD 73.12 billion by 2034, exhibiting a CAGR of 5.58% during the forecast period. North America dominated the lab-based IVD market, accounting for a 39.33% market share in 2025.

The lab-based in vitro diagnostics (IVD) market plays an important role in the healthcare sector, involving tests conducted in specialized laboratory environments to diagnose and monitor diseases. The lab-based IVD market is fueled by the rising incidence of chronic and infectious diseases and a growing focus on personalized medicine.

- For example, as per the data provided by the World Health Organization (WHO) in October 2024, approximately 8.2 million people across the globe were diagnosed with tuberculosis (TB) in 2023, which was a notable increase from 7.5 million reported in 2022.

The market is semi-consolidated with the presence of key players, such as Bio-Rad Laboratories, Inc., BD, F. Hoffmann-La Roche Ltd., Abbott, and Thermo Fisher Scientific Inc. Several players are engaging in new product launches and strategic acquisitions & partnerships to enhance their capabilities and product range in the global market.

- For instance, in August 2022, Bio-Rad Laboratories, Inc. acquired Curiosity Diagnostics, a global player in life science research and clinical diagnostic products. This helped the company to strengthen its brand presence globally.

Furthermore, technological advancements in instruments and the launch of new tests for effective diagnosis and treatment of several diseases are some of the additional factors supplementing market growth.

Global Lab-based IVD Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 42.42 billion

- 2026 Market Size: USD 44.85 billion

- 2034 Forecast Market Size: USD 66.41 billion

- CAGR: 5.58% from 2026–2034

Market Share:

- Region: North America dominated the market with a 39.33% share in 2025. This is attributed to the presence of advanced healthcare infrastructure and key companies in the region, along with a high adoption rate of innovative diagnostic technologies.

- By Product Type: The Reagents & Consumables segment held the largest market share. The segment's dominance is driven by increasing regulatory approvals and product launches for novel IVD kits, coupled with a rising number of patients undergoing routine diagnostic tests.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan's market is driven by increasing product launches and rising awareness about the early diagnosis of chronic and infectious diseases, which is boosting the adoption of lab-based IVD tests.

- United States: The market is fueled by a high prevalence of infectious diseases, with reported tuberculosis cases increasing by 5.9% in 2022. Growth is also supported by a consistent stream of regulatory approvals from the U.S. FDA for new diagnostic tests and systems.

- China: Growth in the Chinese market is propelled by the launch of new and advanced diagnostic systems. For instance, Abbott's introduction of the Alinity i immunoassay module and the automated GLP line has expanded the availability of high-tech solutions in the country.

- Europe: The market is advanced by strategic partnerships and a strong focus on innovation. Major players are launching next-generation hematology analyzers and other advanced diagnostic solutions to meet the needs of the region's well-established healthcare systems.

MARKET DYNAMICS

Market Drivers

Growing Prevalence of Chronic and Infectious Diseases Likely to Propel Market Growth

Chronic infectious diseases, such as tuberculosis and hepatitis B and C, along with outbreaks of other illnesses, such as H1N1 and COVID-19, have significantly increased the need for early diagnosis through in-vitro diagnostic tools. The high burden of infectious diseases is leading to an increasing demand for diagnostic procedures.

- For example, as per the data provided by the World Health Organization (WHO) in April 2024, around 254 million people were living with hepatitis B and 50 million with hepatitis C in 2022 across the globe.

- As per the data provided by the Centers for Disease Control and Prevention (CDC) in February 2024, the reported number of tuberculosis (TB) cases in the U.S. increased by 5.9% to 8,331 in 2022.

The increasing geriatric population susceptible to more infectious diseases and chronic conditions is also another attributable factor fueling the demand for these tests and solutions.

Other Market Drivers

Rising Awareness about Early Disease Diagnosis of Chronic Conditions Fuels Market Growth

Increasing awareness about the importance of screening and early detection of these chronic medical conditions in both developed and emerging nations is driving the demand for in-vitro testing solutions across different healthcare facilities. Additionally, the growing initiatives by governmental agencies, national organizations, and market players to promote awareness about early screening are resulting in a higher acceptance of IVD testing solutions among the population.

- For instance, in October 2023, the World Health Organization (WHO) published its 2023 Essential Diagnostics List (EDL), which is a scientifically-supported catalog of in vitro diagnostics (IVD) that supports countries to make national diagnostic choices.

Increasing Strategic Initiatives such as Partnerships and Acquisitions Among Market Players to Support Market Development

The growing focus of market players on strategic collaborations and acquisitions to develop and launch products with the latest technology to cater to the rising demand among the population is expected to boost market growth.

- For example, in February 2024, Sysmex Corporation collaborated with CellaVision AB to introduce innovative advanced hematology solutions in the global market.

Market Restraints

Unfavorable Reimbursement Policies for In-Vitro Diagnostics to Hinder Market Growth

The high cost of in-vitro diagnostic testing, including genetic testing and molecular testing for chronic diseases, hinders the adoption of these tests in emerging countries such as Brazil, Australia, African countries, and many others.

The reimbursement scenario for in-vitro diagnostics products has been unfavorable in many countries worldwide. Various regions and their changing reimbursement policies have impacted the growth of the in-vitro diagnostics market globally.

- For example, in China, IVD reimbursement is performed at the provincial level. Each province has a different code for IVD, national government is not involved in the reimbursement procedure for IVD products. These policies are anticipated to limit the demand for laboratory-based in-vitro diagnostics products.

Thus, limited reimbursement for lab-based in-vitro diagnostic tests, especially in emerging countries, coupled with higher costs of advanced and innovative IVD tests, limits the adoption of these tests, thereby hindering market growth.

Market Opportunities

Gradual Shift of Preference Toward Adoption of Molecular Diagnostics Techniques to Provide Growth Opportunities for Market Players

Molecular diagnostics is one of the most dynamic techniques in the in-vitro diagnostics industry, leading to advances in monitoring and revolutionizing healthcare across the globe. Over the past few years, the adoption of molecular diagnostics has surged, becoming the predominant method for transplant and transfusion diagnostics and disease testing. As a result, industry players are increasingly focused on the development and introduction of advanced technologies.

- For instance, in March 2023, DiaSorin S.p.A. received approval from the U.S. Food and Drug Administration (FDA) for its Simplex COVID-19 & Flu A/B Direct assay aimed at enhancing its global product portfolio.

Moreover, advancements in molecular diagnostic techniques, such as next-generation sequencing (NGS), coupled with the rising prevalence of cancer and other chronic diseases, are expected to offer diverse opportunities for companies operating in the in-vitro diagnostics market.

The shift of preference from traditional diagnostic methods to advanced molecular diagnostics is likely to expand further avenues for market players capable of meeting these emerging demands through the introduction of advanced testing solutions in the global market.

Market Challenges

Stringent Regulatory Guidelines for Manufacturing of Lab-based IVD Products is Considered a Major Challenge for Market Players

Regulatory changes pose a significant challenge for the lab-based IVD market due to the diverse and evolving regulatory landscape globally. Differences in regulations across countries, stringent requirements, and the time-consuming nature of obtaining approvals can hinder market access, innovation, and growth for IVD manufacturers.

- For example, the U.S. Food and Drug Administration (FDA) introduced new regulations requiring laboratory-developed tests (LDTs) to demonstrate accuracy and safety, aiming to improve diagnostic reliability.

Different countries globally follow varying regulatory frameworks for in-vitro devices, making it difficult for in-vitro manufacturers to comply uniformly. It is one of the biggest and most difficult challenges for in-vitro diagnostic product manufacturers asmedical devices in-vitro device industry has yet to have globally harmonized regulations.

Therefore, adherence to stringent safety and quality standards for the manufacturing and supply of in vitro diagnostic products are the main challenges faced by market players.

LAB-BASED IVD MARKET TRENDS

Rising Emphasis on Technological Advancements, Automation, and Personalized Medicine by Key Players are Key Market Trends

In recent years, there has been a growing focus on precision medicine, where diagnostics are tailored to individual genetic profiles. The next-generation sequencing (NGS) is gaining traction for cancer and genetic disorder detection. Therefore, due to the increasing demand for personalized medicine, several market players are focusing on the development and launch of technologically advanced devices and novel diagnostic tests.

- For example, in February 2024, Quest Diagnostics Incorporated announced the launch of MelaNodal Predict, a highly advanced predictive gene expression test to help personalize treatment decisions for patients with melanoma.

The growing focus of companies on the development of state-of-the-art devices to create automation in laboratory testing is considered one of the major trends in the lab-based IVD market.

- For instance, in April 2025, Seegene Inc. announced that its product CURECA, a next-generation system currently under development, designed to streamline automation in polymerase chain reaction (PCR) testing and laboratory environments.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product Type

Reagents & Consumables Segment Led due to Increasing Regulatory Approvals and New Product Launches

On the basis of product type, the market is divided into instruments and reagents & consumables.

The reagents & consumables segment dominated the market, accounting for the major proportion of the global lab-based IVD market share in 2024. The dominant share of this segment is attributed to the increasing regulatory approvals and product launches for novel IVD kits.

- For example, in August 2024, Illumina, Inc. announced the U.S. Food and Drug Administration (FDA) approval of its in vitro diagnostic (IVD) TruSight Oncology (TSO) comprehensive test.

Furthermore, growing awareness about the importance of early diagnosis in developed and emerging countries is leading to the rising number of patients undergoing routine tests. This further enhances the demand for kits and reagents in the global market.

On the other hand, the instruments segment is expected to grow at a considerable CAGR from 2025-2032. Technologically advanced instruments and the introduction of rapid testing tools are some of the factors propelling the segment's growth.

- For example, in January 2023, Bio-Rad Laboratories, Inc. launched the CFX Opus Deepwell Dx Real-Time PCR System, a real-time PCR system, with an aim to strengthen its product portfolio for in-vitro diagnostic products.

- Also, in February 2022, Thermo Fisher Scientific Inc. launched the Renvo Rapid PCR Test, used for the detection of in-air SARS-CoV-2 pathogens, which is performed on samples collected through the AerosolSense Sampler.

To know how our report can help streamline your business, Speak to Analyst

By Technique

Immunodiagnostics Segment Led Due to Rising New Product Launches

On the basis of technique, the market is divided into immunodiagnostics, clinical chemistry, molecular diagnostics, hematology, and others. The immunodiagnostics segment is further categorized into enzyme-linked immunosorbent assay (ELISA), fluorescence immunoassay (FIA), rapid test, and others. Moreover, the clinical chemistry segment is sub-segmented into electrolyte panels, basic and comprehensive metabolic panels, liver tests, renal tests, lipid panels, and others. On the other hand, the molecular diagnostics segment is further divided into polymerase chain reaction (PCR), in situ hybridization, DNA sequencing & next-generation sequencing, and others.

The immunodiagnostics segment dominated the market, accounting for the major proportion of the global lab-based IVD market share in 2024. The dominant share of this segment is attributed to the increasing product launches for novel immunoassay products.

- For example, in November 2023, F. Hoffmann-La Roche Ltd. introduced Elecsys HBeAg quant, an immunoassay designed to identify both the presence and quantity of the hepatitis Be antigen (HBeAg) in human serum and plasma. This product helps healthcare professionals in diagnosing and monitoring individuals with acute or chronic hepatitis, while also expanding the company’s product range.

The clinical chemistry segment held a moderate market share in 2024. The growing focus of market players on receiving regulatory approvals for assay test kits for the assessment of various diseases-related biomarkers is one of the factors propelling the segment's growth.

- For example, in August 2021, Siemens Healthineers AG announced that its enhanced liver fibrosis (ELF) test was granted marketing authorization under the De Novo review pathway, specifically for the U.S. This blood test is used for patients with advanced fibrosis and helps assess the likelihood of progressing to cirrhosis and liver-related clinical events.

The molecular diagnostics segment accounted for the second-largest market share in 2024, owing to the increasing launch of novel molecular diagnostic solutions, including polymerase chain reaction (PCR) devices. This, along with the rising number of clinical laboratories in developing countries, is further driving the segment's growth.

- For example, in October 2021, ELITechGroup announced the launch of ELITe BeGenius, the new CE-IVD stand-alone “Sample-to-Result” real-time PCR solution.

The hematology segment held considerable market share in 2024 and is expected to grow at the second-highest CAGR from 2025-2032. The growing collaborations among market players for the development of innovative hematology solutions are the main factors of the segment growth. Additionally, the increasing number of surgeries requiring blood transfusions, along with the growing prevalence of hematology disorders, are some of the prominent factors driving the demand for hematology tests in the global lab-based in-vitro diagnostics market.

- For example, in August 2023, F. Hoffmann-La Roche Ltd. entered into a partnership with Sysmex Corporation to bring hematology testing innovations to laboratories and help patients get access to routine hematology diagnostics solutions.

The others segment is expected to grow at a moderate CAGR during the forecast period. Constant focus on research and development aimed at discovering new uses for in vitro diagnostic (IVD) tests has resulted in the creation of tests for various applications such as allergies, autoimmune disorders, neurology, and nephrology. This innovation is projected to drive the adoption of these non-invasive IVD tests for diagnosing various medical conditions during the forecast period.

By Sample Type

Blood Segment Dominated Due to Its Increased Usage as a Sample for Assessment

Among sample type, the market is categorized into blood, urine, saliva, tissue, and others.

The blood segment accounted for a dominant share of the market in 2024 and is anticipated to grow at the highest CAGR during the forecast period. This is due to the growing regulatory approvals and product launches for IVD kits, and IVD systems utilizing blood as a sample for assessment.

- For example, in January 2025, Inflammatix, Inc. announced that the U.S. Food and Drug Administration (FDA) had granted marketing authorization for the TriVerity test system (TriVerity), a first-in-class molecular blood test for patients with suspected acute infection or sepsis.

The saliva segment accounted for the second-largest market and is expected to grow at the second-largest CAGR during the forecast period. The growing focus of market players on receiving regulatory approvals for test kits that detect specific biomarkers or genes directly from saliva samples is augmenting the segment’s growth.

- For example, in June 2021, Co-Diagnostics, Inc. announced that its Logix Smart SARS-CoV-2 DS (Direct Saliva) test kit received a CE mark for diagnosis of COVID-19. This test kit is designed to detect the presence of the RdRp and E genes of SARS-CoV-2 directly from minimally processed human saliva samples.

The urine segment accounted for a moderate market share in 2024 and is expected to grow at a moderate CAGR during the forecast period. The growing emphasis by pharmaceutical and biotechnological companies on the development of novel diagnostic solutions for detecting chronic diseases via urine samples is supplementing the segment’s growth.

- For instance, in May 2024, Urteste S.A., a biotechnology company specializing in breakthrough technology to detect cancer from urine samples, developed a prototype IVD test for the detection of brain tumors.

The tissue and others segments are expected to grow at a stagnant CAGR from 2025-2032. The rising prevalence of chronic diseases and increasing utilization of tissue and other samples for assessment of diseases are some of the important factors driving segment growth.

By Application

High Burden of Chronic Infectious Diseases Boosted Segment Growth

Based on application, the market is divided into infectious diseases, cardiology, oncology, gastroenterology, allergy, autoimmunity, prenatal screening, and others.

The infectious diseases segment held a dominant market share in 2024 and is expected to grow at a moderate CAGR throughout the forecast period. The dominant share of this segment is attributed to the high burden of chronic infectious diseases across the globe.

- For example, according to data published by the World Health Organization (WHO) in July 2024, it was reported that approximately 39.9 million people were living with HIV in 2023 globally.

The others segment is expected to grow at the highest CAGR from 2025-2032. The rising focus of market players on research and development activities to explore new application areas for IVD tests has led to the development of tests for different applications, including metabolic disorders, neurology, and nephrology. This is anticipated to drive the adoption of these lab-based IVD tests for the diagnosis of various disease conditions during the forecast period.

The oncology segment is expected to grow at the second-largest CAGR throughout the forecast period, owing to the high burden of cancer across the globe.

- For example, as per the data provided by the Journal of American Cancer Society in January 2025, around 2,041,910 new cancer cases are projected to occur in the U.S. by the end of 2025.

Furthermore, the development of innovative tests for cancer diagnosis based on new techniques, including analysis of DNA/ RNA, proteins, and other novel biomarkers, has been pivotal in driving the growth of the oncology segment in the global market.

By End-use

High Burden of Chronic Diseases Increases Patients Shift Toward Clinical Laboratories for Diagnosis Purpose, Augmented Segmental Growth

Based on end-user, the market is divided into hospitals, clinical laboratories, and others.

The clinical laboratories segment dominated the market in 2024 and is estimated to grow at the highest CAGR during the forecast period. The high burden of chronic and infectious diseases has resulted in a greater influx of patients seeking diagnostic tests for various medical conditions. This has led to an increased demand for in-vitro diagnostic instruments and consumables in clinical laboratories. Additionally, the rapid growth of clinical laboratories in emerging countries is contributing to a larger share of this segment in the global market by 2024.

- For example, as per the data provided by the Centers for Disease Control and Prevention (CDC) in May 2025, around 10,347 tuberculosis cases were provisionally reported, with a corresponding rate of 3.0 cases per 100,000 population in 2024 in the U.S.

The hospitals segment accounted for a moderate market share in 2024. The increasing number of hospitalizations for the treatment of chronic diseases is one of the major factors propelling the growth of the hospitals segment during the 2025-2032 period. This trend is anticipated to elevate the demand for in-vitro diagnostics (IVD) tests in hospitals to diagnose chronic conditions.

- For instance, as per the data provided by the Australian Institute of Health and Welfare in May 2024, there was a total of 12.1 million hospitalizations in 2022-23 in Australia. This was a 4.6% increase in hospitalizations across all Australian hospitals, including private and public, compared to 2021-22.

The others segment is expected to grow at a stagnant CAGR during the forecast period. The increasing utilization of in vitro diagnostic instruments and kits in academic and research institutes is supplementing the segment’s growth.

LAB-BASED IVD MARKET REGIONAL OUTLOOK

In terms of regions, the global market can be divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Lab-based IVD Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market with a 39.33% share in 2025, generating revenues of USD 17.64 billion in 2025. The dominance of this region is largely attributed to the presence of advanced healthcare infrastructure and the presence of key companies in this region. The U.S. market is projected to reach USD 17.27 billion by 2026.

In addition, the growing focus of industry players on receiving regulatory approvals and product launches has fueled lab-based IVD market growth in the U.S.

- For example, in November 2023, Abbott received U.S. Food and Drug Administration (FDA) approval for its molecular human papillomavirus or HPV screening solution, with an aim to add a powerful cancer screening tool for detecting high-risk HPV infections to the Alinity m family of diagnostic assays.

Europe

Europe held the second-largest market share in 2024, driven by the increasing prevalence of chronic diseases, new product launches, and growing strategic partnerships among market players. The UK market is projected to reach USD 1.59 billion by 2026, while the Germany market is projected to reach USD 3.04 billion by 2026.

- For example, in May 2023, Siemens Healthineers AG launched next-generation hematology analyzers, Atellica HEMA 570 and 580 analyzers, with an aim to broaden its product portfolio in the hematology field.

Asia Pacific

Asia Pacific is projected to register a comparatively higher CAGR during the forecast period, owing to the increasing product launches and rising awareness about early diagnosis of chronic and infectious diseases are some of the prominent factors boosting market growth in this region. The Japan market is projected to reach USD 2.9 billion by 2026, the China market is projected to reach USD 5.19 billion by 2026, and the India market is projected to reach USD 1.49 billion by 2026.

- For example, in October 2024, Abbott announced the launch of the immunoassay module Alinity i and the automated GLP line in the Chinese market.

Latin America and Middle East & Africa

The market in Latin America and the Middle East & Africa are expected to grow at a stagnant CAGR during the forecast period. The rising burden of chronic and infectious diseases such as diabetes, cancer, and tuberculosis play a significant role in driving demand for in-vitro diagnostics. Additionally, the rising number of R&D activities among market players to develop and introduce novel products in these regions is another factor contributing to market growth.

- For example, as per the data provided by Spotlight in October 2024, around 270,000 new tuberculosis cases were found in South Africa in 2023.

- In January 2024, Beckman Coulter, Inc. introduced its new product, the DxC 500 AU chemistry analyzer, an automated clinical chemistry analyzer, at Medlab Middle East in Dubai, UAE.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Focus on Launch of New Products to Enhance their Product Offerings

The global market is led by key companies such as F. Hoffmann-La Roche Ltd., Abbott, Thermo Fisher Scientific Inc., and Siemens Healthineers AG. These companies offer a wide range of lab-based in vitro diagnostic products, with a growing focus on new product launches, which has been a major driver for their significant share in the global market.

- For instance, in June 2024, F. Hoffmann-La Roche Ltd. announced the launch of the first clinically approved, highly-sensitive in-situ hybridization (ISH) test, the VENTANA Kappa and Lambda Dual ISH mRNA Probe Cocktail assay, in countries accepting the CE Mark. This product is intended for in vitro diagnostic (IVD) use.

Moreover, other market players include BD, QIAGEN, Sysmex Corporation, and several small-scale companies across the globe. These players are focusing on strategic collaborations and acquisitions to expand their geographic presence and establish a strong brand presence in the global market.

List of Key LAB-based IVD Companies Profiled

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Sysmex Corporation (Japan)

- Siemens Healthineers AG (Germany)

- BD (U.S.)

- QIAGEN (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Seegene Inc. (South Korea)

- DiaSorin S.p.A. (Italy)

- Quest Diagnostics Incorporated (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2024 - Sysmex Corporation expanded its operations in Italy by commencing direct sales and services in the fields of hematology, urinalysis, and hemostasis with an aim to expand its brand presence.

- December 2023 - Seegene Inc. received ISO45001 certification for PCR molecular diagnostics with an aim to strengthen its product portfolio globally.

- November 2023 - DiaSorin S.p.A. collaborated with Gilead Sciences, an American biopharmaceutical company, with an aim to develop a fully automated diagnostics assay for hepatitis delta virus on the Diasorin LIAISON XL immunoassay system in the U.S.

- August 2023 - Quest Diagnostics Incorporated received U.S. Food and Drug Administration (FDA) approval for AAVrh74 ELISA assay (CDx) with an aim to strengthen its product portfolio globally.

- July 2023 - DiaSorin S.p.A. launched the LIASION legionella urinary antigen immunodiagnostic assay in all countries for the diagnosis of legionnaires’ disease (LD), a life-threatening type of atypical community-acquired pneumonia (CAP) in the community.

- July 2023 - Quest Diagnostics Incorporated launched a novel prostate biomarker test through its subspecialty pathology business, AmeriPath, in collaboration with Envision Sciences, aiming to strengthen its presence globally.

REPORT COVERAGE

The global market report provides a detailed competitive landscape and market insights. It focuses on key aspects such as competitive landscape, product type, technique, sample type, application, end-user, and region. In addition to the global lab-based IVD market size, it covers regional analysis of different market segments, profiles of key market players, and market dynamics. Moreover, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.58% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

|

|

By Technique

|

|

|

By Sample Type

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 44.85 billion in 2025 and is projected to reach USD 73.12 billion by 2034.

In 2025, the market value stood at USD 44.85 billion.

The market will exhibit steady growth at a CAGR of 5.58% during the forecast period (2026-2034).

By sample type, the blood segment led the market.

Growing awareness about early diagnosis and the rising prevalence of chronic diseases are the key factors driving market growth.

Abbott, Thermo Fisher Scientific Inc., and Sysmex Corporation are the major players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us