Liquid Biopsy Market Size, Share & Industry Analysis, By Product (Kits & Reagents, and Instruments), By Application (Oncology, Non-invasive Prenatal Testing (NIPT), and Others), By End User (Hospitals, Clinical Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

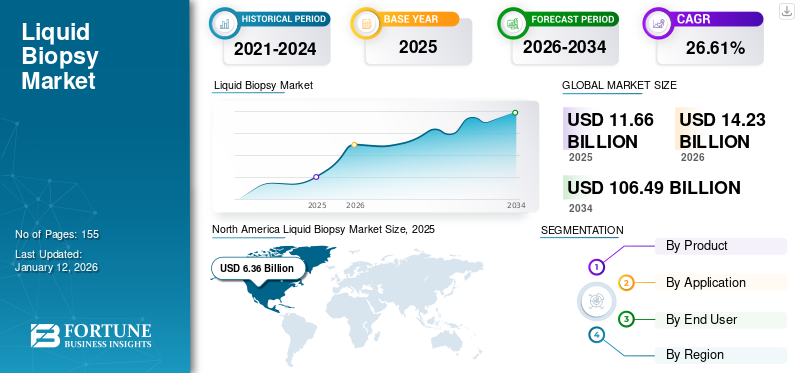

The global liquid biopsy market size was valued at USD 11.66 billion in 2025 and is projected to grow from USD 14.23 billion in 2026 to USD 106.49 billion by 2034, exhibiting a CAGR of 28.61% during the forecast period. North America dominated the global market with a share of 54.57% in 2025.

Cancer is a major contributor to disease burden across the globe, with its increasing incidence among the population. Certain environmental risk factors, such as air pollution and biological risk factors, including tobacco use, smoking, and physical inactivity, lead to cancer and other infectious diseases.

- According to data published by the National Cancer Registry Programme of the Indian Council of Medical Research (ICMR), an estimated incidence of cancer in India in 2020 was 1.39 million. The incidence increased from around 1.42 million in 2021 to 1.46 million in 2022.

Thus, with rising cancer prevalence, the demand for early screening and therapeutics has increased globally. Furthermore, the rising incidence of genetic abnormalities among neonates and fetuses of pregnant women has led to the need for prenatal testing among the population. Also, a surge in government initiatives for public screening tests to reduce the surge of infectious diseases and chronic disorders such as cancer has led to the high adoption of non-invasive screening tests conducted by biological fluids such as blood, amniotic fluid, and Cerebrospinal Fluid (CSF).

The tests detect signs of cancerous tumors, including circulating biomarkers, cell free DNAs, and circulating tumor DNAs (ctDNAs), in all cancer patients at screening or recurrent stages. The regulatory agencies such as the Food and Drug Administration (FDA) have approved tests that can detect advanced cancers in a patient, predict prognosis and assist healthcare providers in ruling further treatment decisions. The rising introduction of advanced tests over various indications and extensive clinical studies on developing new products will boost the liquid biopsy market growth during the forecast period.

The impact of the COVID-19 pandemic resulted in a decline in market growth in 2020. The pandemic led to the postponement and de-prioritization of non-essential diagnostic tests such as cancer screening by various healthcare agencies among the population. Similarly, the disruption caused by the COVID-19 pandemic to international supply chains led to high-profile shortages of cancer diagnostic kits and assays across the globe.

- According to an article published by the NCBI in 2021, molecular tests decreased by 27.0% from 15th March to 15th April 2020, compared to the same period in 2019. As per similar estimates, the liquid biopsy testing for detecting epidermal growth factor receptor (EGFR) decreased by about 67.0% during a similar timeframe in Italy.

However, the lifting of lockdown restrictions post-pandemic and the resumption of screening programs led to increased cancer prognostic tests. The rise in adoption of at-home tests and the high demand for oncology testing among patients further propelled the market growth.

- As per Guardant Health, Inc., annual report estimates in 2021, the precision oncology clinical tests increased to 87,600 for the year ending December 2021 from 63,254 for the year ending December 2020.

Thus, the rebound in cancer screening cases post-pandemic and the high demand for these products at home settings augmented the market growth.

Liquid Biopsy Market Overview & Key Metrics

Market Size & Forecast

- 2025 Market Size: USD 11.66 billion

- 2026 Market Size: USD 14.23 billion

- 2034 Forecast Market Size: USD 106.49 billion

- CAGR: 28.61% from 2025–2032

Market Share

- By Region: North America dominated the global liquid biopsy market with a 54.57% share in 2025, driven by increased adoption of precision oncology testing, product innovation, and favorable reimbursement frameworks in the U.S. and Canada.

- By Product: Kits & reagents held the largest share in 2024 due to frequent product launches and approvals for ctDNA and NIPT testing solutions. Companies such as Illumina, Guardant Health, and Foundation Medicine are expanding their assay portfolios to offer high-sensitivity tests with faster turnaround times.

Key Country Highlights

- United States: The U.S. leads due to strong R&D investment, FDA-approved assays for advanced cancer diagnostics, and widespread adoption of at-home oncology tests post-COVID-19. For example, Guardant Health’s Guardant360 CDx was the first FDA-approved liquid biopsy for NSCLC.

- India: Rising cancer incidence—from 1.39 million in 2020 to 1.46 million in 2022—has led to increased demand for early cancer screening and NIPT. National health initiatives and ICMR data have pushed adoption, especially in urban centers.

- China: Market growth is fueled by increasing investment in genetic testing and a growing aging population. Rapid expansion of molecular diagnostic labs and local innovation are improving access to liquid biopsy tests for both oncology and prenatal screening.

- Europe: Driven by government-led cancer screening programs and regulatory approvals. The U.K.’s NHS launched liquid biopsy-based early cancer detection programs, and Germany and France are expanding NIPT availability. Dxcover Ltd. and other companies are receiving government funding to develop new platforms.

- Japan: Demand is high due to an aging population and government support for early detection of genetic disorders and cancers. Japanese hospitals are adopting NGS-based liquid biopsy technologies for prenatal and oncology applications.

Liquid Biopsy Market Trends

Increasing Product Deployment for Oncology Diagnosis

Tissue biopsy for cancer screening is associated with inherent limitations such as high test turnaround time, extensive time consumption, and its invasive nature. Liquid biopsy is emerging as a novel, non-invasive approach for detecting and monitoring cancer in several body fluids instead of tumor tissue. These tests pose an alternative for patients unable to undergo an invasive biopsy for screening, which additionally offers other clinical applications to patients, including disease prognosis, drug resistance, and drug response.

- According to data published by Pharmaceutical Technology in May 2021, about 27.0% to 31.0% of non-small cell lung carcinoma (NSCLC) patients are unable to provide a suitable tissue specimen upon diagnosis.

Therefore, the product demand is high owing to several advantages over traditional methods. These include early results, high sensitivity, and extensive presence across healthcare settings with the potential to offer insights across multiple metastatic sites, among others.

- In December 2022, Haymarket Media, Inc. published a cohort study of 170 newly diagnosed patients with stage IV non-small cell lung cancer (NSCLC). The results stated that the liquid biopsy samples provided sufficient material for next-generation sequencing (NGS), resulting in a success rate of 100.0%. However, the tissue biopsy samples had a success rate of 89.2%.

Thus, owing to high demand, manufacturers are focused on developing screening tests for the early detection of diseases with advanced technologies and extensive applications. Moreover, increasing product approvals by regulatory authorities for cancer screening coupled with high awareness of liquid biopsies among patients aid the growth of the market.

Download Free sample to learn more about this report.

Liquid Biopsy Market Growth Factors

Rising Investments for Clinical Trials by Industry Players to Propel the Market Growth

Recent advancements in liquid biopsies are enabling the use of new technologies in cancer screening, therapeutic selection, drug trial optimization, and recurrence monitoring. Several major companies are focusing on investing in R&D for conducting clinical studies on liquid biopsy to offer precision medicine for patients. This is due to rising cancer prevalence and the high adoption of liquid biopsies among patients.

- For instance, in July 2022, Delfi Diagnostics, Inc. raised a funding of USD 225.0 million for the development of liquid biopsy tests to be utilized for the detection of cancer.

Moreover, strong investments by government organizations across the world to conduct clinical test studies to meet the growing demand for such tests in the market are also driving the market growth. Also, research institutes are now providing funds to manufacturing companies to support R&D for the early detection and screening of various genetic and infectious disorders.

- In November 2021, BioMark Diagnostics Inc., a subsidiary of BioMark Diagnostic Solutions Inc., received funding of up to USD 135,640.0 from the National Research Council of Canada Industrial Research Assistance Program (NRC IRAP). The funding was aimed at supporting the R&D of its liquid biopsy assay for screening and early detection of lung cancer in patients.

Furthermore, the increasing attention of key industry players in collaborating with other companies and research institutions to offer evidence-based treatment options with liquid biopsies for patients further augmented the market growth.

- In December 2022, Guardant Health, Inc. partnered with Susan G. Komen to conduct clinical studies for identifying early-stage breast cancer patients with the help of Guardant Reveal, a blood-based test.

- In December 2022, Menarini Silicon Biosystems, Inc., in collaboration with Dana-Farber cancer institute, conducted a clinical study that showed potential for the minimally invasive management of patients with multiple myeloma at early stages of disease using the CELLSEARCH system.

Therefore, such high investments by industry players and a wide range of potential applications are anticipated to fuel the introduction of advanced products across developed nations, further propelling the market growth.

RESTRAINING FACTORS

High Costs of Tests and its Reimbursement Challenges to Limit the Product Adoption

Liquid biopsy is emerging as a complementary approach to tissue biopsy for screening and therapy of several indications such as cancer, prenatal testing, and others. However, despite potential advantages over traditional approaches in early disease detection and monitoring, the cost associated with screening and the test assay kits is comparatively high.

- For instance, as per data published by Healio in December 2023, the cost of liquid biopsy for colorectal cancer screening is comparatively higher than a colonoscopy. To enhance the adoption amongst the general population, the cost of liquid biopsy would need to decrease by 66.0%.

- According to various published articles and company product catalogs, a single liquid biopsy test may often cost more than USD 2,000 in the U.S. As per NCBI estimates as of July 2022, the cost of a Guardant360-NGS test can be as high as USD 3,557.6 compared to the tumor tissue biopsy collection of USD 1,402.4

Moreover, the Polymerase Chain Reaction (PCR) or Next-Generation Sequencing (NGS) based assays provide better clinical utility and are widely used. However, the costs associated with developing those technologies are very high. These factors, along with high investment costs in conducting various clinical studies for screening, are restraining the market growth.

Besides, the use of these tests for early screening is constrained by reimbursement issues caused by test accuracy and uncertain clinical outcomes. The lack of insurance coverage for specific clinical outcomes, such as relapse monitoring, recurrence, advanced stage III and IV cancers, and others, limits the adoption of these tests for screening. This resulted in fewer incentives for companies to develop tests for cancer screening.

- According to data published by the NCBI in 2021, it was stated that the Centers for Medicare & Medicaid Services (CMS) does not provide insurance coverage for liquid biopsy tests for screening and restricts coverage to conditions including metastasis, recurrence, or advanced stage III and IV cancers.

Moreover, the lack of awareness and unavailability of insurance coverage in developing countries such as India, China, along with South Africa for such tests further restricts the market growth in these countries.

The factors mentioned above and the lack of clinical utility of these tests are limiting their adoption. This is anticipated to hamper the market growth during the forecast period.

Liquid Biopsy Market Segmentation Analysis

By Product Analysis

Increasing Launch of Technologically Advanced Assay Kits to Augment Segment Share

By product, the market is segmented into kits & reagents and instruments. The kits & reagents segment accounted for the largest market share of 80.08% in 2026. The dominance was attributed to the rising focus of key players to expand their footprint and bolster their market presence through new product launches. In addition, many industry players are introducing the advanced versions of their existing diagnostic assay kits to provide faster and reliable results.

- For instance, in November 2023, Illumina Inc. launched a second version of the TruSight Oncology 500 ctDNA kit to enable the genomic profiling of solid tumors. This second version of the assay kit provides faster results with greater sensitivity, enabling precision medicine.

- In February 2021, Guardant Health, Inc. launched a Guardant reveal test for residual disease and recurrence monitoring in patients with early-stage colorectal cancer. The test detects the residual disease after surgery and recurrence months earlier than current standard-of-care methods.

Furthermore, rise in the approval of assay & kits and increase in commercial reimbursement policies by regulatory authorities across developed economies further boosted the segment growth.

- As per data published by the National Cancer Institute (NCI), in November 2021, the FDA expanded the approval of the FoundationOne Liquid CDx test in cancer detection & therapy for ovarian and breast cancer. The FDA approved the test earlier in 2020 to identify patients with lung and prostate cancer who receive specific targeted drugs.

On the other hand, the instruments segment is expected to register a moderate CAGR during the forecast period. The segment growth is attributed to increasing investments in production and launch of new instruments and equipment by key players.

- In September 2021, Thermo Fisher Scientific launched the Applied Biosystems QuantStudio Absolute Q digital PCR system. The system uses microfluidic array technology and simplified workflows to run liquid biopsy assays to identify genetic and cancer mutations.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Increasing Preference of Non Invasive Prenatal Tests among Pregnant Women to Augment the Segment Growth

Based on application, the market is classified into Non-Invasive Prenatal Testing (NIPT), oncology, and others.

The non-invasive prenatal testing (NIPT) segment accounted for the highest market share 68.69% globally in 2026. The share was attributed to the rising genetic and congenital abnormalities such as Down syndrome in the fetus of pregnant women across the globe. Similarly, the high demand for non-invasive screening tests among women and rising product approvals of advanced prenatal tests launched by key players further propelled the segmental share.

- According to an article published by the United Nations group in March 2022, the estimated incidence of Down syndrome is between 1 in 1,000 to 1 in 1,100 live births worldwide. Furthermore, approximately 3,000 to 5,000 children are born with this chromosome disorder yearly.

- In May 2021, Yourgene announced the launch of IONA care, a non-invasive prenatal test (NIPT) service offering. The solution provided an extended benefit of measuring the probability that a pregnant woman is carrying a fetus with sex chromosome aneuploidies (SCA1) and autosomal aneuploidies (AA2) along with screening for trisomies 21, 18 and 13 and fetal sex determination.

The oncology segment is projected to register a comparatively higher CAGR over the forecast period. This is due to the increasing focus of industry players to offer advanced tests to meet the growing demand for early diagnosis and monitoring of various non-communicable diseases such as cancer. Moreover, rising partnerships among key players to market their product portfolio and boost their global presence further propelled the segment share.

- In June 2021, Guardant Health, Inc. expanded its product portfolio by adding Guardant360 Response, a blood-based test for immunotherapy and targeted therapy.

By End User Analysis

Surge in Demand for Tests in Hospital Settings to Propel Segment Growth

Based on end user, the market is divided into hospitals, clinical laboratories, and others.

The hospitals segment held the highest market share 75.01% in 2026. The dominant share can be attributed to the rising number of cancer diagnostic tests and prenatal tests at hospitals across the globe. Additional factor favoring segment growth is the rising awareness regarding cancer screening among the population, especially in emerging countries.

- According to an article published by the Annual Review of Genomics and Human Genetics Report in August 2021, approximately 25.0% to 30.0% of pregnant women in Australia undergo NIPT in private hospital settings.

The clinical laboratories segment is expected to grow at a considerable CAGR during the forecast period. The growth of the segment is owing to increasing number of clinical laboratories providing liquid biopsies across developing countries.

- According to an article published by the Laboratory of Florida LLC., in 2021, more than 200,000 clinical laboratories provide testing services in the U.S. As per further estimates, around 5,414 independent labs performed 32.0% of the total tests in the U.S.

REGIONAL INSIGHTS

Rise in Introduction of Technologically Advanced Products to Augment North America Market Share

Based on region, the market is segmented into North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa.

North America Liquid Biopsy Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The North America market was valued at USD 5.26 billion in 2024 and is predicted to dominate the global market share over the forecast period. The market expansion is driven by rising R&D and introduction of new technologies by key players to help aid in patient screening for chronic disorders or abnormalities. Furthermore, several life science companies are providing liquid biopsy testing solutions across various regions to provide targeted therapies for patients with cancer. Moreover, increasing collaborations among manufacturing players and growing approvals of new products with extensive regional presence further enhanced the North America market. The U.S. market is projected to reach USD 7.33 billion by 2026.

- For instance, in May 2023, Labcorp launched a novel liquid biopsy testing for patients with metastatic solid tumors. This test evaluates circulating DNA released by the tumor cells and helps oncologists manage patient care through targeted therapy plans.

- In November 2022, Thermo Fisher Scientific introduced digital PCR liquid-biopsy assays for its Applied Biosystems absolute Q dPCR system and a custom design tool to simplify cancer research in academics & clinical research institutes.

Europe

Europe is the second dominant region in terms of market share and revenue. The Europe market held a significant share owing to the rising awareness regarding cancer and prenatal screening among the population. Moreover, several market players are focusing on receiving funding for the development of a liquid biopsy platform with the help of advanced technologies. Similarly, increasing strategic initiatives by the European government to boost cancer screening along with other pathology tests will further strengthen the regional growth during the forecast timeframe. The UK market is expected to reach USD 0.46 billion by 2026, while the Germany market is projected to reach USD 1.01 billion by 2026.

- For instance, in February 2023, Dxcover Limited raised nearly USD 12.4 (GBP 10.0) million for the development of a new liquid biopsy platform for the detection of different types of cancer.

- In March 2022, the U.K. National Health Service was reported to offer liquid biopsy tests to certain cancer patients as a complement to anatomic pathology testing with an effort to diagnose 75.0% of all cancers at stage I or stage II by the year 2028.

- According to data published by the MDPI in 2022, around 6,560 patients annually benefit from liquid biopsy tests for Non-Small Cell Lung Cancer (NSCLC) screening in Europe.

Asia Pacific

The rising prevalence of genetic abnormalities, such as Down syndrome and chromosomal aneuploidies, among the population drives the market growth in Asia Pacific. The region is anticipated to exhibit the highest CAGR over the study period. This is due to the increasing demand for predictive screening owing to high disease prevalence. The Japan market is anticipated to reach USD 0.72 billion by 2026, the China market is projected to reach USD 0.55 billion by 2026, and the India market is expected to reach USD 0.39 billion by 2026.

- According to a ScienceDirect article published in December 2022, a study stated that from 2016-2020, an estimated 265 annual liquid biopsies with Down syndrome (1 in 1,158) were reported in Australia.

Latin America

The Latin America market is anticipated to grow at a slower pace over the forecast period. The growth is due to the rising cancer prevalence amongst the population and the high demand for cancer screening across hospitals and pathology laboratories.

Middle East & Africa

The Middle East & Africa is expected to grow at a moderate CAGR owing to the rising NIPT testing among pregnant women, creating demand for non-invasive liquid biopsies during the forecast period.

List of Key Companies in Liquid Biopsy Market

Strategic Collaborations among Key Players to Offer Growth Opportunities for the Market

The industry is majorly dominated by manufacturers such as Guardant Health, Inc., Foundation Medicine, Personalis, Inc., and other prominent players. The key players are aiming at accelerating test production and receiving product approvals from various regulatory bodies, which is responsible for their higher liquid biopsy market share.

- In May 2021, Guardant Health, Inc., received the U.S. FDA approval for the Guardant360 CDx test as the first and only test for the diagnosis of advanced non-small cell lung cancer.

Other major players operating in the market, such as F. Hoffmann-La Roche Ltd, are focusing on key developments such as strategic partnerships with other research institutions across the globe to develop effective screening and monitoring tests for patients. Such initiatives by significant players are expected to boost the global market during the forecast period.

- In June 2022, F. Hoffmann-La Roche Ltd. partnered with the Lung Cancer Research Foundation (LCRF) and Lung Cancer Mutation Consortium (LCMC) to participate in the LCMC 4th screening trial to evaluate actionable drivers in early-stage lung cancer to offer targeted therapy options for patients.

Furthermore, other players operating in the global market include Menarini Silicon Biosystems, Inc., Thermo Fisher Scientific Inc., QIAGEN, Bio-Rad Laboratories, Inc., BioChain Institute Inc., Stilla, BIOCEPT, INC., and GRAIL, LLC. The robust focus on conducting various clinical studies to offer highly accurate assays for disease diagnosis and therapy selection is responsible for other players' high market growth rate.

Such continuous engagement in the launch of diagnostic tests by several market players and a rising focus on collaborations with other organizations to establish their footprints in screening tests will further propel the market expansion.

LIST OF KEY COMPANIES PROFILED:

- Guardant Health (U.S.)

- PERSONALIS, INC. (U.S.)

- FOUNDATION MEDICINE, INC. (U.S.)

- Natera, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Menarini Silicon Biosystems, Inc. (Italy)

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Twist Bioscience Corporation introduced a cfDNA library preparation kit to support liquid biopsy research.

- May 2022: Guardant Health, Inc. announced that blood sample-based cancer testing services in Europe are operational at the Vall d’Hebron Institute of Oncology (VHIO) liquid biopsy testing facility in Barcelona.

- April 2022: Stilla Technologies partnered with Promega Corporation to offer a complete digital PCR workflow solution for a wide range of applications for cancer research. These included liquid biopsy, sentinel pathogen testing, and others.

- September 2021: Thermo Fisher Scientific Inc. collaborated with AstraZeneca to develop NGS-based (CDx) to support AstraZeneca's expanding portfolio of targeted therapies.

- July 2021: QIAGEN collaborated with Sysmex Corporation to develop cancer companion diagnostics using ultra-sensitive liquid biopsy next-generation sequencer technology.

- June 2021: Illumina Inc. and Next Generation Genomic Co., Ltd. launched VeriSeq NIPT Solution v2 in Southeast Asia.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on crucial aspects such as leading players, product types, and major applications of the product. Additionally, it offers insights into market trends, and key industry developments, such as mergers, partnerships, and acquisitions. In addition to the factors mentioned above, the report includes the factors that have contributed to the market growth in recent years with a regional analysis of different segments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 28.61% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 14.23 billion in 2026 to USD 106.49 billion by 2034.

Registering a CAGR of 28.61%, the market will exhibit steady growth over the forecast period (2026-2034).

By product, the kits & reagents segment is expected to lead this market during the forecast period.

The rising prevalence of cancer and the increasing R&D for technologically advanced products across the globe are the key factors driving the market growth.

Guardant Health, Inc., Foundation Medicine, and Natera, Inc. are the major players in the global market. Guardant Health, Inc., Foundation Medicine, and Natera, Inc. are the major players in the global market.

The growing prevalence of genetic disorders in the fetuses of pregnant women and an upsurge in the number of cancer screening tests across the globe are expected to drive the adoption of these tests.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us