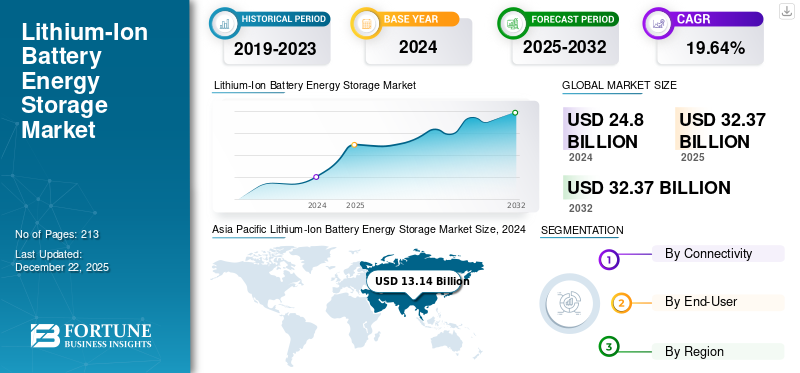

Lithium-Ion Battery Energy Storage Market Size, Share & Industry Analysis, By Connectivity (On-Grid and Off-Grid), By End-User (Residential, Commercial and Industrial, and Utility), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global lithium-ion battery energy storage market size was valued at USD 24.80 billion in 2024. It is projected to be worth USD 32.37 billion in 2025 and expected to reach USD 113.64 billion by 2032, exhibiting a CAGR of 19.65% during the forecast period. Asia Pacific dominated the global market with a share of 52.98% in 2024.

The majority of storage systems functioning today employ lithium batteries. Lithium batteries comprise various technologies that store energy through the use of lithium ions, which are positively charged particles that readily react with other elements.

Charging and discharging lithium batteries involves chemical reactions between a positive electrode (lithium cathode) and a negative electrode (carbon anode), enabling the storage and release of energy generated by renewable sources. Lithium batteries possess remarkable advantageous technological attributes for energy applications, such as modularity, elevated energy density, and impressive charging and discharging efficiency, which can exceed 90% at the level of a single module, thus all these factors drives the market growth.

Tesla Inc., LG Chem, ABB, and others are the major vendors. LG Chem led in high-density, long-life battery cells that suit energy storage systems. ABB adds value through smart system design, modularity, and integration that appeal to cost-sensitive buyers.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Renewable Energy Adoption to Drive the Market Growth

As solar, wind, and other renewable sources expand globally, there is an increasing need for reliable energy storage to balance the intermittent nature of these power sources. Lithium-ion batteries provide an efficient and scalable solution to store excess renewable energy generated during peak production periods and supply it during times of low generation. This makes lithium-ion technology critical for enabling better renewable energy integration into utility-scale grids and achieving decarbonization goals.

In May 2025, General Motors and LG Energy Solutions transformed lithium manganese-rich prismatic battery cells for future GM electric trucks and full-size SUVs in a modern battery technology development. This is based on a collaboration between the two companies to build prismatic battery cell technology and connected chemistries, and on GM’s long history of American creativity, which has manufactured inventions such as small block V8 engine, and the OnStar connected vehicle service.

MARKET RESTRAINTS

Raw Material Supply Chain Issues to Hinder Market Growth

Lithium-ion batteries rely on raw materials such as lithium, cobalt, and nickel, which are sourced mainly from a few countries (e.g, cobalt from the Democratic Republic of Congo and lithium from Australia and South America). This geographical concentration increases the risk of supply disruptions due to political instability, trade restrictions, or labor issues.

Fluctuations in prices of these materials make battery production more expensive and unpredictable. This also affects the project costs and limits the affordability of large-scale energy storage systems.

MARKET OPPORTUNITIES

Rising Adoption of Electric Vehicles to Drive the Lithium-Ion Battery Energy Storage Demand

The rapid increase in electric vehicle production and sales boosts the demand for lithium-ion batteries, leading to advanced battery technology, economies of scale, and stronger supply chains. These developments make lithium-ion energy storage systems more cost-effective and widely available, supporting their use in grid-scale, commercial, and residential applications, thus driving market growth.

In October 2022, Eaton introduced innovative power management solutions to facilitate the Asia Pacific green energy transition. This offering features a collection of electric vehicle charging infrastructure (EVCI) solutions and its battery energy storage systems (BESS) series tailored to Asia Pacific's specific business and operational context.

Lithium-Ion Battery Energy Storage Market Trends

Smart Energy Management and Digitalization to Surge the Market Growth

The increasing integration of smart energy management systems and digital technologies at a large scale is significantly driving the lithium-ion battery energy storage market growth. These systems enable real-time monitoring, predictive analytics, and automated control of energy flows, optimizing battery performance and lifespan. Digitalization supports seamless integration with renewable energy sources, improving grid services such as peak shaving and frequency regulation, and enabling participation in virtual power plants.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Connectivity

Expanding Renewable Energy Integration to Lead the Growth for the On-grid Segment

The market, by connectivity, covers on-grid and off-grid segments.

On-grid segment held the dominant market share in the year 2024. On-grid lithium-ion battery systems help store excess solar/wind power and release it during peak demand, ensuring grid stability and efficient use of renewables. Utilities and grid operators are upgrading infrastructure to reduce dependence on fossil fuels. Lithium-ion batteries are crucial for supporting cleaner, smarter grids as they provide fast response times for balancing supply and demand.

Off-grid is the second dominant segment in the market. Off-grid systems often rely on solar or wind power, and lithium ion batteries offer high energy density and fast charging making them ideal for storing intermittent energy and ensuring 24/7 availability. Falling costs of lithium ion batteries have made off-grid energy storage affordable.

By End-User

High Energy Requirement in Commercial & Industrial Sector to Drive Segment Growth

By end-users, the market is segmented into residential, commercial and industrial, and utility.

Commercial and industrial segments dominate the market. Commercial and industrial customers in many regions face high demand charges based on peak electricity use. Lithium-ion battery systems allow businesses to cut prices by supplying stored energy during high-demand periods, reducing utility bills.

Residential segment is also growing rapidly in the market. Homeowners are pairing solar PV systems with lithium ion batteries to store excess solar energy and use it during nightfall or outages, enhancing energy independence.

LITHIUM-ION BATTERY ENERGY STORAGE MARKET REGIONAL OUTLOOK

The market has been analyzed geographically in to North America, Europe, Asia Pacific, and Rest of World. Asia Pacific is the dominating region in the market.

Asia Pacific

Asia Pacific Lithium-Ion Battery Energy Storage Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific is the holding the majority lithium-ion battery energy storage market share. Asia Pacific countries, especially China, India, Japan, South Korea, and Australia, are leading globally in solar PV and wind power. Battery energy storage systems are critical to store this renewable energy and ensure grid stability, as these sources are variable, thus driving the regional market growth.

For instance, in May 2025, China launched its first major lithium-sodium hybrid energy storage facility, which operates predominantly on green energy, achieving a 98% rate. Many Asia Pacific countries are investing in smart, microgrids, and island grids as battery storage is significant for these systems.

North America

The market growth in the North America, especially the U.S., is due to huge wind and solar capacity. Lithium-ion BESS is essential to store intermittent renewable power and ensure grid reliability when the sun is not shining or the wind isn’t blowing. In June 2024, California's battery storage capacity of 8.6 gigawatts (GW) represents about 50% of the total utility-scale battery capacity in the U.S. It is double that of Texas, which has the second-highest battery storage capacity. The total estimated battery storage capacity across the U.S. is approximately 17.5 GW, as reported by the U.S. Energy Information Administration and Cleanview.

U.S.

The U.S. is rapidly increasing its solar and wind energy capacity. Lithium-ion batteries help store excess power during peak production and release it during demand peaks, ensuring grid stability. Aging U.S. grid infrastructure needs flexible, fast responding storage solutions. Lithium ion batteries aids in frequency regulations, load balancing, and blackout prevention thus, driving the lithium-ion battery energy storage market growth in the U.S.

Europe

The European Union and most of the European countries have ambitious climate goals of net zero by 2050 or earlier. Energy storage is critical for achieving these targets by enabling a shift from fossil fuels to renewables.

As coal and gas plants are phased out, grids need fast response solutions including lithium-ion batteries for frequency regulation, voltage support, and reserve power. BESS helps prevent blackouts and supports grid modernization thus, driving the lithium-ion battery energy storage market growth in the region.

In July 2024, Exide Technologies, an international leader in battery storage solutions, transformed the energy industry with its steady dedication to invention and sustainability. With a legacy of over 135 years, Exide Technologies has become a trusted partner for industries worldwide, ideally combining renewable energy into its offerings.

Rest of the World

Latin America is steadily moving toward adopting clean energy sources, as countries such as Chile, Brazil, Mexico, and Argentina are expanding these capacities fast. Lithium-ion BESS helps store renewable energy and deliver it when needed, solving intermittency challenges. Moreover, Countries across the Middle East and Africa, especially Saudi Arabia, the UAE, Egypt, Morocco, and South Africa, heavily invest in solar and wind energy to diversify their energy mix. Lithium-ion battery storage is crucial to store surplus solar/wind and supply it when demand peaks or generation dips.

Some countries in the rest of the world are creating regulatory frameworks for energy storage. In April 2025, Chile Energy Minister Diego Pardow was present at the inauguration of the 200 MW/800 MWh BESS del Desierto, a project its developers describe as the first large-scale standalone energy storage plant in Latin America.

COMPETITIVE LANDSCAPE

Key Industry Players

Vendors are Developing Higher Energy Density Batteries Driving Market Growth

Hitachi ABB Power Grids has been assigned to install its BESS system solution, PowerStore, with its digital controls platform e-Mesh, by locally-headquartered project developer, Impact Solar Limited. The project will be placed at Saha Industrial Park in Sri-Racha, closeby to Thailand’s south-west coast.

The technologically supported microgrid will combine the different distributed resources while behaving similar to utility-scale power system, managing and improving power output from the resources in real time across the industrial park. The system will be able to combine the variable output of the solar power facilities, offering backup power to a data center at the park and ensuring power quality and dependability for companies based there.

List of the Key Lithium-ion Battery Storage Companies Profiled

- Tesla Inc. (U.S.)

- LG Chem (South Korea)

- Panasonic Corporation (Japan)

- ABB Ltd (Switzerland)

- Hitachi Ltd (Japan)

- Toshiba Corporation (Japan)

- NEC Corporation (Japan)

- Saft Groupe S.A. (France)

- BYD Company (China)

- Eaton Corporation (U.S.)

- Alevo Group S.A.

- Sharp Corporation (Japan)

- Kokam Co ltd. (South Korea)

- Sharp Technology (Japan)

KEY INDUSTRY DEVELOPMENTS

- In April 2025, CATL declared the second generation of its Shenxing fast-charging battery technology at the company’s tech event. The company assumes the new battery, which utilizes lithium iron phosphate chemistry, adds a span of 520 kilometers with a 5-minute charge and can go up to 5% to 80% charge in 15 minutes in cold weather.

- In December 2024, Coherent Corp. declared it would inspect strategic substitutes for its SHARP technology, which effectively recycles valuable metals from lithium-ion batteries. As demand for LiBs increases due to applications in electric vehicles and energy storage, the importance of recycling these batteries grows.

- In November 2024, LG Energy Solution (LG ES) has secured a four-year contract with developer Terra-Gen. The parent firm announced the agreement between LG ES Vertech, ACT's subsidiary, and California headquartered renewable energy independent power producer (IPP) Terra-Gen. The agreement will cover the supply of "up to 8GWh" of modular, containerized Lithium Iron Phosphate (LiFePO4) battery energy storage system (BESS) technology between the year 2026 and 2029. The BESS systems will be manufactured in North America.

- In November 2023, Toshiba Corporation built a modern lithium-ion battery utilizing a cobalt-free 5V high-potential cathode material that remarkably repressed performance-degrading gases as a result. This battery can function for various applications, from power tools to electric vehicles.

- In July 2022, Kokam Limited Company, a worldwide supplier of inventive lithium-ion battery solutions and a fully-owned subsidiary of SolarEdge Technologies, Inc., declared that its Offshore Liquid-cooled battery system (KOL) acquired DNV certification under the changed 2021 class rules.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product/service processes, competitive landscape, and leading sources of lithium-ion battery energy storage systems. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 19.64% from 2025 to 2032 |

|

Unit |

Value (USD Billion), Volume (MW) |

|

Segmentation |

By Connectivity

|

|

By End-User

|

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 24.80 billion in 2024.

In 2024, the Asia Pacific market value stood at USD 13.14 billion.

The market is expected to exhibit a CAGR of 19.64% during the forecast period.

Commercial & industrial segment led the market by end users.

Increasing renewable energy adoption to drive the market growth.

Some of the top major players in the market are Tesla Inc., LG Chem, and Toshiba Corporation.

Some of the top major players in the market are Tesla Inc., LG Chem, and Toshiba Corporation.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us