Maternal Health Therapeutics Market Size, Share & Industry Analysis, By Drug Type (Hormonal Therapies, GnRH Modulators, Pain & Symptom Management, Metabolic Drugs, Fertility Drugs, & Others), By Application (Preeclampsia & Gestational Hypertension, Gestational Diabetes, Postpartum Hemorrhage, Postpartum Depression, Hyperemesis Gravidarum, Alloimmune Thrombocytopenia, Postpartum Endometritis, & Others), By Phase (Preconception, Prenatal, Labor & Delivery, and Postnatal/Postpartum), By Route of Administration (Oral & Parenteral), By Distribution Channel, and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

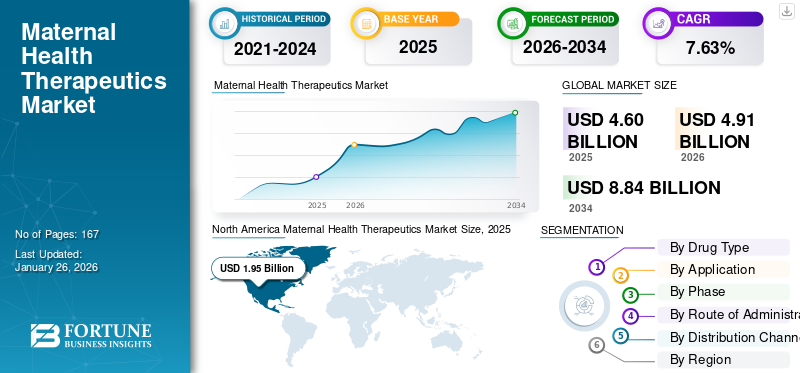

The global maternal health therapeutics market size was valued at USD 4.6 billion in 2025. The market is projected to grow from USD 4.91 billion in 2026 to USD 8.84 billion by 2034, exhibiting a CAGR of 7.63% during the forecast period. North America dominated the maternal health therapeutics market with a market share of 42.32% in 2025.

The market is witnessing steady growth, driven by the government’s focus toward maternal health, rising number of government programs and investment, and initiatives for the betterment of women and new mother’s health.

- For instance, in October 2025, an Indian government initiative for women’s health, ‘Swasth Nari Sashakt Parivar’ was concluded and outreached 6.26 million patients for antenatal checkups and immunizations.

Additionally, the growing prevalence of lifestyle-related disorders, delayed pregnancies, and rising birth complications also creates a strong demand for specialized treatment options. Attributing to these advantages, many key industry players are actively investing resources toward the development of numerous pipeline candidates to support the increasing demand.

Key industry players, such as Johnson & Johnson, Novartis AG, and Pfizer Inc., are focusing on developing various pipeline candidates to support the rising demand for effective therapeutics for diverse maternal health complications.

MARKET DYNAMICS

MARKET DRIVERS

Rising Number of Births Accelerates Maternal Health Therapeutics Market Growth

The rising number of global births is a major factor driving maternal health therapeutics market growth. The rising number of births expands the population at risk for pregnancy-related complications. With more women giving birth under medical supervision, the demand for therapeutic drugs such as uterotonics, antihypertensives, insulin, and antibiotics increased significantly. Overall, the growing number of institutional births, combined with better access to healthcare and an expanding maternal population, is creating sustained demand for maternal health therapeutics globally.

- In 2023, UNICEF reported a 132.11 billion number of births globally.

MARKET RESTRAINTS

Lack of Dedicated Pregnancy-Specific Therapeutics to Restrict Market Growth

A major restraint to the global maternal health therapeutics market is the high dependence on off-label and supportive therapies rather than dedicated, pregnancy-specific drugs. Many treatments used for conditions such as preeclampsia, gestational diabetes, and postpartum depression were originally developed for the general population and later repurposed for maternal use. This reliance creates limitations in efficacy and safety, as these drugs are not always optimized for pregnant or postpartum women. Despite a large patient volume of women with health complications due to insufficient care, there is a major gap in the therapeutics offered. This overdependence on non-specialized drugs continues to act as a barrier despite the rising prevalence of maternal disorders.

- In December 2023, the World Health Organization (WHO) reported that every year, at least 40.0 million women experience a long-term health problem caused by childbirth. The study showcased a high burden of postnatal conditions persisting for years after giving birth. These include pain during sexual intercourse (dyspareunia), low back pain, anal incontinence, urinary incontinence, anxiety, depression, perineal pain, fear of childbirth, and secondary infertility.

MARKET OPPORTUNITIES

Innovation in Postpartum Care Offers a Prominent Opportunity for Market Development

Innovation in postpartum care presents a major opportunity for market growth, as this stage of maternal health has long been underserved despite its high burden of complications. Conditions such as postpartum hemorrhage, depression, and infections continue to contribute significantly to maternal morbidity and mortality worldwide. By underscoring this gap, various key companies are directing their resources toward research and development for new drug development.

- In December 2023, Biogen Inc., in collaboration with Sage Therapeutics, Inc., launched ZURZUVAE for the treatment of postpartum depression (PPD) for adults in the U.S.

MARKET CHALLENGES

Lower Access to Maternal Health Therapeutics in Lower Income Countries Pose a Critical Challenge to Market

Lower access to maternal health therapeutics pose a critical challenge to the market’s growth. In many lower income countries, these essentials are inconsistently available due to weak supply chains and poor cold-chain infrastructure. Many rural and under-resourced health facilities experience frequent drug stock outs.

- In 2024, UNICEF’s manual for Maternal and Newborn Health Update, reported several low-income nations including South Sudan, Chad, and Somalia continue to have inadequately equipped healthcare facilities to provide emergency maternal care. These factors have led to increase in demand but inability to distribute and administer medicines effectively.

MATERNAL HEALTH THERAPEUTICS MARKET TRENDS

Increasing Government Support for Maternal Health Therapeutics

A key trend observed in the market is the increasing government support and policy prioritization of maternal healthcare across developed and developing nations. Governments are strengthening national programs, expanding healthcare budgets, and implementing maternal safety initiatives to reduce preventable complications during pregnancy and childbirth.

- For instance, in February 2024, the U.S. Department of Health and Human Services (HHS) launched the Secretary’s Postpartum Maternal Health Collaborative. This initiative aims to address the issue of postpartum mortality.

Download Free sample to learn more about this report.

Segmentation Analysis

By Drug Type

Increasing Research Initiatives for Hormonal Therapies Propel Segment’s Growth

Based on drug type, the market is divided into hormonal therapies, GnRH modulators, pain & symptom management, metabolic drugs, fertility drugs, and others.

To know how our report can help streamline your business, Speak to Analyst

The Fertility Drugs segment is projected to dominate the market with a share of 33.39% in 2026. The hormonal therapies segment is anticipated to account for the largest maternal health therapeutics market share owing to high-utilization indications, most importantly, uterotonics for postpartum hemorrhage. Uterotonics such as oxytocin/carbetocin are first-line, used immediately at delivery, creating high-volume hospital demand. Underscoring these advantages, many key players are streamlining their resources for clinical trials and new drug development.

- In August 2025, Reunion Neuroscience, Inc., showcased positive topline results from its RECONNECT Phase 2 clinical trial evaluating RE104 in adult female patients with moderate-to-severe postpartum depression (PPD). RE104 is part of the hormonal/neurosteroid space for PPD.

By Application

Rising Prevalence of Post-Partum Hemorrhage Drive Segment’s Growth

By application, the market is sub-segmented into preeclampsia & gestational hypertension, gestational diabetes, postpartum hemorrhage, postpartum depression, hyperemesis gravidarum, alloimmune thrombocytopenia, postpartum endometritis, and others.

In 2026, the Gestatiol Diabetes segment is projected to lead the market with a 27.09%share. The post-partum hemorrhage (PPH) segment is anticipated to witness a significant growth over the forecast period. In 2025, the segment is anticipated to capture 15.7% market share as it remains one of the leading causes of maternal mortality worldwide, particularly in low and middle-income countries. There is a high prevalence of hemorrhage cases, coupled with the urgent need for immediate pharmacological intervention. Additionally, global health initiatives and funding for health programs are heavily focused on PPH prevention and treatment, further expanding access and market opportunities.

- In July 2025, the American Hospital Association (AHA) and health care technology company Epic collaborated to help more hospitals consider adopting a set of tools to aid in the detection and treatment of postpartum hemorrhage (PPH) and potentially life-threatening complications of childbirth.

The preeclampsia & gestational hypertension segment is estimated to grow at a CAGR of 8.30% over the forecast period.

By Phase

High Burden of Complications and Awareness Regarding Post-Partum Drives its Dominance

On the basis of phase, the market is segmented into preconception, prenatal, labor & delivery, and postnatal/ postpartum.

The Preconception segment is poised to account for 42.25% of the market share in 2026. The postpartum segment is anticipated to witness significant growth over the forecast period. The postpartum stage carries the highest burden of complications and mortality, with postpartum hemorrhage, postpartum depression, and infections being among the leading causes of maternal morbidity globally. Moreover, awareness around postpartum depression and long-term maternal health outcomes is rising, driving demand for both pharmacological and digital health solutions. Global health agencies and donors are prioritizing postpartum interventions to reduce maternal mortality, further boosting investment and accessibility in this phase. Also, the clinical urgency, high prevalence, and strong policy focus make the postpartum segment the dominant phase.

- For instance, in March 2024, the U.S. Department of Health and Human Services (HHS) launched the Secretary’s Postpartum Maternal Health Collaborative. This initiative aims to improve the critical issue of postpartum mortality by fostering collaboration among state leaders, community partners, and federal experts.

The labor & delivery segment is estimated to grow at a CAGR of 5.03% over the forecast period.

By Route of Administration

High Investments in R&D and Novel Product Launches for Therapies Using Parenteral Route Assists the Segment’s Leadership

On the basis of route of administration, the market is segmented into oral and parenteral.

The Oral segment is expected to account for 55.10% of the market in 2026. The parenteral segment is anticipated to witness a significant growth over the forecast period and held a market share of 45.7% in 2024. Several critical maternal health complications require rapid-acting therapies that can only be delivered through parenteral routes. These have resulted in key companies investing profoundly in research and development for novel product launches.

- In April 2025, Unitaid reported a clinical trial to evaluate the broader use of medicine for postpartum hemorrhage. The clinical stage drug is administered intravenously.

The oral segment is estimated to grow at a CAGR of 8.06% over the forecast period.

By Distribution Channel

Hospital Pharmacies Hold Top Position as they offer Specialized Service for Complicated Medical Conditions

On the basis of distribution channel, the market is segmented into hospital pharmacies, drug stores & retail pharmacies, and online pharmacies.

In 2024, the global market was dominated by the hospital pharmacies segment due to their central role in managing acute and high-risk maternal conditions. The segment is set to hold a 50.8% share of the market in 2025. Critical complications, such as postpartum hemorrhage, preeclampsia, and severe infections, require immediate intervention, which is typically available only in hospital settings. Hospitals serve as primary sites for labor, delivery, and emergency obstetric care, ensuring timely access to specialized medical personnel and equipment. Underscoring this importance, hospital associations carry out various initiatives to provide better maternal healthcare.

- In July 2024, the American Hospital Association collaborated with health care technology leader Epic to help hospitals adopt tools that support the early detection and treatment of postpartum hemorrhage, a leading cause of maternal mortality.

In addition, drug stores & retail pharmacies as a distribution channel are projected to grow at a CAGR of 8.64% during the study period.

Maternal Health Therapeutics Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America Maternal Health Therapeutics Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

North America

North America held the dominant share in 2025 valued at USD 1.95 billion and also took the leading share in 2026, with USD 2.08 billion. The maternal health therapeutics market in North America is expected to grow strongly due rising prevalence of postpartum depression, preeclampsia, and gestational diabetes, coupled with a strong healthcare infrastructure and reimbursement through healthcare systems. Additionally, growing investments in women’s health research and digital maternal care platforms are further supporting market expansion in the region.

The rising prevalence of maternal diseases such as preeclampsia and postpartum endometriosis in the U.S. also accelerates the market growth. In 2026, the U.S. market is estimated to reach USD 1.91 billion.

- In October 2022, the Centers for Disease Control and Prevention (CDC) estimated that it occurs in 5 to 7% of all pregnancies and is one of the leading causes of maternal morbidity.

Europe

Europe and Asia Pacific are anticipated to witness a notable growth in the coming years. During the forecast period, Europe is projected to record a growth rate of 6.88% which is the second highest amongst all regions and reach USD 1.19 billion in 2025. The region is estimated to grow with rising investment for maternal health, growing awareness, as well as advancement in diagnostics to facilitate treatment. Backed by these factors, the U.K. anticipates to record USD 0.27 billion, Germany to reach USD 0.3 billion in 2026 and France to hit USD 0.22 billion in 2025. Following Europe, the market in Asia Pacific is estimated to reach USD 1.14 billion in 2025 and secure the position of the third-largest region. India and China are estimated to reach USD 0.24 billion and USD 0.32 billion respectively in 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa will witness a moderate growth in this market. Latin America’s market in 2025 is set to record USD 0.19 billion. Improving access to treatment alternatives and government initiatives is expected to drive market growth in these regions. In the Middle East & Africa, GCC is set to attain the value of USD 0.06 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Focus on Strategic Expansion Opportunities by Key Players to Propel Market Progress

The global maternal health therapeutics market holds a semi-consolidated structure, constituting prominent players such as Biogen, Bristol-Myers Squibb Company, Merck & Co., Inc., and Pfizer Inc. The significant share of these companies is due to collaboration among operating entities for advancing and improving maternal health, which also strengthens their market position.

- In April 2025, Merck & Co., Inc., launched a new maternal health initiative in collaboration with the Pan American Health Organization (PAHO) and the Ministry of Health to improve maternal health and reduce unintended pregnancies across the Americas.

Other notable players include Shionogi & Co., Ltd., Novartis AG, Bayer AG, and Biogen. These companies are anticipated to prioritize new product launches and collaborations to boost their market share.

LIST OF KEY MATERNAL HEALTH THERAPEUTICS COMPANIES PROFILED

- Novartis AG (Switzerland)

- Johnson & Johnson (U.S.)

- Shionogi & Co., Ltd. (Japan)

- Bayer AG (Germany)

- Bristol-Myers Squibb Company (U.S.)

- Biogen (U.S.)

- Pfizer Inc. (U.S)

- Merck & Co., Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2024: Johnson & Johnson announced that the company’s innovations in maternal-fetal medicine are expected to be showcased at the Society for Maternal-Fetal Medicine’s (SMFM) 2024 Pregnancy Meeting.

- December 2023: Shionogi & Co., Ltd. completed the second phase of the “Mother to Mother SHIONOGI Project” a maternal and child healthcare program in Africa in co-operation with international NGO World Vision Japan.

- March 2022: Johnson & Johnson, in collaboration with Janssen Research & Development, launched the Maternal-fetal Immune Disorders QuickFire Challenge: Innovating for Health Equity—the initiative aims to understand better the manifestations of immune-mediated diseases of pregnancy impacting historically marginalized communities.

- March 2021: Merck & Co., Inc. acquired Alydia Health. Alydia Health is a commercial-stage company focused on preventing maternal morbidity and mortality caused by postpartum hemorrhage (PPH) or abnormal postpartum uterine bleeding.

- September 2020: Bayer AG acquired UK-based biotech company KaNDy Therapeutics Ltd. to expand its drug development pipeline in women’s healthcare.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.63% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Drug Type, Application, Phase, Route of Administration, Distribution Channel, and Region |

|

By Drug Type |

· Hormonal Therapies · GnRH Modulators · Pain & Symptom Management · Metabolic Drugs · Fertility Drugs · Others |

|

By Application |

· Preeclampsia & Gestational Hypertension · Gestational Diabetes · Postpartum Hemorrhage · Postpartum Depression · Hyperemesis Gravidarum · Alloimmune Thrombocytopenia (FNAIT) · Postpartum Endometritis · Others |

|

By Phase |

· Preconception · Prenatal · Labor & delivery · Postnatal/ Postpartum |

|

By Route of Administration |

· Oral · Parenteral |

|

By Distribution Channel |

· Hospital Pharmacies · Drug Stores & Retail Pharmacies · Online Pharmacies |

|

By Geography |

· North America (By Drug Type, Application, Phase, Route of Administration, Distribution Channel, and Country) o U.S. o Canada · Europe (By Drug Type, Application, Phase, Route of Administration, Distribution Channel, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Drug Type, Application, Phase, Route of Administration, Distribution Channel, and Country/Sub-region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Drug Type, Application, Phase, Route of Administration, Distribution Channel, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Drug Type, Application, Phase, Route of Administration, Distribution Channel, and Country/Sub-region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 4.6 billion in 2025 and is projected to reach USD 8.84 billion by 2034.

In 2025, the market value stood at USD 8.84 billion.

The market is expected to exhibit a CAGR of 7.63% during the forecast period of 2026-2034.

The hormonal therapies segment led the market by drug type.

The increasing prevalence of preeclampsia, hemorrhage, and post-partum depression is expected to drive the demand for maternal therapeutics in the forecast period.

Bristol-Myers Squibb Company, Pfizer Inc., Merck & Co., Inc., and Biogen are the major players in the global market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us