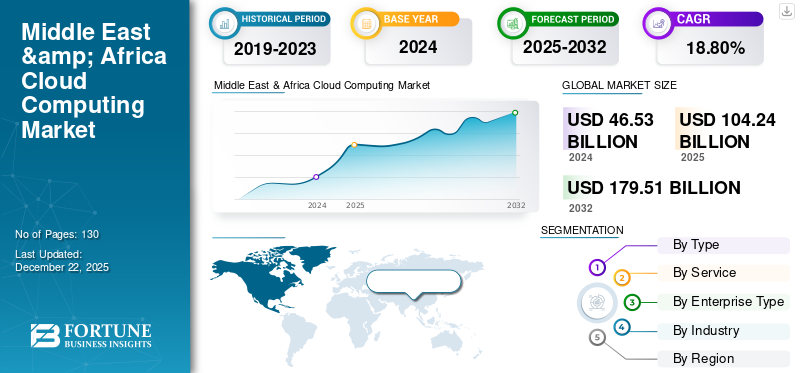

Middle East & Africa Cloud Computing Market Size, Share & Analysis, By Type (Public Cloud, Private Cloud, and Hybrid Cloud), By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS) and Software as a Service (SaaS)), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT and Telecommunications, Government, Consumer Goods and Retail, Healthcare, Manufacturing and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The Middle East & Africa cloud computing market size was valued at USD 46.53 billion in 2024. The market is projected to grow from USD 104.24 billion in 2025 to USD 179.51 billion by 2032, exhibiting a growth at a CAGR of 18.80% during the forecast period.

The cloud computing landscape in the Middle East & Africa is undergoing a significant shift as digital-first strategies become central to business and national agendas. Organizations across sectors are embracing cloud platforms not just to modernize IT infrastructure, but to unlock new growth opportunities through smarter, data-driven decision-making. Additionally, regulatory reforms and national digital economy visions are acting as catalysts, pushing for more secure, locally hosted cloud environments. As a result, the Middle East & Africa region is emerging as a dynamic hub for cloud innovation, driven by a blend of economic diversification, tech entrepreneurship, and strategic public-private partnerships.

Middle East & Africa Cloud Computing Market Trends

Strong Infrastructure Investments to be a Key Driver for Market Growth

Strong infrastructure investment is a major trend shaping the cloud computing landscape across the Middle East & Africa. Governments and private enterprises are significantly increasing funding toward cloud infrastructure, including large-scale data centers, fiber networks, and high-speed connectivity to meet growing digital demands. These developments are helping to improve data accessibility, reduce latency, and strengthen compliance with local data regulations, while also supporting broader goals of digital transformation and economic modernization.

Key takeaways

- The market is projected to be worth USD 179.51 billion by 2032.

- By type, the public cloud segment accounted for 59.2% of the market in 2024.

- By service, the Infrastructure as a Service (IaaS) segment is projected to grow at a CAGR of 21.8% over the forecast period.

- By enterprise type, large enterprises accounted for around 51.2% of the market in 2024.

- The cloud computing market in GCC was worth USD 16.45 billion in 2024.

- By region, GCC is projected to grow at a CAGR of 20.3% over the forecast period.

Middle East & Africa Cloud Computing Growth Factors

Adoption of Emerging Technologies to Boost Market Growth

The adoption of emerging technologies such as artificial intelligence, the Internet of Things, and edge computing is significantly accelerating the Middle East & Africa cloud computing market growth. By integrating these advanced technologies with cloud infrastructure, businesses are unlocking new possibilities and innovative use cases that were previously unattainable. Together, these technologies broaden the scope of cloud applications and encourage more organizations across various sectors to adopt cloud solutions, thereby expanding the overall market and driving innovation.

- As of May 2024, Oman recorded a 118.7% year-on-year surge in IoT connections, reaching 1.55 million active connections. Mobile subscriptions also rose to 8.13 million, nearly doubling the country’s population of 4.5 million.

Middle East & Africa Cloud Computing Market Restraints

Cost Challenges and Price Perceptions to Change Restrain Market Growth

Although cloud computing offers long-term cost benefits such as reduced infrastructure investment and lower maintenance expenses, many small and medium-sized enterprises in the Middle East & Africa remain cautious due to the upfront costs involved. Migrating to the cloud often requires spending on system upgrades, data transfers, staff training, and temporary disruptions during the transition. On top of that, ongoing subscription fees can seem high for businesses working within limited budgets.

Middle East & Africa Cloud Computing Market Segmentation Analysis

By Type

Based on type, the market is divided into public cloud, private cloud, and hybrid cloud.

In the Middle East & Africa, public cloud services continue to lead the market as they offer accessibility, ease of use, and support from major cloud providers. At the same time, the demand for hybrid cloud is rising quickly as industries with sensitive data requirements, such as finance and healthcare, look for solutions that combine local data control with the scalability of the cloud.

- A survey of technology leaders from over 50 major African companies revealed that, on average, approximately 45 % of their workloads are currently hosted on public cloud platforms.

By Service

Based on service, the market is divided into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS).

In the Middle East & Africa, Software as a Service (SaaS) remains the dominant segment as businesses increasingly rely on cost-effective, subscription-based tools to improve remote collaboration, customer service, and daily operations.

Infrastructure as a Service (IaaS) is expanding at a faster pace, supported by rising investments in digital infrastructure from startups, tech firms, and public institutions seeking scalable solutions that reduce the need for heavy upfront investment.

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

In the Middle East & Africa, large enterprises continue to lead in cloud adoption by investing in scalable infrastructure and integrating advanced cloud technology to accelerate their digital transformation efforts. At the same time, small and medium-sized enterprises (SMEs) are increasingly embracing cloud platforms due to improved accessibility, localized solutions, and pay-as-you-go models that support their growth in a competitive market.

By Industry

Based on industry, the market is segmented into BFSI, IT and telecommunications, government, consumer goods and retail, healthcare, manufacturing, and others.

In the Middle East & Africa, the IT and telecommunications sector continues to be a major force behind cloud growth. It utilizes cloud platforms to modernize infrastructure, enable faster service delivery, and support the rollout of technologies such as 5G. At the same time, the public sector and government agencies are emerging as key adopters, fueled by national digitalization programs and the push for improved public service delivery, data sovereignty, and secure cloud environments tailored to regulatory frameworks.

By Country

Based on region, the market is segmented into Turkey, Israel, GCC, North Africa, South Africa, and the Rest of Middle East & Africa.

The GCC is set to lead by securing the largest Middle East & Africa cloud computing market share and achieving the highest growth rate in the region. This momentum is driven by increased adoption of cloud-based solutions across government and private sectors, aggressive digital transformation roadmaps, and substantial investments in data centers and connectivity.

Key industries such as healthcare, banking, and logistics are rapidly embracing cloud services to enhance operational efficiency and innovation. Furthermore, ongoing efforts to improve regulatory frameworks and promote cloud-enabled smart infrastructure are accelerating market expansion in countries such as Qatar, Bahrain, and UAE.

List of Key Companies in Middle East & Africa Cloud Computing Market

In the Middle East & Africa cloud computing market, regional specialists such as Logo Business Solutions, Kolay Yazılım, and MedOne are emerging as influential players. These companies are making significant strides by offering localized cloud services designed to address the unique digital transformation needs of businesses across the region.

Unlike the global giants, these companies are deeply embedded in local markets, enabling them to deliver agile, cost-effective solutions for SMEs, startups, and mid-market enterprises. Their ongoing investments in infrastructure, cybersecurity, and AI-driven services position them to capture an expanding share of the Middle East & Africa cloud ecosystem, especially as digital adoption accelerates across emerging economies in the region.

LIST OF KEY COMPANIES PROFILED

- Logo Business Solutions (Turkey)

- Kolay Yazılım A.Ş. (Turkey)

- MedOne (Israel)

- ASOCS (Israel)

- CloudWize (Israel)

- Solutions by stc (Saudi Arabia)

- MEEZA (Qatar)

- Sahara Net (Saudi Arabia)

- Deimos Cloud (South Africa)

- CipherWave (South Africa)

- Liquid Intelligent Technologies (South Africa)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Africa Data Centres (a Cassava Technologies company) partnered with Blue Turtle Technologies to expand cloud and colocation services in South Africa. The collaboration enables secure, scalable, and compliant private cloud solutions for enterprises via data centers in Cape Town and Midrand.

- April 2025: Microsoft and du (Emirates Integrated Telecommunications Company PJSC) agreed to build a hyperscale data center in Dubai, in a deal worth USD 544 million. Announced during Dubai AI Week, Microsoft will be the primary tenant, with the new facility set to boost the UAE’s cloud and AI infrastructure in phases.

REPORT COVERAGE

The Middle East & Africa cloud computing market report offers a detailed examination of the region’s cloud industry, focusing on market trends, policy updates, and key strategic activities such as collaborations, mergers, and data sovereignty measures. It highlights emerging developments, including the push for environmentally friendly cloud solutions, growth in sovereign cloud adoption, and advancements in AI and edge computing technologies. The report also assesses how these factors influence cloud service demand and provides a competitive analysis of leading global hyperscalers alongside regional cloud service providers.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 18.80% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Public Cloud · Private Cloud · Hybrid Cloud |

|

By Service · Infrastructure as a Service (IaaS) · Platform as a Service (PaaS) · Software as a Service (SaaS) |

|

|

By Enterprise Type · SMEs · Large Enterprises |

|

|

By Industry · BFSI · IT and Telecommunications · Government · Consumer Goods and Retail · Healthcare · Manufacturing · Others |

|

|

By Country · Turkey · Israel · GCC · North Africa · South Africa · Rest of Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the market was worth USD 46.53 billion in 2024.

The market is expected to exhibit a CAGR of 18.80% during the forecast period of 2025-2032.

By industry, the IT and Telecommunications industry is set to lead the market.

Logo Business, MedOne, ASOCS, and CloudWize are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us