Military Protective Eyewear Market Size, Share & Industry Analysis, By Devices (Cameras, Goggles, and Tubes or Scopes), By Technology (Thermal Imaging and Image Intensifier), By Application (Gunner Sights, Naval Trackers, Driving Sights, and Infantry Weapon Sights), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

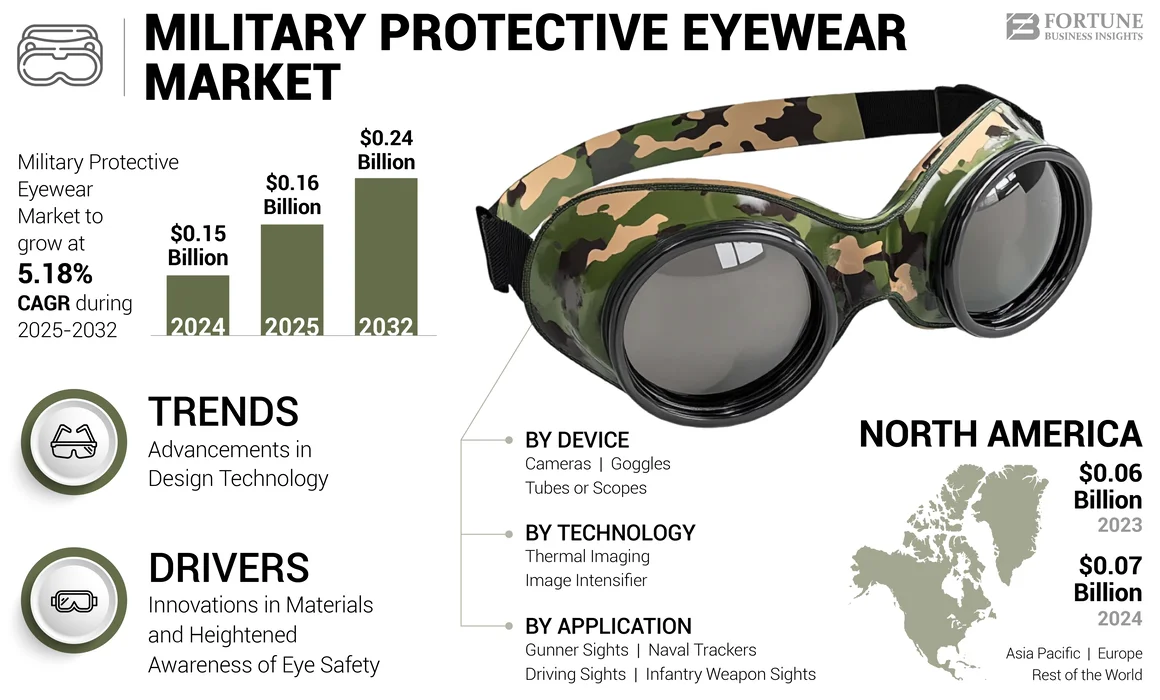

The global military protective eyewear market size was valued at USD 0.15 billion in 2024. The market is projected to grow from USD 0.16 billion in 2025 to USD 0.24 billion by 2032, exhibiting a CAGR of 5.18% during the forecast period. North America dominated the military protective eyewear market with a market share of 46.67% in 2024.

Military protective eyewear is specifically designed for use in combat or training scenarios to safeguard soldiers' eyes from injury. These glasses are constructed from durable materials and incorporate advanced technology to withstand ballistic impacts, shrapnel, and other battlefield hazards. Eye injuries caused by blast fragmentation are common in such settings but are often preventable with appropriate protective equipment. Typically, military protective eyewear features polycarbonate lenses that are engineered to resist high impacts and endure rapid shocks without shattering.

The frames of these glasses are designed for strength and durability, featuring a wrap-around design with adjustable temples and non-slip nose pads to ensure a secure and comfortable fit during vigorous physical activities. In addition to protection from ballistic threats, these glasses also offer defense against ultraviolet (UV) rays, bright lights, and airborne particles. Certain types of military-grade eyewear allow soldiers to swap out lenses to adapt to varying light conditions and apply specialized coatings to enhance visual clarity.

Demand for military protective eyewear has surged within the defense sector due to escalating terrorist threats and increased cross-border conflicts. Awareness of the importance of modern protective eyewear is growing among personnel operating in hazardous environments. Advances in technology have significantly improved the design and manufacturing of military protective eyewear, enhancing their ability to resist ballistic and other risks more effectively than ever before. Consequently, the need for eyewear tailored to the specific requirements of various military branches continues to grow, further driving the market for military protective eyewear.

The major key players in the market include a mix of global defense contractors, specialized eyewear manufacturers, and safety equipment companies. These companies lead the market by offering advanced ballistic, laser safety, and environmental protection eyewear designed for military and paramilitary personnel. Notable key players are BAE Systems, Elbit Systems, FLIR, and others.

RUSSIA-UKRAINE WAR IMPACT

Increase in Demand for Protective Gear to Fuel Market Growth

The ongoing Russia-Ukraine war has significantly influenced the military protective eyewear market growth, a key segment within the broader military personal protective equipment (PPE) industry. The conflict has reshaped defense spending priorities, accelerated technological advancements, and heightened the demand for protective gear tailored to modern combat scenarios.

The war has underscored the importance of advanced protective equipment for soldiers operating in high-risk environments. Protective eyewear, particularly those integrated with night vision and ballistic resistance capabilities, has become a critical asset for military forces. The demand for such eyewear is driven by its ability to enhance soldier safety during nighttime operations and provide protection from shrapnel and debris in urban combat zones.

The war has catalyzed innovation in military protective eyewear. Defense manufacturers are focusing on developing lightweight, durable, and multifunctional eyewear compatible with other protective systems such as advanced combat helmets and communication devices. For instance, the U.S. Department of Defense has been investing in next-generation lightweight PPE systems that improve scalability and adaptability based on mission requirements. Similarly, companies such as Teijin have introduced advanced materials such as Twaron Ultra Micro yarns to enhance ballistic resistance while maintaining comfort.

The conflict has reshaped global defense procurement priorities, with increased emphasis on technologies addressing modern threats such as electronic warfare and urban combat scenarios. As a result, demand is growing for protective eyewear integrated with features such as augmented reality (AR) and enhanced night vision. These innovations are particularly critical as both Russian and Ukrainian forces rely heavily on drones and electronic warfare systems, which require soldiers to operate effectively in GPS-denied environments.

Military Protective Eyewear Market Overview & Key Metrics

Market Size & Forecast

- 2024 Market Size: USD 0.15 billion

- 2025 Market Size: USD 0.16 billion

- 2032 Forecast Market Size: USD 0.24 billion

- CAGR: 5.18% from 2025–2032

Market Share

- North America dominated the military protective eyewear market with a 46.67% share in 2024, primarily driven by the U.S.’s extensive defense budget, modernization initiatives, and strong demand for advanced ballistic and night vision protective eyewear.

- By technology, image intensifier systems held the largest share due to their widespread adoption in night vision devices used in military operations.

Key Country Highlights

- United States: Largest global market due to high defense spending and emphasis on advanced ballistic and night vision eyewear for ground troops and special forces.

- China & India: Rapid growth fueled by rising defense budgets, cross-border tensions, and focus on equipping soldiers with modern protective gear.

- Europe (France, U.K., Germany): Significant investments in NATO modernization programs and joint development of protective technologies boosting demand.

- Middle East & Africa: Demand driven by ongoing conflicts, extreme environmental conditions, and modernization of armed forces.

- Latin America: Gradual growth due to increasing defense allocations in countries like Brazil and Mexico for border security and counter-terrorism operations.

MILITARY PROTECTIVE EYEWEAR MARKET TRENDS

Advancements in Design Technology to Propel Market Growth

The market for military protection glasses (MPG) is projected to experience positive growth during the study period. This expansion is driven by the militarization of law enforcement agencies, advancements in defense technology, and greater military usage. These factors have led to a heightened demand for military protective eyewear in different combat missions, troop transport, and landmine and explosive detection.

- North America witnessed military protective eyewear market growth from USD 0.06 Billion in 2023 to USD 0.07 Billion in 2024.

Military protective eyewear is designed to safeguard users' eyes from dirt, sand, airborne objects, and shrapnel when they operate in dangerous environments. To ensure optimal performance, these products must meet or exceed military ballistic standards. Protective eyewear for military personnel must be extremely impact-resistant, optically transparent, properly fitting, and U.S.V. These characteristics encompass safety, environmental resilience, chemical durability, interchangeable lenses, scratch resistance, lightweight design, and longevity.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Innovations in Materials and Heightened Awareness of Eye Safety are Propelling the Military Protective Eyewear Market

As countries enhance their military capabilities and update their weaponry, the demand for advanced protective equipment, including eyewear, continues to grow. The significance of vision in military training and combat has raised awareness about eye safety, highlighting the necessity for comprehensive protection against ultraviolet rays. Innovations in materials and technologies, such as ballistic-resistant lenses, anti-fog coatings, and superior UV protection, have led to the development of military sunglasses that are highly functional and also visually appealing.

The ongoing emphasis on modernization and equipping personnel with state-of-the-art gear is further fueling the demand for premium protective eyewear. Eyewear designed to shield against dust, debris, and intense sunlight is essential for military operations in challenging environments, such as deserts and mountainous regions. These factors collectively contribute to the expansion of the military protective eyewear market share.

MARKET CHALLENGES

High Costs of Advanced Materials and Technologies and Supply Chain Disruptions and Material Sourcing Issues are the Challenges in the Market

Military protective eyewear incorporates sophisticated materials such as ballistic-resistant lenses, polycarbonates, and advanced coatings (anti-fog, UV protection), which significantly increase production costs. These high costs pose a barrier to acquisition, especially for defense procurement budgets that must balance multiple priorities. The integration of cutting-edge features like augmented reality (AR) further escalates expenses, making it difficult to maintain affordability while meeting performance standards.

The military eyewear sector is vulnerable to supply chain disruptions, as critical raw materials like polycarbonate and nylon face shortages and increased global demand. The COVID-19 pandemic exposed these vulnerabilities, causing delays and increased costs in production. Transportation logistics, rising shipping costs, and tariff barriers further complicate timely delivery and scalability of manufacturing operations.

MARKET OPPORTUNITIES

Innovations and Rising Military Adoption of Protective Eyewear are the Latest Market Opportunities

Opportunities for market expansion are expected to emerge from advancements in protective eyewear design and increased adoption by armed forces globally due to regional conflicts and security threats. The demand for military protective eyewear in the defense industry is growing due to a rise in terrorist activities and cross-border gunfire. Civilians sectors, particularly those employed in hazardous settings, are increasingly recognizing the benefits of using military-grade protective eyewear, contributing to broader product expansion.

Advancements in technology for creating and manufacturing military protective eyewear enhance protection against ballistic and various other dangers. The demand for specialized protective eyewear tailored to the specific needs of different armed services continue to rise. The increasing presence of counterfeit products in the global market presents an opportunity for legitimate manufacturers to strengthen their brand value and increase revenue, further boosting the market share of military protective eyewear.

MARKET RESTRAINTS

High Production and Certification Costs are Impacting Market Expansion

The widespread adoption of advanced materials and technologies in military protective eyewear often results in elevated production costs, posing a challenge for defense procurement, especially in defense acquisitions. For manufacturers, obtaining the necessary stringent certifications for environmental safety and ballistic standards is both costly and time-consuming. Despite ongoing improvements, achieving an optimal balance between comfort, visibility, and protection remains difficult, particularly in demanding environments. Additionally, dependence on specific components and raw materials can disrupt production and delivery schedules and strain supply chains. Developers are further challenged by the rapid pace of advancements in technology, struggling to integrate new features into protective eyewear without significantly increasing costs. Collectively, these factors are hindering the growth of the military protective eyewear market.

SEGMENTATION ANALYSIS

By Device

Technological Advancements, Geopolitical Tensions, and Strategic Importance have Driven the Growth of the Tubes or Scopes Segment

By device, the military protective eyewear market is categorized into cameras, goggles, and tubes or scopes.

The tubes or scopes segment leads the market, with numerous optics manufacturers recognizing its growing relevance in modern military operations. For example, Trijicon offers a combination of its ACOG scope with a reflex red sight, while Burris features a 1-4x24 wide-angle riflescope paired with the Fastfire 3 open reflex sight. Leupold’s introduced the "D-Evo," an optical device that integrates 6x and 1x magnification in a compact form, enhancing situational awareness. These innovations have contributed to the segment’s momentum, supporting the global compound annual growth rate (CAGR) of the market in recent years.

By Technology

Due to the Ability to Combining High Detector and Conversion Efficiency in Image Intensifier Boosting the Market Expansion

In terms of technology, the military protective eyewear market is divided into thermal imaging and image intensifier segments.

In 2024, the image intensifier segment accounted for the largest share of the market. The demand for the image intensifier segment within the market is strong and growing steadily. This segment primarily includes night vision devices such as goggles and weapon sights that rely on image intensifier tubes to enhance visibility in low-light conditions. The image intensifier segment in military protective eyewear is experiencing strong demand fueled by rising defense budgets, modernization programs, and the critical need for enhanced night vision capabilities in military operations.

By Application

Technological Advancements in Naval Trackers have led to more Precise Data, which is Boosting Market Growth

By applications, the military protective eyewear market is fragmented into gunner sights, naval trackers, driving sights, and infantry weapon sights.

The naval tracker segment led the market, in terms of revenue, as it delivers precise information on a ship's position and location, surrounding atmospheric pressure, wave intensity, and other critical operational and environmental factors essential for navigation.

MILITARY PROTECTIVE EYEWEAR MARKET REGIONAL OUTLOOK

The global market is segmented, based on region, into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Military Protective Eyewear Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America, particularly the U.S., dominates the market due to its substantial defense budget and ongoing modernization programs. The region's focus on advancing military technology and ensuring high safety standards for troops has led to significant investments in protective eyewear. The U.S. military protective eyewear market is expanding steadily, driven by technological innovation, regulatory support, and rising defense expenditures. The market is characterized by strong competition among key manufacturers and significant demand for advanced, multi-functional protective eyewear to enhance soldier safety and operational effectiveness.

Europe

Europe holds a significant share of the market, driven by defense modernization programs and collaborations among NATO member countries.

European countries are increasingly investing in advanced protective equipment to address emerging threats and enhance soldier safety.

Asia Pacific

The Asia Pacific region is experiencing rapid growth due to rising defense budgets in countries such as China and India, along with regional conflicts and territorial disputes. The demand for protective eyewear is fueled by a growing focus on upgrading military capabilities and increasing procurement of advanced defense equipment.

Rest of the World

In the rest of the world, the Middle East and Africa and Latin America contribute to market growth due to ongoing conflicts and defense investments. Regional military investments and extreme operational conditions drive demand for military protective eyewear.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on R&D Investment to Meet Growing Military Needs

The military protective eyewear market is shaped by several major players who contribute significantly to its growth and dynamics. Companies like BAE Systems (U.S.), FLIR Systems, Inc. (U.S.), Elbit Systems Ltd. (Israel), and others are known for their innovative solutions, strong brand presence, and commitment to safety standards. By investing in research and development, integrating smart technologies, and meeting evolving military needs for enhanced protection and performance, these firms are driving the market forward.

LIST OF KEY MILITARY PROTECTIVE EYEWEAR COMPANIES PROFILED

- BAE Systems (U.S.)

- FLIR Systems, Inc. (U.S.)

- Elbit Systems Ltd. (Israel)

- L3 Technologies, Inc. (U.S.)

- Thales Group (France)

- Bharat Electronics Limited (BEL) (India)

- Harris Corporation (U.S.)

- Meopta (Czech Republic)

- Revision Military (U.S.)

- Oakley, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2024 - Revision Military, a global leader in specialized ballistic eye protection for military and tactical applications, secured a framework contract with the NATO Support and Procurement Agency (NSPA) to supply various high-performance protective eyewear options. Revision, the leading global supplier of ballistic and laser protective military eyewear, offers solutions to major MoDs around the world.

- November 2024 - Gentex Corporation, a global leader in personal protective and situational awareness solutions for military forces, aircrew, emergency responders, and industrial workers, received the United States Air Force Aircrew Laser Eye Protection (ALEP) Night Spectacle contract to create and manufacture its laser protective eyewear for aircrew, known as the Block III Night Spectacle.

- September 2021 - Revision Military received a contract from the Defence Materiel Administration of Sweden for Military Protective Eyewear Systems (MPES) that will be valid for a total of seven (7) years. The agreement was finalized in June 2020, and the first product shipments began reaching Sweden in August 2021.

- June 2021 - Advanced Material Development (AMD) was awarded a contract by the Warfare Technical Support Directorate (IWTSD, previously CTTSO) to create protective films for safety eyewear. The project involves creating laser filtering coatings utilizing AMD's nanomaterial and photonic crystal technologies.

- July 2020 - Gentex Corporation, a worldwide leader in personal protection and situational awareness solutions for defense forces, aircrew, emergency responders, and industrial personnel, has announced that it has been awarded the United States Air Force Aircrew Laser Eye Protection (ALEP) Daytime Spectacle contract to design and manufacture its laser protective eyewear for aircrew, known as the Block III Day Spectacle.

REPORT COVERAGE

The market report offers an in-depth examination of the market, emphasizing crucial elements such as product launches, connections among market participants, and opportunities for growth. Additionally, the research report provides insights into significant market trends, competitive environment, market rivalry, product pricing, market condition, and major industry advancements. Along with the previously mentioned factors, the report includes various direct and indirect elements that have played a role in the expansion of the global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.18% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Device

|

|

By Technology

|

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 0.15 billion in 2024 and is projected to reach USD 0.24 billion by 2032.

Registering a CAGR of 5.18%, the market will exhibit rapid growth during the forecast period.

BAE Systems (U.S.), FLIR Systems, Inc. (U.S.), Elbit Systems Ltd. (Israel), L3 Technologies, Inc. (U.S.), Thales Group (France), and others.

North America dominates the market in terms of share.

Asia Pacific is the fastest growing in the market for the period of 2025-2032.

Innovations in materials and heightened awareness of eye safety are propelling the military protective eyewear market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us