Mobile Biometrics Market Size, Share & Industry Analysis, By Component (Hardware and Software), By Authentication Method (Single-factor Authentication and Multi-factor Authentication), By End-user (BFSI, Government & Public Sector, Retail & E-commerce, Healthcare, Education, Enterprise, and Others), and Regional Forecast, 2026 – 2034

MOBILE BIOMETRICS MARKET SIZE AND FUTURE OUTLOOK

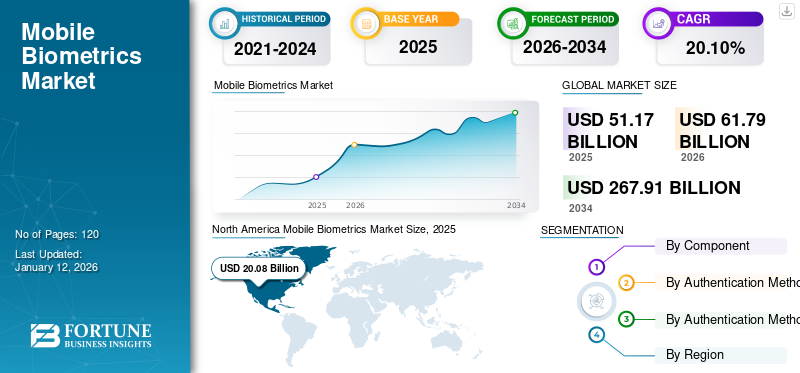

The global mobile biometrics market size was valued at USD 51.17 billion in 2025. The market is projected to grow from USD 61.79 billion in 2026 to USD 267.91 billion by 2034, exhibiting a CAGR of 20.10% during the forecast period. North America dominated the market with a share of 39.20% in 2025.

Mobile biometrics is an approach to multi factor authentication that verifies a person’s identity using mobile biometric devices. It uses biometric authentication methods such as facial recognition, fingerprint recognition, iris scanning, and voice recognition to verify a user’s identity on mobile devices. Governments and businesses are integrating mobile biometrics with IoT devices, connected cars, and smart city infrastructure, allowing secure access control and seamless identity verification.

The market is dominated by established key players, such as NEC Corporation, Nuance Communications, Inc., Aratek, Aware, Inc., and HID Global Corporation. These players focus on partnerships with telecom providers and financial institutions to expand their reach. Many larger firms acquire smaller and more innovative biometric startups to strengthen their businesses worldwide.

The COVID-19 pandemic had a positive impact on the market, as the pandemic fueled digital transformation and prompted a significant shift from traditional cash-based payments to digital payments. Financial institutions and e-commerce sectors implemented biometric-based multi-factor authentication (MFA) to optimize security in online and mobile banking. Additionally, the rise in remote work increased the need for secure authentication methods for accessing corporate networks and sensitive data.

IMPACT OF GENERATIVE AI

Increasing Demand for Enhanced Biometric Accuracy to Aid Market Growth

Generative AI improves facial recognition and voice authentication by learning subtle user-specific patterns, thereby reducing false positives. Generative AI produces artificial biometric data to train more robust models without privacy risks. AI can simulate diverse demographic data to eliminate racial/gender biases in biometric recognition. In biometric-based payments Generative AI enhances fraud detection by analyzing past behaviors. Additionally, generative AI plays a vital role in boosting the speed and efficiency of payment processes. AI-enabled mobile biometric algorithms process authentication quickly in milliseconds. However, the use of AI technology introduces fraud risks such as deepfake-based spoofing. The future will require maintaining a balanced approach between leveraging AI for stronger authentication and ensuring robust anti-spoofing mechanisms and ethical AI governance.

- For instance, in April 2024, HID Global partnered with ASSA ABLOY to enhance the airport experience by pairing self-service gate control with AI-powered facial recognition to modernize the passenger experience.

USE CASE ANALYSIS

Use Case 1: Border Control and National ID Programs

Mobile biometric solutions (e.g., facial, fingerprint, and iris recognition) are widely used for border entry and exit verification. National identity programs also integrate mobile-based biometrics for secure citizen identification. For instance, the U.S. Customs and Border Protection uses mobile facial recognition for entry and exit checks at airports. Thus, the integration of mobile facial recognition at airports helps to improve national security and speed up the immigration process.

Use Case 2: Patient Identification and Secure Health Data Access

Facial and fingerprint recognition method is used to authenticate patients during telehealth sessions and hospital visits. Healthcare providers use biometric verification to access patient records securely via mobile devices. For instance, Cerner integrates facial recognition to enhance security in telehealth consultation. Adoption of Facial and fingerprint recognition methods improves patient data privacy and reduces identity theft in healthcare.

MARKET DYNAMICS

Market Drivers

Rising Security Concerns Over Data Breaches Drive the Adoption of Mobile Biometrics

Businesses are increasingly using biometric access control systems to prevent unauthorized entry into highly sensitive areas. Many governments have implemented biometric passports and national ID systems for secure identity verification.

- For instance, the U.S. Transportation Security Administration (TSA) PreCheck & India’s Aadhaar systems use biometric authentication for security screening.

Traditional passwords are easily hacked, which leads to a rise in the adoption of biometric authentication methods in smartphones, banking apps, and enterprise security. Android’s fingerprint authentication and Apple’s Face ID & Touch ID replace traditional password-based authentication methods to prevent unauthorized access. Furthermore, digital wallets such as (Google Pay and Apple Pay) and banking apps use fingerprint and facial recognition methods for secure transactions. Regulations such as Payment Services Directive Two (PSD2) (EU) require multi-factor authentication, inspiring banks to implement biometric methods to protect and secure their customers’ important data from cybercriminals.

- For instance, banks such as Citibank and HSBC use voice recognition AI technology to verify customers and detect fraudsters.

Market Restraints

High Implementation and Hardware Costs May Hinder Market Growth

Technologically advanced biometric solutions, such as 3D facial recognition and ultrasonic fingerprint scanners require costly components. The need for expensive biometric software and sensors increases mobile device manufacturing costs. Furthermore, organizations implementing biometric authentication methods in access control systems, mobile banking apps, or IoT devices face high upfront costs for infrastructure upgrades and compliance. Additionally, businesses with outdated IT systems that do not support biometric authentication methods, requires high investment for system renovations. This puts an additional financial burden on small and medium-sized enterprises, as they have limited budgets for infrastructure upgradation. Thus, these cost-related factors are expected to hinder market growth.

Market Opportunities

Increasing Adoption of Mobile Biometrics in Government Initiatives Presents Lucrative Opportunities for Market Growth

Many governments worldwide are implementing biometric-based identification systems for border control, national identification programs, and law enforcement boosting the demand for biometric solutions. Mobile biometrics improve online tax filing, healthcare access, and voting systems and reduce fraud activities.

- For instance, India’s Aadhaar system is the world’s largest biometric identification system with fingerprint readers and iris recognition for over 1.4 billion citizens.

- Furthermore, European digital identity (EUDI Wallet) uses biometrics to secure access to government and financial services.

In addition, governments use mobile biometrics for border control and contactless passport verification. Police departments implement mobile fingerprint scanners and facial recognition for real-time criminal identification. Governments integrate biometrics into public services, smart city surveillance, and transportation. Additionally, this biometric authentication technology is used for contactless payments in metros and buses to improve security and traveling experience for passengers.

- For instance, China’s Smart City Projects use AI-powered facial recognition for public security and cashless payments. Additionally, Dubai Metro implements facial recognition for ticketless entry.

Mobile Biometrics Market Trends

Rapid Adoption of IoT Devices is Fueling Market Growth

As IoT expands into healthcare, banking, smart homes, and industrial applications, biometric authentication is becoming the preferred method for securing connected devices. Integration of mobile biometrics into IoT-powered smart devices prevents unauthorized access. Smartwatches and fitness bands use voice, fingerprint, and heart-rate-based biometrics for authentication. For instance, Samsung Galaxy Watch and Apple Watch use biometrics for device unlocking and secure mobile payments. Furthermore, Amazon Ring and Google Nest incorporate facial recognition to improve smart home security. Thus, these factors play a crucial role in fueling mobile biometrics market growth.

- For instance, in March 2024, HID Global and Imprivata engaged in a partnership to develop healthcare biometric kiosks. The product uses biometrics to identify duplicate accounts, perform patient identification, and secure the healthcare system.

SEGMENTATION ANALYSIS

By Component

Rising Need for Higher Security and Faster Authentication Boosted the Hardware Segment Growth

Based on component, the market is bifurcated into hardware and software.

Hardware captured the largest market share of 64.24% in 2026. Physical biometric sensors are more difficult to spoof than software-based authentication, providing a higher level of security. Hardware-based biometric processing confirms instant verification, making it a preferred choice of applications in healthcare, banking, smartphones, and IoT. As AI, 5G, and blockchain technologies continue to evolve, biometric hardware is expected to become more accurate, secure, and seamlessly integrated into daily life.

Software is anticipated to grow at the highest CAGR during the forecast period, driven by AI advancements that improve biometric matching accuracy. AI-enabled biometric software protects from deepfake, spoofing, and hacking attacks. Additionally, seamless integration with IoT & cloud-based software allows biometric authentication across wearables, smartphones, and connected devices, further expanding its adoption.

By Authentication Method

Increasing Demand for Strong Protection Against Hacking Boosted the Popularity of Multi-factor Authentication Segment

Based on authentication method, the market is divided into single-factor authentication and multi-factor authentication.

Multi-factor authentication captured the largest market share in 2024 and it is expected to continue its dominance by growing at the highest CAGR during the forecast period. Combining biometric authentication with a personal identification number (PIN), password, or one-time password (OTP,) reduces the risk of unauthorized access. Furthermore, AI-based liveness detection, behavioral biometrics, and encryption enhance fraud detection, making multi-factor authentication a crucial component in providing enhanced security and fraud prevention in biometric authentication. The segment is expected to capture a share of 78.15% in 2026, exhibiting a CAGR of 22.30% during the forecast period.

Single-factor authentication is expected to grow at a moderate CAGR in the coming years, as it allows users to unlock devices or access apps with just a fingerprint, facial scan, or voice recognition. This method eliminates the need to remember complex passwords or use multiple verification steps, providing a faster and more convenient user experience for accessing apps, files, or data.

By End-user

To know how our report can help streamline your business, Speak to Analyst

Surge in Demand for Simplified Mobile Banking Encouraged the BFSI Segment Growth

Based on end-user, the market is classified into BFSI, government & public sector, retail & e-commerce, healthcare, education, enterprise, and others (travel & immigration).

BFSI captured the highest market share in 2024, as biometric authentication eliminates the need for passwords in banking applications. Customers can securely access banking apps without remembering complex login credentials. Biometrics helps customers for fast and secure digital payments using mobile banking apps such as Apple Pay, Google Pay, and others, significantly enhancing customer experience in BFSI sector. The segment is expected to capture 26.29% of the market share in 2026.

Healthcare is anticipated to grow at the highest CAGR of 24.70% during the forecast period. It prevents duplicate medical records and identity fraud by verifying patients accurately. Biometric verification makes sure that only authorized users can access sensitive patient data. Additionally, biometric authentication secures patient data on smartwatches and fitness trackers, further improving healthcare data security.

MOBILE BIOMETRICS MARKET REGIONAL OUTLOOK

Based on the region, the market is studied across North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America

North America Mobile Biometrics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest mobile biometrics market share with a valuation of USD 20.08 billion in 2025 and USD 23.79 billion in 2026, owing to technological advancements, increasing security concerns, and the rise of digital services. Increasing incidents of identity theft, fraud, and data breaches have boosted the need for secure authentication methods.

- For instance, according to an Experian study, the Federal Trade Commission (FTC) registered over 1 million identity theft reports in 2023. Additionally, more than 2.6 million fraud related-cases were reported, with a total losses exceeding USD 10.3 billion.

Tech companies and financial institutions have adopted mobile biometrics to improve user verification and avoid unauthorized access. Leading smartphone manufacturers, such as Apple and Samsung, have integrated biometric sensors such as (Face ID and Touch ID) into their devices. Over 90% of smartphones sold in North America have built-in fingerprint scanners and facial recognition technology, further driving market growth in the region. The U.S. market is foreseen to grow with a valuation of USD 16.47 billion in 2026.

Download Free sample to learn more about this report.

Financial institutions in the U.S. such as Bank of America and JPMorgan Chase use facial and fingerprint recognition authentication methods for secure login and transaction verification. Over 75% of major banks in the U.S. use biometric authentication for customer login and transaction approval. Digital wallet providers such as PayPal and Venom have also adopted biometric verification to secure payments. These factors play an important role in fueling market growth across the U.S.

South America

The adoption of biometrics is growing significantly in South America, driven by an increase in government-led identity programs. Brazil and Argentina have introduced national ID systems that use biometric data for verification. Biometric passports and voter registration systems incorporating facial and fingerprint recognition are widely adopted. Additionally, over 70% of South American banks have adopted mobile-based fingerprint and facial recognition for customer authentication. Furthermore, mobile payment platforms are rapidly integrating biometric verification methods to enhance security and prevent fraud.

Europe

Europe is the third leading region, anticipated to stand at USD 13.85 billion in 2026. In Europe, the market is growing at a prominent pace. The region has one of the highest smartphone penetration rates globally, with over 85% of the population using smartphones enabled with fingerprint and facial recognition technology. The U.K. market is expanding and is anticipated to be valued at USD 2.63 billion in 2026. Leading smartphone brands such as Apple, Samsung, and Huawei dominate the European market with in-built biometric authentication features. Countries such as Germany, Sweden, and Estonia have implemented national identification systems that incorporate biometric authentication for online access to public services. Moreover, hospitals in Germany and the U.K. are using biometric-based mobile apps for patient identity verification and secure medical record access. The UK National Health Services (NHA) is testing facial recognition for secure patient logins. Germany is set to reach USD 2.57 billion in 2026, while France is estimated to hit USD 1.88 billion in the same year.

Middle East & Africa

The Middle East & Africa (MEA) is the fourth leading region, likely to reach a market value of USD 4.57 billion in 2026,expected to showcase noteworthy growth during the forecast period. Mobile phone usage is significantly increasing across MEA, with smartphone penetration rates exceeding 70% in major countries such as Saudi Arabia, UAE, and South Africa. National ID programs using biometrics have been introduced in countries such as the UAE (Emirates ID), Saudi Arabia, and South Africa. The GCC market is projected to reach a value of USD 1.16 billion in 2025. Additionally, biometric e-passports and mobile-based verification methods are rapidly used across the region to access government services. For instance,

- In March 2023, Aware, Inc. partnered with Uqoud, a provider of contract management platform, based in the Middle East. Through this collaboration, the company aimed to integrate Knomi, its mobile biometric authentication framework, into the Uqoud platform.

Asia Pacific

Asia Pacific is is the second largest market, expected to hit USD 16.07 billion in 2026 and is expected to grow at the highest CAGR of 26.20% during the forecast period (2025-2032). Asia Pacific is the leading region in the world to have the largest number of smartphone users, with over 1.5 billion smartphone users in China and India alone. China is estimated to reach a value of USD 3.77 billion in 2026. Major smartphone manufacturers such as Samsung, Xiaomi, Vivo, and Oppo offer in-built biometric authentication at various price points. Governments are increasingly implementing biometric solutions for various applications. China has adopted facial recognition for border control and public surveillance. Japan and South Korea use mobile-based biometric verification for airport security and visa processing. These factors are expected to fuel market growth across the region. India is set to be valued at USD 2.48 billion in 2026, while France is likely to stand at USD 2.67 billion in the same year.

- For instance, in November 2023, NEC Corporation partnered with Mastercard to use its face recognition and liveness verification technology into Mastercard’s payment systems to enhance customer experience. This new biometric payment method helps customers in the Asia Pacific region to provide secure and easy checkout experiences.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Players Are Focusing on Partnership and Acquisition Strategies to Expand Their Customer Base

Key players are focusing on expanding their global geographical presence by presenting industry-specific services. Major players are strategically focusing on acquisitions and collaborations with regional players to maintain dominance across regions. Top market participants are launching new solutions and implementing strategic initiatives to sustain their competitiveness and increase their consumer base. Increasing R&D investments by key players for product innovations is also enhancing market expansion.

List of Key Mobile Biometrics Companies Profiled:

- Aratek (Taiwan)

- Aware, Inc. (U.S.)

- M2SYS Technology (U.S.)

- Precise Biometrics (Sweden)

- Nuance Communications, Inc. (U.S.)

- Safran SA (France)

- NEC Corporation (Japan)

- HID Global Corporation (U.S.)

- Applied Recognition, Inc. (Canada)

- CardLogix Corporation (U.S.)

- Parsons Corporation (U.S.)

- 3M Congent, Inc. (U.S.)

- Mobile-Technologies (U.S.)

- BIO-key (U.S.)

- EyeVerify, Inc. (U.S.)

- Integrated Biometrics (U.S.)

- Crossmatch (U.S.)

- Secunet Security Networks AG (Germany)

- iProov (U.K.)

- Veridium (U.K.)

….and more

KEY INDUSTRY DEVELOPMENTS:

January 2025: Xiaomi, a consumer electronics company launched a novel Mijia Smart Safe Box. Xiaomi used Precise Biometrics’ fingerprint authentication algorithm as one of the unlocking methods in the Mijia Smart Safe Box.

September 2024: Precise Biometrics launched an embedded version of its BioLive biometric authentication solution for various mobile devices, such as smart devices, laptops, and vehicles. BioLive is developed to reduce the risk of unauthorized access and identity theft.

September 2024: NEC Corporation unveiled a new biometric system, that uses facial recognition to verify customers’ identities even while they are moving. This authentication method is helpful for crowded places such as retail stores and airports.

July 2024: Aratek partnered with Dialtronics, an Indian-based company with an aim to enhance the authentication system for inmates in India with its technologically advanced biometric hardware and software.

May 2022: Mastercard launched a biometric checkout program called ‘Pay by Smile’ which utilizes facial recognition for payment authentication. The company initiated this payment method in Brazil in collaboration with Payface and St Marche to enhance the checkout experience.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Demand for under-display and side-mounted fingerprint sensors is rising. Key players operating in the market, such as Aratek, Aware, Inc., NEC Corporation, Nuance Communications, Inc., Parsons Corporation, and HID Global Corporation are increasingly integrating 3D facial recognition in smartphones and security systems. Apple (Face ID), Samsung, Sony, and other players are investing in next-gen facial recognition technology. Apple dominates facial recognition through face ID technology and Samsung Electronics dominates in fingerprint and facial recognition technology.

Moreover, increasing smartphone adoption, especially in emerging economies, and the rise of 5G improve biometric functionality and real-time identity verification. Investors who are prominently focusing on innovation, partnerships, and market expansion are likely to benefit from the long-term growth of the market. These factors are expected to create a lucrative opportunity for the market growth. For instance,

- In October 2024, Parsons Corporation was sponsored by the U.S. Army with an amount of nearly USD 2 million. This amount will help the company in acquiring biometric static and mobile devices.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 20.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Authentication Method

By End-user

By Region

|

|

Companies Profiled in the Report |

Aratek (Taiwan), Aware, Inc. (U.S.), M2SYS Technology (U.S.), Precise Biometrics (Sweden), Nuance Communications, Inc. (U.S.), Safran SA (France), NEC Corporation (Japan), HID Global Corporation (U.S.), Applied Recognition, Inc. (Canada), CardLogix Corporation (U.S.), etc. |

Frequently Asked Questions

The market is expected to reach USD 267.91 billion by 2034.

In 2025, the market was valued at USD 51.17 billion.

The market is projected to grow at a CAGR of 20.10% during the forecast period.

By authentication method, multi-factor authentication segment led the market.

Rising security concerns over data breaches is a key factor driving the growth of the market.

Aratek, Aware, Inc., M2SYS Technology, Precise Biometrics, Nuance Communications, Inc., Safran SA, NEC Corporation, HID Global Corporation, Applied Recognition, Inc., and CardLogix Corporation are the top players in the market.

North America held the highest market share.

By end-user, BFSI held the highest market share in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us