Monolithic Microwave IC Market Size, Share & Industry Analysis, By Component (Power Amplifiers, Low Noise Amps, Mixers, Switches, Phase Shifters, Attenuators, Oscillators/VCOs, and Others), By Technology (Gallium Arsenide (GaAs), Gallium Nitride (GaN), Silicon Germanium (SiGe), Indium Phosphide (InP), Silicon CMOS, and Others ), By Frequency Band (<10 GHz, 10–20 GHz, 20–40 GHz, >40 GHz, and Others), By Application (Telecommunications, Automotive, Aerospace & Defense, Consumer Electronics, Satellite Communications, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

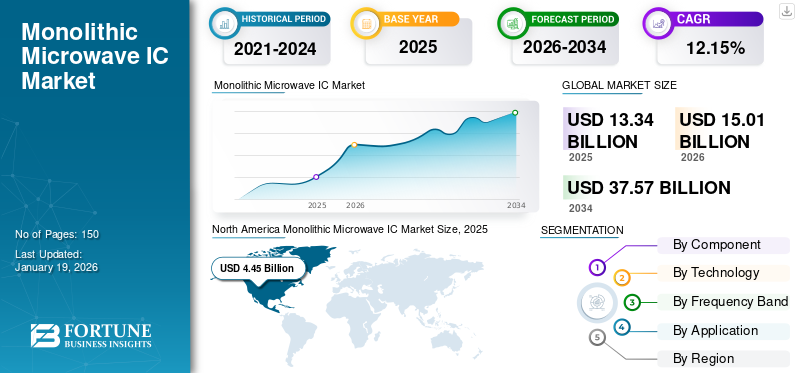

The global monolithic microwave IC market size was valued at USD 13.34 billion in 2025. The market is projected to grow from USD 15.01 billion in 2026 to USD 37.57 billion by 2034, exhibiting a CAGR of 12.15% during the forecast period. North America dominated the monolithic microwave IC market with a market share of 33.34% in 2025.

The Monolithic Microwave Integrated Circuit (MMIC) market focuses on designing and producing compact integrated circuits operating in the microwave frequency range. These mini circuits are widely used in telecommunications, advanced driver assistance systems (ADAS), aerospace & defense, consumer electronics, satellite communications, etc. The market is driven by increasing demand for high-speed data transmission, 5G and millimeter-wave technologies advancements, and continuous investments in research and development in aerospace and defense modernization programs.

- For instance, Capgemini's report emphasizes digital continuity as a critical factor in driving business transformation within the aerospace and defense sector, with 80% of leaders recognizing it as a competitive advantage. Investments in digital continuity initiatives are expected to grow from 2.1% of annual revenue in 2024 to 3.4% by 2028.

The COVID-19 pandemic caused remarkable disruptions in the market, impacting supply chains and reducing demand in specific sectors. However, the market demonstrated recovery, driven by amplified demand in communications and aerospace & defense applications. Qorvo, Inc., MACOM Technology Solutions, Skyworks Solutions, Inc., NXP Semiconductors, Infineon Technologies AG, Texas Instruments Incorporated, Mini-Circuits, Keysight Technologies, VectraWave, and STMicroelectronics NV are the key players in the market.

IMPACT OF RECIPROCAL TARIFFS

The introduction of reciprocal tariffs has affected the market, specifically for companies dependent on international supply chains. Higher tariffs on necessary raw materials and components have increased end-user production costs. This has pressured the MMIC manufacturers to adapt to increased expenses while focusing on maintaining profitability. Moreover, reciprocal tariffs have encouraged companies to modify their sourcing strategies to minimize the financial impact. In response, some manufacturers are shifting production to regions with more favorable trade conditions. These trade obstacles have also introduced uncertainties in market projections, possibly delaying product launches and causing disruptions in supply chains.

MONOLITHIC MICROWAVE IC MARKET TRENDS

Increasing Adoption of GaN-based Devices Fuels Market Growth

The increasing adoption of GaN-based devices significantly fuels the growth of the market. GaN technology performs superior to traditional semiconductor materials, particularly in high power density, energy efficiency, and thermal stability. Thus, monolithic microwave ICs based on GaN are becoming integral to communications and aerospace & defense applications, where power efficiency and miniaturization are critical.

This trend is further driven by the growing demand for advanced communication systems, such as 5G networks, which require high-performance RF devices. GaN-based MMICs enable enhanced signal amplification and lower energy consumption, making them smart mobile infrastructure choices. The ongoing technological advancements and increased investment in GaN research and development are poised for the continued expansion of the market.

- For instance, in November 2024, MACOM Technology Solutions Holdings, Inc. obtained ENGIN-IC, Inc., a fabless designer of advanced GaN MMICs and microwave assemblies based in Plano, Texas, and San Diego, California. This acquisition will enhance MACOM’s design capabilities and support its strategic expansion in key target markets.

MARKET DYNAMICS

Market Drivers

5G Technology Adoption Drives Demand for MMIC Technology in High-Performance Communication Systems

The increasing adoption of 5G technology drives the monolithic microwave IC market growth. For instance,

- According to 5G Americas, the global wireless telecommunications sector reached a significant landmark in 2024, with 5G connections totaling 2.25 billion globally.

Monolithic microwave ICs are crucial for efficient signal processing and amplification to meet the high-frequency and high-speed requirements of 5G networks. Their ability to integrate multiple functions into a single chip provides a compact, high-performance solution that aligns with the space and power demands of 5G infrastructure.

The broader expansion of next-generation wireless communication systems, such as IoT and industrial applications, further drives demand for monolithic microwave ICs. These systems require advanced RF components to ensure reliable connectivity and data transmission. Therefore, the growing demand for faster and more efficient wireless communication across industries makes them essential for future communication technologies.

Market Restraints

High Production Costs and Design Complexities Restrain Market Growth

The intricate fabrication process and reliance on specialized equipment for GaN-based monolithic microwave IC production result in higher manufacturing costs. This factor can limit product adoption in price-sensitive sectors, as smaller companies or those in emerging markets may face challenges competing with well-established players. Moreover, the complexity of design and testing intensifies with the rise in demand for monolithic microwave ICs in high-performance sectors such as communications and aerospace & defense. This restraining factor leads to longer development cycles and higher costs for specific applications. Therefore, the manufacturing and technical challenges and high initial investments pose substantial challenges for the market.

Market Opportunities

Rising Demand for Satellite Communication Systems Creates Market Opportunities

The growing demand for satellite communication systems creates a substantial opportunity for the market. The need for high-performance RF components is rising due to the increasing reliance on satellite-based services such as broadband internet, television broadcasting, and earth observation. These ICs can operate at high frequencies and handle large data transmissions efficiently, which is crucial for supporting the advanced capabilities required by modern satellite communication networks.

Expanding next-generation satellite constellations, such as Low Earth Orbit (LEO) networks, will drive the demand for monolithic microwave ICs. For instance,

- In July 2025, Sateliot selected Alén Space to manufacture five satellites for its LEO network, scheduled for launch in 2026. This development strengthens Sateliot's position as a dual-use 5G satellite connectivity operator, supporting both civilian and defense applications in alignment with Europe's space autonomy strategy.

These systems require smaller, more efficient, cost-effective components to maintain seamless communication and high reliability. Therefore, the widespread adoption of complex satellite communication systems increases the demand for these ICs, creating significant growth prospects for the market.

SEGMENTATION ANALYSIS

By Component

Power Amplifiers Dominate Due to Their Crucial Role in High-Performance Communication Systems

Based on component, the market is divided into power amplifiers, low noise amps, mixers, switches, phase shifters, attenuators, oscillators/VCOs, and others.

The Power Amplifiers segment will account for 35.41% market share in 2026. Power amplifiers lead the market share by boosting signal strength for high-performance communication systems, including 5G and radar. Their demand is expected to grow at the highest CAGR as the need for faster, more reliable communication systems rises.

The others’ segment holds the second-largest share in the market, as it encompasses components such as low-noise amplifiers and mixers, which are critical in various applications. These components are vital for the functionality and performance of telecommunications, aerospace & defense systems.

By Technology

GaAs Leads Market Due to Its Proven Reliability and Efficiency in High-Frequency Applications

Based on technology, the market is divided into Gallium Arsenide (GaAs), Gallium Nitride (GaN), Silicon Germanium (SiGe), Indium Phosphide (InP), Silicon CMOS, and others.

The Gallium Arsenide (GaAs) segment is projected to dominate the market with a share of 35.12% in 2026. Gallium Arsenide (GaAs) dominates the market due to its proven reliability and efficiency in high-frequency applications such as telecommunications and aerospace & defense. It remains the preferred material for RF and microwave components in medium power systems.

Gallium Nitride (GaN) is expected to experience the highest CAGR in the market, driven by its superior power efficiency, thermal stability, and ability to handle higher frequencies. These advantages make GaN ideal for emerging applications such as satellite communications and radar systems.

By Frequency Band

<10 GHz Frequency Band Leads, Owing to Its Versatility in Wireless Communications and Satellite Systems

On the basis of frequency band, the market is categorized into <10 GHz, 10–20 GHz, 20–40 GHz, >40 GHz, and others.

The <10 GHz Frequency Band segment is anticipated to hold a dominant market share of 32.58% in 2026. The <10 GHz frequency band leads the market due to its widespread use in wireless communications, Wi-Fi, and satellite systems, where lower frequencies are sufficient for reliable transmission. Its flexibility across various applications ensures its continued segmental dominance.

The >40 GHz frequency band is expected to see the highest CAGR due to rising demand for high-speed communication systems such as 5G and future 6G technologies. This frequency range is also critical for next-generation radar systems and space communications.

By Application

To know how our report can help streamline your business, Speak to Analyst

Telecommunications Segment Holds Largest Share Due to Expansion of 4G, 5G, and 6G Networks

Based on application, the market is divided into telecommunications, automotive, aerospace & defense, consumer electronics, satellite communications, and others.

The Telecommunications segment is anticipated to hold a dominant market share of 36.14% in 2026. Telecommunications holds the largest monolithic microwave IC market share, driven by the rapid deployment of 4G, 5G, and upcoming 6G networks that rely on these ICs for signal processing. This sector continues to lead due to the growing demand for mobile data and connectivity.

Automotive is projected to grow at the highest CAGR in the market, owing to the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicle technologies. These ICs are crucial in radar, Lidar, and other sensing systems for next-generation automotive applications.

MONOLITHIC MICROWAVE IC MARKET REGIONAL OUTLOOK

The market is categorized by region into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America Monolithic Microwave IC Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 4.45 billion in 2025 and USD 4.96 billion in 2026. North America leads the market due to the concentration of major technology companies and substantial investments in telecommunications, defense, and aerospace sectors. The rapid deployment of 5G networks and advancements in satellite communications, radar, and electronic warfare continue to fuel demand for monolithic microwave ICs in the region. Additionally, the strong presence of established manufacturers in the U.S. and continuous innovation in commercial and military applications contribute to the region's dominant position in the market. The U.S. market is valued at USD 2.9 billion by 2026.

Download Free sample to learn more about this report.

Asia Pacific

Asia Pacific is expected to experience the highest CAGR in the market, driven by the rapid adoption of 5G networks, increasing investments in defense, and the growing demand for IoT applications. Countries, for instance, China, Japan, and South Korea, dominate in developing next-generation wireless infrastructure and consumer electronics, boosting the demand for these ICs. Furthermore, the region's robust semiconductor industry and government-led initiatives supporting 5G deployment are key factors in accelerating the market growth. The Japan market is valued at USD 1.15 billion by 2026, the China market is valued at USD 1.43 billion by 2026, and the India market is valued at USD 0.94 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe holds a significant market share due to its strong aerospace, defense, and telecommunications presence. The continuous development of 5G networks and increased investments in high-frequency technologies drive demand for monolithic microwave ICs in various applications. Europe's leadership in satellite communications through organizations including the European Space Agency further increases the demand for MMIC components, strengthening its prominent position in the market. The UK market is valued at USD 0.73 billion by 2026, while the Germany market is valued at USD 0.63 billion by 2026.

Middle East & Africa and South America

The Middle East & Africa region is expected to have the second-highest CAGR in the market, driven by increasing investments in telecommunications infrastructure, defense modernization, and satellite communication technologies. However, South America is expected to grow slowly due to economic challenges, limited infrastructure development, and a slower adoption of advanced technologies, which may hinder the region's market growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Launch New Products to Strengthen Market Positioning

Key players launch new product portfolios to enhance their market positioning by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches help companies maintain and grow their market share in a rapidly evolving industry.

Long List of Monolithic Microwave IC Companies Studied

- Qorvo, Inc. (U.S.)

- MACOM Technology Solutions (U.S.)

- Skyworks Solutions, Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Infineon Technologies AG (Germany)

- Texas Instruments Incorporated (U.S.)

- Mini-Circuits (U.S.)

- Keysight Technologies (U.S.)

- VectraWave (France)

- STMicroelectronics NV (Switzerland)

- Renesas Electronics Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Murata Manufacturing Co., Ltd. (Japan)

- Broadcom, Inc. (U.S.)

- WIN Semiconductors (Taiwan)

- United Monolithic Semiconductors (Germany)

- And more...

KEY INDUSTRY DEVELOPMENTS

- In June 2025, Mini-Circuits launched a portfolio of 76 AEC-Q200 qualified RF and microwave components for automotive applications. The range, part of the µCeramIQ product line, includes filters, 90° hybrids, and splitters, and is featured on a newly dedicated section of the company’s website.

- In June 2025, Texas Instruments announced plans to invest over USD 60 billion in developing and expanding semiconductor manufacturing facilities across the U.S. The initiative will focus on seven sites in Texas and Utah, with an estimated creation of 60,000 new jobs.

- In May 2025, MACOM Technology Solutions Inc. presented its high-performance RF, microwave, and mmWave solutions at IMS 2025. The company’s experts conducted technical presentations to highlight the performance benefits of its offerings throughout the event.

- In February 2025, Keysight Technologies, Inc., enhanced its RF and microwave instrument portfolio with new signal generators, synthesizers, and analyzers. These additions support compact single- and multi-channel testing solutions for component and device characterization up to 54 GHz.

- In February 2025, the OPTIREG PMIC portfolio provided efficient voltage regulation through integrated DC/DC and linear regulators with tracking capabilities. It also includes monitoring and control features to support the design of automotive ECUs for safety-related applications.

REPORT COVERAGE

The market report focuses on key aspects such as leading companies, product/service types, and product applications. Besides, the report offers insights into the market trend analysis and highlights vital industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years. The market segmentation is mentioned below:

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Unit |

Value (USD Billion) |

|

|

Growth Rate |

CAGR of 12.15% from 2026 to 2034 |

|

|

Segmentation |

By Component

By Technology

By Frequency Band

By Application

By Region

|

|

|

Companies Profiled in the Report |

|

|

Frequently Asked Questions

The market is projected to reach USD 37.57 billion by 2034.

In 2025, the market size stood at USD 13.34 billion.

The market is projected to grow at a CAGR of 12.15% during the forecast period.

Telecommunications is the leading application segment in the market.

Surging demand for 5G and next-gen wireless networks drives the market.

Qorvo, Inc., MACOM Technology Solutions, Skyworks Solutions, Inc., and NXP Semiconductors are the top players in the market.

North America holds the highest market share.

Asia Pacific is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us