Multi-mode Receiver Market Size, Share & Industry Analysis, By Platform (Fixed Wing and Rotary Wing), By Fit Type (Line-fit and Retrofit), By Application (Landing and Navigation & Positioning), By End-use (Commercial Aviation, General Aviation, Military Aviation, and Unmanned Aerial Systems (UAS) / Drones), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

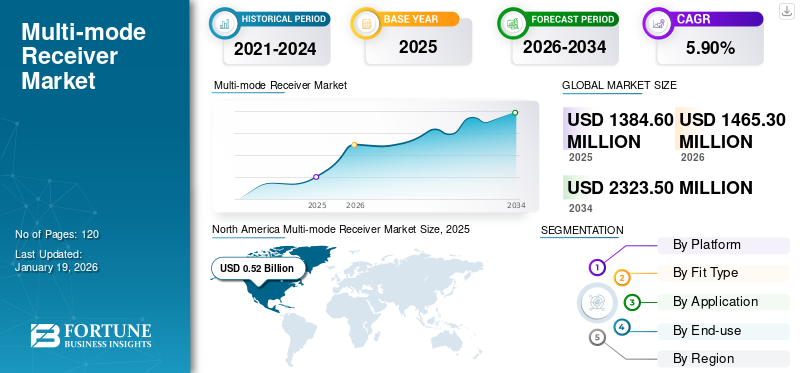

The global multi-mode receiver market size was valued at USD 1.38 billion in 2025 and is projected to grow from USD 1.46 billion in 2026 to USD 2.32 billion by 2034, exhibiting a CAGR of 5.90% during the forecast period. North America dominated the global market with a share of 37.90% in 2025.

A multi-mode receiver (MMR) is an advanced navigation and communication system used in aviation and some other military-related fields. MMR is developed to function across different radio frequencies and signals, and brings together a range of communications and navigation systems in a single unit. This flexibility also enables the exploitation and processing of signals from a diverse set of sources and reliable operation over a broad range of mission environments, including manned and unmanned aircraft.

MMRs combine various navigation and communication functions into one receiver, requiring fewer separate units. This results in lower installation, maintenance costs, and minimizes aircraft weight. Thus, it is considered a major driving factor for market growth in military and commercial aviation.

The market is dominated by established key players, such as Thales Group, Rockwell Collins, Inc., BAE Systems PLC, Leonardo SPA, and Saab AB. These players focus on investing in research and development to create cutting-edge MMR products integrated with novel technologies such as AI, IoT, and 5G. These factors are anticipated to fuel the market growth across the globe.

IMPACT OF RECIPROCAL TARIFF

The impact of reciprocal tariffs has negatively affected the market growth. The tariff rates impacted supply chain dynamics, cost structures, and market growth trajectories. The rise in component costs has forced MMR manufacturers to look for alternatives, such as reassessing their supply chains and shifting their manufacturing facilities to countries that have the lowest tariff rates. Thus, it may result in slowing the market growth.

IMPACT OF GENERATIVE AI

Growing Demand for Signal Processing and Noise Reduction Fuels Market Growth

MMR is continuing to evolve in the aerospace and defense sector. The integration of generative AI’s capabilities into MMR offers transformative potential. Generative AI uses its algorithms, such as Variational Autoencoders (VAEs) and GANs (Generative Adversarial Networks), to identify complex channel distributions and enhance accuracy in dynamic environments. Further, to improve signal efficiency, generative AI creates artificial data to train models for noise reduction and offering enhanced signal clarity.

Moreover, Gen AI helps to identify uncommon patterns and indicate potential security breaches in communication signals in advance. Thus, these factors play a vital role in boosting the market growth.

MARKET DYNAMICS

Market Drivers

Rising Air Traffic and Demand for Precision Landing Drive Market Growth

The global aviation industry is observing a significant increase in passenger numbers. Owing to this factor, air traffic necessitates the use of modern systems for navigation in order to guarantee safe and efficient flights.

- For instance, the International Air Transport Association (IATA) anticipated that global passenger traffic is expected to reach approximately 5 billion in 2025.

With the growing number of air traffic, the need for precision landing systems becomes more important to ensure the safety of flights, especially in low-visibility conditions. Multi-mode receivers have a pivotal function in precision landing, especially in adverse weather conditions and crowded airspace. For instance,

- The Federal Aviation Administration (FAA) allocates over USD 3 billion annually for airport upgrades, including landing gear infrastructure.

Thus, increasing adoption of advanced navigation systems in airport infrastructure is propelling the growth of MMRs in commercial and defense aviation. Thus, these factors play an important role in fueling the market growth.

Market Restraints

High Initial Cost of Implementation May Hinder Market Growth

Multi-mode receiver integrates multiple navigational aids, such as Global Navigation Satellite System (GNSS), Instrument Landing System (ILS), and microwave landing system (MLS) into a single unit, which requires advanced technology and manufacturing processes. Thus, this integration of advanced technologies increases MMRs’ production cost of which makes them more expensive than traditional navigation systems.

Also, retrofitting older aircraft with the MMR system would be a very costly process for commercial airlines with existing fleets, as the process involves massive investments in terms of labor, maintenance, and downtime for aircraft. Thus, higher manufacturing costs may act as a barrier to market growth.

Market Opportunities

Increasing Demand for Technological Advancements May Create Lucrative Market Opportunities

The development of Global Navigation Satellite Systems (GNSS) is expanding the capabilities of satellite navigation. The integration of Satellite-Based Augmentation Systems (SBAS) technology improves the reliability and accuracy of GNSS signals, which is important for high-precision applications.

Further, governments across the world are investing in satellite navigation infrastructure, which supports the growth of the global multi-mode receiver market.

- For instance, the European Union has invested massively in the Galileo program, with a budget of approximately USD 15 billion for the 2021 to 2027 period.

Thus, this factor is expected to fuel the market growth during the forecast period.

Multi-Mode Receiver Market Trends

Increasing Spoofing/Jamming Incidents are Driving the Adoption of Anti-Jam Capable Receivers

Global Navigation Satellite Systems (GNSS), including GPS, Galileo, and other technologically advanced systems, are important to provide positioning and navigation services to various industries. However, dependence on GNSS leads to spoofing and jamming attacks.

- For instance, according to the U.S. Department of Homeland Security (DHS), between 2018-2023, the number of reported GNSS interference incidents in the U.S. tripled during this period, which severely impacted the airport sector.

To overcome this issue, OEMs started shifting towards the adoption of anti-jam capable GNSS receivers to tackle vulnerable spoofing and jamming attacks effectively. These next-generation MMRs incorporate a range of technologies to detect, mitigate, and recover from spoofing incidents. Thus, these factors play a crucial role in fueling the multi-mode receiver market growth during the forecast period.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Platform

Rising Demand for Long-Range Navigation and Precision Boosts the Adoption of Fixed Wing Aircraft

Based on platform, the market is divided into fixed wing and rotary wing.

Fixed wing accounting for 62% market share in 2026. Commercial and military airliners use fixed wing aircraft that operate over long distances and require precise navigation systems for the safe takeoff and landing stage. MMRs that support Ground-Based Augmentation System (GBAS) and Global Navigation Satellite System (GNSS) improve long-range navigation and the accurate landing phase. Aircraft like the Airbus A350 and Boeing 787 use multi-mode receivers to enhance precision during takeoff and landing.

Rotary wing is anticipated to grow at the highest CAGR during the forecast period. Aircraft such as helicopters and UAVs that operate at low altitudes use rotary wings. MMR system helps these aircraft for accurate landing in congested urban areas where GPS signals are weak or blocked by buildings, mountains, or trees. Thus, demand for MMR is expected to increase significantly in rotary wings aircraft during the forecast period.

By Fit Type

Rising Demand for Seamless OEM Integration Propels Adoption of Line-fit MMRs

Based on fit type, the market is bifurcated into line-fit and retrofit.

Line-fit contributing for 67.4% market share globally in 2026. Line-fit MMRs are installed during the initial manufacturing of aircraft. It can be seamlessly integrated into an aircraft’s avionics systems. As the MMR is part of the aircraft’s OEM, the system can be accurately optimized for compatibility with other flight systems, such as weather radar, autopilot, and others. These factors play an important role in driving the segmental growth.

Retrofit is expected to grow at the highest CAGR during the forecast period. Multiple airlines are significantly retrofitting their older aircraft with modern MMRs to ensure that their aircraft remain compliant with the latest aviation regulations. Through retrofitting, they can extend the aircraft’s operational life and also ensure that it meets safety standards.

By Application

Rising Need for Enhanced Accuracy and Reliability Fuels the Adoption of Navigation & Positioning

Based on application, the market is classified into landing and navigation & positioning.

Navigation & positioning capture the largest market with a share of 54.33% in 2026. In the aerospace sector, the multi-mode receiver system is increasingly used to provide a higher level of navigation & positional reliability and accuracy. Also, this system provides flexibility by supporting different navigation signals from multiple systems. This feature is beneficial in areas where GPS might have weak or blocked signals. These factors play a vital role in driving the segmental growth.

Landing is anticipated to grow at the highest CAGR during the forecast period. In aviation, an accurate landing is very important; owing to this, Global Navigation Satellite Systems (GNSS) and Instrument Landing Systems (ILS) are integrated into MMR to ensure the safe landing of aircraft in low-visibility conditions. During the landing phase, MMR merges satellite data with local ground-based systems to enable accurate runway alignment. Thus, these factors are expected to boost segment growth.

By End-use

To know how our report can help streamline your business, Speak to Analyst

Technological Advancements and Cost Reduction Propel the Adoption of Commercial Aviation

Based on end-use, the market is categorized into commercial aviation, general aviation, military aviation, and unmanned aerial systems (UAS)/drones.

The commercial aviation segment accounts for the largest market share in 2024. With growing technological advancements, demand for compact devices is increasing across multiple industries. Owing to this, the miniaturization of GPS and other satellite-based navigation systems are made easier to integrate and affordable for commercial aviation systems. This factor fuels the segmental growth.

Unmanned aerial systems (UAS)/drones are projected to grow at the highest CAGR during the forecast period. With the growing adoption of digital technology, demand for drones is increasing for autonomous operations. In autonomous operation, MMRs are increasingly used, as they provide the precise navigation data required for autonomous flight, real-time tracking, and critical applications.

MULTI-MODE RECEIVER MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Asia Pacific, Europe, Middle East & Africa, and South America.

North America

North America Multi-mode Receiver Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest multi-mode receiver market share in 2024. This is owing to the presence of a large number of commercial aerospace industry participants in the region, who play a vital role in increasing the adoption of MMR systems in the aerospace industry. For instance,

- According to Trimble, Hexagon, and Septentrio’s study, the adoption of multi-frequency GNSS in North American aircraft has resulted in more than 30% improved accuracy in the navigation and landing phase.

Also, the presence of a large number of OEMs plays a pivotal role in driving market growth in the region. These factors bolster the market growth across the region.

The U.S. has a significant military GNSS footprint that requires secure navigation systems. The OEMs in the country integrate multi-mode receivers in aircraft for robustness in poor weather conditions. Also, the country is deploying GPS III satellites, which are supported by multi-mode receivers, to modernize its GPS infrastructure. These factors play an important role in fueling the market growth across the U.S. The U.S. market is estimated to reach USD 0.3863 billion by 2026.

South America

South America is expected to grow at a prominent pace. The region has a prominent presence of dense forests and mountainous terrain, which may create GNSS signal degradation due to obstruction or poor satellite geometry. In such a geography, the use of MMR is beneficial to improve signal availability and accuracy in the aerospace industry to navigate aircraft precisely. Thus, this factor plays a vital role in fueling the market growth in the region.

Europe

In Europe, the market is expected to showcase noteworthy growth during the forecast period. The European Union Aviation Safety Agency (EASA) mandates integration of GNSS-based navigation and surveillance systems for precise and secure navigation and landing. For instance,

- According to industry experts, over 70% of European Union commercial drones are projected to be GNSS-multimode equipped by 2030.

Moreover, in the region, market players are focusing on engaging in contracts with airlines to offer services and strengthen their business in the region. For instance,

- In October 2024, Collins Aerospace entered into a 10-year contract with Air Europa, a Spanish airline. Through this contract, the company will provide maintenance, repair, and overhaul (MRO) services to Air Europa’s aircraft.

Thus, these factors are contributing to market growth in the region. The UK market is expected to reach USD 0.0739 billion by 2026, while the Germany market is anticipated to reach USD 0.0720 billion by 2026.

Middle East and Africa

The adoption of CMOS sensors is growing significantly in the Middle East & Africa, owing to the rising adoption of Multi-mode Receivers (MMRs) in countries like Israel, UAE, and Saudi Arabia to modernize airspace infrastructure. Adoption of the MMR system enhances military and strategic operations through independent and resilient navigation systems. Further, investment in military aviation modernization, national space programs, and UAV development accelerates the market growth in the region.

- For instance, Israel and the UAE have developed UAV systems integrated with MMRs for precise navigation in military operations.

Asia Pacific

The Asia Pacific is expected to grow at the highest CAGR during the forecast period. Several countries in the region, such as China, Japan, South Korea, and India, have invested heavily in developing regional satellite navigation systems like BeiDou, QZSS, KASS, and NavIC, respectively. These systems play an important role in offering critical positioning, navigation, and timing (PNT) capabilities. Also, the MMR system is increasingly used in Unmanned Aerial Vehicles (UAVs) and space launch systems in the Asia Pacific. These factors collectively make the MMR system crucial for the future growth of the aerospace sector in the region. The Japan market is forecast to reach USD 0.0650 billion by 2026, the China market is set to reach USD 0.0669 billion by 2026, and the India market is likely to reach USD 0.0473 billion by 2026.

COMPETITVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Players Are Focusing on Partnership and Acquisition Strategies to Expand Their Customer Base

Key players are focusing on expanding their global geographical presence by presenting industry-specific services. Major players are strategically focusing on acquisitions and collaborations with regional players to maintain dominance across regions. Top market participants are launching new solutions to increase their consumer base. An increase in constant R&D investments for product innovations is enhancing market expansion. Hence, top companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

Long List of Companies Studied

- Thales Group (France)

- Collins Aerospace (U.S.)

- BAE Systems (U.K.)

- Leonardo SPA (Italy)

- Honeywell International Inc. (U.S.)

- Saab AB (Sweden)

- Indra Sistemas (Spain)

- Val Avionics Ltd. (U.K.)

- Intelcan Techno Systems Inc. (Canada)

- Systems Interface Ltd. (U.K.)

- Garmin Ltd. (U.S.)

- Deere & Company (U.S.)

- Trimble Inc. (U.S.)

- Avidyne Corporation (U.S.)

- L3 Technologies (U.S.)

- Astronics Corporation (U.S.)

- Teledyne Technologies (U.S.)

- NovAtel Inc. (Canada)

- VectorNav Technologies (U.S.)

- Cobham Limited (U.K.)

….and more

KEY INDUSTRY DEVELOPMENTS

- June 2025: Thales Group invested approximately USD 57 million to develop secure navigation solutions for the civil and military sectors. This investment will take place between 2025 and 2028 to meet the requirements of secured navigation solutions.

- December 2024: Avianca, a Colombia airline, entered into a partnership with Honeywell International Inc. Through this partnership, Honeywell will provide its cockpit technologies to Avianca for its new Airbus A320neo fleet. It will help the airline to improve operational efficiencies.

- November 2024: Naval Group entered into a partnership with Thales and KNDS. Through this collaboration, the company aims to develop a multipurpose and modular launching system (MPLS). This system is used to optimize logistical support and crew training in the aviation sector.

- November 2024: Quectel Wireless Solutions, a provider of IoT solutions, unveiled SC682A, a smart module enabled with multi-mode LTE Cat 4 and Wi-Fi connectivity as well as dual-band GNSS capabilities. This module offers an extended life cycle for customers.

- February 2024: Air India entered into a partnership with Collins Aerospace. Through this collaboration, Air India will procure a suite of avionics hardware for its Boeing 737 MAX fleet. These hardware components include navigation, communication, and surveillance equipment to improve the safety and operational performance of Air India’s aircraft.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key players operating in the market, such as Thales Group, Rockwell Collins, Inc., BAE Systems PLC, Leonardo SPA, and Saab AB, are increasingly investing in software platforms that add value to the hardware through Cloud-based GNSS analytics, Subscription-based positioning services, Real-time corrections, and GNSS health monitoring and diagnostics. For instance,

- Septentrio N.V., a manufacturer of high-end multi-frequency GNSS receivers, provides cloud-based augmentation services for IoT and industrial applications.

Also, market players are investing in R&D and certification programs to comply with region-specific GNSS ecosystems regulations. These factors are expected to create a lucrative opportunity for market growth.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the multi-mode receiver market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Platform

By Fit Type

By Application

By End-use

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is expected to reach USD 2.32 billion by 2034.

In 2025, the market was valued at USD 1.38 billion.

The market is projected to grow at a CAGR of 5.90% during the forecast period.

By platform, the fixed wing segment led the market.

Rising air traffic and demand for precision landing drive market growth.

Thales Group, Collins Aerospace, BAE Systems, Leonardo SPA, Honeywell International Inc., Saab AB, Indra Sistemas, Val Avionics Ltd., Intelcan Techno Systems Inc., and Systems Interface Ltd. are the top players in the market.

North America held the highest market with a share of 37.9% in 2025.

By end-use, the unmanned aerial systems (UAS) / drones are expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us