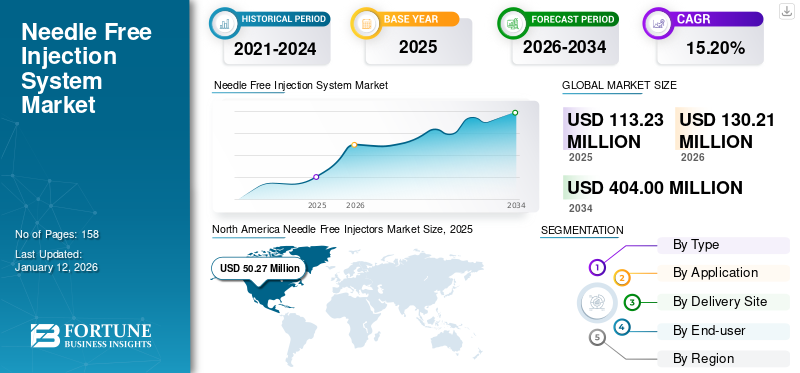

Needle Free Injectors Market Size, Share & Industry Analysis, By Type (Disposable and Reusable), By Application (Autoimmune Disorders, Diabetes, Pain Management, and Others), By Delivery Site (Subcutaneous Delivery, Intradermal Delivery, and Intramuscular Delivery), By End-user (Pharmaceutical & Biotechnology Companies and Contract Research & Manufacturing Organizations), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global needle free injectors market size was valued at USD 113.2 million in 2025. The market is projected to grow from USD 130.21 million in 2026 to USD 404 million by 2034, exhibiting a CAGR of 15.2% during the forecast period. North America dominated the needle free injectors market with a market share of 44.39% in 2025.

Needle free injectors are drug delivery devices that deliver medication into the skin through high-speed fluid through a tiny orifice without the use of needles. These needle free injections reduce needle phobia, improve patient compliance, simplify vaccination storage and distribution, and have also been proven to reduce cost in research studies.

- For instance, in October 2024, PharmaJet announced the positive results of a study conducted in Nigeria that evaluated the impact on coverage, costs, and acceptability of intradermal fractional inactivated poliovirus vaccine (fIPV) administration using its Tropis ID needle-free system. This strengthened the company's brand presence.

Therefore, the various advantages associated with the use of these injections have been fueling the market growth globally.

Moreover, market players such as PharmaJet, NuGen Medical Devices, and CROSSJECT have been focusing on new advanced product launches with an aim to strengthen their brand presence.

Needle Free Injectors Market Overview & Key Metrics

Market Size & Forecast

- 2025 Market Size: USD 113.2 million

- 2026 Market Size: USD 130.21 million

- 2034 Forecast Market Size: USD 404 million

- CAGR (2026–2034): 15.20%

Market Share

- North America: Dominated the market with a 44.39% share in 2025, driven by higher awareness, favorable reimbursement, and strong presence of companies like PharmaJet and Portal Instruments.

- By Application: Diabetes segment led the market owing to the high global prevalence and need for regular, less painful insulin administration.

Key Country Highlights

- United States: Significant growth expected; major manufacturers like PharmaJet and Portal Instruments lead innovation.

- United Kingdom: Strategic partnerships (e.g., NuGen Medical Devices and EziAutoJector in 2024) promote adoption.

MARKET DYNAMICS

MARKET DRIVERS

Growing Prevalence of Chronic Diseases has been Fueling the Demand for Needle Free Injectors

The number of children and adults suffering from conditions including diabetes, osteoporosis, and growth hormone deficiencies has been growing significantly.

- For example, according to data released by Healthline in November 2023, around 13.1% of women in the U.S. between the ages of 50 and 64 and 27.5% of women 65 and older have osteoporosis.

- In addition, according to data released by the International Diabetes Federation, around 10.5% of adults worldwide between the ages of 20 and 79 had diabetes in 2021. By 2045, it is anticipated that the prevalence of diabetes will have increased by 46%.

The need for efficient medicine delivery methods, including needle free injections, has been fueled by the rising prevalence of these disorders. This factor has been fueling the needle free injectors market growth.

MARKET RESTRAINTS

High Costs Associated with the Use of Needle Free Injectors have been Limiting the Market Growth

Needle-free injectors typically have a higher cost compared to conventional needle-based systems.

- For instance, a needle-free injection can cost around USD 165.0-300.0, whereas the price of the needle can start from USD 4.53.

Due to such cost differences, customers prefer using needle free injectors alternatives, thereby restricting the needle free injectors market growth.

Moreover, the initial investment and ongoing maintenance expenses can limit their use, particularly in low-income areas or budget-constrained healthcare settings.

Regulatory Hurdles Also Limit the Market Growth

Stringent regulatory requirements for approval can delay the introduction of new products into the market. For example, in September 2024, Amneal Pharmaceuticals sued the state of Colorado to block a law requiring the company to provide free generic EpiPens to pharmacies, arguing that the law constituted an unconstitutional taking of property under the Fifth Amendment.

Limited Awareness Regarding also Hampers the Market Growth

In certain regions, there is a lack of awareness and understanding of the benefits of needle-free injectors, hindering market penetration.

MARKET OPPORTUNITIES

Increasing Number of Research Studies for the Development of Drugs and Vaccines is Expected to fuel the Market Growth

Due to the various advantages associated with the use of needle free injectors, many pharmaceutical and biotechnology have been focusing on the use of these devices during clinical studies for the development of effective medications and vaccines.

- For instance, in December 2024, PharmaJet announced the publication of a Phase 1 clinical trial to evaluate the safety and immunogenicity of its plasmid DNA Hantavirus vaccines administered with the Stratis IM System, a needle-free system.

The approval and commercialization of these medications will fuel the needle free injectors market growth in the coming years.

Download Free sample to learn more about this report.

Needle Free Injectors Market Trends

Technological Advancements

Continuous innovations have led to the development of efficient, portable, and user-friendly needle-free injectors.

Growing Vaccination Programs

Needle-free injectors are becoming integral to mass immunization programs due to their ease of use and reduced risk of needle-stick injuries. Government initiatives to advance healthcare systems are boosting demand for these devices.

Segmentation Analysis

By Type

Various Advantages Associated with Disposable Injectors is Responsible for Segment’s Dominance

Based on type, the market is segmented into disposable and reusable segments.

The disposable segment dominated the market in 2024. The segment’s dominance is attributed to their convenience and reduced risk of cross-contamination. Moreover, their adoption has been growing in settings requiring quick administration with minimal preparation.

The reusable segment is expected to grow at a significant CAGR during the forecast period. The segment’s growth during the forecast period is attributed to its multiple usability, durability, and cost-effectiveness.

By Application

Growing Prevalence of Diabetes is Responsible for the Segment’s Dominance

Based on application, the market is segmented into autoimmune disorders, diabetes, pain management, and others.

The diabetes segment accounted for the largest portion of the market in 2024. The segment’s dominance is attributed to the increasing prevalence of diabetes. Diabetic patients require regular insulin injections, which can be painful. Needle-free systems offer a less painful and more convenient alternative to traditional needles, improving adherence to treatment regimens. These factors are responsible for the segment’s dominance.

The pain management segment is expected to grow at a significant CAGR during the forecast period. Pain management therapeutics are required after many surgeries, such as endoscopic mucosal resection, laparoscopic surgery, hip arthroplasty, knee arthroplasty, organ transplants, etc., to manage severe pain. Therefore, the growing number of these surgeries has been fueling the segment’s growth.

By Delivery Site

Adoption of Subcutaneous Delivery Devices for Insulin and Vaccine Administration is Responsible for the Segment’s Dominance

Based on the delivery site, the market is segmented into subcutaneous delivery, intradermal delivery, and intramuscular delivery.

The subcutaneous segment dominated the market in 2024. The segment’s dominance is attributed to the increasing adoption of these needle free injectors for vaccine and insulin administration.

The intramuscular delivery segment is expected to grow at a significant CAGR during the forecast period. Drug delivery through these devices gives faster absorption of the medication. Due to this, the adoption of these devices for hormone therapeutics has been growing, thereby fueling the market growth.

By End-user

Clinical Studies Conducted By Pharmaceutical And Biotechnology Companies Is Responsible For Pharmaceutical And Biotechnology Companies’ Dominance

Based on end-user, the market is segmented into pharmaceutical & biotechnology companies and contract research & manufacturing organizations.

The pharmaceutical and biotechnology companies dominated the market in 2024. The segment's growth is attributed to the increased focus of these companies on conducting clinical trials to study the safety and efficacy of drugs using these devices for administration.

Moreover, the contract research and manufacturing organizations segment is expected to grow at a significant CAGR during the forecast period. The segment’s growth during the forecast period is attributed to the growing awareness regarding the advantages, such as minimizing discomfort associated with these devices.

Needle Free Injectors Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Needle Free Injectors Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 50.27 billion in 2025 and USD 57.82 billion in 2026. North America held the leading position, accounting for 44.4% of the global needle free injector market share in 2024. The market growth in the region is attributed to the increasing awareness of various advantages associated with the use of these devices.

The needle free injectors market in the U.S. is expected to grow significantly due to the strong presence of market players, such as PharmaJet, Portal Instruments, and INOVIO Pharmaceuticals, in the country.

Europe

Europe also held a significant portion of the market in 2024. The market’s growth in the region is attributed to the increasing focus of the market players on partnerships for the commercialization of their products.

- For instance, in October 2024, NuGen Medical Devices announced its partnership with EziAutoJector Limited for the U-100 insulin to diabetic patients and subcutaneous biosimilar products using its InsuJetTM device and consumables in the U.K.

Asia Pacific

Asia Pacific is projected to be the fastest-growing region, with a CAGR of around 16.1% in the forecast period. Rapidly developing healthcare infrastructure, government-led immunization programs, and increasing awareness of non-invasive technologies in countries such as China, India, and Japan are driving the market’s growth in the region.

Latin America and Middle East & Africa

The market in Latin America and the Middle East & Africa is expected to grow substantially during the forecast period. These regions are gradually adopting needle-free injectors due to improvements in healthcare access, rising vaccination demands, and increasing awareness of non-invasive injection technologies.

COMPETITIVE LANDSCAPE

Key Industry Players

Focus of Market Players on Partnership for New Product Launches is Responsible for their Revenue Growth

PharmaJet, NuGen Medical Devices, and CROSSJECT are among the major players in the market. These players account for a significant portion of the market in 2024. The focus of these players on the development of needle-free medication devices is responsible for their revenue growth.

- For instance, in September 2024, PharmaJet announced its partnership with Scancell Sign for the development and commercialization of a needle-free DNA vaccine for advanced melanoma.

Moreover, other players such as NuGen Medical Devices, Ferring, and Aijex Pharma International Inc. have been focusing on new product launches to strengthen their presence in the market.

LIST OF KEY NEEDLE FREE INJECTORS COMPANIES PROFILED

- PharmaJet (U.S.)

- CROSSJECT (France)

- Portal Instruments (U.S.)

- NuGen Medical Devices (Canada)

- INOVIO Pharmaceuticals (U.S.)

- Ferring (Switzerland)

- Aijex Pharma International Inc. (Japan)

- IntegriMedical (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2025: PharmaJet announced that its Tropis intradermal (ID) delivery system, a needleless injection system, was used in the World Health Organization’s (WHO) polio eradication campaign held in Pakistan in February 2025.

- February 2025: PharmaJet shared the latest immunization study results at the 61st Annual Medical Conference and International Health Exhibition, which occurred between the 21st and 22nd of February.

- May 2024: Serum Institute of India (SII) announced the strategic investment in IntegriMedical by acquiring 20% of the company's stake to enhance the Needle-Free Injection System technology.

- April 2023: PharmaJet announced that its Gennova Biopharmaceuticals had submitted data for Emergency Use Authorization (EUA) of its mRNA-based Omicron-specific Covid-19 booster shot through needle-free injections to the Drug Controller General of India (DCGI).

- October 2022: NuGen Medical Devices announced the launch of InsuJet, a needle-free injection devices in Canada.

REPORT COVERAGE

The global needle free injectors market analysis report provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the prevalence of malocclusion in key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions and the number of orthodontists in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.2% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Delivery Site

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 113.2 million in 2025 and is projected to record a valuation of USD 404 million by 2034.

In 2025, the North America market value stood at USD 50.27 million.

The market is expected to exhibit a CAGR of 15.2% during the forecast period.

The disposable segment led the market, by type.

The growing burden of chronic diseases, along with the increasing awareness regarding needle free injectors, is responsible for the market’s growth.

PharmaJet, NuGen Medical Devices, and CROSSJECT are the top players in the market.

North America dominated the market in 2025.

Increasing demand for easy-to-use injections for convenient and effective drug delivery is expected to favor the market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us