North America Cloud Computing Market Size, Share & Analysis, By Type (Public Cloud, Private Cloud, and Hybrid Cloud), By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT and Telecommunications, Government, Consumer Goods and Retail, Healthcare, Manufacturing, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

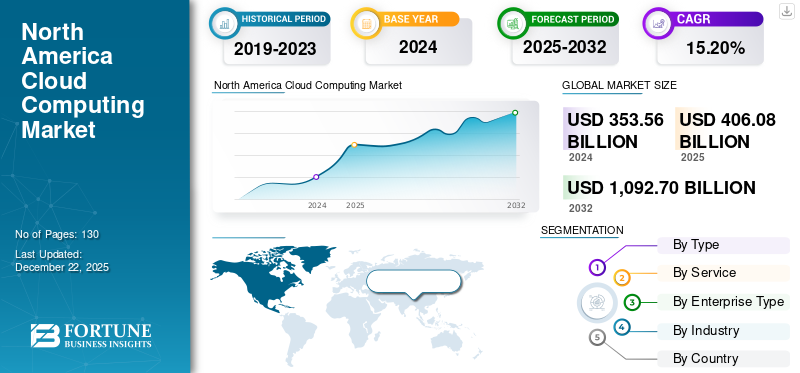

The North America cloud computing market size was valued at USD 353.56 billion in 2024. The market is projected to grow from USD 406.08 billion in 2025 to USD 1,092.70 billion by 2032, exhibiting CAGR of 15.20% during the forecast period.

With businesses moving rapidly toward digitalization and adoption of novel technologies such as artificial intelligence, big data analytics, or the Internet of Things (IoT), there has been unprecedented growth in cloud adoption in North America. In 2025, it remained a leading area of cloud research and innovations, with the U.S. holding the largest share of cloud infrastructure investments and uses.

North America Cloud Computing Market Trends

Growing Focus on Sustainability in Cloud Infrastructure to be Key Driver for Market Growth

Sustainability is now a top priority for cloud providers across North America as they implement more energy-efficient technologies and renewable energy options into their operations. Cloud Providers are utilizing technologies such as liquid cooling and investing more into green data centers as cloud operations develop more sustainably and utilize energy resources more sustainably. Surging emphasis on sustainability in cloud infrastructure is boosting the North America cloud computing market growth.

- Amazon operates over 100 data centers globally, each housing approximately 50,000 servers to power its cloud computing services.

- Scientists estimate that North American data centers’ power consumption nearly doubled, rising from 2,688 megawatts at the end of 2022 to 5,341 megawatts by the end of 2023.

North America Cloud Computing Market Key Takeaways

- The North America cloud computing market is projected to be worth USD 1,092.70 billion by 2032.

- In by type segmentation, public cloud for around 54.6% of the market in 2024.

- In the by service segmentation, Infrastructure as a Service (IaaS) is projected to increase at a CAGR of 16.7% over the forecast period.

- In the enterprise type segmentation, large Enterprises accounted for around 52.6% of the market in 2024.

- The cloud computing market in the U.S. was worth USD 218.28 billion in 2024.

- In the country segmentation, Canada is projected to rise at a CAGR of 18.0% over the forecast period.

North America Cloud Computing Growth Factors

Adoption of Hybrid and Multi-Cloud Strategies to Boost Market Growth

Organizations are turning to hybrid and multi-cloud strategies for more agility and control over their IT environments. These strategies allow organizations to balance data security, compliance, and cost more effectively by keeping sensitive data in private clouds or on-premises, while using public clouds when scalable compute and storage are required. Using multiple clouds also decreases dependency on any one vendor, which can improve operational resiliency, too.

- According to Spacelift, in 2025, approximately 80% of organizations deploy multiple public cloud services, and 60% manage workloads across more than one private cloud environment.

North America Cloud Computing Market Restraints

Security Concerns and Lack of Internal Expertise Limit Market Growth

Security has always been the top priority for so many enterprises across North America, especially those mid-sized firms that do not have the expertise needed on-site for good governance in the cloud, access controls, or on threats. Lack of skilled cloud security professionals adds to these insecurities, which means that an organization may be open to misconfigurations and potential breaches. As a result, many businesses hesitate to fully migrate mission-critical workloads, especially in industries with legacy systems and strict compliance demands.

- As per StationX, North America accounted for 29% of Global Cloud-Related Security Incidents in the Year to June 2023.

North America Cloud Computing Market Segmentation Analysis

By Type

Based on type, the market is divided into public cloud, private cloud, and hybrid cloud.

The public cloud segment accounts for a larger proportion of the North America cloud computing market share. With broader enterprise adoption and established infrastructure. The forecast period will see the hybrid cloud segment growing at a higher growth rate with the rise in demand for data sovereignty, regulatory compliance, and flexible deployment models.

By Service

Based on service, the market is divided into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS).

There is a growing preference among enterprises for flexible, scalable, and easily deployable solutions, driving strong adoption of Software as a Service (SaaS) across the region. The SaaS segment accounts for the largest share of the North American cloud computing market. At the same time, Infrastructure as a Service (IaaS) is projected to grow at the fastest pace over the forecast period.

- According to industry reports, SaaS adoption rates have reached over 700% since 2016.

By Enterprise Type

Based on enterprise type, the market is segmented into Large Enterprises and SMEs.

In North America, cloud adoption used to be a large-enterprise thing- though investment in scalable infrastructure continues to be the foremost priority, the adoption of advanced cloud-native capabilities looks to be topping the list of priorities. SMEs, on the other hand, are suddenly reducing cloud usage as flexible pay-as-you-go solutions are becoming increasingly present alongside easing platform complexities. While large enterprises have retained a market share in the overall market assessment, the SME sector is, in fact, expected to witness expansion.

- According to a survey of 800 organizations, over 94% of companies with more than 1,000 employees run a substantial share of their workloads in the cloud.

By Industry

Based on industry, the market is segmented into BFSI, IT and telecommunications, government, consumer goods and retail, healthcare, manufacturing, and others.

The IT and telecommunications segment remains the primary driver of cloud adoption in North America, leveraging advanced cloud infrastructure to support data-intensive operations, network modernization, and service innovation.

Meanwhile, the Healthcare industry is emerging as the fastest-growing segment, propelled by increasing demand for secure data storage, telemedicine platforms, and compliance-driven digital transformation. As cloud solutions become more tailored to industry-specific needs, the market is witnessing a shift from early adopters to rapid expansion across regulated and traditionally slower-moving sectors such as healthcare.

By Country

Based on country, the market is segmented into the U.S., Canada, and Mexico.

The U.S. accounts for the vast majority of cloud computing adoption in North America, supported by a mature digital ecosystem, high enterprise cloud readiness, and large-scale investments by hyperscalers. While the U.S. continues to dominate in overall market share, Canada is projected to grow at the fastest rate during the forecast period, driven by accelerating digital transformation efforts, favorable regulatory support, and rising demand for localized cloud infrastructure.

List of Key Companies in the North America Cloud Computing Market

Amazon Web Services (AWS), Microsoft Azure, and Google Cloud dominate the North America cloud computing industry. AWS dominates the market with its wide-ranging services portfolio and robust infrastructure network. Meanwhile, Microsoft Azure is also known for its native integration with enterprise solutions and hybrid cloud connectivity. Google Cloud is aggressively building its presence through advances in AI and data analytics.

Some of the other major players in the market include IBM, Oracle, and Salesforce, with several small and medium-sized cloud service providers. The firms are strategically investing in AI-driven cloud platforms, increasing regional data centers, and providing industry-focused cloud solutions. These activities will help increase their market share and competitiveness in a rapidly changing cloud environment.

LIST OF KEY COMPANIES PROFILED

- Amazon Web Services, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- DigitalOcean, LLC (U.S.)

- Cloudflare, Inc. (U.S.)

- Broadcom, Inc. (U.S.)

- Backblaze (U.S.)

- CGI Inc. (Canada)

- ThinkOn (Canada)

- Terago Networks Inc. (Canada)

- KIO (Mexico)

- Neoris (Mexico)

KEY INDUSTRY DEVELOPMENTS

- July 2025: HTC Global Services earned the Guidewire PartnerConnect Cloud Ready - North America specialization, recognizing their expertise in cloud-based solutions for Guidewire's platform. As a Select-level Consulting partner, HTC demonstrates strong capabilities in supporting insurers with cloud implementations, leveraging their data and AI expertise to drive innovation and value in the property and casualty (P&C) insurance sector.

- January 2025: Atlas Salt, a Canadian mining company, is using Oracle’s Aconex, Primavera Cloud, and NetSuite to enhance project and financial management for its Great Atlantic Salt project, North America’s first new salt mine in nearly 30 years. These tools improve collaboration, transparency, and efficiency, potentially saving millions and cutting months off the project timeline by optimizing schedules, managing supply chain risks, and streamlining financial processes.

REPORT COVERAGE

The North America cloud computing market report provides a detailed analysis of the market. It focuses on market dynamics and key industry developments, such as mergers and acquisitions. Additionally, it includes information about the rise in demand for AI-based infrastructure, increasing investment in hyperscale data centers, and growing adoption of hybrid and multi-cloud strategies. Besides this, the report also offers insights into the latest industry trends and the impact of various factors on the demand for cloud services across sectors such as BFSI, healthcare, and retail.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 15.20% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Service

|

|

|

By Enterprise Type

|

|

|

By Industry

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the market was worth USD 353.56 billion in 2024.

The market is expected to exhibit a CAGR of 15.20% during the forecast period of 2025-2032.

By industry, the IT and Telecommunications industry leads the market.

Amazon Web Services, Microsoft Corporation, IBM Corporation, and CGI are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us