Polyimide Film Market Size, Share & Industry Analysis, By Application (Flexible Printed Circuits, Specialty Fabricated Products, Pressure-Sensitive Tapes, Wires & Cables, and Others), By End-use Industry (Electronics, Automotive, Aerospace, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

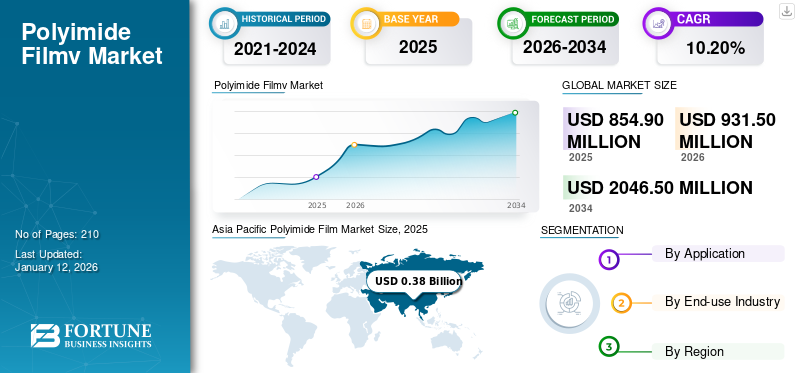

The global polyimide film market size was valued at USD 0.85 billion in 2025. The market is projected to grow from USD 0.93 billion in 2026 to USD 2.04 billion by 2034 at a CAGR of 10.20% during the forecast period. Asia Pacific dominated the polyimide film market with a market share of 45% in 2025.

Polyimide (PI) film is a thin film insulating material made from polyimide, a polymer consisting of imide monomers. It is synthesized through a two-stage process involving diamines and dianhydrides, resulting in a polyamic acid that is then imidized using heat or a chemical dehydrating agent. Polyimide films are used in electronics, aerospace, automotive, and consumer products due to their robust properties. They are also used in flexible printed circuit boards (FPCB), semiconductors, medical devices, and as insulation for electronic cables. It serves as the insulating base film and coverlay in FPCs. FPCs are utilized in various electronic devices, including smartphones and medical equipment. The product's versatility makes it an essential material in various high-performance applications.

Increasing demand from the electronics sector and rapid use in the aerospace industry are the driving factors for market growth. DuPont, 3M, PPI Adhesive Products, Thermo Fisher, Arkema, and PI Advanced Material Co., Ltd. are among the key players operating in the industry.

Global Polyimide Film Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 0.85 billion

- 2026 Market Size: USD 0.93 billion

- 2032 Forecast Market Size: USD 2.04 billion

- CAGR: 10.20% from 2026–2034

Market Share:

- Asia Pacific dominated the polyimide film market with a 45% share in 2025, driven by a robust electronics manufacturing industry, rapid industrialization, and strong demand in automotive and infrastructure development across China, India, and other regional economies.

- By application, flexible printed circuits are expected to retain the largest market share in 2025, supported by growing demand for thin, space-saving components in smartphones, cameras, and other compact electronic devices.

Key Country Highlights:

- United States: Market growth is driven by rising demand in the aerospace, automotive, and electronics sectors, with strong infrastructure and high disposable income fueling industry expansion.

- China: As the world’s largest electronics manufacturing hub, China supports rapid growth in demand for PI films across mobile devices, automotive electronics, and industrial components.

- Germany: Growth in electric vehicle production and established electronics and medical device sectors support rising demand for polyimide films.

- Brazil: Economic improvements and expansion of the electronics and automotive industries are attracting global investment and contributing to regional market growth.

- Saudi Arabia: Increasing demand for consumer electronics and the development of flexible electronic components are driving adoption of PI films across local manufacturing sectors.

POLYIMIDE FILM MARKET TRENDS

Growing Trend toward Sustainability Drives Market Growth

There is a growing emphasis on sustainable materials, leading to the development of eco-friendly polyimide films that can be recycled or have a lower environmental impact. Some companies offer high-quality and eco-friendly alternatives for these products using recyclable polyethylene. It minimizes environmental impact while maintaining performance.

Research focuses on creating recyclable porous dielectric films with ultralow permittivity from soluble fluorinated polyimide. These films exhibit exceptional thermal stability, mechanical strength, and recyclable capability, making them suitable for high-frequency communication devices such as insulating dielectrics.

The growing initiatives toward using bio-based, greener solvents in the synthesis of high-performance polyimide materials are paving the way for a sustainable future.

MARKET DYNAMICS

MARKET DRIVERS

High Thermal Stability and Electrical Insulation Properties of PI Films are Driving Market Growth

The polyimide film market growth is significantly driven by the material's high thermal stability and electrical insulation properties. These characteristics make PI films indispensable in the production of flexible printed circuits, pressure-sensitive tapes, and other electronic products. These are in high demand due to the growing mobile and complex electronics, which are smaller in size and have lighter materials with high reliability. Asia Pacific witnessed a growth from USD 340.85 million in 2023 to USD 355.26 million in 2024.

PI films perform efficiently in extreme temperatures and varying weather conditions, making them suitable for use as insulation in renewable energy sources such as solar, wind, and hydro. These films are also utilized in medical tubes, circuits, and insulation for medical devices and circuit boards, further driving the market growth as healthcare facilities expand and demand efficient equipment.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

High Manufacturing Costs of PI Films Hinder Market Growth

High manufacturing costs hinder the growth of the market. These costs arise from several factors, such as the cost of raw materials and production procedures, solvents and chemicals, and high-temperature operations.

The raw materials, production procedures, and unique characteristics of polyimide materials contribute to high manufacturing costs. Similarly, polymerization and film casting demand the use of expensive solvents and chemicals. These must be carefully selected to ensure the desired film qualities while adhering to safety and environmental regulations. Additionally, the products attaining exceptional thermal resistance necessitates high-temperature manufacturing processes, which increases equipment and energy costs. These factors are hindering the market growth.

MARKET OPPORTUNITIES

Increased Product Demand from the Electronics Industry Creates a Lucrative Opportunity for the Market

The market is gaining huge opportunities from increased demand for the product by the electronics industry. This is majorly due to the growing need for thinner and more flexible insulation materials as electronic devices become smaller and more compact. PI films are ideal for electrical insulation in devices such as smartphones, tablets, and wearables. They possess outstanding thermal stability, which is essential for maintaining the integrity of electrical systems and preventing short circuits caused by high temperatures.

Specifically, PI films are crucial in the production of flexible printed circuits (FPCs), circuit insulating tapes, and other components due to their electrical conductivity and heat resistance. The rising adoption of smartphones, tablets, and wearable gadgets further augments this demand. Additionally, the rapidly growing IoT market, which requires compact and efficient electronic systems, also contributes to the growing need for the product.

MARKET CHALLENGES

Competition from Alternative Materials Hampers the Market

Competition from alternative materials may hamper the market growth. Several substitute polymers, including polyethylene terephthalate (PET), polycarbonates, PTFE, and liquid crystal polymers (LCP), compete with the product. PET films are widely used as an alternative to PI films as they provide effective dimensional stability, resistance to moisture, and clarity. PET films are often used in applications such as packaging and labels and are more affordable compared to PI films. This cost advantage makes them an attractive choice for applications where the high-performance properties of polyimide are not critical. PET films are known for their flexibility, which can also be advantageous in applications requiring conformability or where bending and flexing are common.

Regulatory Compliance Impacts Market Growth

Traditional polyimide production methods may involve solvents and chemicals that harm the environment. This creates a demand for more eco-friendly production processes and materials. Industries such as healthcare and food packaging have strict regulatory standards that impact the use of polyimides due to concerns about potential chemical migration and safety. The heat-resistant market is subject to environmental and health regulations. For instance, strict EU regulations on chemical usage and sustainability can challenge the manufacturers.

IMPACT OF COVID-19

Stalled End-use Industry Due to Pandemic Hampered Market Growth

The COVID-19 pandemic negatively impacted the market due to shutdowns in end-user industries. The pandemic caused supply chain issues and a decrease in exports of electronic products. However, the market is expected to recover rapidly due to its increased use in the electronics sector. The sales of electronic products such as wires, cables, televisions, and laptops, which use PI films for insulation, have increased. Demand for polyimide films in items such as laptops and tablets rose as remote work and study became more common.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Global economic conditions and trade policies influence the market. Trade protectionism, such as tariffs and trade barriers, can disrupt the supply chain, increase costs, and affect the competitiveness in the market. Geopolitical issues can also disrupt the supply chain, particularly if key manufacturing regions or transportation routes are affected.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

Major manufacturers are developing new techniques to produce polymeric nanocomposites with superior performance, strength, dependability, and durability. These materials are expected to broaden the applications of PI films across various fields. R&D is focused on creating bio-based polyimide films with biodegradable or recyclable content to align with the global push for reducing plastic use and carbon emissions.

SEGMENTATION ANALYSIS

By Application

Growing Demand for Flexible Printed Circuits to Make the Films Thin and Save Space for Installation Led the Segmental Growth

Based on application, the market is segmented into flexible printed circuits, specialty fabricated products, pressure-sensitive tapes, wires & cables, and others.

The flexible printed circuits segment held the largest polyimide film market share of 45.99% in 2026. The flexible printed circuits segment is also anticipated to experience substantial growth. PI films are used in flexible printed circuit boards to make them thin and space-saving for installation in smartphones, cameras, and other electronic devices.

Specialty fabricated products are an emerging application segment projected to gain a higher market share with healthy growth due to increased use in consumer electronics.

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Electronics Segment Dominated the Market Due to the Crucial Role Played by Polyimide Films in Semiconductor Devices

Based on the end-use industry, the market is segmented into electronics, automotive, aerospace, and others.

The electronics segment registered a dominating market share in 2024. PI films serve as insulation in flexible circuits and cables and are also used in semiconductor devices. Its applications include wafer carriers, chip trays, electrical connectors, wire insulators, and components for digital copiers and printers. Polyimides are also present in intermetallic layers and bond pad redistribution layers and are used for flexible substrates, rigid substrates for PCB technologies, and gate insulators. The electronics industry also uses PI films to cover magnets and as a dielectric substrate in flexible solar cells.

- The segment is expected to dominate the market share of 52.53% in 2026.

The aerospace sector uses PI films for their thermal resistance capacity and lightweight properties in spacecraft and satellites. They protect sensitive components from extreme temperatures and harsh environmental conditions.

The automotive segment is anticipated to forecast a CAGR of 6.9% during the forecast period.

POLYIMIDE FILM MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Polyimide Film Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the leading market share in 2026, valued at USD 0.42 billion. This region also held USD 0.38 billion in 2025. This is attributed to the region's strong electronics manufacturing industry, rapid industrialization, growing demand for electronics, expanding automotive sector, and infrastructure development. China has the world's largest electronics manufacturing sector. The increasing demand for products in automotive sectors throughout the area and the growing need in electronic industries such as displays, mobiles, and others are regarded to be two of the most important market drivers for the polyimide film business in Asia Pacific.

- The market value in China is expected to be USD 0.16 billion in 2026.

On the other hand, Japan is projected to reach USD 61.36 million, while India is likely to account for USD 86.41 million in 2025 and Indonesia for USD 0.06 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is anticipated to account for the second-highest market size of USD 0.18 billion in 2026, exhibiting the second-fastest growing CAGR of 10.01% during the forecast period.

North America accounted for a significant market share in 2024. The region is driven by growth in the aerospace, automotive, and electronics sectors. The U.S. market size was valued at USD 152.1 million in 2024. The presence of top manufacturers in the automotive industry and proper infrastructure, coupled with high disposable income, are expected to drive market growth. The U.S. market is accounted to hit USD 0.18 billion in 2026.

Europe

Europe region is to be anticipated the third-largest market with USD 162.50 million in 2025. Europe is also expected to experience significant growth in the market. The region has established electrical and electronics, medical, and automobile industries. The rise in the manufacturing of electric vehicles in the region has also contributed to market growth. The market value in U.K. is expected to be USD 33.21 million in 2025.

On the other hand, Germany is projecting to hit USD 0.05 billion and France is likely to hold USD 0.03 billion in 2026.

Middle East & Africa

The Middle East & African market is poised for growth, driven by its strategic position in the electronics and automotive sectors. This region is anticipated to be the fourth-largest market with USD 0.06 billion in 2026. Rising demand for consumer electronics such as smartphones and tablets boosts the use of PI films in displays and flexible components across the region. Saudi Arabia is estimated to hit USD 20.76 million in 2025.

Latin America

Latin America also registers a notable share in the market. Positive economic trends have increased purchasing power, favorably impacting the regional market growth. The ongoing development in the electronic and automotive sectors attracts global investors, contributing to market growth in the region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Companies Focus on Expansion of Production Capacity to Gain a Competitive Edge

DuPont (U.S.), 3M (U.S.), Kolon Industries Inc. (South Korea), Kaneka Corporation (Japan), and Arkema (France) are the key players in the market. Prominent players in the industry have significant production capacities and are focusing on the expansion of their product portfolio.

LIST OF KEY POLYIMIDE FILM COMPANIES PROFILED

- DuPont (U.S.)

- 3M (U.S.)

- PPI Adhesive Products (Ireland)

- Thermo Fisher (U.S.)

- Arkema (France)

- PI Advanced Material Co., Ltd. (South Korea)

- Kolon Industries Inc. (South Korea)

- Kaneka Corporation (Japan)

- Taimide Tech. Inc. (Taiwan)

- Ube Industries Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS

- December 2023 – Arkema finalized its acquisition of Glenwood Private Equity’s 54% stake in PI Advanced Materials (PIAM), a South Korean company. The acquisition, based on a USD 827.91 million enterprise value, aims to enhance Arkema's portfolio of high-performance technologies for high-growth markets such as advanced electronics and electric mobility.

- May 2022 – DuPont announced the expansion of its Kapton polyimide film production in the U.S. to meet the growing global demand in the automotive, consumer electronics, telecom, specialized industrial, and defense segments.

- March 2019: Kaneka Corporation developed colorless polyimide films for flexible electroluminescent (EL) displays. These displays are intended for use in next-generation electronic devices.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, applications, and end-use industry. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion), Volume (Kilo Ton) |

|

Growth Rate |

CAGR of 10.20% from 2026 to 2034 |

|

Segmentation |

By Application

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 0.85 billion in 2025 and is projected to reach USD 2.04 billion by 2034.

Recording a CAGR of 10.20%, the market is slated to exhibit steady growth during the forecast period of 2026-2034.

The electronics end-use industry segment led the market in 2025.

Asia Pacific held the highest market share in 2025.

High thermal stability and electrical insulation properties of PI films is driving market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us