Polyphenols Market Size, Share & Industry Analysis, By Source (Grape Seeds, Green Tea, Cocoa, Berries, Citrus Fruits, Rosemary, and Other), By Application (Functional Food, Dietary Supplements, Beverages, Animal Feed, Cosmetics, and Others), By Form (Liquid, Powder, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

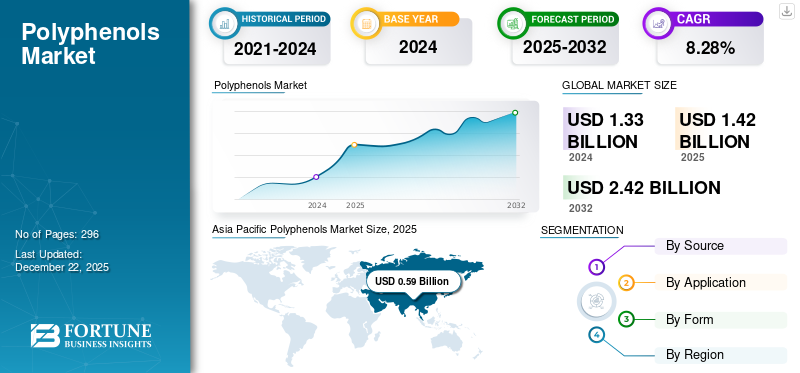

The global polyphenols market size was valued at USD 1.42 billion in 2025. The market is projected to grow from USD 1.53 billion in 2026 to USD 2.88 billion by 2034, exhibiting a CAGR of 8.28% during the forecast period. Asia Pacific dominated the polyphenols market with a market share of 41.56% in 2025.

Polyphenols are organic compounds that are derived from plants and act as antioxidants, possessing several health benefits. The compound is derived from plants such as fruits, vegetables, herbs and roots, tea, cocoa, and other products. Some of the major polyphenolic compounds include flavones, isoflavones, flavanones, tannins, edible flowers, phenolic acids, and others. The scope includes natural compounds, which are used in the manufacturing of beverages, functional food, dietary supplements, animal feed, cosmetics, and others.

Impact of COVID-19

The COVID-19 pandemic hampered the production of natural compounds, owing to the disruption in the global supply chain. As fruits, vegetables, and herbs are the key sources for production, the imposition of lockdowns in different countries restricted border trade and intra-state trade. Hence, the availability of raw materials was severely restricted during that time. On the other hand, the consumption of natural food and beverages increased significantly during the period, which resulted in a surge in demand for such compounds in the food and beverage industry. Thus, manufacturers had to carefully recalibrate their production and delivery schedules to balance the demand and supply of these compounds for industrial use.

Polyphenols Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.42 billion

- 2026 Market Size: USD 1.53 billion

- 2034 Forecast Market Size: USD 2.88 billion

- CAGR: 8.28% from 2026–2034

Market Share:

- Asia Pacific dominated the polyphenols market with a 41.56% share in 2025, driven by high consumption of functional foods and beverages and increasing demand for plant-based ingredients.

- Citrus fruits accounted for the highest share by source due to their rich polyphenol content, while beverages led by application, reflecting consumer preference for natural ingredient-based drinks. The powder form dominated the market due to its stability and ease of transport, holding a 62.34% share in 2024.

Key Country Highlights:

- China: Rising demand for antioxidant-rich food and beverages with “naturally healthy” and “fortified” label claims is supporting market growth.

- U.S.: High consumer focus on preventive healthcare has driven demand for naturally derived dietary supplements, boosting polyphenol usage.

- Germany: Surge in demand for natural cosmetics and organic food is increasing the use of phenolic ingredients.

- Brazil: Government fortification initiatives and demand for healthier food options are supporting polyphenol usage.

- South Africa: Growing popularity of functional beverages rich in polyphenols is driven by lifestyle changes and health awareness.

Polyphenols Market Trends

Surging Demand for Functional Cosmetics is the Current Trend

The cosmetics industry has experienced a remarkable shift in the past few years, with the rise of functional cosmetics – beauty products that provide more than aesthetic enhancement. Unlike conventional cosmetics, which mainly concentrate on improving appearance and covering imperfections, functional beauty products combine proven skincare advantages with beauty. These products are designed with potent active ingredients such as antioxidants, including polyphenols, vitamins, peptides, and others, that offer solutions for particular skin conditions (skin hydration, sun protection, and anti-aging, among others), thus improving the usage of phenolic. For instance, in July 2024, Unilever, a U.K.–based consumer goods firm, launched its latest Vaseline body lotion, composed of 100% green tea extract, which is rich in these compounds. Asia Pacific witnessed a growth from USD 0.51 Billion in 2023 to USD 0.55 Billion in 2024.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Increasing Demand for Naturally Derived Polyphenols to Boost Market Expansion

Naturally sourced ingredients have been acknowledged since ancient times. The demand for polyphenol-rich products has increased globally in the past few years. As individuals become more aware of the importance of leading a healthy lifestyle and are health-conscious, the demand for natural ingredients, especially food products comprising plant-sourced ingredients, is on the rise. As a result, this improved awareness of natural compounds escalates the usage of phenolic ingredients. The surging trend of veganism in several global countries is also a pivotal factor supporting the use of natural ingredients, as consumers adopting a vegan lifestyle mainly opt for plant-centric ingredients and look out for cruelty-free food products with proven health benefits.

Rising Use of Polyphenols as Flavor and Color Enhancers Drives the Industry Growth

Flavor and color enhancers are recognized as pivotal ingredients in the evolving global food industry. With the rapid changes in consumer attitudes, individuals’ need for food has drastically shifted from basic hunger satisfaction to health and nutrition. The majority of consumers are leaning toward natural color and flavor enhancers, primarily due to their visual appeal, medicinal, and nutritional benefits. As a result, such demand for naturally sourced flavor and color ingredients drives the usage of phenolic compounds.

Market Restraints

Sensory Concerns of Phenolic Compounds and Minimal Consumer Awareness Obstruct the Market Potential

Limited knowledge regarding these products among global consumers limits the growth of the industry. A considerable portion of the population is still not fully aware of these compounds and their specific health advantages. Hence, such limited awareness hampers the market’s growing potential. The sensory limitations of such products are also one of the strong restraints in the global market. It can often impart undesirable colors and flavors to finished food products, which limits their application in various industries. Thus, such concerns restrict the utilization rate of such ingredients.

Market Opportunities

Increasing Product Usage for Eco-Friendly Packaging to Create Opportunity for Market Growth

As per the ongoing research, scientists have highly utilized polyphenol compounds as active agents in creating sustainable packaging materials in recent years. Additionally, polyphenol ingredients are often used in active packaging, mainly due to their antimicrobial and antioxidant properties, which help in maintaining the color, flavor, and overall end product quality. Thus, such use of these products in eco-friendly packaging unlocks numerous growth opportunities and promotes a high market growth rate.

Market Challenges

Rising Challenges in the Extraction to Hinder Market Growth

One of the crucial factors hindering the polyphenols market growth is the rising hurdles in the extraction of polyphenol ingredients. Deriving plant-based sources of polyphenols can be complex, especially due to their varied chemical composition, as well as the presence of several other compounds, thus requiring optimization of the extraction methods. Moreover, they are frequently tightly bound inside plant cells, which makes them challenging to release. As a result, such difficulties in the extraction method impede the production rate.

SEGMENTATION ANALYSIS

By Source

Citrus Fruits Accounted for the Highest Market Share Owing to High Polyphenol Content

On the basis of source, the market is distributed into grape seeds, green tea, cocoa, berries, citrus fruits, rosemary, and others.

Out of all, the citrus fruits segment held the most prominent position in the market. Citrus fruits such as oranges, lemons, raspberries, and clementines, among others, are recognized as excellent sources and are responsible for creating the odor profile and unique flavor of citrus fruits.

The others category, which comprises fruits, vegetables, tea leaves (excluding green tea), and others, emerged as the fastest-growing segment and is anticipated to soar at the same pace in the upcoming years. Likewise, citrus fruits and vegetables, including artichokes, spinach, broccoli, onions, and others, are also known to offer a vast range of such compounds, which entice consumers.

The green tea segment is projected to capture a share of 9% in 2025.

The cocoa segment will grow at a CAGR of 6.73% during the forecast period (2025-2032).

By Application

Beverages Held the Largest Market Share Due to a High Usage Rate

Depending on application, the market is segmented into functional food, dietary supplements, beverages, animal feed, cosmetics, and others.

The beverage sector dominated the global market and held the major polyphenols market share. Beverages, such as smoothies and juices, among others, are highly consumed by individuals worldwide due to the increasing socializing culture and improved availability of a range of beverages. However, in today’s health-centric era, most consumers are seeking natural ingredients enriched beverages that contribute to the consumer’s health.

Functional foods ranked second in the market and generated a 41.34% share in 2026. In a few years, the demand for functional foods (kefir, yogurt, and others) is flourishing, primarily owing to the surging health consciousness, lifestyle changes, and rising need for nutritious food options.

- The animal feed segment held the market share of 6% in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Form

Powder Segment Accounts for the Highest Market Share Due to the Stability and Easier Transportability

Based on form, the global market is divided into liquid, powder, and others.

Amid all this, the powder segment leads in the global market and holds a major share of 62.64% in 2026. Powdered forms of ingredients are recognized as an economical option in comparison to other forms and tend to be more concentrated in nature. With respect to handling, the powder is easy to transport and store, mainly due to its stable nature.

Liquids secured second position in the global market and are expected to grow at a CAGR of 7.73% during the forecast period (2025-2032). Liquid formulations offer rapid absorption and allow flexible dosing, unlike powdered forms. Compared to other forms, liquid ingredients are considered versatile ingredients and can be utilized in a diversified application, thus adding texture and moisture to the formulation.

Polyphenols Market Regional Outlook

Geographically, the global market report covers analysis across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Polyphenols Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific dominated the global polyphenols market with a valuation of USD 0.64 billion in 2026 and USD 0.59 billion in 2025. Consumers in the Asia Pacific region are some of the leading consumers of functional food and beverages globally. With the expansion in industrialization and a growing number of people with higher disposable income, healthier food and beverage products are becoming popular among consumers. Thus, the demand for ingredients such as polyphenols, which are used for manufacturing such products, is increasing rapidly in the region. Food, beverages, and dietary supplement consumption in countries such as China and Japan is evolving, and the demand for products with health benefits is increasing rapidly among consumers

China

China is poised to reach a value of USD 0.2 billion in 2026. Spending on health-promoting food products in China has increased in recent years. The demand for antioxidant-rich polyphenol compounds is also increasing in the country for innovative food and beverage products. A diverse range of polyphenol-rich foods and beverages has been launched in the market, and several labeling claims such as “naturally healthy” and “fortified and functional” are popular among consumers. For instance, food and beverages that are fortified with acerola powder have been in high demand since the pandemic, as it has been associated with boosting the immune system. India is expected to be valued at USD 0.09 billion in 2026, while Japan is projected to reach a value of USD 0.13 billion in the same year.

North America

North America is the second largest market with a valuation of USD 0.4 billion in 2026, exhibiting a CAGR of 8.04% during the forecast period (2025-2032). The dietary supplements market has experienced substantial growth in North America over the decades and is fueled by numerous factors supporting its sustained demand. These supplements provide a myriad of advantages, serving as convenient sources of important minerals, bioactive compounds, and vitamins that promote consumers’ overall well-being. The primary reason for this surge in demand is the focus on preventive healthcare and improved awareness among U.S. consumers. To enhance their health by natural means, the majority of U.S. consumers seek supplements made with natural ingredients, as they are perceived as safer. The U.S. market is anticipated to capture a share of USD 0.26 billion in 2026.

Europe

Europe is the third largest market with a share of USD 0.3 billion in 2026. Germany emerged as one of the biggest markets for organic and natural cosmetics across the European region. For a few years, the European personal care industry has been moving toward natural and sustainable products. The U.K. market is expanding and is projected to reach a value of USD 0.05 billion in 2026. This trend has increased the demand for ecological and organic brands among Germans. In today’s health-centric era, most consumers are aware of the advantages of organic and natural compounds and are seeking healthy food and beverage items. As a result, such demand for sustainable cosmetics and food products improves the usage of phenolic ingredients. France is expected to be valued at USD 0.04 billion in 2025, while Germany is projected to reach a value of USD 0.07 billion in 2026.

South America

South America is the fourth largest market with a valuation of USD 0.11 billion in 2025. Brazil is considered one of the prominent countries in South America in terms of food consumption and production. Likewise, in the conventional food sector, the fortified food industry is also growing at a faster pace, especially owing to the surging awareness about nutrition and government initiatives to address the gap of malnutrition by mandating fortification. Moreover, the fortified food industry is emphasizing the use of natural ingredients to produce healthier food options, ultimately driving the usage of phenolic ingredients.

Middle East & Africa

Functional beverages emerged as the fastest-growing segment within the functional food category across South Africa. This is majorly attained owing to their perceived advantages for chronic disease prevention. These beverages comprise bioactive ingredients such as minerals, vitamins, and phenolic compounds, which provide several health benefits beyond hydration. The rise of on-the-go lifestyles and the amplified focus on health and wellness are other substantial factors promoting the consumption of functional beverages. Thus, such soaring demand for functional drinks (energy drinks, yogurt drinks, and others) supports the production of polyphenol-based beverages. Saudi Arabia is estimated to encounter a market share of USD 0.02 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Focus on Product Innovation by Key Players to Support Market Growth

The global market is fragmented, and the active players in the global market are embarking on two strategies (base expansion and brand promotion) to gain a competitive edge in key markets. Along with these main strategies, the companies are also focusing on sustainability and innovation in new products. The firms are keenly focusing on introducing innovative and superior-quality polyphenol ingredients with enhanced properties, which will help them differentiate themselves in the global market.

Key Players in the Polyphenols Market

To know how our report can help streamline your business, Speak to Analyst

ARCHER-DANIELS MIDLAND COMPANY, International Flavors & Fragrances Inc., Givaudan, Ajinomoto Co., Inc., and EVONIK Group are some of the largest players in the market. The global market is moderately consolidated, with the top 5 players accounting for around 20% of the global market share.

List of Key Polyphenol Companies Profiled

- Givaudan (Switzerland)

- International Flavors & Fragrances Inc. (U.S.)

- Symrise AG (Germany)

- Ajinomoto Co., Inc. (Japan)

- AQUANOVA AG (Germany)

- Kemin Industries, Inc. (U.S.)

- ARCHER-DANIELS-MIDLAND COMPANY (U.S.)

- Van Drunen Farms (U.S.)

- Indena S.p.A. (Italy)

- Evonik Group (Germany)

KEY INDUSTRY DEVELOPMENTS

- June 2024: ADM extended its partnership with Bayer AG, a German enterprise, in order to strengthen the adoption of regenerative agricultural practices across Europe.

- May 2024: Indena S.p.A. collaborated with DSM Firmenich, a Dutch company, to launch products that are made up of a combination of essential nutrients, active botanical extracts, and biotics. The products launched include Quercefit, which supports healthy aging, and all the manufactured products were launched at Vitafoods, a fair event held in Europe.

- February 2023: Evonik introduced its latest plant-centric premix in the field of animal nutrition. The product, PhytriCare IM, comprises polyphenols extracts, which are rich in flavonoid content. Moreover, this premix is mainly used to alleviate inflammation in laying hens, dairy cows, and sows. Thus, such launches pave the way toward profit generation.

- September 2022: Van Drunen Farms introduced its new range of ingredients, “NatureKnit,” which offers dietary fiber extracted from plants and polyphenols to the gut across the U.S. On consumption, the fiber-bound products are slowly released in the gut and act as antioxidants that support gut health.

- August 2019: Van Drunen Farms announced its entry into partnership with Southam Freeze Dry, a Santiago-based freeze-dried fruit supplier. In this partnership, the former firm, Van Drunen Farms, acquired the majority of SouthAm's stake.

Investment Analysis and Opportunities

The market report provides comprehensive investment analysis and opportunities aimed at providing investors and business leaders with actionable insights. The global market overview report highlights the various opportunities that have the potential for investments, including new product launches, technological advancements, mergers & acquisitions, and geographic expansions.

REPORT COVERAGE

The global polyphenols market report analyzes the market in depth and highlights crucial aspects such as global market trends, prominent companies, and applications. Besides this, the market statistics report also provides insights into the market trends and highlights significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.28% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Source

|

|

By Application

|

|

|

By Form

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the worldwide market was USD 1.42 billion in 2025 and is anticipated to reach USD 2.88 billion by 2034.

At a CAGR of 8.28%, the global market will exhibit steady growth over the forecast period (2026-2034).

By source, the citrus fruits segment led the market in 2025.

Increasing demand for naturally derived polyphenols to boost market expansion.

ARCHER-DANIELS MIDLAND COMPANY, International Flavors & Fragrances Inc., Givaudan, Ajinomoto Co., Inc., and EVONIK Group are the leading companies in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us