Polypropylene Fiber Market Size, Share & Industry Analysis, By Product Type (Staple and Yarn), By End-use Industry (Textile, Construction, Healthcare & Hygiene, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

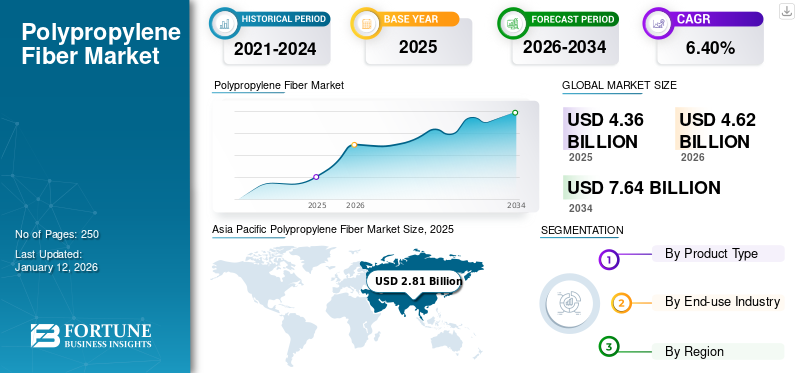

The global polypropylene fiber market size was valued at USD 4.36 billion in 2025. The market is projected to grow from USD 4.62 billion in 2026 to USD 7.64 billion by 2034, exhibiting a CAGR of 6.40% during the forecast period. Asia Pacific dominated the polypropylene fiber market with a market share of 65% in 2025.

Polypropylene fiber is a synthetic polymer strand derived from propylene monomers through polymerization processes. These fibers possess exceptional properties, including lightweight characteristics, high tensile strength, remarkable chemical resistance, and a hydrophobic nature that prevents water absorption and promotes quick drying. Beaulieu Fibres International NV, Indorama Ventures Public Company Limited, and Mitsubishi Chemical Group are the key players operating in the market.

The versatile fibers find widespread applications across numerous industries. In the textile industry, they are used for sportswear, thermal underwear, and outdoor apparel. The construction sector incorporates them as concrete reinforcement to prevent cracking and enhance durability. Other applications include manufacturing ropes, carpets, geotextiles for soil stabilization, filters, medical textiles, and packaging materials. Their combination of durability, cost-effectiveness, and resistance to chemicals and moisture makes polypropylene fibers invaluable across these diverse applications.

- Polypropylene is the lightest of all fibers and is lighter than water. It is 34% lighter than polyester and 20% lighter than nylon.

Global Polypropylene Fiber Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 4.36 billion

- 2026 Market Size: USD 4.62 billion

- 2034 Forecast Market Size: USD 7.64 billion

- CAGR: 6.40% from 2026–2034

Market Share:

- Asia Pacific dominated the polypropylene fiber market with a 65% share in 2025, fueled by rapid urbanization, expanding textile and construction industries, and large-scale manufacturing in China, India, and Southeast Asia.

- By product type, Staple fibers are expected to retain the largest market share in 2025, supported by their versatility in nonwoven applications across hygiene, geotextile, and automotive sectors.

Key Country Highlights:

- China: The largest contributor to regional demand, driven by booming construction, automotive, and textile manufacturing industries.

- United States: Leads North American demand with strong consumption in healthcare, automotive, and construction sectors; focus on high-value, technical-grade fibers.

- India: Key player in the regional market due to strong growth in textile production, infrastructure projects, and rising disposable income.

- Germany: Demand is driven by automotive industry initiatives to reduce vehicle weight using polypropylene fibers to meet EU environmental regulations.

Polypropylene Fiber Market Trends

Polypropylene-Based Geotextiles and Concrete Reinforcement Fibers Fuel Demand in Construction Sectors

The polypropylene fibers market is experiencing steady growth driven by increasing demand in automotive, geotextiles, and hygiene applications. Sustainability initiatives are accelerating development of bio-based and recyclable polypropylene fibers. Manufacturing innovations are focusing on improving fiber strength and durability while reducing production costs. The Asia Pacific region continues to dominate market share, with significant expansion in emerging economies. Growing construction activities globally have boosted demand for polypropylene-based geotextiles and concrete reinforcement fibers. The market is also seeing increased integration of polypropylene fibers in advanced composites for lightweight applications.

MARKET DYNAMICS

MARKET DRIVERS

Automotive Sector Drives Market Growth owing to Product Adoption in Interior Components

The automotive industry represents a significant market growth driver. Manufacturers increasingly adopt these lightweight, durable fibers to produce interior components, reducing vehicle weight and improving fuel efficiency. Their excellent chemical resistance and temperature stability make them ideal for under-the-hood applications, while their cost-effectiveness appeals to automakers facing margin pressures. As the global push for more sustainable transportation solutions intensifies, polypropylene’s recyclability and low environmental footprint further cement its position as the preferred material in modern vehicle design.

MARKET RESTRAINTS

Rising Environmental Concerns Hampers the Market Growth

Environmental sustainability issues pose a significant restraint to the market. As petroleum-derived synthetic materials, they face mounting criticism for their carbon footprint and non-biodegradable nature, taking hundreds of years to decompose in landfills. Increasing consumer awareness and governmental regulation targeting single-use plastics and microplastic pollution have prompted industries to seek bio-based alternatives. Additionally, polypropylene’s recyclability challenges includes contamination issues and degradation during reprocessing, which further limits the market expansion as brands commit to circular economy principles and sustainable materials sourcing.

- The manufacturing process of PP is a significant contributor to greenhouse gas emissions, with the widespread use of polypropylene expected to contribute 1.3 billion tonnes of CO2 to the atmosphere.

MARKET OPPORTUNITIES

Bio-Based Polypropylene Fibers Emerge as a Promising Market Trend

The development of bio-based polypropylene fibers presents a substantial market opportunity for industry players. Derived from renewable resources such as corn, sugarcane, or agricultural waste, these bio-based fibers address growing environmental concerns while maintaining the performance properties of conventional polypropylene. Manufacturers investing in this technology can differentiate their offerings in a competitive landscape, access green procurement programs, and command premium pricing. As regulatory frameworks increasingly favor sustainable materials and major brands commitment to reduce fossil-based plastics usage, early adopters of bio-based polypropylene fiber technology stand to capture significant market share and position themselves as sustainability leaders.

- According to European Bioplastics, the global bioplastics production capacity is set to increase significantly from around 2.47 million tonnes in 2024 to approximately 5.73 million tonnes in 2029.

MARKET CHALLENGES

Petroleum Fluctuations and Alternative Synthetic Fibers Destabilize Market Growth

The market faces intense competition from alternative synthetic fibers, particularly polyester, which offers better dyeability and aesthetic properties. Volatile raw material prices, directly tied to petroleum markets, create significant cost uncertainties for manufacturers. Environmental concerns regarding microplastic pollution from synthetic fibers pose regulatory and consumer acceptance challenges. Limited recycling infrastructure for polypropylene fiber products hampers sustainability goals. The market also struggles with technical limitations in certain applications requiring high-temperature resistance, as polypropylene has relatively low melting points compared to competing fibers. Asia Pacific witnessed a growth from USD 2.53 billion in 2023 to USD 2.67 billion in 2024.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product Type

Staple Segment Holds a Dominant Share Due to High Demand from Nonwoven Applications

Based on product type, the market is segmented into staple and yarn.

The staple segment held the largest global polypropylene fiber market share in 2024 and is expected to dominate the market during the forecast period. The dominant share is due to the versatility and widespread use of staple fibers in nonwoven applications, including hygiene products, geotextiles, and automotive components. These short-length fibers offer excellent bulk, insulation properties, and cost-effectiveness, making them particularly valuable in disposable applications where the strength-to-weight ratio is critical.

By End-use Industry

Textile Segment to Led in the Demand Due to Product’s High Utilization in Apparel

Based on end-use industry, the market is segmented into textile, construction, healthcare & hygiene, and others.

The textile segment held the largest market share in 2024. The textile industry represents significant opportunities for polypropylene fibers, primarily utilizing them in sportswear, outdoor apparel, and carpeting applications. Their moisture-wicking properties, lightweight nature, and durability make them ideal for performance fabrics, while their stain resistance and color retention capabilities drive adoption in home textiles and upholstery markets.

Polypropylene Fiber Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Polypropylene Fiber Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest share of the polypropylene fiber market in 2024, generating market revenue worth USD 2.67 billion. China, India, and Southeast Asian countries drive this dominance through massive manufacturing capabilities and low production costs. The region’s booming construction industry, expanding automotive production, and growing textile sector fuel consistent demand growth. Rapid urbanization, infrastructure development, and increasing disposable income further accelerates market expansion. Local manufacturers continue to increase production capacity, positioning Asia Pacific as both the largest producer and consumer of polypropylene fibers globally.

- According to HSBC, Over the past 20 years, the textile and apparel trade in Asia has grown at a rate of 4.5% a year and now accounts for nearly 65% of the global market, up from just over half in 2005.

- Globally, the textiles and apparel industry accounts for up to 10% of greenhouse gas emissions and consumes over 200 trillion liters of water each year.

North America

North America presents a mature market characterized by technological innovation and high-value applications. The U.S. leads regional consumption, with significant demand from the healthcare, automotive, and construction industries. The region focuses on specialty and technical-grade polypropylene fibers that command premium pricing. Stringent quality standards, sustainability initiatives, and advanced manufacturing capabilities distinguish this market.

- According to the Centers for Medicare & Medicaid Services, U.S. healthcare spending grew 7.5% in 2023, reaching USD 4.9 trillion or USD 14,570 per person. As a share of the nation's Gross Domestic Product, health spending accounted for 17.6 percent.

Europe

Stringent environmental regulations and sustainability initiatives drive the demand in Europe. The region emphasizes recycled and recyclable solutions, with manufacturing investing heavily in circular economy approaches. The automotive industry remains a key consumer, utilizing these fibers to meet vehicle weight reduction targets.

- According to Eurostat together, HDPE and PP account for almost a third of all converter demand in the EU28 for polymer resins.

- According to ACEA, the turnover generated by the automotive sector represents 7% of the EU’s total GDP. Vehicle manufacturing is a strategic industry in the EU, where 13.1 million cars, vans, trucks, and buses are manufactured per year. Motor vehicles account for USD 414.9 billion in taxes in major European markets.

Latin America

The Latin American polypropylene fiber market growth is associated with increasing industrialization and infrastructure development. Brazil & Mexico lead in regional consumption, with significant demand from packaging, construction, and agriculture applications. The region benefits from abundant natural gas resources serving as feedstock for polypropylene production.

Middle East & Africa

The Middle East & Africa region leverages its strategic advantage in raw material access, with GCC countries establishing themselves as major producers. Saudi Arabia and UAE lead production capacity, benefitting from integrated petrochemical operations and competitive pricing. Africa represents an emerging market with significant growth potential driven by rapid urbanization, infrastructure development, and an expanding construction industry.

COMPETITIVE LANDSCAPE

Key Industry Players

Investment in Product Innovations is the Key Strategy Adopted to Gain Market Competence

The global polypropylene fiber market is concentrated with companies such as Beaulieu Fibres International NV, Chemosvit Fibrochem, s.r.o., Indorama Ventures Public Company Limited, Mitsubishi Chemical Group, and Radici Partecipazioni SpA accounting for a significant market share. Polypropylene fiber companies are focusing on sustainable solutions, regulatory compliance, and innovation. They are developing eco-friendly products, investing in advanced manufacturing technologies, and expanding into emerging markets. Additionally, companies are enhancing their recycling capabilities and forming strategic partnerships to strengthen their market position and address environmental concerns.

LIST OF KEY POLYPROPYLENE FIBER COMPANIES PROFILED

- Beaulieu Fibres International NV (Belgium)

- Chemosvit Fibrochem, s.r.o. (Slovakia)

- Indorama Ventures Public Company Limited (Thailand)

- Mitsubishi Chemical Group (Japan)

- Radici Partecipazioni SpA (Italy)

- DuPont (U.S)

- Avient (U.S.)

- FiberPartner (Denmark)

- IFG International Fibres Group (Austria)

- Sika (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2023: Avient Corporation, a leading provider of specialized and sustainable material solutions, showcased its portfolio of sustainable polymers, colorants, additives, specialty engineered materials, and services at Plastimagen 2023.

- April 2023: Beaulieu Fibres International showcased sustainable bio-component fibers at INDEX 23, including Meralux for material savings, Ultrabond for binder-free bonding, and Hyper Soft for comfort. Their Belgium and Italy sites earned ISCC Plus certification for bio-circular fibers.

REPORT COVERAGE

The global market research report provides detailed market analysis and focuses on crucial aspects such as leading companies, product types, and end-use industries. Also, the report offers insights into market trends and highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) & Volume (Kiloton) |

|

Growth Rate |

CAGR of 6.40% during 2026-2034 |

|

Segmentation |

By Product Type

|

|

By End-use Industry

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 4.62 billion in 2026 and is projected to reach USD 7.64 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 2.81 billion.

The market is expected to exhibit a CAGR of 6.40% during the forecast period.

The textiles segment led the market by end-use industry.

Surging demand for textiles and construction to drive market growth.

Asbury Carbons, EagleGraphite, HEG Limited, Imerys S.A., and Mineral Commodities Ltd. are the top players in the market.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us