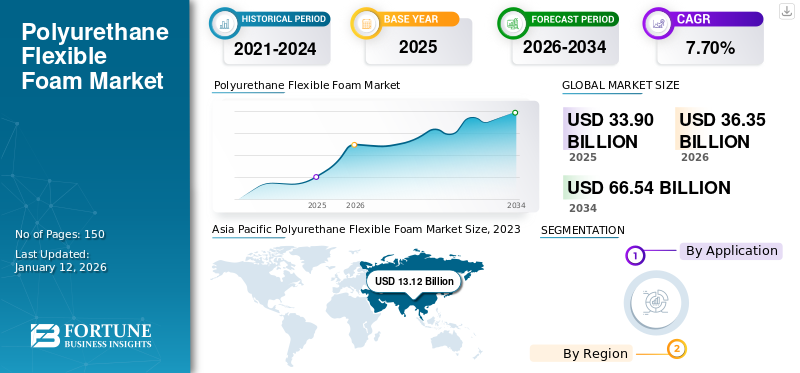

Polyurethane Flexible Foam Market Size, Share & Industry Analysis, By Application (Bedding & Furniture, Automotive, Packaging, Footwear, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global polyurethane flexible foam market size was valued at USD 33.90 billion in 2025. The market is projected to grow from USD 36.35 billion in 2026 to USD 66.54 billion by 2034 at a CAGR of 7.70% during the forecast period. Asia Pacific dominated the polyurethane flexible foam market with a market share of 45% in 2025.

Global Polyurethane Flexible Foam Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 33.90 billion

- 2026 Market Size: USD 36.35 billion

- 2034 Forecast Market Size: USD 66.54 billion

- CAGR: 7.70% during the forecast period (2026–2034)

Market Share

- Asia Pacific dominated the polyurethane flexible foam market with a 45% market share in 2025.

Regional Insights

- Asia Pacific: Largest market share in 2023, led by China, India, and Southeast Asia’s urbanization and industrial growth.

- North America: Significant growth driven by construction and consumer demand for comfort products; U.S. valued at USD 4.56 billion in 2023.

- Europe: Growth fueled by automotive sector’s lightweight foam usage and e-commerce packaging demand.

- South America: Rising demand for memory foam mattresses and ergonomic furniture.

- Middle East & Africa: Growth supported by urbanization and large infrastructure projects, including Saudi Vision 2030.

MARKET DYNAMICS

POLYURETHANE FLEXIBLE FOAM MARKET TRENDS

Growing Consumer Preference toward High-Quality Bedding and Furniture Products is an Emerging Market Trend

There is a growing trend among consumers toward high-quality bedding and furniture products, which are often made from flexible polyurethane foam. This shift in consumer preferences is allowing foam manufacturers to enhance their offerings.

Consumers are increasingly seeking high-quality bedding and furniture that not only offers comfort but also aligns with sustainability goals. Flexible polyurethane foam can be manufactured using bio-based materials, which appeals to eco-conscious consumers. Additionally, advances in foam technology, including the development of high-resilience and memory foams, are enhancing the appeal of polyurethane foam in the bedding and furniture sectors. These innovations provide better support and comfort and cater to evolving consumer preferences.

MARKET DRIVERS

Growing Demand for Lightweight Materials in Various Applications is Driving the Market

The growing demand for lightweight materials is significantly driving the adoption of polyurethane flexible foam across various applications. This trend reflects a broader shift toward materials that enhance performance while minimizing weight, which is crucial in industries, such as automotive, furniture, and packaging. Polyurethane flexible foam is known for its low density, making it an ideal choice for applications where weight reduction is essential. For instance, in the automotive industry, using lightweight foam can lead to improved fuel efficiency and better handling characteristics.

Beyond its lightweight benefits, polyurethane foam also provides superior insulation against heat and sound, making it a preferred choice in construction and HVAC applications. The material exhibits exceptional resilience and adaptability, allowing it to return to its original shape after deformation. This property is particularly beneficial in applications that require repeated use.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

Fluctuations in Raw Material Prices Hinder Market Growth

Fluctuations in raw material costs are significantly restraining the polyurethane flexible foam market growth. The volatility in raw material prices can deter companies from making long-term investments in capacity expansion or research and development. Manufacturers may hesitate to commit resources when future costs remain uncertain, potentially delaying innovation and growth within the industry.

The ongoing instability in global oil markets has led to unpredictable pricing patterns for petroleum-based resins, which are critical for producing polyurethane foam. Factors, such as production cuts by oil-producing nations and energy supply issues have created an environment of uncertainty, making it difficult for manufacturers to plan and budget effectively.

MARKET OPPORTUNITIES

Energy Efficiency and Sustainability Open New Avenues for Market Growth

The market is experiencing significant opportunities driven by the increasing focus on energy efficiency and sustainability. As industries and consumers alike prioritize environmental considerations, the unique properties of polyurethane foam position it as a key material for achieving these goals.

There is a growing emphasis on energy-efficient products across various sectors, including construction and furniture. Polyurethane foams are known for their superior insulation properties, which help in reducing energy consumption in buildings. The shift toward eco-friendly materials also align with consumer preferences, as polyurethane foams can be produced from bio-based resources, further enhancing their appeal.

Advancements in polyurethane technology, including the adoption of environmentally friendly blowing agents, enhance its sustainability profile. Manufacturers are increasingly focusing on producing polyurethane flexible foams that meet stringent environmental standards while maintaining high performance.

MARKET CHALLENGES

Growing Emphasis on Environmental Regulations is Challenging Market Growth

Environmental regulations are presenting significant challenges to market growth. These regulations, aimed at reducing harmful emissions and promoting sustainability, impose strict compliance requirements that can affect production processes and costs.

The U.S. Environmental Protection Agency (EPA) has established stringent standards to limit emissions of hazardous air pollutants from flexible polyurethane foam manufacturing processes. These regulations require manufacturers to reduce emissions of substances including methylene chloride and toluene diisocyanate (TDI) by implementing advanced control technologies. Compliance with these standards necessitates significant investments in equipment and processes, which can strain manufacturers' financial resources.

IMPACT OF COVID-19

The COVID-19 pandemic significantly disrupted the market, impacting various sectors and leading to a downturn in demand and production. The pandemic led to widespread factory closures and reduced operational capacities due to lockdown measures imposed by governments globally. This resulted in significant delays in production and supply chain interruptions, affecting the availability of polyurethane foams for various applications, including automotive, furniture, and construction.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Trade protectionism and geopolitical factors could influence the market, offering both challenges and opportunities for manufacturers and consumers. Trade protectionism can disrupt supply chains, making it difficult for manufacturers to obtain necessary components or raw materials. This disruption can lead to delays in production and fulfillment, ultimately affecting market availability and pricing stability.

Similarly, geopolitical tensions can lead to uncertainty in trade agreements and international relations, impacting the flow of goods across borders. For instance, tensions between major economies can result in sanctions or trade disputes that directly affect the market by restricting access to key markets or suppliers.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

Research and development (R&D) trends in the polyurethane flexible foam market are increasingly focused on innovation, sustainability, and performance enhancement. As industries evolve and consumer demands shift, companies are investing heavily in R&D to stay competitive in the market and meet regulatory requirements.

There is a growing emphasis on developing bio-based polyols derived from renewable sources such as soy or castor oil. This shift aims to reduce reliance on fossil fuels and lower the environmental impact of polyurethane foam production. Companies are exploring formulations that incorporate these sustainable materials to appeal to eco-conscious consumers and comply with stringent environmental regulations.

SEGMENTATION ANALYSIS

By Application

To know how our report can help streamline your business, Speak to Analyst

Bedding & Furniture Accounted for a Leading Share Owing to Consumer Preference for Comfort, Quality, and Innovative Designs

Based on application, the market is segmented into bedding & furniture, automotive, packaging, footwear, and others.

The bedding & furniture segment accounted for the largest polyurethane flexible foam market share in 2023. There is a growing emphasis on comfort and customization in furniture and bedding design. Flexible polyurethane foams are favored for their cushioning properties, allowing manufacturers to create products that align with current market trends while offering durability and cost-effectiveness. In addition, this segment is expected to continue leading the market due to rising urban populations and increasing living standards, particularly in emerging economies, such as China, India, and Indonesia.

Manufacturers are continuously developing innovative foam designs to meet specific consumer needs. This includes advancements in foam technology that enhance comfort, support, and longevity, further driving demand in the segment.

Flexible polyurethane foam is widely used in the automotive industry for seating and other components. The automotive segment is projected to grow at a positive growth rate during the forecast period. It offers a combination of lightweight, strength, and versatility, contributing to improved fuel efficiency and reduced emissions.

POLYURETHANE FLEXIBLE FOAM MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, South America, and Middle East & Africa.

Asia Pacific

Asia Pacific Polyurethane Flexible Foam Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the largest market share in 2023. The Asia Pacific region is witnessing rapid growth in the furniture and bedding markets due to urbanization and rising disposable incomes. This trend is expected to bolster the demand for high-quality polyurethane flexible foam products as consumers seek improved living standards. China is the largest contributor within the Asia Pacific region and is anticipated to achieve significant market growth during the forecast period. The country's robust automotive, construction, and furniture industries drive this demand, reflecting its vast population and economic expansion.

To know how our report can help streamline your business, Speak to Analyst

Rapid urbanization in countries, such as India, China, and Southeast Asian nations has led to increased demand for construction materials, including flexible polyurethane foam for insulation and cushioning applications. This growth is further fueled by rising disposable incomes and consumer spending on home furnishings.

North America

North America is experiencing significant growth in the market, driven by various factors, including robust demand from key industries, technological advancements, and increasing consumer preferences for comfort-oriented products. The U.S. accounted for the notable market share in 2023, valued at USD 4.56 billion. The construction industry is a major driver of demand for flexible polyurethane foam, as it is widely used for insulation, soundproofing, and sealing applications. The increasing number of residential and commercial construction projects is boosting the need for high-performance foam products.

Europe

The automotive sector significantly contributes to the growth of the European market. Manufacturers are increasingly using lightweight, flexible foams in vehicle interiors for seats, headrests, and insulation materials to meet fuel efficiency standards and enhance comfort. In addition, the rapid expansion of e-commerce has increased the demand for protective packaging materials made from flexible foams. These foams are essential for cushioning fragile items during shipping, particularly in the electronics and consumer goods sectors.

South America

Polyurethane flexible foam is witnessing a growing demand in South America. There is a rising demand for comfort-oriented products such as memory foam mattresses and ergonomic furniture. This trend is driving the adoption of high-quality flexible foams in bedding and furniture applications as consumers seek improved sleep quality and overall comfort.

Middle East & Africa

The market in the Middle East & Africa is experiencing significant growth. The rapid urbanization and extensive infrastructure development in countries, such as Saudi Arabia and the UAE are major contributors to the demand for polyurethane foams. These materials are essential for insulation, soundproofing, and sealing applications in both residential and commercial buildings. The ongoing construction projects under initiatives including Saudi Arabia's Vision 2030 further enhance this demand.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Players are Leveraging Acquisitions and New Product Developments to Enhance Their Market Presence

Covestro AG (Germany), BASF SE (Germany), Huntsman International LLC (U.S.), and Carpenter Co. (U.S.) are the key players in the market. These companies have used acquisitions and new product developments as their key strategies to increase their global presence and serve the customer demand in the market.

LIST OF KEY POLYURETHANE FLEXIBLE FOAM COMPANIES PROFILED

- Covestro AG (Germany)

- BASF SE (Germany)

- DOW (U.S.)

- Huntsman International LLC (U.S.)

- SEKISUI CHEMICAL CO., LTD. (Japan)

- Interplasp (Spain)

- Saint-Gobain (France)

- Carpenter Co. (U.S.)

- Rogers Corporation (U.S.)

- Sheela Group (India)

KEY INDUSTRY DEVELOPMENTS

- April 2024 - BASF introduced a new generation of flexible polyurethane foams that can be thermoplastically recycled at the end of their lifecycle. This innovative product is fully recyclable and can be utilized as a raw material for producing new foams across diverse sectors, including footwear, automotive, and furniture.

- December 2021 - Covestro AG joined forces with Eco-Mobilier to address advanced recycling methods for polyurethane mattress foam. This partnership allowed the company to strengthen its market position while providing sustainable options to consumers.

- March 2021 – Covestro AG developed a groundbreaking method for the chemical recycling of polyurethane (PU) flexible foam originating from old mattresses. This innovation stems from its involvement in the PUReSmart project, which the Recticel Company manages.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, forms, and applications. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 7.70% from 2026 to 2034 |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 33.90 billion in 2025 and is projected to reach USD 66.54 billion by 2034.

Recording a CAGR of 7.70%, the market is slated to exhibit steady growth during the forecast period.

The bedding & furniture application segment led in 2026.

Asia Pacific held the highest market share in 2026.

Growing demand for lightweight materials aids the growth of the polyurethane flexible foam market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us