Porcine Vaccines Market Size, Share & Industry Analysis, By Product (Inactivated, Live Attenuated, Recombinant, and Others), By Route of Administration (Oral and Parenteral), By Distribution Channel (Veterinary Hospitals, Veterinary Clinics, Pharmacies & Drug Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

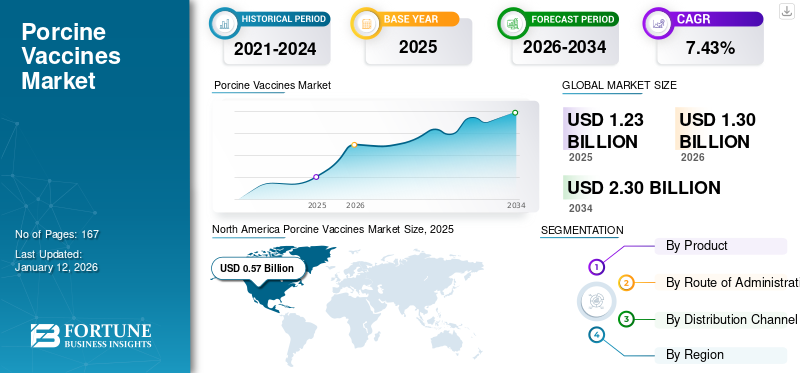

The global porcine vaccines market size was valued at USD 1.23 billion in 2025. The market is projected to grow from USD 1.3 billion in 2026 to USD 2.3 billion by 2034, exhibiting a CAGR of 7.43% during the forecast period. North America dominated the Porcine Vaccines Market with a market share of 17.74% in 2025.

The porcine vaccines market is expected to witness significant growth due to various factors. Vaccines play a major role in preventing diseases and maintaining good health in animals. It has been effective in reducing disease burden in animals. Vaccines contain antigens from bacteria, viruses, bacterial toxins, or parasites. They stimulate an immune response without causing the actual disease. When vaccines are administered to a pig, its immune system responds to the vaccine and remembers the infectious agent. These products are designed to elicit protective immune responses in animals and prepare their immune system to fight future infections from various disease-causing agents.

Furthermore, the increasing prevalence of animal disease and the demand for animal protein intensify the risk of disease outbreaks among densely populated farms, leading to economic loss for farmers. Such scenarios collectively increase the demand for vaccination in pig farms and drive market growth.

- For example, in February 2024, according to the data published by the National Institute of Health, the prevalence of influenza in European swine was estimated to be 56.6% herd level. The widespread nature of the disease increases the need for effective preventive measures to ensure livestock safety and disease spread, thus bolstering the growth of the market.

Moreover, the presence of key players in the market, such as Zoetis Services LLC, Elanco, and Virbac, with strong research and development activities, strategic initiatives, and robust product offerings, boosts the market growth.

Global Porcine Vaccines Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.23 billion

- 2026 Market Size: USD 1.3 billion

- 2034 Forecast Market Size: USD 2.3 billion

- CAGR: 7.43% from 2026–2034

Market Share:

- Region: North America dominated the market with a 17.74% share in 2025. This leadership is driven by stringent animal health and food safety guidelines, which in turn increase the demand for adequate vaccination in pigs to prevent the spread of zoonotic diseases.

- By Product: The Inactivated segment held a significant market share. The segment's growth is fueled by the safety and efficacy of inactivated vaccines and their ability to control outbreaks of viral diseases in swine, along with an increasing number of new product launches by key players.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan's market is driven by increasing government initiatives to promote porcine vaccination and a growing need to mitigate the economic losses faced by farmers from disease outbreaks.

- United States: Market growth is supported by a high prevalence of swine diseases, with Porcine Reproductive and Respiratory Syndrome (PRRS) costing the industry approximately USD 560.0 million annually. Strong R&D, such as the development of a new vaccine candidate for African Swine Fever (ASF), also propels the market.

- China: As a major market in the Asia Pacific, growth is fueled by a high volume of pork production and consumption, which necessitates robust vaccination programs to maintain herd health and prevent the spread of diseases.

- Europe: The market is driven by a high prevalence of diseases such as swine influenza, which affects an estimated 56.6% of herds. The region is also seeing significant innovation, with the European Commission granting marketing authorization for new genotype-specific vaccines to combat common pathogens.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence for Swine Diseases and Growing Pork Consumption to Drive Market Growth

The increasing outbreaks of swine diseases is a significant factor driving the growth of the porcine vaccines market. Diseases such as classical swine fever, foot-and-mouth disease, porcine parvovirus, and porcine reproductive and respiratory syndrome pose serious threats to pig populations.

- For example, the World Organization for Animal Health (WOAH) reports that Porcine Reproductive and Respiratory Syndrome (PRRS) is a prevalent viral disease affecting domestic pigs. This costs approximately USD 560.0 million annually in the U.S. due to reproductive issues in adult females and severe pneumonia in nursing piglets.

Furthermore, the growing demand for pork meat due to rising global populations and changing dietary preferences is pushing the need for healthier livestock. Also, increased awareness of zoonotic diseases that can transfer from animals to humans has prompted animal farmers to prioritize the health of their livestock and invest in preventive healthcare.

- According to data from the Food and Agriculture Organization of the United Nations, as cited by Our World in Data, total pig meat production reached approximately 124.67 million tons in 2023. Such high pig meat consumption drives the need for vaccination to avoid the spread of diseases and thus drives the global porcine vaccines market growth.

MARKET RESTRAINTS

Lack of Immunization Adoption in Developing Countries May Hinder Growth

The limited adoption of immunization in developing countries significantly hampers the veterinary vaccine market. Factors such as inadequate healthcare infrastructure, low levels of public awareness, and economic challenges impede the widespread use of vaccines for both livestock and companion animals in these regions.

- For example, according to the data published by, The Food and Agriculture Organization, the livestock in developing countries had a large number of preventable deaths each year. Meta-analysis indicated that approximately 20.0% of ruminants (with 25.0% of young and 10.0% of adult animals) die prematurely annually, and around half of these deaths are due to infectious diseases. Key livestock epidemics include foot and mouth disease, Newcastle disease, African swine fever, classical swine fever, and contagious bovine pleuropneumonia.

Such a rise in vaccine-preventable diseases highlights the limited adoption of immunization in developing regions, thereby constraining market growth.

MARKET OPPORTUNITIES

Rising Government Initiatives and Vaccination Drive to Offer Lucrative Growth Opportunity

The increasing number of government initiatives aimed at enhancing animal health and productivity is a significant opportunity for market growth. Rising awareness about the importance of vaccination in preventing swine diseases, such as Porcine Reproductive and Respiratory Syndrome (PRRS) and swine influenza, is leading to greater adoption of vaccines among farmers.

Moreover, governments worldwide are implementing programs to support swine health management, which includes funding for vaccination drives and educational campaigns.

- For instance, the Department of Animal Husbandry and Veterinary Services in Nagaland, India, has launched the Round II Classical Swine Fever (CSF) vaccination programs for the 2024-25 period under the Livestock Health & Disease Control/Classical Swine Fever-Control Programme (LH & DC/CSF-CP). The objective of this vaccination campaign is to immunize 250,000 pigs that are vulnerable to CSF. This program is essential for preventing the spread of CSF, which has a devastating effect on the economy, the pig farming industry, and the livelihoods of farmers involved in the piggery. Thus, such initiatives offer a significant opportunity for market growth.

MARKET CHALLENGES

Genetic Mutation & Regulatory Complexity to Challenge Market Growth

The market faces significant challenges due to the constant mutation of pathogens such as Porcine Reproductive and Respiratory Syndrome (PRRS) virus and Influenza, leading to vaccine mismatches that diminish their effectiveness. Genetic mutations in pathogens can lead to altered virulence and vaccine efficacy, necessitating continuous updates to vaccine formulations. These rapid mutations necessitate frequent updates to vaccine formulations, complicating production and distribution processes.

Additionally, the regulatory landscape for vaccines is becoming increasingly stringent, with rigorous approval processes that can delay the introduction of new products. Also, navigating diverse regulatory requirements across different regions complicates market entry for new vaccines. The combination of evolving pathogen genetics and complex regulatory frameworks creates a challenging environment for vaccine developers, potentially delaying market growth and limiting the availability of effective solutions for swine health management.

PORCINE VACCINES MARKET TRENDS

Technological Advancements in Porcine Immunization is a Prominent Trend

The technological advancements in porcine immunization have significantly influenced the global porcine vaccines market trends with the development of genotype vaccines. Genotype vaccines are designed to target specific strains of pathogens by utilizing genetic information to enhance the immune response in pigs. This precision in vaccination allows for more effective control of diseases, particularly those caused by rapidly evolving viruses and bacteria, such as the Porcine Reproductive and Respiratory Syndrome Virus (PRRSV) and Swine Influenza Virus (SIV).

Furthermore, advancements in genomics and biotechnology have enabled researchers to develop vaccines that can be tailored to specific genetic backgrounds of swine populations, leading to improved herd health and productivity.

- For example, in October 2024, Ceva received European marketing authorization from the European Commission for Cirbloc M Hyo. This new vaccine is developed using the PCV2d genotype, which is the most prevalent in the field, along with the Mycoplasma hyopneumoniae (M.hyo) strain BA 2940, which has already proven effective in the Hyogen vaccine. PCV2 and M.hyo are among the most common pathogens impacting pig health, both being major contributors to the Porcine Respiratory Diseases Complex, which can be effectively managed through vaccination.

Moreover, as producers seek to optimize herd performance and minimize economic losses due to disease outbreaks, the trend toward genotype vaccines is expected to continue to gain momentum, ultimately transforming the landscape of porcine immunization.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic negatively impacted the market. The slower growth of the market was due to disruption in the manufacturing and supply of the vaccines due to stringent travel regulations and a shift toward human vaccine development to combat the pandemic situation.

However, the resumption of COVID-19 guidelines and the increasing need for porcine vaccination among livestock farmers resulted in boosting the demand for porcine vaccine products during the forecast period.

SEGMENTATION ANALYSIS

By Product

New Product Launches Under Inactivated Segment Helped it Dominate the Market in 2024

On the basis of product, the global market is segmented into inactivated, live attenuated, recombinant, and others.

The inactivated segment held a significant share of the market in 2024. The growth of the segment is driven by the safety and efficacy of the vaccine and its ability to control outbreaks of viral diseases in swine. Additionally, increasing product launches by key players is a prominent factor bolstering the segment's growth in the market.

- For instance, in June 2023, Zoetis Services LLC launched the product of CircoMax in Europe. It is an inactivated recombinant Porcine Circovirus type 2 (PCV2) vaccine that includes two genotypes (a & b), providing broader coverage and protection against PCV2 threat.

The live attenuated segment is expected to hold a substantial portion of the global porcine vaccines market share in 2024. This is augmented by their ability to induce strong and long-lasting immunity. Also, increasing government initiatives to launch these vaccines for swine fever is another key factor propelling the segment's growth.

- For instance, in February 2020, the Director General of the Indian Council of Agricultural Research (ICAR), the Department of Agricultural Research and Education (DARE), and the Secretary of the Department of Animal Husbandry and Dairying (DAHD) unveiled the Live Attenuated Classical Swine Fever Vaccine (IVRI-CSF-BS) technology, developed by the ICAR-Indian Veterinary Research Institute (IVRI) in Izatnagar. This advancement aimed to help to recover the shortfall in vaccine requirements across the country.

On the other hand, recombinant vaccine is expected to grow with a significant CAGR during the forecast period due to their positive features, such as purity, safety, efficacy, and targeted immune response. These are widely used for the prevention of diseases such as foot-and-mouth disease, circovirus in swine.

Moreover, the cost-effective production of higher-quality products has contributed to the high growth of the recombinant segment. Such benefits bolster the segment's market share during the forecast period.

By Route of Administration

Parenteral Segment to Lead in Terms of Revenue Generation Due to Advancements in Parenteral Immunization Products

On the basis of route of administration, the global market is segmented into parenteral and oral.

The parenteral segment has established a leading position within the route of administration category. This dominance is primarily due to the rapid onset of action and superior efficacy in eliciting immunity compared to other administration methods. Parenteral administration typically involves injecting the vaccine directly into the animal's body through subcutaneous, intramuscular, or intradermal routes. Moreover, the growth of this segment is further supported by increasing research and development efforts, along with new product launches in the parenteral vaccine sector.

- For example, in June 2023, Merck Animal Health introduced the Circumvent CML vaccine for pigs. This single-dose intramuscular vaccine is designed to control Porcine Circovirus Type 2a (PCV-2a), Porcine Circovirus Type 2d (PCV-2d), Mycoplasma hyopneumoniae, and Lawsonia intracellularis in pigs. Such product launches are expected to enhance the segment's growth in the market.

The oral segment is expected to grow with a significant CAGR during the forecast period. The preference for these routes in situations where mass vaccination is needed and administered easily to large groups is boosting the segment's growth in the market. Moreover, increasing funding activities to launch oral vaccines for pigs is also driving the segment's growth in the market.

- For instance, in May 2022, Mazen secured USD 11.0 million for the development of a novel oral vaccine to prevent swine from porcine epidemic diarrhea virus. Such activities are bolstering the segment's growth.

By Distribution Channel

Rising Awareness Programs by Veterinary Hospitals Segment to Hold Largest Share

On the basis of distribution channel, the market is segmented into veterinary hospitals, veterinary clinics, pharmacies & drug stores, and others.

The veterinary hospitals segment is expected to hold a significant share throughout the forecast period. This is mainly due to their ability to provide advanced care and specialized treatment options for pigs. These hospitals are equipped with cutting-edge technology and a skilled team of professionals, allowing them to address a wide array of medical issues effectively. Also, increasing awareness programs by the hospitals for domestic animals to prevent diseases, is boosting the segment's growth in the market.

- For instance, in April 2025, Noney Veterinary Hospital organized an awareness program along with a vaccination campaign for domestic animals in the villages of Longsai and Longmai Part-IV in the Noney district. The program aimed to educate the community about important livestock diseases such as foot-and-mouth disease (FMD), brucellosis, peste des petits ruminants (PPR), and classical swine fever.

Meanwhile, the veterinary clinics segment is anticipated to maintain a robust position during the forecast period. This is primarily because vaccinations are typically short-duration procedures often carried out at smaller facilities.

The others segment is expected to grow with a moderate Compound Annual Growth Rate (CAGR) during the forecast period. The segment comprises research institutes and academic centers that are constantly developing novel vaccines for preventing porcine from deadly infections and decreasing the economic loss of the farmers.

- For instance, in June 2024, PlantForm Corporation secured funds from the Canadian Swine Research and Development Cluster (CSRDC) to collaborate with scientists from Agriculture and Agri-Food Canada (AAFC) for the development of an affordable and efficient oral vaccine to safeguard swine herds against porcine epidemic diarrhea virus (PEDv).

PORCINE VACCINES MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Porcine Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America's porcine vaccines market size was valued at USD 0.54 billion in 2024 and is expected to grow significantly in the forecast period. The growth of the region is augmented by the stringent animal health and food guidelines, which, in turn, increases the demand for adequate vaccination in the pigs to avoid the spread of zoonotic diseases.

U.S.

In North America, the U.S. held a dominating share of the market. Increasing pork consumption and rising activities for the active immunization of pigs by farmers are boosting the market growth in the country.

Additionally, the strong presence of key players and emphasis on research and development activities in the country for vaccine development further boosts the country's growth.

- For instance, in April 2022, scientists at the U.S. Department of Agriculture's Agricultural Research Service (ARS) announced that the new vaccine candidate for African Swine Fever (ASF) passed an important safety test required for regulatory approval. Such positive results propel the launch of new vaccines and the growth of the market.

Europe

Europe held the second-largest share of the market. The region's growth is driven by increasing demand for pork products, which, in turn, is increasing the pressure on pig farmers to maintain healthy herds and maximize production efficiency.

- For example, the data released by the Department for Environment, Food & Rural Affairs indicates that the U.K.'s statistics on cattle, sheep, and pig slaughter and meat production for December 2024 show that pig meat production reached 77,000 tons, reflecting an 8.9% increase compared to December 2023.

This surge in pork consumption requires minimal risk of disease outbreaks among densely populated farms. Thus, to support this, the adoption of preventive measures such as immunization becomes essential.

Asia Pacific

The Asia Pacific market is expected to grow with the highest CAGR during 2025-2032. The growing need for porcine vaccinations to mitigate economic losses faced by farmers from disease outbreaks, along with increasing government initiatives promoting porcine vaccination, are driving the heightened demand. This scenario is expected to drive market growth throughout the region.

- For example, the National Animal Disease Control Programme (NADCP) is a prominent initiative launched in 2019 aimed at controlling Foot and Mouth Disease (FMD) and Brucellosis. The program's objective is to vaccinate the entire population of cattle, buffalo, sheep, goats, and pigs against FMD, as well as all female bovine calves aged 4 to 8 months against Brucellosis.

Latin America and the Middle East & Africa

The Middle East & Africa and Latin America are expected to witness slower growth during the forecast period. The increasing pork product consumption in Latin American countries and rising demand for vaccination to maintain herd immunity are propelling the demand for porcine immunization in the country.

Additionally, increasing government initiatives to protect against the spread of zoonotic diseases will bolster the region's growth during the forecast period.

- For example, the U.S. Department of Agriculture has projected that pork consumption in Mexico will reach 22.6 kilograms per person by 2033—such rising demand for pork produce boosts the demand for vaccination amongst pig farmers.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Robust Product Offerings and Strong Global Presence of Zoetis Services, LLC and Other Players to Strengthen their Positions

Zoetis Services LLC, Merck & Co., Inc., and Elanco are some of the prominent players in the market. The strong market position is due to their robust product portfolio and key strategic decisions. The continued R&D for new product approvals and extensive geographical presence of these companies are expected to propel the company's share.

- In September 2022, Zoetis acquired Jurox, an animal health company that provides veterinary medicines for treating livestock and companion animals in Australia.

Other prominent players, such as Ceva, Virbac, and HIPRA, are expected to hold a significant revenue share of the market, with rising development activities and product launches.

LIST OF KEY PORCINE VACCINES COMPANIES PROFILED

- Elanco (U.S.)

- HIPRA (Spain)

- Boehringer Ingelheim International GmbH (Germany)

- Virbac (France)

- Merck & Co., Inc.(U.S.)

- Zoetis Services LLC (U.S.)

- Ceva (France)

- NEOGEN CORPORATION (U.S.)

- Hester Biosciences Limited (India)

KEY INDUSTRY DEVELOPMENTS

- September 2024: Merck & Co., Inc. announced that the European Medicines Agency granted marketing authorization in the European Union for PORCILIS PCV M Hyo ID. This ready-to-use intradermal vaccine protects two of the most prevalent swine pathogens: Porcine Circovirus Type 2 (PCV2) and Mycoplasma hyopneumoniae (M. hyo).

- June 2023: Merck & Co., Inc., launched a three- in-one vaccine that prevents diseases such as Porcine Circovirus Type 2a (PCV-2a), Porcine Circovirus Type 2d (PCV-2d), Mycoplasma hyopneumoniae and Lawsonia intracellularis in pigs.

- June 2023: Boehringer Ingelheim International GmbH, Canada, launched FLEX CircoPRRS, a combination vaccine that protects pigs against two major swine diseases: Porcine Circovirus 2 (PCV2) and Porcine Reproductive and Respiratory Syndrome (PRRSV).

- April 2021: Hester Biosciences Limited acquired technologies for the production and commercialization of the classical swine fever vaccine and sheep pox vaccine from the ICAR-IVRI (Indian Council of Agricultural Research - Indian Veterinary Research Institute).

- February 2021: Virbac and Algenex SL signed an international commercial licensing agreement to develop and commercialize CrisBio.

REPORT COVERAGE

The global porcine vaccines market report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, products, routes of administration, and distribution channels. Moreover, it comprises market dynamics, key insights on the prevalence of zoonotic diseases, and guidelines for porcine vaccination, among others. In addition to the factors mentioned above, it encompasses of global porcine vaccines market industry forecast and the impact of COVID-19 on the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.43% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to record a valuation of USD 2.3 billion by 2034.

By registering a CAGR of 7.43%, the market will exhibit steady growth during the forecast period of 2026-2034.

Based on product, the live attenuated segment is expected to lead the market during the forecast period.

The rising prevalence of swine diseases and growing pork consumption would drive the growth of the market.

Zoetis Services LLC. Elanco, and Merck & Co., Inc. are the top players in the market.

North America is expected to hold the largest share of the market.

Rising transmission of zoonotic diseases and economic loss due to porcine diseases would drive the adoption of porcine vaccines.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us