Poultry Vaccines Market Size, Share & Industry Analysis, By Technology (Inactivated, Live Attenuated, Recombinant, and Others), By Disease Type (Viral Diseases {Avian Influenza, Newcastle Disease, Marek’s Disease, and Others}, Bacterial Diseases {Salmonellosis, Mycoplasmosis, and Others}, and Parasitic Diseases), By Route of Administration (Parenteral, Intranasal, and Others), By Distribution Channel (Veterinary Hospitals, Veterinary Clinics, Pharmacies & Drug Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

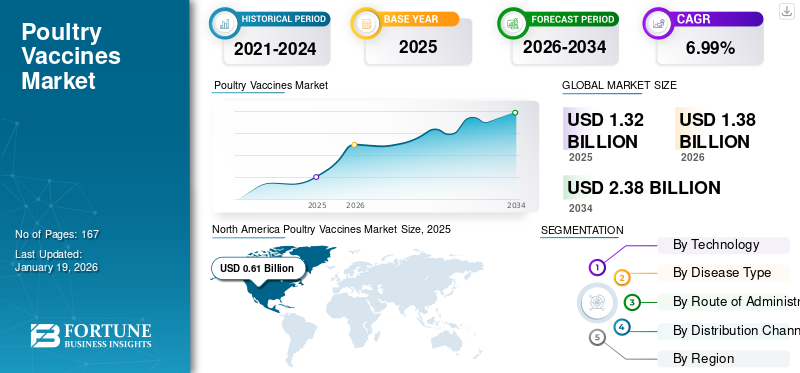

The global poultry vaccines market size was valued at USD 1.32 billion in 2025. The market is projected to grow from USD 1.38 billion in 2026 to USD 2.38 billion by 2034, exhibiting a CAGR of 6.99% during the forecast period. North America dominated the poultry vaccines market with a market share of 46.11% in 2025.

The poultry vaccines market is witnessing a significant growth trajectory during the forecast period. The rising demand for poultry products and rising incidences of infectious diseases such as avian influenza, Newcastle disease, and infectious bronchitis have heightened the need for effective vaccination strategies.

Additionally, growing awareness about disease prevention for poultry farming and biosecurity amongst the poultry farmers is further boosting vaccine adoption. Also, key players are investing in research and development to develop more effective and affordable vaccines. All these factors collectively bolster the market growth.

- For instance, in November 2024, Vaxxinova announced the grant of marketing authorization for poultry vaccine Vaxxon ND Clone from the European Commission. This vaccine is used to prevent the spread of infection with Newcastle Disease virus in poultry animals.

Furthermore, the market encompasses several major players with Zoetis Services LLC, Merck & Co., Inc., and Boehringer Ingelheim International GmbH at the forefront. A broad portfolio with innovative product launch and strong geographic presence expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Rising Consumption of Poultry Eggs and Meat to Propel Market Growth

The most prominent driver for the market is the increasing consumption of poultry eggs and meat globally. The growing population is leading to increased demand for animal-based protein. Thus, it becomes important to maintain flock health to offer nutritional quality and food security.

Additionally, vaccination helps in reducing disease outbreaks, which can cause severe economic losses, and helps in maintaining productivity and a consistent supply of poultry products.

- For instance, as per the U.S. Department of Agriculture, 21.34 million metric tons of chicken meat were produced in the U.S. in 2024/2025, which accounts for around 21.0% of global production. Such a huge production rate increases the demand for healthy, disease-free chickens, and thus drives the demand for poultry vaccinations and global poultry vaccine market growth.

MARKET RESTRAINTS

Vaccine Failures May Hinder Market Growth

Leaky vaccine risks and vaccine failure have emerged as a major restraint to the growth of the poultry vaccines market. High demand for poultry products and heavy reliance on vaccines to control rapidly mutating poultry diseases. Such diseases include Marek’s disease, avian influenza, and vaccine failure, leading to the spread of diseases in the flock. Such scenarios lead to reduced protection, farmer dissatisfaction, and economic losses.

- For instance, in March 2020, as per the World’s Poultry Science Journal, despite vaccination efforts, Marek’s disease (MD) is a re-emerging disease in Indian poultry, leading to significant economic losses. It has also been observed that around 10.0% to 40.0% flock mortality is reported even in vaccinated flocks. Such situations hamper the adoption of vaccination, increase customers' disbeliefs, and restrict the market growth.

MARKET OPPORTUNITIES

Increasing Government Vaccination Campaigns to Create Lucrative Growth Opportunities

With the rising outbreaks of poultry diseases such as avian influenza, which is a viral disease affecting birds, with occasional transmission to mammals. The outbreaks of the diseases significantly increase the risk to food security, impact farmer livelihoods, and international trade.

Moreover, economic constraints of small-scale farmers also create gaps in immunity coverage, allowing outbreaks to spread and undermining disease control.

Thus, many government authorities are focusing on offering vaccinations to ensure uniform coverage and stop the spread.

- For instance, in April 2025, the Department of Animal Husbandry & Dairying (DAHD) of India collaborated with the poultry industry to offer a vaccine against Highly Pathogenic Avian Influenza (HPAI) in India, to prevent bird flu outbreaks. Such initiatives aimed to offer lucrative growth opportunities for market growth.

POULTRY VACCINES MARKET TRENDS

Shift toward In-Ovo Vaccination Technology is a Key Trend in Industry

The traditional poultry vaccination methods, such as subcutaneous injections and eye drops, are labor-intensive, time-consuming, and stressful for the chicks. However, with growing flock size, hatcheries required a faster, uniform, and automated vaccination process, such as in-ovo technology. In this, the vaccines are injected into the egg on day 18 of incubation. This technique offers immunity to the chicks before hatching and eliminates the need for mass handling.

Furthermore, many key companies are focusing on launching these vaccines for poultry application, thus acting as a prominent global poultry vaccines market trends.

- For instance, in October 2022, HIPRA launched EVANOVO in Europe. It is a vaccine against coccidiosis for in-ovo administration.

MARKET CHALLENGES

Supply Chain Disruption and Storage Issues to Challenge Market Growth

Vaccines must be stored at 2-8°C to remain effective, and it is difficult for lower-middle-income farmers to maintain a cold chain during transportation, storage, or on-farm handling. Such factors lead to degradation of vaccines, poor immune responses, disease outbreaks, financial losses, and also raise the vaccine wastage rates. Such factors collaboratively challenge the market growth.

Download Free sample to learn more about this report.

Segmentation Analysis

By Technology

Approval and Launches of Inactivated Vaccines Contributed to Segmental Growth

On the basis of the segmentation of technology, the market is classified into inactivated, live attenuated, recombinant, and others.

The inactivated segment accounted for a significant poultry vaccines market share in 2024. The rising outbreak of poultry diseases and increasing demand for animal protein collectively increase the demand for food security and safety. Thus, boost the adoption of vaccines and the segment’s growth in the market.

Furthermore, increasing product launches by key players to propel the segment’s growth.

- For instance, in February 2025, Zoetis Services LLC received a conditional license from the U.S. Department of Agriculture (USDA), Center for Veterinary Biologics (CVB) for Avian Influenza Vaccine, H5N2 Subtype, killed virus.

By Disease Type

Increasing Outbreaks of Viral Diseases and Demand for Active Vaccination to Bolster Segment’s Growth

In terms of disease type, the market is categorized into viral diseases, bacterial diseases, and parasitic diseases.

The viral diseases segment captured the largest share of the market in 2024. The increasing spread of viral diseases such as avian influenza, Newcastle disease, Marek’s disease, and other viral diseases. Increasing focus of key players to develop and launch preventive vaccines for viral poultry diseases to ensure biosecurity, to boost the segment’s growth in the market.

- For instance, in November 2024, Boehringer Ingelheim International GmbH launched a three-in-one poultry vaccine in India for protection against Bursal, Newcastle, and Marek’s disease.

By Route of Administration

Widespread Usage of Parenteral Poultry Vaccines Supplemented Segment Growth

Based on route of administration, the market is segmented into parenteral, intranasal, and others.

The parenteral segment held the dominating position in 2024. Several advantages, such as accurate dose delivery, strong immune responses compared to oral or spray methods, are boosting the demand for parenteral vaccines.

- For instance, in March 2024, Merck & Co., Inc. received a European Commission grant for the marketing authorization of NOBILIS MULTRIVA REOm for intramuscular use in chickens.

By Distribution Channel

Active Involvement of Veterinary Hospitals in Government Activities Propelled Segment Growth

Based on distribution channel, the market is segmented into veterinary hospitals, veterinary clinics, pharmacies & drug stores, and others.

In 2024, the global market was dominated by veterinary hospitals in terms of distribution channels. Increasing government programs and service offerings by veterinarians to boost the adoption of poultry vaccines is leading to the segment’s growth.

- For instance, in June 2025, the poultry sector of South Africa launched a mass vaccination campaign to combat Highly Pathogenic Avian Influenza (HPAI) in poultry.

Poultry Vaccines Market Regional Outlook

By region, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Poultry Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2023, valued at USD 0.56 billion, and also took the leading share in 2024 with USD 0.58 billion. The region’s dominance in the market is due to the presence of stringent guidelines for vaccination, food-producing animals, and human safety. Also, the region has a strong presence of key players with robust product offerings for poultry vaccination to propel the market.

- For instance, in April 2025, the U.S. Department of Agriculture funded USD 100 million for the avian influenza vaccine development research projects. Such activities aimed to propel the launch of new vaccines and boost the region’s growth.

Europe and Asia Pacific

Other regions, such as Europe and Asia Pacific, are anticipated to witness a notable growth in the coming years. During the forecast period, the European region is projected to record a growth rate of 5.97%, which is the second highest amongst all the regions, and touch the valuation of USD 0.36 billion in 2025. This is primarily driven by increasing demand for poultry products and rising focus on maintaining flock health. After Europe, the market in the Asia Pacific is estimated to reach USD 0.17 billion in 2025 and secure the position of the third-largest region in the market.

Latin America and Middle East & Africa

Over the forecast period, Latin America and the Middle East & Africa regions would witness a moderate growth in this market. The Latin America market in 2025 is set to record USD 0.11 billion as its valuation. Rising government initiatives to reduce the economic burden due to poor poultry health further drive usage in these regions. In the Middle East & Africa, GCC is set to attain the value of USD 0.06 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Robust Product Offering coupled with Strong Research and Development Activities of Key Companies supported their Leading Position

The global poultry vaccines market shows a semi-fragmented structure with numerous small- to mid-size companies actively operating across the globe. These players are actively involved in product launches, strategic activities, and geographic expansion.

Zoetis Services LLC, Merck & Co., Inc., and Boehringer Ingelheim International GmbH are some of the dominating players in the market. A comprehensive range of poultry vaccines, with strategic activities to launch novel vaccines, are a few characteristics of these players that support their dominance.

Apart from this, other prominent players in the market include Elanco, Ceva, HIPRA, and others. These companies are undertaking various strategic initiatives, such as partnerships and launches, to enhance their market presence.

LIST OF KEY POULTRY VACCINE COMPANIES PROFILED

- Elanco (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Virbac (France)

- Merck & Co., Inc. (U.S.)

- Zoetis Services LLC (U.S.)

- Ceva (France)

- Bioveta, a.s. (Czech Republic)

- Indian Immunologicals Ltd. (IIL) (India)

- HIPRA (Spain)

KEY INDUSTRY DEVELOPMENTS

- July 2025- Bioveta, a.s. launched an inactivated vaccine against bacterial poultry pasteurellosis, which Pasteurella multocida causes serotypes A1, A3, A4, and A3x4.

- October 2023- Virbac acquired Globion to expand its poultry vaccine segment in India.

- June 2022- Ceva participated in the UK Poultry Layer Conference to showcase their latest developments in the layer industry and innovative initiatives to enhance the health and welfare of laying hens.

- May 2022- Ceva launched the Cevac IBird vaccine in several cities of Gujarat, India.

- May 2021- Elanco launched ZoaShield in the U.S. to keep coccidiosis under control in an easy, manageable way.

REPORT COVERAGE

The global poultry vaccines market analysis provides an in-depth study of market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The market research report also encompasses a detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.99% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

|

|

By Disease Type

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.32 billion in 2025 and is projected to reach USD 2.38 billion by 2034.

In 2025, the market value stood at USD 0.61 billion.

The market is expected to exhibit a CAGR of 6.99% during the forecast period.

By technology, the inactivated segment led the market.

The key factors driving the market are the expanding adoption, rising outbreak of avian diseases, and increasing demand for animal protein.

Zoetis Services LLC, Merck & Co., Inc., and Boehringer Ingelheim International GmbH are some of the prominent players in the market.

North America dominated the market with a share of 46.11% in 2025.

Increase in demand for safe animal-based protein and stringent guidelines are some of the factors that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us