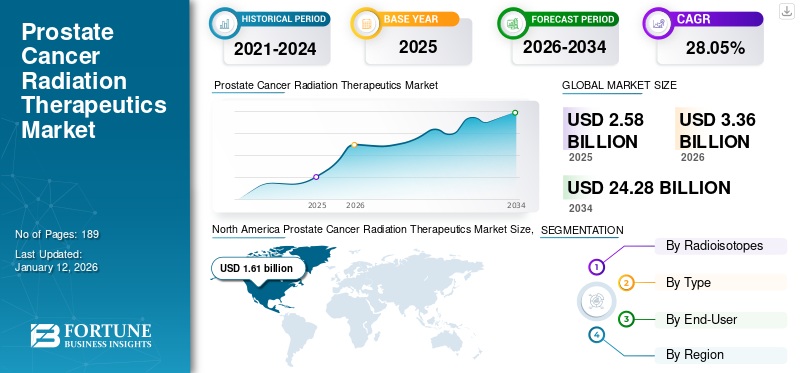

Prostate Cancer Radiation Therapeutics Market Size, Share & Industry Analysis, By Radioisotopes (Radium-223, Lutetium-177, and Others) By Type (Metastatic Castration-Resistant Prostate Cancer and Non-Metastatic Castration-Resistant Prostate Cancer), By End-User (Hospitals, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

PROSTATE CANCER RADIATION THERAPEUTICS MARKET SIZE AND FUTURE OUTLOOK

The global prostate cancer radiation therapeutics market size was valued at USD 2.58 billion in 2025. The market is projected to grow from USD 3.36 billion in 2026 to USD 24.28 billion by 2034, exhibiting a CAGR of 28.05% during the forecast period. North America dominated the cancer radiation therapeutics market with a market share of 62.37% in 2025.

The prostate cancer radiation therapeutics market is expected to witness an upward growth trajectory due to the rising prevalence of prostate cancer and increasing demand for targeted therapies to limit the damage to healthy tissues.

- For instance, according to the data published by the World Cancer Research Fund, in 2022, around 1,467,854 new prostate cancer cases were registered worldwide. Such a large number of prostate cancer cases increases the demand for adequate treatment and thus, drives the growth of the market.

Radiation therapeutics for prostate cancer involve radioisotopes such as Radium-223, Lutetium-177, and others. Radiation therapy utilizes radioactive isotopes linked to molecules that specifically bind to cancer cells and deliver targeted radiation directly to tumor sites, which damages the DNA of the cancer cells, ultimately leading to cell death. This targeted approach not only enhances the treatment efficiency but also minimizes side effects by reducing the damage to healthy tissues, in contrast to traditional radiation methods that can affect both cancerous and healthy cells alike. Such benefits associated with the treatment, shift the patient's and provider's focus, leading to increased adoption and the growth of the market.

Also, the presence of key players such as Bayer AG, Novartis AG, and others with extensive research and development activities, regulatory approvals, and product launches to expand radiation therapeutics for prostate cancer is expected to further bolster the market’s growth.

Prostate Cancer Radiation Therapeutics Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 2.58 billion

- 2026 Market Size: USD 3.36 billion

- 2034 Forecast Market Size: USD 24.28 billion

- CAGR: 28.05% from 2026–2034

Market Share:

- North America dominated the market with a 62.37% share in 2025, driven by the rising prevalence of prostate cancer, advanced healthcare infrastructure, and strong reimbursement policies.

- Lutetium-177 is the leading radioisotope segment, supported by multiple regulatory approvals and product launches, such as Novartis' Pluvicto.

Key Country Highlights:

- United States: Leads the market in North America with advanced healthcare facilities, favorable reimbursement, and robust R&D environment; recent FDA fast-track designations boost pipeline development.

- Canada: Expanding public funding for novel radioligand therapies like Pluvicto improves patient access and market growth.

- Europe: Second-largest market with strong awareness campaigns (e.g., Movember) increasing early diagnosis and treatment adoption.

- Asia Pacific: Fastest-growing region (~33% CAGR) fueled by a rising geriatric population, increasing prostate cancer prevalence, and strong R&D initiatives in countries like Australia and China.

Rest of the World: Moderate growth driven by emerging infrastructure and government investments, e.g., new cancer centers in UAE.

MARKET DYNAMICS

MARKET DRIVERS:

Rising Geriatric Population and Increasing Prevalence of Prostate Cancer Drives the Market Growth

The rising aging population significantly drives the growth of the market. Prostate cancer is predominantly diagnosed in older men, with a median age of diagnosis at 66 years. As life expectancy increases, so does the risk of developing prostate cancer, leading to higher demand for treatments.

Additionally, the increasing number of awareness programs and the presence of reimbursement policies for cancer treatment are some of the factors projected to propel the global prostate cancer radiation therapeutics market growth substantially over the forecast period.

- For instance, in 2023, according to the data published by the American Society of Clinical Oncology, approximately 60.0% of cases were identified in men over the age of 65.

MARKET RESTRAINTS:

High Cost Associated with Radiation Therapeutics to Limit Market Expansion

One of the key factors that limit the adoption of the prostate cancer radiation therapeutics is the higher treatment cost associated with these products. This factor poses a significant barrier to the market expansion in emerging regions. The high cost of the drug is associated with the development cost and isotope cost.

- According to data from Drugs.com, the cost of Pluvicto (1000 MBq/mL) intravenous solution is approximately USD 50,856 for a single solution. This price is applicable for cash-paying customers and may vary depending on the pharmacy and insurance coverage. Such a high cost of products may hinder its adoption in lower economic populations.

Additionally, the lack of healthcare infrastructure to offer radiation therapeutics and regulatory frameworks to support the safe use of nuclear medicine and inadequate reimbursement policies are also restricting the market growth.

MARKET OPPORTUNITIES:

Increasing Collaborations for Radioisotope Supply to Offer Lucrative Growth Opportunity

As the demand for targeted therapies increases, partnerships among pharmaceutical companies, research institutions, and radioisotope manufacturers are becoming crucial for ensuring a consistent and reliable supply chain. These collaborations facilitate the development of innovative therapies that leverage advanced radioisotope technologies, enhancing treatment efficacy and patient outcomes.

- For instance, in December 2024, Ariceum Therapeutics partnered with Eckert & Ziegler, a leading provider of medical isotopes. The partnership is aimed for a global supply agreement for the radionuclides Actinium-225 (Ac-225) and Lutetium-177 (Lu-177), which is used in Ariceum's innovative radiopharmaceutical pipeline.

Thus, the synergy between stakeholders in the radioisotope supply chain presents lucrative opportunities for growth in the prostate cancer radiation therapeutics landscape.

PROSTATE CANCER RADIATION THERAPEUTICS MARKET TRENDS:

Expansion of the Theranostics Approach Represents a Notable Market Trend

Combining diagnostics imaging and targeted therapy for personalized treatment in prostate cancer represents a significant trend in the market. Theranostics approach utilizes specific biomarkers to identify patients who are most likely to respond to targeted radiopharmaceuticals, enhancing treatment efficacy while minimizing side effects. Thus, by precisely targeting cancer cells, theranostics can improve survival rates and quality of life for patients with metastatic prostate cancer.

Moreover, major players of the market are increasing their research capabilities to launch radiotheranostics products for prostate cancer treatment to offer significant trends for the market growth.

- For instance, in November 2023, Clarity Pharmaceuticals announced the successful completion of the first stage of cohort 3 in its Phase I/IIa theranostic trial, SECuRE. This trial evaluated 64Cu/67Cu-SAR-bisPSMA in patients with metastatic castration resistant prostate cancer (mCRPC). This trend reflects a broader shift towards personalized medicine in oncology, emphasizing the need for individualized treatment strategies.

MARKET CHALLENGES:

Side Effects Associated with the Treatment and Regulatory Hurdles to Challenge the Market Growth

The market faces significant challenges, mainly due to the adverse side effects associated with radiation therapy, such as nausea, kidney damage, low blood cell counts, and others. These side effects can severely impact prostate cancer patients' quality of life and may lead to a decrease in the adoption of radiopharmaceuticals for treatment.

Additionally, stringent regulatory hurdles can delay the introduction of innovative therapies, hindering the market's ability to adapt to patients' needs. The lengthy approval process can strangle innovation and limit access to potentially life-saving treatments. By addressing these challenges, more advanced prostate cancer care can be developed, eventually improving patient outcomes.

Download Free sample to learn more about this report.

Segmentation Analysis:

By Radioisotopes:

Robust Regulatory Approvals and Launches to Drive the Lutetium-177 Segment’s Growth

Based on the radioisotopes, the market is classified into Radium-223, Lutetium-177, and others.

Lutetium-177 dominated the prostate cancer therapeutics market. This is majorly driven by the increasing number of regulatory approvals for Lu-177 as a radiation therapeutics for prostate cancer treatment.

- For instance, in March 2022, Novartis AG announced that the U.S. FDA approved Pluvicto (lutetium Lu 177 vipivotide tetraxetan) for treating adult patients with prostate-specific membrane antigen-positive metastatic castrationresistant prostate cancer (PSMA-positive mCRPC) that has spread to other parts of the body. Such approvals boost the segment growth.

On the other hand, Radium-223 is expected to grow with a moderate CAGR during the forecasted timeframe. The growth of the segment is attributed to the increasing prevalence of cancer and rising usage of Radium-223 in cancer therapies.

The others segment is expected to grow considerably with significant CAGR during the forecast period. Increasing demand for radiation therapeutics and a rising number of research activities to utilize different radioisotopes for prostate cancer treatment are expected to boost the segment’s growth. Additionally, the rising collaborations between the key companies and isotope suppliers are expected to propel the segment’s growth.

- For instance, in January 2025, Ariceum Therapeutics signed a supply agreement with ITM Isotope Technologies Munich SE (ITM) for the supply of Actinium-225 (Ac-225) to support the development of a targeted radiopharmaceutical therapies (RPT) pipeline.

By Type:

Reimbursement Policies for Metastatic Castration-Resistant Prostate Cancer Treatment to Boost Segment’s Growth

Based on type, the market is divided into metastatic castration-resistant prostate cancer and non-metastatic castration-resistant prostate cancer.

The metastatic castration-resistant prostate cancer segment is expected to account for a more prominent global prostate cancer radiation therapeutics market share in 2024. The increasing prevalence of metastatic castration-resistant prostate cancer and presence of key market players with robust product offerings for metastatic castration-resistant prostate cancer treatment augments the growth of the segment. Furthermore, increasing collaborations among the key market players and government authorities to increase the access of drugs for mCRPC to propel is the segment growth in the market.

- In March 2025, Novartis Canada applauded Alberta's decision to publicly fund Pluvicto, a radioligand therapy for patients with PSMA-positive metastatic castration-resistant prostate cancer (mCRPC). This decision positions Alberta alongside Ontario and Nova Scotia, enhancing access to this groundbreaking treatment across Canada. Such developments contribute significantly to the growth of the market segment by expanding innovative treatment options.

On the other hand, the non-metastatic castration-resistant prostate cancer segment is anticipated to grow faster during the forecast period. This growth will be driven by the shift of focus of key players to launch radiation therapeutics products for its treatment.

By End-User:

Integration of AI for Prostate Cancer Diagnostics in Hospitals to Propel Segment’s Growth

Based on end-user, the market is segmented into hospitals, specialty clinics, and others.

The hospital segment dominated the market in 2024. Hospitals are highly equipped with specialized equipment for the administration of radioactive materials. Also, these settings have the presence of skilled professionals to help with early diagnosis and adequate treatment. This has led to the high share of hospitals segment in the overall market.

- For instance, in November 2024, IDIBAPS-Hospital Clínic Barcelona introduced a new artificial intelligence (AI) tool to enhance prostate cancer diagnosis as part of the European Union-funded INCISIVE project. This initiative aimed to improve the diagnosis of four significant cancers: lung, colorectal, breast, and prostate cancer. Thus, such launches help in earlier and more effective cancer detection, leading to the adoption of prostate cancer radiation therapeutics for the treatment. Such scenarios boost the segment’s growth in the market.

Specialty clinics are expected to grow with considerable CAGR during the forecast period. This is driven by the growing preference for specialized care centers that can provide comprehensive and focused treatment options for complex conditions.

Other segments are expected to grow during the forecast period. The increasing research and development activities in the academic and research institutes of cancer research centers are aimed at utilizing new radioisotopes for prostate cancer treatment to boost the market during the forecast period.

PROSTATE CANCER RADIATION THERAPEUTICS MARKET REGIONAL OUTLOOK:

By geography, the market is divided into North America, Europe, Asia Pacific, and the Rest of the World.

North America:

North America Prostate Cancer Radiation Therapeutics Market Size, 2025 (USD billion)

To get more information on the regional analysis of this market, Download Free sample

The North America prostate cancer radiation therapeutics market size was valued to be USD 1.61 billion in 2025 with a share of 62.37%, rising prevalence of prostate cancer and the presence of advanced healthcare infrastructure with facilities for radiation treatment boost the growth of the region in the market.

The U.S. dominated the North America market. The dominant share of the country is due to the presence of advanced healthcare facilities with adequate reimbursement coverages. Also, the country has an intense research and development atmosphere to offer radiation therapeutics for prostate cancer. Such factors promote the country’s growth.

- In February 2025, Clarity Pharmaceuticals announced that the U.S. Food and Drug Administration (FDA) had granted Fast Track Designation for their drug 67Cu-SAR-bisPSMA. This treatment is aimed at adult patients with metastatic castration-resistant prostate cancer (mCRPC) who have previously undergone androgen receptor pathway inhibition. Such approvals lead to the country's growth in the market.

Europe:

Europe held the second-largest share of the market. The rising prevalence of prostate cancer and increasing demand for targeted therapies. Also, increasing awareness campaigns for early diagnosis of prostate cancer is expected to propel the region’s growth in the market.

- For instance, the month of November every year is globally recognized and celebrated to raise awareness for prostate cancer in males. In November 2024, Europa Uomo members in Hungary and Italy raised awareness of prostate cancer by launching testing programs during the "Movember" Campaign. Such campaigns boost the adoption of the products and propel the region’s growth in the market.

Asia Pacific:

As per the global prostate cancer radiation therapeutics market forecast, the Asia Pacific region is projected to be the fastest-growing region, with a CAGR of around 33.0%. The rising geriatric population and prevalence of prostate cancer in the region is one of the significant factors for the growth of the market in the region.

- For instance, according to the Australian Institute of Health and Welfare, in 2024, prostate cancer was the most commonly diagnosed cancer, with an estimated case of 26,400 in Australian males. It accounted for 28.0% of all cancer cases diagnosed.

Also, the region has a strong presence of market players with research and development initiatives to launch radiation therapeutics products, which is propelling the region’s growth in the market.

Rest of the World:

The markets in Latin America and the Middle East & Africa are poised for moderate growth in the near future, driven by increasing demand and rising government initiatives supporting radiopharmaceuticals. This growth is expected to be fueled by various factors, including rising awareness and strategic investments in healthcare infrastructure.

- For example, in July 2024, the launch of The Burjeel Cancer Institute in Abu Dhabi by Burjeel Holdings, which offers advanced treatments such as targeted therapy and precision medicine, is anticipated to boost regional market expansion. Such developments underscore the region's potential for substantial growth in the radiopharmaceuticals sector.

COMPETITIVE LANDSCAPE:

KEY INDUSTRY PLAYERS:

Strong Product Portfolio Accounted for the Highest Market Share Owing to the Diversified and Robust Product Portfolio

The global market is highly consolidated, with leading players such as Novartis AG and Bayer AG, accounting for a significant market share.

The dominance of these companies is attributed to the presence of two key notable radiation therapeutics approved for prostate cancer in the company’s product portfolio. Additionally, the other major players in the market, such as Lantheus Holdings Inc., Clarity Pharmaceuticals, Radiopharm Theranostics Limited, and others, are increasingly getting engaged in R&D initiatives for the launches of innovative radiation therapeutics.

LIST OF KEY PROSTATE CANCER RADIATION THERAPEUTICSCOMPANIES PROFILED:

- Novartis AG (Switzerland)

- Bayer AG (Germany)

- Telix Pharmaceuticals Limited (Australia)

- Ariceum Therapeutics (Germany)

- Radiopharm Theranostics Limited (Australia)

- Lantheus Holdings, Inc. (U.S.)

- Clarity Pharmaceuticals (Australia)

KEY INDUSTRY DEVELOPMENTS:

- October 2024- GLYTHERIX collaborated with Eckert & Ziegler to utilize GMP-grade Lutetium-177 chloride for GlyTherix's clinical trials, which are centered on the treatment of aggressive cancers through innovative antibody radiopharmaceuticals.

- June 2024- Lantheus acquired the global rights to 177Lu-DOTA-RM2 and 68Ga-DOTA-RM2 from Life Molecular Imaging. These agents represent a clinical-stage radiotherapeutic and radio diagnostic pair aimed at addressing unmet medical needs in the treatment of prostate and breast cancer.

- October 2023- Eli Lilly and Company acquired POINT Biopharma Global, Inc., a company specializing in radiopharmaceuticals. The acquired company has a pipeline of clinical and preclinical radioligand therapies aimed at treating cancer. This acquisition aimed to expand Lilly’s oncology capabilities with radioligand therapies, including actinium-225 and lutetium-177.

- April 2023- Lantheus Holdings Inc. and POINT Biopharma Global Inc. announced that the U.S. FDA has awarded fast-track designation for their treatment 177Lu-PNT2002, intended for metastatic castration-resistant prostate cancer (mCRPC).

- December 2022- Novartis AG announced that the European Commission (EC) had approved Pluvicto (lutetium (177Lu) vipivotide tetraxetan) for use in combination with androgen deprivation therapy (ADT) as a targeted radioligand therapy for metastatic castration-resistant prostate cancer (mCRPC).

REPORT COVERAGE:

The global prostate cancer radiation therapeutics market analysis provides market size & forecast by all the segments included in the report. The global prostate cancer radiation therapeutics market report comprises details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the prevalence of cancer in key regions/countries, key industry developments, new product launches, and details on partnerships, mergers & acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 28.05% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Radioisotope, Type, End-User, and Region |

|

By Radioisotope |

· Radium-223 · Lutetium-177 · Others |

|

By Type |

· Metastatic Castration-Resistant Prostate Cancer · Non-Metastatic Castration-Resistant Prostate Cancer |

|

By End-User |

· Hospitals · Specialty Clinics · Others |

|

By Region |

· North America (By Radioisotopes, Type, End-User, and Country) o U.S. o Canada · Europe (By Radioisotopes, Type, End-User, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Rest of Europe · Asia Pacific (By Radioisotopes, Type, End-User, and Country/Sub-region) o China o Japan o India o Australia o Rest of Asia Pacific · Rest of the World (By Radioisotopes, Type, and End-User) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.96 billion in 2025 and is projected to reach USD 15.19 billion by 2034.

In 2025, the market value for North America stood at USD 1.61 billion.

The market is expected to exhibit a CAGR of 28.05% during the forecast period.

Among radioisotopes, the Lutetium-177 segment led the market.

The key factor driving the market is the increasing prevalence of prostate cancer amongst the geriatric population.

Novartis AG and Bayer AG are the top players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us