Prostate Cancer Vaccines Market Size, Share & Industry Analysis, By Product (PROVENGE (sipuleucel-T) and Others), By End User (Hospitals, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

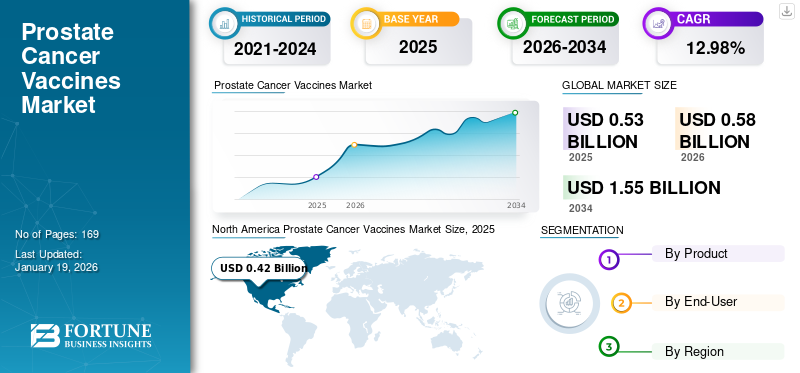

The global prostate cancer vaccines market size was valued at USD 0.53 billion in 2025. The market is projected to grow from USD 0.58 billion in 2026 to USD 1.55 billion by 2034, exhibiting a CAGR of 12.98% during the forecast period. North America dominated the prostate cancer vaccines market with a market share of 79.56% in 2025.

The vaccines for prostate cancer are therapeutic cancer vaccines and are not yet approved for preventive purposes. The available vaccines are used to activate immune cells capable of targeting prostate cancer to either eradicate recurrent disease or at least delay the disease progression. The market is expected to grow upward due to rising disease prevalence and increasing demand for personalized treatments such as PROVENGE, the only FDA-approved vaccine.

While traditional treatments such as hormone therapy and chemotherapy remain widely used, they often show limited long-term effectiveness, especially in advanced or metastatic cases such as castration-resistant prostate cancer.

- For instance, according to the data published by the World Cancer Research Fund, in 2022, around 1,467,854 new prostate cancer cases were registered worldwide. Such a large number of cases associated with prostate cancer increases the demand for adequate treatment and thus drives market growth.

Furthermore, immunotherapy offers a targeted, lower-toxicity alternative that uses the body’s immune system to fight against cancer. It provides durable responses, fewer side effects, and can be combined with other treatments, making it a crucial advancement in prostate cancer care. Also, key players such as Dendreon Pharmaceuticals LLC., with the only approved product as a vaccine for prostate cancer, are expected to bolster the company’s growth in the market.

MARKET DYNAMICS

MARKET DRIVERS

Resistance to Hormonal Therapy is a Significant Factor Boosting the Market Growth

In terms of existing treatments, hormone therapy, such as androgen deprivation therapy (ADT), has a mechanism of action wherein the therapy lowers testosterone levels. The prostate cancer cells depend on heightened levels of testosterone to rapidly increase in number. But, over time, the prostate cancer cells develop resistance toward these therapies which lowers its effectiveness. Furthermore, various mutations in the androgen receptor or related pathways can reduce the positive outcomes of these therapies. Many researchers are exploring the patterns of cancer resistance to hormone therapy, which drives the market growth.

- For example, in December 2023, researchers from the UCLA Jonsson Comprehensive Cancer Center are exploring metabolic changes and patterns in cancer cells to develop new treatment strategies. Their study revealed that there are two types of cells in the prostate: basal and luminal cells. They found that tumors that are predominantly luminal are more responsive to hormone therapy, while those that are less luminal become more resistant and harder to treat.

This resistance to the available treatment increases the demand for advanced treatment options such as vaccine therapy.

MARKET RESTRAINTS

Longer Administration Time May Hamper the Market Expansion

One of the key restraints hindering the growth of the prostate cancer vaccine market is the lengthy and complex administration process associated with the currently approved vaccine, Provenge (Sipuleucel-T), by Dendreon Pharmaceuticals.

- As per the Dendreon Pharmaceuticals website, the treatment requires a multi-step procedure starting with leukapheresis at a physician’s office or blood-collection center, where antigen-presenting cells (APCs) are extracted from the patient’s blood. The collected cells are then shipped to Dendreon’s centralized manufacturing facility in New Jersey, where they are incubated with a recombinant fusion protein containing prostatic acid phosphatase (PAP) and granulocyte-macrophage colony-stimulating factor (GM–CSF) to activate the APCs.

Once prepared, the vaccine is transported back to the infusion center for administration to the patient. This entire cycle takes roughly four days. Such a tedious and time-consuming procedure may increase the complications and thus hinder its adoption.

MARKET CHALLENGES

Complex Regulatory Requirements and Failure in Clinical Trials to Challenge Market Growth

One of the significant challenges for the prostate cancer vaccine market is the complexity involved in developing, transporting, and preserving personalized vaccines. Ensuring sterility and maintaining cellular stability throughout the process is critical, leading to additional operational costs for the manufacturers.

Additionally, the development of these vaccines is subject to stringent and constantly evolving global regulatory frameworks, which often results in delayed approval, commercialization, and overall market adoption.

Moreover, a high rate of clinical trial failures further impedes the market growth. Different vaccine candidates do not meet regulatory requirements during clinical trials, thus leading to early termination of studies and substantial financial losses for companies.

- For example, in May 2022, Ventac Partners announced its Phase 2 clinical trial failure for RV001, an antigen-based vaccine for prostate cancer. The vaccine did not demonstrate significant efficacy in preventing or delaying disease progression in patients experiencing biochemical recurrence after curative therapy. These failures result in financial strain, discourage future investments, and delay the launch of new vaccine candidates.

MARKET OPPORTUNITIES

Rising Demand for Immunotherapy and Research and Development Activities to Offer Lucrative Growth Opportunity

The rising prevalence of prostate cancer and the presence of only one FDA-approved vaccine for prostate cancer is offering an opportunity for market growth. This unmet medical need has spurred increased interest among pharmaceutical and biotech companies to invest in developing, developing, and commercializing novel vaccine candidates, particularly for patients with localized or early-stage prostate cancer.

- For instance, in December 2024, Candel Therapeutics, Inc. announced positive results from a multicenter phase 3 clinical trial evaluating CAN-2409 viral immunotherapy in localized prostate cancer patients. CAN-2409 viral immunotherapy, in combination with radiation therapy, showed clinically effective benefits for patients with intermediate-to-high-risk localized prostate cancer.

This evolving pipeline of innovative candidates underlines a lucrative opportunity for the prostate cancer vaccines market growth and expansion, thus enhancing patient outcomes in prostate cancer care.

PROSTATE CANCER VACCINES MARKET TRENDS

Advancements in the Development of DNA-Based Vaccines for Prostate Cancer a Notable Market Trend

A prominent trend shaping the prostate cancer vaccine market is the growing focus on DNA-based vaccine platforms, driven by advancements in immuno-oncology and personalized medicine. Tumor vaccines, which rely on tumor-specific antigens (TSA) and tumor-associated antigens (TAA) to activate immune responses, are evolving with the integration of nucleic acid technologies. DNA vaccines, in particular, are gaining higher attention for their ability to induce potent anti-tumor cellular immune responses, particularly against prostate cancer antigens. Platforms such as PCaA-SEV (Prostate Cancer Antigens-Synthetic Enhanced DNA Vaccine) allow for the synthesizing of multiple prostate cancer antigens to trigger a broader immune response. Furthermore, key players in the market are focusing on developing DNA-based vaccines for prostate cancer treatment for the patient's resistance to current therapies.

- For instance, Madison Vaccines, Inc. is advancing the development of MVI-118, a DNA vaccine targeting the androgen receptor ligand-binding domain, for treating metastatic castration-sensitive prostate cancer (mCSPC). Preclinical studies have demonstrated that combining this vaccine with androgen deprivation therapy (ADT) can postpone tumor progression. In a completed Phase 1 trial involving men with metastatic prostate cancer initiating ADT, MVI-118 exhibited a strong safety and tolerability profile. Additionally, a significant association was observed between the immune response to the AR plasmid and a longer time to disease progression over 18 months.

- Currently, MVI-118 is being evaluated in a Phase 2 clinical trial in combination with Keytruda and MVI-816 in patients with metastatic castration-resistant prostate cancer (mCRPC).

These findings showcase the increasing role of DNA-based immunotherapies in the prostate cancer vaccine landscape and offer significant market trends over the forecasted timeframe.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product

Rising Preference Towards Personalized Treatment to Boost Dominance of PROVENGE (Sipuleucel-T) Segment

Based on the product, the global market is divided into PROVENGE (Sipuleucel-T) and others.

The PROVENGE (Sipuleucel-T) segment held the maximum prostate cancer vaccines market share in 2024. As the only FDA-approved vaccine for prostate cancer, it accounts for a substantial share of the market. The rising prevalence of prostate cancer, coupled with growing awareness around personalized immunotherapies, is driving its increased adoption. Thus, practitioners are encouraging their patients to use PROVEGNE for customized prostate cancer treatment. Additionally, an increasing number of studies show its effectiveness in the treatment of advanced prostate cancer, thus boosting the segment’s growth in the market.

- For instance, in October 2020, Dendreon Pharmaceuticals LLC published an analysis of real-world survival outcomes in men with metastatic castrate-resistant prostate cancer (mCRPC) treated with PROVENGE and other commonly prescribed oral therapies. The study revealed that patients receiving Sipuleucel-T demonstrated a notable improvement in median overall survival and a reduced risk of death at three years.

These findings enhance patient and physician confidence, fostering greater uptake of the therapy.

On the other hand, the others segment is expected to grow moderately during the forecast period. With advancements in immuno-oncology and personalized medicine, companies focus on developing and launching new cancer vaccines for prostate cancer treatment. This is expected to boost the segment’s growth over the forecast period.

- For instance, in October 2024, Barinthus Biotherapeutics announced the initiation of PCA001, a Phase 1 clinical trial of VTP-850. The trial was initiated for the VTP-850 vaccine after completion of enrolment of the men with rising prostate-specific antigen (PSA) after definitive local therapy for prostate cancer. These advancements are expected to boost the segment’s growth during 2025-2032.

By End User

Hospitals Offering Vaccine Treatment to Propel Segmental Dominance

Based on end-user, the market is segmented into hospitals, specialty clinics, and others.

The hospital segment dominated the market in 2024. This is primarily due to their critical role in administering and managing advanced cancer treatments such as PROVENGE (Sipuleucel-T). It requires a highly specialized treatment process, including leukapheresis, cell processing, and reinfusion. Hospitals are well equipped and have skilled professionals for administering and monitoring this critical immunotherapy to the patients. Moreover, the rising number of hospitals offering this treatment boosts the adoption and growth of the segment in the market.

- For instance, in April 2024, Mon Health Preston Memorial Hospital, U.S., announced offering PROVENGE for treating metastatic castration-resistant prostate cancer (mCRPC). These offerings boost the segment’s growth in the market.

Specialty clinics are expected to grow with considerable CAGR during the forecast period. Targeted cancer care drives segmental growth. Dedicated oncology services and expanding capabilities of the clinics to advanced immunotherapies, including prostate cancer vaccines, also contribute to segmental growth.

Other segments are expected to grow during the forecast period. The increasing research and development activities in the academic and research institutes of cancer research centers aim to develop new vaccine platforms for prostate cancer treatment to boost the market during the forecast period.

PROSTATE CANCER VACCINES MARKET REGIONAL OUTLOOK

By geography, the market is divided into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

North America

North America Prostate Cancer Vaccines Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The North America prostate cancer vaccines market dominated the market with a valuation of USD 0.42 billion in 2025 and USD 0.46 billion in 2026. The rising prevalence of prostate cancer and the presence of advanced healthcare infrastructure with accredited infusion centers boost the growth of the regional market.

U.S.

The U.S. dominated the North America market. The geriatric population is at high risk, and the increasing incidence of prostate cancer is significantly increasing the demand for adequate treatment, thus boosting the market growth.

- For instance, in 2023, according to the data published by the American Society of Clinical Oncology, approximately 60.0% of prostate cancer cases were identified in men over 65.

Additionally, the country has advanced healthcare facilities for proper administration of immunotherapy with adequate reimbursement coverages, thus significantly contributing to market growth in the U.S.

Europe

Europe held the second-largest share of the market. The rising prevalence of prostate cancer and increasing awareness campaigns for prostate cancer diagnosis and treatment are expected to propel the region’s growth in the market.

- For instance, in November 2024, Europa Uomo members launched testing programs during the "Movember" Campaign in Hungary and Italy. This program raised prostate cancer awareness, thus boosting the diagnosis and increasing the adoption of the products. This has propelled the region’s growth in the market.

Asia Pacific

As per the forecast, the market in the Asia Pacific region is expected to grow with a significant CAGR during the forecasted timeframe. The increasing prevalence and rising recurrence of prostate cancer with traditional therapies upsurge the demand for prostate cancer vaccines in the region. Additionally, new prostate cancer care centers are opening to increase vaccine adoption and boost market growth.

- For instance, in November 2024, St Vincent's Hospital Sydney opened a prostate cancer care center to offer free integrated care and treatment to public and private patients.

Latin America & Middle East & Africa

The markets in Latin America, the Middle East & Africa are poised for slower growth shortly. The high cost and limited awareness about the prostate cancer vaccine are limiting the market growth in the region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Presence of the Only Approved Product by Dendreon Pharmaceuticals LLC. Owing Results In Its Highest Market Share

The prostate cancer vaccines market is highly consolidated, with Dendreon Pharmaceuticals LLC's only leading player accounting for a significant market share. The presence of a key notable product for prostate cancer vaccine bolsters the company’s dominance.

Additionally, the other major players in the market, such as Barinthus Biotherapeutics, Candel Therapeutics, Inc., BioNTech, and others, are increasingly getting engaged in R&D initiatives for the launches of innovative vaccines for prostate cancer, which is expected to help the company to mark their presence in the market.

LIST OF KEY PROSTATE CANCER VACCINES COMPANIES PROFILED

- Dendreon Pharmaceuticals LLC. (U.S.)

- Barinthus Biotherapeutics (U.K.)

- Candel Therapeutics, Inc.(U.S.)

- BioNTech (Germany)

- Madison Vaccines, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025: BioNTech presented clinical trial data from its oncology pipeline at the American Society of Clinical Oncology (ASCO) Annual Meeting. The company highlighted encouraging results from ongoing Phase 1/2 trials of BNT324/DB-1311, a B7H3-targeting antibody-drug conjugate (ADC) candidate, for treating castration-resistant prostate cancer (CRPC).

- May 2025: Candel Therapeutics, Inc. announced the positive results from phase 3 clinical trial of aglatimagene besadenovec (CAN-2409). It is used to treat patients with intermediate-to-high-risk localized prostate cancer.

- November 2023: Candel Therapeutics, Inc. announced a strategic reorganization aimed at advancing the development of CAN-3110 and the enLIGHTEN Discovery Platform while simultaneously downsizing its workforce and reducing expenses related to the commercial preparation for CAN-2409. The company continues to evaluate CAN-2409 in clinical trials for non-small cell lung cancer (NSCLC), borderline resectable pancreatic cancer, and localized, non-metastatic prostate cancer.

- June 2023: Barinthus Biotherapeutics initiated dosing in its PCA001 clinical trial (NCT05617040), a multi-center, Phase 1/2 study. The trial is designed to determine the recommended Phase 2 regimen and assess the safety, prostate-specific antigen (PSA) response, and T cell response of VTP-850 monotherapy in men with rising PSA following definitive local therapy.

- December 2022: Candel Therapeutics, Inc. showcased its clinical-stage pipeline during its Research and Development Day. The company presented clinical data on CAN-2409 and CAN-3110, highlighting both candidates as active investigational viral immunotherapies demonstrating strong biomarker evidence of local and systemic immune response against cancer cells.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.98% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 0.53 billion in 2025 and is projected to reach USD 1.55 billion by 2034.

In 2025, the market value stood at USD 0.42 billion.

The market is expected to exhibit a CAGR of 12.98% during the forecast period.

Among products, the PROVENGE (sipuleucel-T) segment led the market.

The key factor driving the market is the increasing prevalence of prostate cancer and resistance to hormonal therapy.

Dendreon Pharmaceuticals LLC. is the top player in the market.

North America dominated the market in 2024.

The rising focus on personalized medicine for prostate cancer is expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us