Quantum Dots Market Size, Share & Industry Analysis, By Material (Cadmium-based and Cadmium-free), By Product Type (Display and Others), By End User (Consumer, Healthcare, Defense, Media and Entertainment, and Others), and Regional Forecast, 2026 – 2034

QUANTUM DOTS MARKET SIZE AND FUTURE OUTLOOK

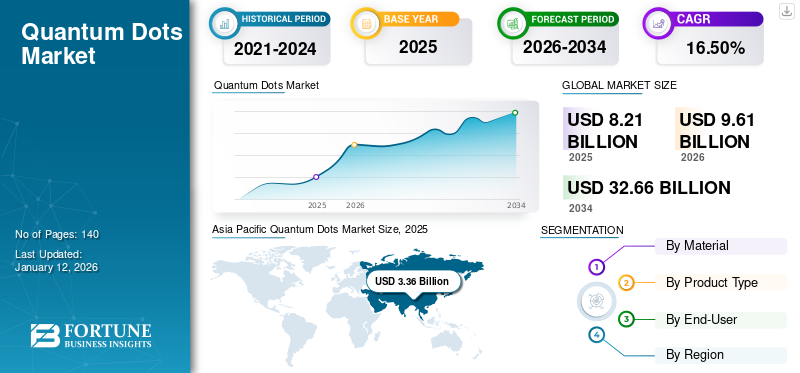

The global quantum dots market size was valued at USD 8.21 billion in 2025 and is projected to grow from USD 9.61 billion in 2026 to USD 32.66 billion by 2034, exhibiting a CAGR of 16.50% during the forecast period. Asia Pacific dominated the global market with a share of 40.50% in 2025.

Quantum Dots (QDs) are solution-processable semiconductor nanoparticles with unique electronic and optical characteristics. These properties include high resistance to photobleaching, superior brightness, and simultaneous excitation of multiple colors from a single light source, among others. These features help the particles find potential applications in biotechnology, optoelectronics, and medicine.

The increasing inclination of end users toward cadmium-free QDs has propelled the market’s growth in recent years. Currently, the display sector captures most of the market’s use cases. Besides, the consumer electronics and defense sectors have showcased early adoption of QDs. However, the healthcare sector is expected to showcase a heavy adoption rate in the coming years.

The market is dominated by prominent key players, such as Nanoco Group plc, SAMSUNG ELECTRONICS CO., LTD. (SAMSUNG DISPLAY), BOE Technology Group Co., Ltd., Merck KGaA, and Shoei Chemical, Inc. (Nanosys). These players focus on entering into strategic alliances and collaborations to multiply the product portfolio, technological innovations, and other contributions for year-on-year revenue growth. Partnerships and collaborations with startups and new vendors also enhance their business growth.

The initial phase of COVID-19 affected the market due to supply chain differences and halted projects. However, the market paced up quickly due to a significant response from the healthcare sector. This sector showcased a rise in demand for QDs in displays and medical imaging applications. A similar pace was then taken forward across all other end-use industries.

IMPACT OF RECIPROCAL TARIFF

Tariff Pressures Spark Manufacturing Migration in Quantum Dot Ecosystem

Trump’s tariffs have significantly impacted the quantum dot industry across various dimensions, including supply chain disruptions, cost increases, and strategic manufacturing and research shifts. The U.S. labs and manufacturing facilities importing QD procure films from Asian countries such as South Korea and China, dealing with 10–25% tariffs, suddenly faced skyrocketing cost hikes. Owing to this, multiple TV manufacturers shifted their manufacturing facilities to South Asian countries. For instance,

- In April 2025, Omdia stated that multiple TV manufacturing companies are proactively shifting final assembly locations to countries, including Vietnam or Mexico, to avoid U.S. import duties and maintain competitiveness with their competitors globally.

IMPACT OF GENERATIVE AI

Usage of Generative AI Models Across Development and Advancement of Quantum Dot-based Applications to Create Various Market Opportunities

AI technologies, such as generative AI, machine learning (ML), and deep learning, are incorporated into the quantum dots-based solutions to improve their phases of development and applications. Generative AI can renovate the QDs sector with faster innovation, cheaper, and more targeted solution development. It is a robust tool to overcome some customary research and development bottlenecks in the nanotech space.

In drug delivery, the impact of AI on QDs is simplifying the development of directed therapies. QDs can be engineered to deliver drugs to precise cells, including cancer cells, decreasing harm to healthy tissues. AI prototypes can forecast the way in which QDs would interact with biological systems, improving their design for larger safety and efficacy.

- In February 2024, Zapata Computing, Inc., in collaboration with St. Jude Children's Research Hospital and Insilico Medicine, showcased the future of hybrid quantum gen AI for drug discovery using constantly advancing quantum devices. This collaboration showcases the successful running of a generative model on quantum hardware with the intent of developing viable cancer drug candidates.

Hence, generative AI is anticipated to impact the quantum dot market positively.

MARKET DYNAMICS

Market Drivers

Advancements in Display Technologies to Boost the Market Growth

The usage of quantum dots in display technology is rising owing to their ability to improve color brightness and accuracy. QDs improve color by transforming light from a backlight into pure green, red, and blue hues. The QD color improvement procedure is one of the prominent reasons for preferring these displays for high-end watching experiences. For instance,

- As per the industry experts, sales of quantum dot diffusers and film plates have increased by 42% year-on-year in 2024. A rise aided the sharp growth in the usage of QD-LCD and MiniLED TVs.

Hence, various display manufacturers are developing and introducing QD-based display devices and monitors, owing to the increased demand for quantum dot-based solutions. For instance,

- In May 2025, TCL announced the launch of the C6K QD-Mini LED TV range in the UAE. The series is designed to offer exceptional performance and substantial value. The C6K product line redefines home entertainment by uniting modernized display innovation, immersive sound, and well-designed aesthetics.

These factors augment the demand for quantum dot technology in the market.

Market Restraints

Presence of Substitute Display Solution Options to Limit the Usage of Quantum Dot-based Solutions

Substitute display solutions to quantum dot-based displays comprising micro-LED and OLED technologies, among others, are emerging as alternates for LCDs. OLED displays deliver energy effectively, emitting light straight rather than leveraging a backlight. They use less power as compared to LCDs as they produce light directly. OLED displays are implemented in several electronic devices, such as smartphones, laptops, TVs, tablets, and motorized dashboards and lighting. These use cases and benefits of alternate display technologies, OLED and micro-LED, can hamper the usage of quantum dot materials across displays.

Market Opportunities

Toxicity-Free Quantum Dots for Healthcare & Biomedical Implementations to Create Lucrative Opportunities for the Market

Customary diagnostic and bio-imaging tools struggle with sensitivity and non-invasive trailing. Quantum dots provide higher optical properties. However, outdated versions comprise toxic materials such as cadmium and lead, restricting their implementation in clinical settings.

As the industry is rapidly transforming, biocompatible, non-toxic QDs empower safer real-time disease checking and modernized medical imaging, opening prospects for extensive adoption in healthcare. Various applications of quantum dot technology in medical imaging are as follows:

- Optical Imaging: Fluorescence-driven imaging is an extended optical imaging mechanism, and quantum dots (QDs) have validated substantial potential as fluorescent probes in this field.

- Magnetic Resonance Imaging (MRI): QD-driven MRI contrast agents deliver various benefits over customary contrast agents. They have higher relaxivities, enabling enhanced contrast augmentation at lower concentrations.

These enhanced benefits and applications of quantum dot technology across healthcare and medical imaging open up various opportunities for market players.

Quantum Dots Market Trends

Growing Shift toward Cadmium-free Quantum Dots to Fuel the Market Development

Quantum dots hold a higher potential for electronic display technology as they offer enhanced, more glittery colors than current standard technology. However, the integration of cadmium in QDs has limited their implementation, keeping producers away from using the advantages of the technology due to various regulations and guidelines. For instance,

- RoHS (Restriction of Hazardous Substances Directive) regulations state that 1,000 ppm of cadmium can be leveraged. However, this exception can terminate, and only 100 ppm of cadmium would be acceptable.

Upcoming displays need to comply with regulations while meeting the requirements of consumers. Cadmium-free QDs provide a less hazardous and eco-friendly substitute for consumers and producers, offering them the color benefit without the risks of toxicity or liability.

These factors are expected to fuel the quantum dots market growth during the forecast period.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Material

Growing Demand for Eco-Friendly and Non-Toxic Alternatives to Propel Cadmium-free QDs Growth

By material, the market is bifurcated into cadmium-based and cadmium-free.

In 2024, cadmium-free quantum dots dominated the market share and is expected to showcase the highest growth rate in the coming years, as they are a more sustainable and safer option. Several companies, such as Nanoco and others, are engaged in initiatives and projects that help develop high-performing nanoparticles that can be used in electronic applications. These companies are focused on developing cadmium-free quantum dots to lower the negative environmental impact of using cadmium-based solutions. The segment held 56.64% of the market share in 2026.

Moreover, cadmium-based quantum dot products hold the prominent share in the market. There are several companies, such as NNCrystal US Corporation and Samsung Electronics Co. Ltd., among others, that are providing cadmium-based quantum dots products which can be used across a diverse set of applications, including OLED color conversion and security tagging, among others. The segmental growth is attributed to the recent commercialization and demand for cadmium-based technology.

By Product Type

Increasing Demand for High-Quality and Energy-Efficient Display Products to Ensure Segmental Growth

By product type, the market is divided into display and others. The other category includes lasers, solar cells, and others.

In 2024, the display segment dominated the global market due to the increasing demand for high-quality, energy-efficient display solutions. Several companies are investing significantly in the market to develop enhanced display products. The segment is foreseen to gain 62.50% of the market share in 2026. For instance,

- In April 2024, NanoPattern Technologies secured over USD 1.5 million in a seed round to market its photo-patternable quantum dot ink. This step is expected to help the company commercialize next-generation displays. The company’s ink product is marketed to display component manufacturers, which helps them to develop full-color micro-displays for virtual reality, augmented reality, smartphones, wearables, televisions, and tablets.

These recent developments highlight that the display sector currently captures most of the market share. Globally, there is an increasing demand for quantum dot displays.

The others segment is expected to grow with the highest CAGR of 20.00% during the forecast period (2025-2032), as the market players are expected to tap into newer markets and expand their global reach. The untapped markets include advancements in lasers, solar cells, and others. For instance,

- In August 2023, UbiQD, Inc., collaborated with First Solar to intelligently integrate fluorescent quantum dot expertise in enhanced solar modules. The companies have been doing the exploratory work since early 2022 for the same purpose.

By End User

To know how our report can help streamline your business, Speak to Analyst

Growing Demand for High-Resolution Displays among Consumers Drives the Segmental Growth

The market is categorized by consumer, healthcare, defense, media and entertainment, and others by end user. The others include agriculture, energy, utilities, and others.

The consumer sector held the largest market share in 2024 as quantum dot technology is increasingly used in QD-LED and MiniLED TVs to enhance brightness, color gamut, and contrast ratios. It makes them suitable for 4K, 8K, and HDR displays. Thus, owing to growing demand for QD-LEDs, multiple display manufacturers, companies such as major brands including Samsung, TCL, and Hisense, are adopting QD technology. The segment is expected to capture 49.87% of the market share in 2026.

The healthcare sector is anticipated to grow at the highest CAGR of 21.00% during the forecast period (2025-2032), owing to the early adoption of the technology across the healthcare sector. The sector has witnessed several use cases and significant advancements in recent years. Companies such as QDI Systems are developing imaging devices for medical applications based on QDs. These use cases include X-rays and mammography screening. Growing patents, research papers by companies, and innovative applications related to the market are a few factors driving the segmental growth.

QUANTUM DOTS MARKET REGIONAL OUTLOOK

The market is categorized by geography into Asia Pacific, North America, Europe, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Quantum Dots Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest quantum dots market share with a valuation of USD 3.36 billion in 2025 and USD 3.97 billion in 2026 and is expected to continue its dominance during the forecast period. The presence of key market players in growing economies such as China, Japan, and India, as well as leadership in the semiconductor market, contributes to the regional dominance. Moreover, several companies are developing advanced materials for display panels that help them reduce dependency on other countries. For instance,

- In May 2023, Canon introduced a material for organic light-emitting diode panels that lacks the use of rare metals. With this, the company aims to reduce its dependency on rare metal manufacturers.

These instances indicate that the Asia Pacific quantum dot market will showcase a substantial growth rate over the forecast period.

The adoption of QD technology in China has grown rapidly over the past few years, owing to the country’s leadership in semiconductor innovation, display manufacturing, and consumer electronics. Moreover, BOE Technology, CSOT (TCL), Visionox, and Tianma are investing in QD-enhanced displays, especially QLED and QD-OLED panels. The Chinese market is foreseen to grow with a value of USD 0.93 billion in 2026. For instance,

- According to industry experts, in 2024, China manufactured over 50% of global LCDs integrated with QD technology.

India is poised to hold USD 0.53 billion in 2026, while Japan is set to reach USD 0.76 billion in the same year.

Europe

Europe is the second largest market expected to be valued at USD 2.81 billion in 2026, exhibiting a CAGR of 29.00% during the forecast period (2026-2034). The region held the second-largest share of the global market in 2025. Strong government backing and investments have contributed to the accelerated market growth. The U.K. market continues to grow, projected to reach a market value of USD 0.48 billion in 2025. Moreover, engagement of market players in partnerships and funding programs with market-related players has propelled regional growth in recent years. For instance,

- In March 2024, Germany, France, and the Netherlands were awarded USD 33.8 million in joint funding to develop a quantum R&D project under the first Trilateral Call for Quantum Innovation. This project will support European cross-border collaboration in quantum computing, communication, and sensing technologies.

Germany is anticipated to hold USD 0.8 billion in 2026, while France is set to be valued at USD 0.43 billion in 2025.

North America

North America is the third largest market anticipated to gain USD 1.76 billion in 2025. The North American market showcases a healthy growth rate owing to the presence of key market players and substantial investments in the region. Further, QDs are used in various applications such as photovoltaic films and transparent solar panels, greenhouses with QD films (agri-tech), and energy-efficient lighting systems in the region. In addition, the U.S. government's push for renewable energy has led to increasing interest in adopting quantum dot technology in solar cells (QDSCs) to obtain higher energy efficiency than traditional solar technologies. The U.S. market is anticipated to acquire USD 1.16 billion in 2025.

South America

South America is the fourth largest market set to be worth USD 2.05 billion in 2026. The adoption of quantum dot technology is growing significantly in South America, owing to the growing adoption of QLED TVs, smartphones, and computers among customers in Brazil, Argentina, and Chile. Further, increasing demand for QDs in displays and healthcare applications and rising investment in R&D activities drive the market growth across the region.

Middle East & Africa

The Middle East & Africa region holds a smaller share of the global market due to the limited presence of major players. However, several countries across the regions have showcased engagements related to the use cases of the market across several industries, such as agriculture, energy, and utilities. These initiatives indicate a healthy and slower pace of growth for the markets. The GCC market is expected to stand at USD 0.14 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Players Are Focusing on Partnership and Acquisition Strategies to Expand Their Customer Base

Key players focus on expanding their global geographical presence by presenting industry-specific services. They strategically focus on acquisitions and collaborations with regional players to maintain regional dominance. Top market participants are launching new solutions to increase their consumer base. Increasing constant R&D investments for product innovations is enhancing the market expansion. Hence, top companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

Long List of Companies Studied:

- Shoei Chemical, Inc. (Nanosys) (Japan)

- Samsung Electronics Co., Ltd. (Samsung Display) (South Korea)

- Nanoco Group plc (U.K.)

- Merck KGaA (Germany)

- Quantum Materials Corp. (U.S.)

- UbiQD, Inc. (U.S.)

- QDI Systems (Netherlands)

- Ocean Nanotech, LLC. (U.S.)

- NNCrystal US Corporation (U.S.)

- Avantama (Switzerland)

- QustomDot BV (Belgium)

- Quantum Materials Corp. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- TCL China Star Optoelectronics Technology Co., Ltd. (China)

- QD Laser (Japan)

- LG Electronics (Japan)

- NanoPhotonica Inc. (U.S.)

- Crystalplex Corporation (U.S.)

- OSRAM Licht AG (Germany)

- Dow Chemical Company (U.S.)

and more…

KEY INDUSTRY DEVELOPMENTS:

May 2025: Nanoco and POE (Guangdong Poly Optoelectronics Co., Ltd.) signed a Licensing and Collaboration contract. Under the contract, Nanoco and POE allied to develop cadmium-free quantum dot products for several applications, such as modernized lighting films and displays.

April 2025: UbiQD secured funding of USD 20 million in Series B to enhance quantum dot technology across industries. The company stated that the funding from Series B would be leveraged to scale up manufacturing, extend R&D competencies, fortify intellectual property, improve marketing efforts, and provision working capital requirements.

April 2025: Nanoco announced the JDA (joint development agreement) with a new Asian chemical customer. Nanoco advances materials leveraged in the manufacture of TV screens and monitors and mechanisms for medical imaging and the initial diagnosis of cancer. The partnership not only strengthens Nanoco's position in the dynamically evolving quantum dot sector but also has the potential to improve its market reach and financial performance.

October 2024: Samsung Display introduced a quantum dot ink recycling mechanism to improve the cost affordability of its QD-OLED displays. With the progress of technology to gather and reprocess QD ink unexploited through the QD-OLED manufacturing procedure, Samsung Display has recovered and recycled over 80% of the ink that goes unused in the manufacture of the QD emissive layer.

February 2024: Diraq, specializing in the quantum computing market, secured over USD 15 million in Series A-2 funding round. With this, the company expects to bolster its efforts in developing fault-tolerant quantum computing with silicon QDs.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key players operating in the market, such as Nanoco Group plc, SAMSUNG ELECTRONICS CO., LTD. (SAMSUNG DISPLAY), BOE Technology Group Co., Ltd., Merck KGaA, and Shoei Chemical, Inc. (Nanosys), are increasingly focusing on Investments and funding for technological innovations are helping key players in the market to innovate. Companies can generate revenue by offering imaging and display solutions and naming rights. Small enterprises and startups are securing funding and investments for new developments and improving their performance within quantum dot-based solutions. For instance,

- In November 2024, QustomDot, a provider of cadmium-free quantum dot mechanisms for display implementations, received funding of USD 2.85 million (EUR 2.7 million). This investment enables the firm to endure its development of economically maintainable and enhanced-performance quantum dot solutions.

These factors are expected to create a lucrative opportunity for the market growth.

REPORT COVERAGE

The report offers valuable insights about the market, such as leading market players, solutions, and key applications of products, among others. Along with this, the report also provides current trends and future opportunities for market players. It encompasses a complete overview of the global market, highlighting factors such as micro and macroeconomic factors, government investments, R&D initiatives, and research paper dominance of the companies.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.50% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

By Product Type

By End-User

By Region

Companies Profiled in the Report:

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 32.66 billion by 2034.

In 2025, the market was valued at USD 8.21 billion.

The market is projected to grow at a CAGR of 16.50% during the forecast period.

The cadmium-free material segment led the market in 2026.

Advancements in display technologies such as QD-LEDs and QD-LCDs to boost the market expansion.

Shoei Chemical, Inc., Samsung Electronics Co Ltd., Nanoco Group plc, UbiQD, Inc., QDI Systems, Ocean Nanotech, LLC, QustomDot BV, NNCrystal US Corporation, Merck KGaA, and Avantama are the top players in the market.

Asia Pacific dominated the global market with a share of 40.50% in 2025.

The consumer segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us