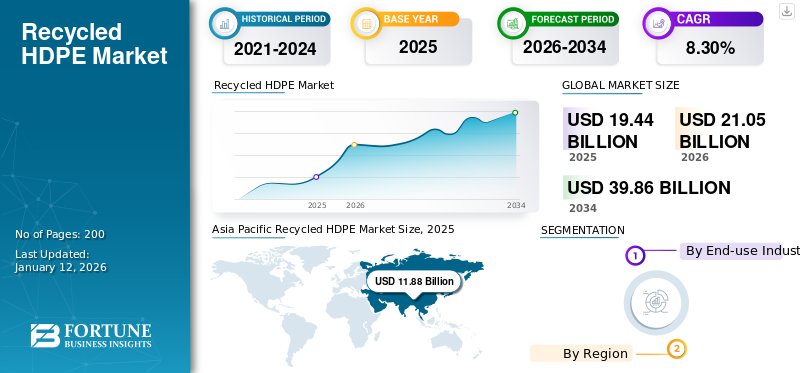

Recycled HDPE Market Size, Share & Industry Analysis, By End-use Industry (Food and Beverage, Construction, Automotive, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global recycled HDPE market size was valued at USD 19.44 billion in 2025. The market is projected to grow from USD 21.05 billion in 2026 to USD 39.86 billion by 2034, exhibiting a CAGR of 8.30% during the forecast period. Asia Pacific dominated the recycled hdpe market with a market share of 61% in 2025.

Recycled HDPE (high-density polyethylene) is mainly used in non-food packaging, particularly for consumer products such as detergents, motor oil, and household cleaners, due to its excellent rigidity and strong resistance to chemical attacks. Furthermore, the increasing use of HDPE for containers in applications such as shampoo, laundry detergent, conditioner, motor oil, antifreeze, and recycling bins is expected to drive market growth during the forecast period. Key players operating in the market are Veolia, Biffa, KW Plastics, Plastipak Holdings, and Envision Plastics.

RECYCLED HDPE MARKET TRENDS

Sustainability Initiatives and a Shift toward Eco-Friendly Solutions are Prominent Trends

HDPE recycling is gaining momentum as lawmakers across the globe seek to phase out single-use plastics and encourage the circular economy of polymers to reduce environmental impact. Many companies are adopting sustainable packaging solutions in response to changing consumer preferences for environmentally conscious businesses. According to the World Economic Forum, consumers are increasingly willing to pay a premium for products and services from sustainable companies, making it a crucial aspect of effective branding.

For instance, Unilever, a leading fast-moving consumer (FMCG) company, has begun implementing more eco-friendly packaging options. The company transitioned from using a non-recyclable folding carton for three detergent brands to a 100% recyclable polyethylene bag in Chile. Unilever has also rolled out sustainability initiatives globally since 2019.

MARKET DYNAMICS

MARKET DRIVERS

Environmental Regulations and Sustainability Goals to Boost Market Growth

Governments and international organizations increasingly implement strict regulations to reduce plastic waste and promote plastic recycling. Policies such as the EU's Single-Use Plastics Directive and Extended Producer Responsibility (EPR) programs require manufacturers to take responsibility for the post-consumer phase of their products. These frameworks encourage industries to incorporate recycled materials, such as HDPE, into their supply chains. Additionally, many companies are setting ambitious sustainability targets, such as using 25% to 50% recycled content in their packaging by 2030. These regulatory measures and voluntary commitments generate a strong demand for the product.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

Quality and Contamination Issues to Limit Market Expansion

Recycled high-density polyethylene often suffers from impurities and inconsistent polymer properties due to inadequate sorting and contamination during collection and recycling. These quality issues restrict its use in applications that require high safety or performance standards, such as food-grade packaging or medical devices. For example, recycled high-density polyethylene products may retain residual odors or exhibit lower tensile strength compared to virgin HDPE, making it unsuitable for critical applications without extensive (and costly) reprocessing or adding additives. This hinders the recycled HDPE market growth.

MARKET OPPORTUNITIES

Circular Economy Initiatives are Expected to Positively Impact Market Growth

The global shift toward a circular economy presents a significant opportunity for recycled HDPE. A circular economy keeps materials in use for as long as possible while minimizing waste. Governments, Non-governmental Organizations (NGOs), and corporations are investing in circular supply chains, which involve designing products for recyclability, enhancing collection systems, and expanding recycling infrastructure. This systemic transformation increases the demand for recycled materials and fosters better collaboration in supply chains and innovation in product design, creating a long-term market opportunity for producers.

MARKET CHALLENGES

Technical Limitations in Reprocessing are Likely to Hamper Market Growth

Reprocessing recycled HDPE into high-performance materials presents significant technical challenges. Each recycling cycle can degrade the polymer's molecular structure, affecting its properties, such as impact resistance, flexibility, and resistance to stress cracking. Advanced applications, such as pressure pipes or automotive components, demand consistent and reliable material performance, and recycled high-density polyethylene may struggle to achieve this without using costly additives or blending with virgin materials. Addressing these limitations requires substantial research and development investment and improvements in sorting, washing, and extrusion technologies.

Segmentation Analysis

By End-use Industry

Excellent Barrier Properties of Recycled HDPE Boosted Food and Beverage Segment Growth

The market is segmented by end-use industry into food and beverage, construction, automotive, and others.

The food and beverage segment dominated the market in 2024, accounting for the largest recycled HDPE market share. Recycled high-density polyethylene is widely used in the food and beverage industry for various applications due to its safety, durability, and recyclability. It is particularly effective for packaging food and beverages since it does not leach harmful substances into the contents and can be sterilized at high temperatures. Additionally, recycled HDPE is suitable for creating a range of packaging products, including bottles for milk, juice, and oil, and containers for various types of food.

The construction segment is anticipated to experience significant market growth during the forecast period. Recycled high-density polyethylene has numerous applications in the construction industry, serving as a sustainable and versatile building material. It is commonly used in geomembranes, geotextiles, drainage systems, and even as an ingredient in concrete and other building materials, such as plastic lumber.

The automotive segment is expected to witness significant market growth in the coming years. Recycled high-density polyethylene is increasingly used in the automotive industry, particularly for interior components and parts requiring impact resistance. It's used in applications such as seat cushions, door panels, and even bumpers. Using recycled HDPE contributes to sustainability by reducing landfill waste and resource consumption. Several automotive manufacturers are exploring using recycled high-density polyethylene in their production processes. For instance, Volvo Cars has committed to incorporating a significant percentage of recycled plastics, including high-density polyethylene, into its vehicles.

Recycled HDPE Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Recycled HDPE Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific led the global market with a size of USD 11.88 billion in 2025 due to rapid industrialization, urbanization, and increasing environmental awareness. Countries such as China, India, Japan, South Korea, and Southeast Asian nations are key contributors to regional demand. China’s ban on plastic waste imports in 2018 led to more localized recycling capacity development. Moreover, India has introduced rules mandating recycled plastic in packaging and promoting Extended Producer Responsibility (EPR). Japan and South Korea, with their mature recycling infrastructure and strong governmental policies, are leaders in quality and efficiency. The Japan market is projected to reach USD 1.44 billion by 2026, the China market is projected to reach USD 5.65 billion by 2026, and the India market is projected to reach USD 2.17 billion by 2026.

North America

In North America, the market is well-established and continues to grow, supported by robust regulatory frameworks and strong corporate sustainability commitments. The U.S. and Canada have implemented strict plastic waste regulations and recycled content mandates, particularly in states such as California. Major consumer goods companies are increasingly integrating post-consumer recycled HDPE into their packaging, driven by ESG targets.The U.S. market is projected to reach USD 0.93 billion by 2026.

Europe

European countries are turning to the circular economy to reduce their carbon footprint and preserve the environment. The European Commission has set the target to recycle over half of the plastic waste generated in Europe. This is expected to create a world-class ecosystem for HDPE recyclers in the coming years. Many recycling companies have already started buckling up their shoes to achieve these ambitious goals. For instance, Germany is emerging as a European recycling hub on the back of companies such as Veolia. In 2019, the company recycled 38,500 tons of HDPE and PP at its plant in Bernburg, Multiport. Other recyclers across other European countries are implementing similar efforts. Some of the HDPE recyclers in the region include Veolia, Becker + Armbrust GmbH, Atlantide Environment, WURSI Recycling, S.L., and many others. The UK market is projected to reach USD 0.38 billion by 2026, while the Germany market is projected to reach USD 1.51 billion by 2026.

Latin America

The market in Latin America is developing rapidly, with Brazil, Mexico, and Chile taking the lead in regional recycling efforts. The growing urban population and increasing plastic consumption have created a larger base for recyclable materials. Government policies, including emerging Extended Producer Responsibility (EPR) frameworks, encourage more systematic recycling practices. Additionally, several NGOs and multinational brands promote plastic waste collection and reuse through public-private partnerships.

Middle East & Africa

In the Middle East & Africa, the recycled HDPE market is still in its early stages but shows potential, especially in the Gulf Cooperation Council (GCC) countries. National strategies, including Saudi Arabia’s Vision 2030 and the UAE’s zero waste initiatives, drive investment in recycling and sustainability. Urban centers across the GCC are increasingly developing waste management systems that support plastic recovery.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies Emphasize Product Quality and Supply Consistency to Maintain Their Dominance

The recycled HDPE market is moderately fragmented, with the presence of both global players and a large number of regional and local recyclers. Competition is primarily based on product quality, pricing, supply consistency, and adherence to regulatory and sustainability standards. Veolia, Biffa, KW Plastics, Plastipak Holdings, and Envision Plastics are key players in the market.

LIST OF KEY RECYCLED HDPE COMPANIES PROFILED

- Veolia (France)

- Biffa (U.K.)

- KW Plastics (U.S.)

- Plastipak Holdings (U.S.)

- Envision Plastics (U.S.)

- ALPLA (Austria)

- Cirplus (Germany)

- KAMAL POLYPLAST (India)

- Reprocessed Plastics, Inc. (U.S.)

- PakTech (U.S.)

- Reclaim Plastics (Canada)

KEY INDUSTRY DEVELOPMENTS

- October 2022: Veolia launched "PlastiLoop," a global brand offering recycled plastics, including HDPE, through its network of 37 recycling plants. This initiative aims to provide ready-to-use recycled resins to meet the rising demand for sustainable materials.

- November 2021: ALPLA opened a new HDPE recycling plant in Mexico to meet the significant demand for recycled materials in Mexico and Central America. The majority of the output from this facility is utilized within the region, supporting local sustainability efforts.

REPORT COVERAGE

The global market analysis provides market size forecasts for all the segments included in the report. It includes details on the market dynamics and trends expected to drive the market in the forecast period. It offers information on recycled HDPE in key regions/countries, key industry developments, new product launches, and details on partnerships, mergers, and acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.30% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By End-use Industry

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 21.05 billion in 2026 and is projected to reach USD 39.86 billion by 2034.

In 2025, the market value stood at USD 11.88 billion.

The market is expected to exhibit a CAGR of 8.30% during the forecast period of 2026-2034.

The food and beverage segment led the market by end-use Industry.

Sustainability initiatives and the shift toward eco-friendly solutions are likely to drive market growth.

Veolia, Biffa, KW Plastics, Plastipak Holdings, and Envision Plastics are the top players in the market.

Asia Pacific held the largest market share in 2024.

The global shift toward a circular economy is expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us