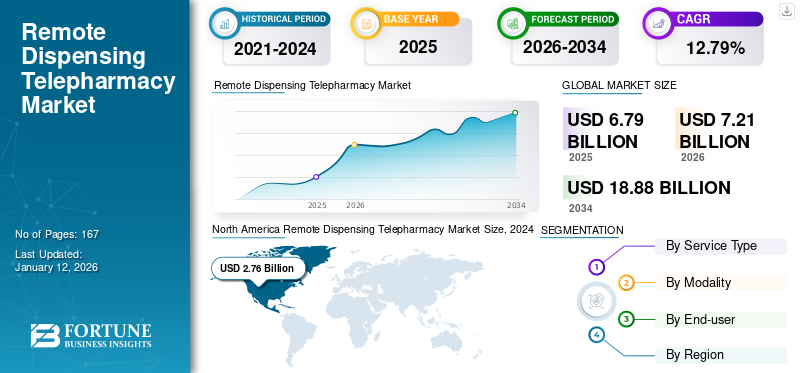

Remote Dispensing Telepharmacy Market Size, Share & Industry Analysis, By Service Type (Prescription and Over-the-counter), By Modality (Store-and-forward (Asynchronous), Real-time (Synchronous), and Hybrid), By End-user (Healthcare Facilities, Homecare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global remote dispensing telepharmacy market size was valued at USD 6.79 billion in 2025. The market is expected to grow from USD 7.21 billion in 2026 to USD 18.88 billion by 2034, exhibiting a CAGR of 12.79% during the forecast period. North America dominated the remote dispensing telepharmacy market with a market share of 60.59% in 2025.

The market refers to the use of telecommunication and telehealth technologies to facilitate the remote dispensing of medications, prescription verification, and counseling. This market is growing rapidly due to several factors, including the need to improve access to pharmacy services, especially in underserved or rural areas, and the ongoing digitization of healthcare services globally. Additionally, technological innovations and the increasing demand for convenient healthcare delivery models help to boost market growth.

The COVID-19 pandemic was the revolutionizing period for the global market.

- During the COVID-19 pandemic, the U.S. Drug Enforcement Administration (DEA) gave temporary permission for telepharmacy consultations and prescription dispensing, which has since been continued in some states.

Some of the key operating players in the market include Cardinal Health, CarepathRx, and McKesson Ventures. The launches of new services and innovative platforms by these key market players also supported the growth.

MARKET DYNAMICS

MARKET DRIVERS

Expansion in Underserved Regions Drive Market Growth

The global market is primarily driven by the expansion in underserved regions and increased adoption of remote dispensing technologies across the globe. Telepharmacy is becoming an essential tool for improving access to medications in rural and remote locations, where pharmacists are often in short supply. In rural and remote locations, traditional pharmacies play a crucial role, but many times, due to a lack of supply chain management, pharmacists do not have sufficient stock. In such situations, remote dispensing telepharmacy helps to solve this problem. Additionally, technological advancements such as the development of telemedicine platforms and the integration of AI enhance medication management and enable remote dispensing telepharmacy in underserved regions.

- In countries with large rural populations, such as the U.S., India, and Brazil, telepharmacy is a critical solution to bridge the healthcare access gap, leading to enhanced product adoption rate and propelling remote dispensing telepharmacy market growth.

MARKET RESTRAINTS

Security and Data Privacy Concerns Limit the Market Expansion

The telepharmacy includes dispensing medications and providing pharmaceutical services remotely leading to challenges related to protecting sensitive patient data. Additionally, the transmission of sensitive patient data raises concerns about privacy and security, which may lower the adoption rate of remote dispensing telepharmacy services. Moreover, the concerns about unauthorized access and misuse of information can also hinder the adoption rate of these services.

- For instance, according to the data published by Modern Phytomorphology in February 2025, telepharmacy systems have cybersecurity threats, such as data breaches, ransomware attacks, and unauthorized access to the patient’s data. These types of risks may lower the service adoption rate and limit the market growth.

OTHER RESTRAINTS

Technology Integration and Infrastructure

One of the challenges for telepharmacy providers is integrating their systems with existing healthcare infrastructures. Hospitals and healthcare centers often depend on legacy systems, and updating these systems to be compatible with telepharmacy technologies can be costly and complex. Furthermore, rural areas with limited internet access may face challenges in adopting telepharmacy solutions effectively.

Resistance to Technological Adoption

Some healthcare professionals and institutions may be hesitant to adopt telepharmacy due to a lack of familiarity with the technology or concerns about job displacement. This resistance requires proper training and education, along with clear evidence of the benefits of telepharmacy in improving healthcare delivery.

MARKET OPPORTUNITIES

Shift Toward Patient-Centered Care to Offer Lucrative Growth Opportunities

Patients are increasingly seeking healthcare options that offer convenience, particularly after the COVID-19 pandemic. Remote dispensing telepharmacy addresses this demand by enabling patients to receive medications from the comfort of their homes, ensuring greater adherence to prescribed therapies, and trying to reduce the need for physical visits to healthcare facilities and medical stores. Additionally, remote dispensing telepharmacy allows personalized and proactive care, which enables pharmacists to provide individual patient counseling and adjust treatment plans as needed.

- To ensure patients access to their medications for ongoing treatment without any delays, telepharmacists authorize prescription refills. This type of patient-centered care raises the adoption rate of remote dispensing telepharmacy services.

MARKET CHALLENGES

Regulatory Challenges May Hurdle Market Growth

The telepharmacy industry faces significant regulatory hurdles due to the fragmented nature of healthcare regulations across various regions. Additionally, service providers face confusion and difficulty in implementing services due to a lack of a standard regulatory framework for remote dispensing telepharmacy across different countries. Moreover, due to the lack of standardized guidelines and pharmacy practice, service providers also face difficulty in ensuring patient safety and quality of service.

- For example, some states in the U.S. have different telepharmacy laws, and telepharmacy companies must navigate these variations to ensure compliance. Internationally, the lack of standardized telepharmacy regulations presents a challenge for companies attempting to expand into global markets.

REMOTE DISPENSING TELEPHARMACY MARKET TRENDS

Integration with E-Prescriptions and Pharmacy Automation is a Prominent Market Trend

With the rise in the need for accuracy, efficacy, and improved patient care, integrating e-prescriptions and pharmacy automation is a significant trend in the market. This integration helps to streamline the workflows, enhances communication and ensures better care coordination. Integration with e-prescription and pharmacy automation potentially saves time in remote dispensing telepharmacy and reduces manual errors. Pharmacy automation includes packaging and accurate medication dispensing, leading to minimizing medication errors and enhancing patient safety. Additionally, automation in medication dispensing reduces human errors and enhances operational efficiency. AI’s involvement extends to patient health monitoring, predictive analytics, and personalized medicine.

- For instance, according to the data published on TATEEDA GLOBAL in March 2025, the e-prescription has access to multiple devices, such as tablets, smartphones, and others, for patient convenience.

Moreover, pharmacies and hospitals can access patient medical history and ensure the accuracy and safety of prescriptions, which leads to better patient engagement.

OTHER MARKET TRENDS

Regulatory Support and Integration

Governments and regulatory bodies are increasingly supporting telepharmacy by creating favorable policies and reimbursement for telehealth services, including remote dispensing. For instance, the U.S. and several European countries have adapted their regulations to accommodate telepharmacy services, thereby accelerating market growth.

Download Free sample to learn more about this report.

Segmentation Analysis

By Service Type

Prescription Segment to Lead Market Due to Its Cost-effectiveness

Based on service type, the market is segmented into prescription and over-the-counter.

The prescription segment is expected to be the dominant and fastest-growing segment during the forecast period. The reduction in in-person visits and more efficient use of resources make this segment cost-effective for both patients as well as healthcare systems. In remote dispensing telepharmacy, the cost of the medications is low as the overhead costs are less.

- For instance, in October 2024, GoodRx, Inc., a leading prescription savings platform in the U.S., announced that QSYMIA is available at low prices in more than 70,000 retail pharmacy locations.

On the other hand, the over-the-counter segment is significantly growing during the forecast period. The growth of the segment is due to the convenience and accessibility of OTC products. Remote dispensing telepharmacy provides a convenient way for patients to access over-the-counter medications, specifically in remote areas.

By Modality

Flexibility and Convenience Boosted Growth of Store-and-forward (Asynchronous) Segment

Based on modality, the market is segmented into store-and-forward (asynchronous), real-time (synchronous), and hybrid.

The store-and-forward (asynchronous) segment dominated the market in 2024. The store-and-forward includes the transmission of medical information and queries to the pharmacists, who review the information and respond at a later time. The store-and-forward model held the largest share as it provides flexibility and convenience to both patients and pharmacists. Additionally, the segment growth is anticipated by its various applications, such as prescription, routine medication review, and verification.

- For instance, according to the data published in the International Medical Science Research Journal in November 2024, the store-and-forward model is useful in chronic disease management in which, by reviewing patient data, pharmacists can give recommendations and feedback at regular intervals.

The real-time (synchronous) was the fastest-growing segment of the global market in 2024. The live interaction between patient & pharmacist and immediate response to the patient queries boost the growth of the segment.

By End-user

Rise in the Prevalence of Chronic Diseases Fueled Homecare Segment Growth

Based on end-user, the market is segmented into healthcare facilities, homecare, and others.

Homecare was the dominating and fastest-growing segment of the global market in 2024. The dominance of the segment is due to the rise in the prevalence of chronic diseases such as diabetes and hormonal imbalance, which require continuous monitoring and regular medications. This leads to a rise in the use of remote dispensing telepharmacy in homecare settings. This rise in demand for homecare products and services boost the market growth during the forecast period. The key players provide telepharmacy services as part of home healthcare solutions for patients who need regular medication management.

The healthcare facilities segment is expected to account for a considerable share of the market during the forecast period. The advanced healthcare facilities and a rise in the number of patient admissions augment the segment's growth.

Remote Dispensing Telepharmacy Market Regional Outlook

By geography, the market is fragmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Remote Dispensing Telepharmacy Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America held the dominant share in 2026 valuing at USD 3.05 Billion and also took the leading share in 2025 with USD 2.89 Billion. The region's growth is augmented by an increase in the adoption of telemedicine services and the rise in the need for remote dispensing, especially in rural areas. Additionally, the presence of key market players, such as Cardinal Health, CarepathRx, etc., helps to boost regional growth.

The U.S. dominated the North America market in 2024. The rise in awareness about telemedicine and remote dispensing telepharmacy drives the market growth in the U.S. Additionally, the well-established healthcare and telecommunication infrastructure drive the market growth. The high service adoption rate and focus on healthcare accessibility, along with data security, further support the growth of the market in the U.S.

- For instance, according to the data published in the African Journal of Biological Sciences in May 2024, the U.S. has strict privacy regulations to protect patient’s data. The Health Insurance Portability and Accountability Act (HIPAA) helps to protect the confidentiality between pharmacists and patients.

Europe

Europe is the second dominant region of the market. The European market is benefitting from regulatory advancements that promote telehealth and telepharmacy adoption. Additionally, the high adoption rate of telehealth platforms, particularly in rural and underserved areas, drives the market growth in this region.

- For instance, according to the data published by the World Health Organization, in October 2024, forty countries in the European region either have a national telehealth strategy or include telehealth in a broader digital health strategy with telemedicine and remote dispensing drugs.

Asia Pacific

Asia Pacific is the fastest-growing region of the market, especially in countries such as India and China. These countries are showing rapid growth in telepharmacy due to large populations, increasing smartphone user base, and expanding internet connectivity. Governments in this region are recognizing the potential of telepharmacy to address healthcare access issues, particularly in rural areas.

- For instance, according to the data published by the Asian and Pacific Center for Transfer of Technology in January 2022, telemedicine and delivery of medications remotely played a crucial role during COVID-19 and post-COVID-19.

Latin America and Middle East & Africa

The market in the Latin America and Middle East & Africa regions is anticipated to witness considerable growth in the near future. Countries in the Middle East & Africa region are beginning to adopt telepharmacy, particularly in countries such as UAE and South Africa, to improve access to healthcare services in rural and underserved areas. However, challenges such as infrastructure limitations and regulatory frameworks need to be addressed.

On the other hand, Brazil and Mexico are exploring telepharmacy solutions to address healthcare disparities, particularly in rural regions with limited access to pharmacies and healthcare professionals. The rise in acceptance of digital health solutions is expected to propel the market in this region.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Technological Development and Introduction of New Services by Key Companies Resulted in their Dominating Positions in Market

The global market is concentrated with companies such as Cardinal Health, CarepathRx and McKesson Ventures accounting for a significant share.

Cardinal Health is one of the major players in the market. Cardinal Health provides remote pharmacy services such as order entry, dispensing, and medication management. These services require advanced technology to improve efficiency and reduce cost. Additionally, Cardinal Health’s remote dispensing telepharmacy services provide comprehensive solutions to help healthcare facilities, improve patient care and reduce costs.

- For instance, in November 2022, Cardinal Health launched Velocare a last-mile fulfillment solution delivering critical products and services required for hospital-level care at home in one to two hours.

CarepathRx is also a major market player with a significant share. The CarepathRx provides end-to-end pharmacy care delivery services and focuses on improving patient outcomes. Additionally, remote dispensing services involve the delivery of pharmaceutical care with the help of telecommunications technology and enable pharmacists to provide services remotely

Additionally, PipelineRx, GoodRx, and Medley Medical Solutions Pvt. Ltd are among the other prominent players in the market. These market players are focusing on improving their market presence by strategically improving their remote dispensing telepharmacy service offerings.

LIST OF KEY REMOTE DISPENSING TELEPHARMACY COMPANIES PROFILED

- Cardinal Health (U.S.)

- CarepathRx (U.S.)

- McKesson Ventures (U.S.)

- PipelineRx (U.S.)

- GoodRx (U.S.)

- Medley Medical Solutions Pvt. Ltd (India)

- InstyMeds MedAvail Technologies Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2024: Ray Anam Inc. acquired Total Care Pharmacy XI Inc., DBA Total Care Pharmacy, to enhance service offerings such as dispensing medications and medication counseling.

- September 2024: Johns Hopkins Aramco Healthcare (JHAH) entered into a partnership with TruDoc Healthcare to improve patient care via the expansion of the Care Anywhere program. They transform patient experience through innovative ‘hospital at home’ services.

- October 2023: JVM launched Next-Generation Automated Drug Dispensing System in the European market with High-End Robot Arm 'MENITH'.

- June 2023: Cardinal Health agreed to contribute its Outcomes business to Transaction Data Systems (TDS). This partnership offers pharmacy workflow software with patient engagement and clinical solutions to serve the patient and pharmacy for smooth dispensing and consultation.

- April 2022: Advanced Dermatology and Cosmetic Surgery (ADCS) acquired Maragh Dermatology, Surgery and Vein Institute. This acquisition expands the geographical coverage for ADCS’s portfolio of over 150 offices nationwide and enhances the remote dispensing ability.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.79% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service Type

|

|

By Modality

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 7.21 billion in 2026 and is projected to record a valuation of USD 18.88 billion by 2034.

In 2025, the market value stood at USD 2.89 billion.

The market is expected to exhibit a CAGR of 12.79% during the forecast period of 2026-2034.

The prescription segment is expected to lead the market during the forecast period.

The key factors driving the market are the expansion in underserved regions and the rise in demand for healthcare access.

Cardinal Health, CarepathRx, and McKesson Ventures are the top players in the market.

North America dominated the market in 2025.

Technological advancement and a rise in demand for convenient healthcare delivery models are some of the factors that are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us