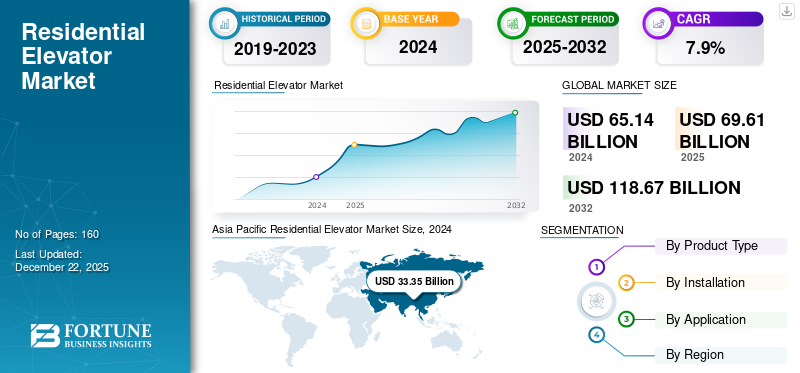

Residential Elevator Market Size, Share & Industry Analysis, By Product Type (Traction with Machine Room, Machine Room Less Traction, and Hydraulic), By Installation (New Installation, Maintenance, and Modernization), By Application (Low-Rise Buildings, Mid-Rise Buildings, and High-Rise Buildings), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global residential elevator market size was valued at USD 65.14 billion in 2024 and is projected to grow from USD 69.61 billion in 2025 to USD 118.67 billion by 2032, exhibiting a CAGR of 7.9% during the forecast period. The Asia Pacific dominated global market with a share of 51.2% in 2024.

Expanding urban areas, growing economies, and shifting demographics are fueling the market for residential elevator across various regions. Infrastructures such as apartments, commercial offices, entertainment spaces, etc. are gaining traction in tier 2 and 3 cities in several developing nations. The aging population and faster mobility solutions in such infrastructures are increasingly gaining traction in emerging and developing economies. Vertical mobility systems in high-rise buildings in countries such as UAE, Saudi Arabia, and India boost the market share.

Download Free sample to learn more about this report.

Government bodies and regulatory authorities are introducing stringent safety standards and features for home elevators. Manufacturing companies such as KONE CORPORATION, Schindler, Mitsubishi Electric Corporation, ThyssenKrupp AG, etc. are striving to expand their presence through strategic collaborations, geographical penetration, and sustainable product development. Technology integration along with energy-efficient smart home systems will further support the market growth.

The COVID-19 pandemic in 2020 has resulted in a significant decline in market demand. Temporary halts at construction sites, delayed property investments, and shutdowns at manufacturing facilities are a few of the prominent factors that have resulted in a revenue drop for the elevator market in the residential sector. However, the market rebounded to its pre-pandemic levels as a result of the resumption of construction activities and the real estate sector and is projected to grow over the forecast period.

Residential elevators to witness slow growth during the short-term period owing to supply chain disruptions, component costs, and delayed projects across regions. Reciprocal tariffs on several raw materials such as steel, safety systems, etc. to limit the growth of the market. However, the market is expected to recover as a result of incentivized domestic production, and supportive investment in the manufacturing sector.

- In September 2024, Maharashtra State- government in India introduced additional incentives for green buildings. The real estate developers are provided additional floor area ratio (FAR) for green buildings.

MARKET DYNAMICS

RESIDENTIAL ELEVATORS MARKET TRENDS

IoT-Integrated Lifts to Bolster the Market Demand

Supportive investment in real estate, government housing development schemes, and smart-city expenditure are all supporting modern housing solutions. Several key market players are inclined towards adopting IoT-integrated and energy-efficient vertical mobility solutions. Technology integration offers energy-saving mobility solutions along with remote operability ensuring customer safety. IoT features such as voice commands, maintenance alerts, and controlled battery-driven lifts are gaining traction across geographies.

MARKET DRIVERS

Growing Real Estate Market and Rapid Urbanization to Boost the Demand for Elevators

The real estate sector and expanding urban areas across emerging countries such as India, Malaysia, etc. owing to changing demographics, and market investment are prominently driving the market for elevators. For instance, the Kingdom of Saudi Arabia has observed investment of about USD 1.3 trillion by 2024 for infrastructure development including residential, and commercial spaces. An aging population and growing high risers across cities are significantly bolstering the market for elevators. Rising living standards, supportive government initiatives, and smart city development projects are further bolstering the growth of the residential sector.

- For instance, Azabudai Hills, a skyscraper in Tokyo was inaugurated in November 2023 considered to be one of the largest buildings in Japan.

MARKET RESTRAINTS

High Maintenance Cost and Inclination Towards Traditional Living to Hinder the Market Growth

Elevator installation and maintenance costs associated with elevators such as inspections, and component replacements, might restrict the growth of the market. Cultural preferences for traditional living such as bungalows, and single-storied buildings might limit the growth of the market. Limited acceptance of urban house models and resistance to nuclear living would further halt the demand for elevators across the residential sector.

MARKET OPPORTUNITIES

Increasing Luxury-Homes and Energy-Efficient Elevators to Bring Market Opportunities

High-rise residential buildings, skyscrapers, and energy-efficient buildings are growing across regions owing to increasing spending, and increase demand for high-rise and luxury properties. Sustainable living and smart elevator solutions integrated with AI and IoT technologies bring strong market opportunities for the residential elevator market growth.

- For instance, TK Elevator in October 2022 has introduced eco-mode in EOX elevator system to boost energy savings and safety systems for enhanced user experience.

Segmentation Analysis

By Product Type

Traction with Machine Room Dominates the Market Share as a Result of Efficient Vertical transportation

Based on product type, the market is classified into traction with machine room, machine room less traction, and hydraulic.

The traction with machine room accounts for the highest revenue market share owing to efficient and smooth transportation. Traction with machine room allows superior and faster quality of vertical mobility, enhanced weight carrying capacity, efficiency for high-rise buildings, and high durability. Residential apartments and luxury homes, where reliability and performance are highly prioritized generate strong demand for traction with machine room elevators. Key players in the market are developing supportive platforms allowing real-time monitoring of the elevators and optimizing performance.

- For instance, in August 2024 Otis Corporation has launched its Gen3 digital elevator in Malaysia available with machine room options.

Machine room less traction and hydraulic type to witness moderate growth owing to limitations in technological innovation, constrained weight lifting capacity, and regulatory policy changes. The real estate sector in developing and emerging economies is attracting significant investment to develop tall and high-rise buildings to further drive the market for elevators.

By Installation

Heavy Investment and Growing Real Estate Sector Primarily Drives the New Installation Segment

Based on installation, the market is segmented into new installation, maintenance, and modernization.

The new installation segment accounts for the highest revenue share in the market owing to rising investments in the real estate sector and urbanization.

Modern buildings and high risers are generating strong demand of tech-enabled and smart elevators. Features such as AI-based maintenance systems, customized control systems, and smart elevators are becoming increasingly preferred in urban landscapes across regions. However, increasing investment in high-rise projects, and the expansion of the real estate sector supported by sustainability solutions are further driving the market for elevators in the new buildings development. Key players are introducing varied smart elevators, digitally-enabled elevators, solar-powered elevators, etc. to minimize carbon footprint and enhance building efficiency.

Several age-old infrastructures are undergoing refurbishments and maintenance activities. Regulatory pressures and new energy efficiency goals are further expected to drive the market of elevators for maintenance and modernization.

By Application

High-rise Buildings to Cater Highest Growth Rate Owing to Higher Urban Development

Based on application, the market is segmented into low-rise, mid-rise, and high-rise buildings.

High-rise buildings account for significant share in the residential elevators market share as a result of increased land constraints, expanding urban areas, growing demand for luxury homes, and increasing standard of living. Urban redevelopment, growing population density, and preference for higher count of floors in skyscrapers are a few of the prominent factors bolstering the market demand for elevators in high—rise buildings. High–rise buildings account for the highest growth rate owing to factors such as emerging economies, rapid urban development, and increasing spending capacity.

Mid-rise and low-rise buildings in several tier 2 and 3 cities are generating significant revenue for elevators. Thereby, mid-rise and low-rise buildings to witness moderate growth over the forecast period.

Residential Elevator Market Regional Outlook

By region, the market is classified as North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific to dominate the elevators market owing to significant investment in residential apartments and high risers.

Asia Pacific

Asia Pacific Residential Elevator Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the residential elevator market share accounting for about 51.2% revenue market share as a result of expanding urban areas, preference towards luxury lifestyle, enhanced affordability patterns, and supportive economic situations. Asia Pacific market is set to generate revenue of about USD 33.35 million in 2024 in the market. Several real estate companies are developing space-efficient and sustainable apartments enabled by automation. The Asia Pacific market is gaining considerable popularity for luxury homes and smart mobility technologies further supporting the market growth. Emerging countries such as India, Indonesia, and Malaysia are a few of the economies attracting significant investment in the real estate sector owing to the growing middle-income population and increased spending capacity.

- For instance, Sun Urban City development was announced in 2024 in Ha Nam city of Vietnam. The residential project is set to complete by the end of 2028.

North America

Increasing demand for accessibility and convenience, demographic shifts, and developments in the real estate sector are a few of the primary factors driving the market for residential elevator. High disposable income, supportive incentivized government regulations, technological advancements, and the need for easy accessibility to further enhance the market for elevators in the residential sector across the region. Technological advancements and demand for sustainable mobility solutions in residential buildings bring strong market opportunities for smart elevators and lifts across the region. The demand would further be supported by green building initiatives and carbon-free emissions.

U.S. to account for highest revenue market share in the North American region in 2024. Aging population, stringent regulations, and rising demand for apartments are few of the prominent factors driving the market demand for elevators in the residential sector in U.S. market.

- For instance, According to Americans with Disabilities Act (ADA) updated in 2021 supports smart elevator features such as voice recognition, touchless operation for easy accessibility of disabled users.

Europe

Europe region to witness stable growth owing to several factors including demand for multistoried buildings, increased population density, renovation of aging infrastructure, and preference for easy mobility options. Economic growth in Eastern European countries such as Poland, rising real estate investment, and lifestyle changes across the region positively impact the demand for residential lifts and elevators.

- For instance, according to European Investment Fund the Central and Eastern European countries such as Poland, Czech Republic has gained over USD 52 million for new housing development in October 2024.

Middle East & Africa

Middle East & Africa market to gain market traction resulting from emerging economies, and investment in the real estate sector. Middle Eastern countries are expanding their real estate sector and investing significantly in skyscraper buildings. All such factors are subject to driving the elevator market in the residential sector.

- For instance, Danube Properties Development L.L.C. had announced development of residential twin tower in Jumeriah Village, Dubai and completed the project in 2019.

South America

Domestic governments in the region are diversifying their revenue streams across sectors and investing in residential infrastructure development. Several government initiatives, economic diversification, increasing demand for luxury and sustainable living, and green initiatives are supporting the growth of the market for elevators in the regions.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Smart Elevators Development and Collaborative Strategy to Boost the Market

The global residential elevator market is moderately concentrated with key players in the market with few of the players including Otis Corporation, Schindler, and KONE Corporation. Along with smart elevator launches, market players are collaborating with prominent distributors and suppliers in the market to expand their market presence across regions. Manufacturers are focusing on the development of smart elevators with IoT advancements, AI, and ML integration optimizing the energy efficiency of buildings. Growing demand for building automation systems across developed nations to further enhance the market demand for smart and energy-efficient elevators.

LIST OF KEY RESIDENTIAL ELEVATOR COMPANIES PROFILED

- Otis Elevator Company (U.S.)

- KONE Corporation (Finland)

- Thyssenkrupp Elevator (Germany)

- Schindler (Switzerland)

- Fujitec Co. Ltd (Japan)

- Johnson Lifts (India)

- Hyundai (South Korea)

- Mitsubishi Electric (Japan)

- Toshiba Elevator (Japan)

- Hitachi (Japan)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Fujitec Co., Ltd. has introduced elevator model Ele Glance with optimal design, enhanced safety, and reliability.

- December 2024: KONE Corporation has introduced new range of Smart elevators in India. The KONE Smart MonoSpace, KONE I MiniSpace include AI-powered monitoring systems to optimize energy usage.

- July 2024: Nibav Lifts, an Indian home elevator brand has introduced AI-enabled home lifts in Mumbai city of India. The new lifts provide advanced technological features with cabin display, and configures with LIDAR 2.0 technology.

- February 2024: TK Elevator has introduced ‘Enta Villa’ a compact and luxury elevators for residential buildings in India. The new lift has been introduced for comfort and luxury homes.

- October 2023: TK Elevator introduced EOX Renew for mid and low-rise buildings. The EOX renew flexible structure allow its installation in age-old and existing buildings.

REPORT COVERAGE

The global residential elevator market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions and number of orthodontists in key countries. The report covers detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.9% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Installation

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 65.14 billion in 2024 and is projected to reach USD 118.67 billion by 2032.

In 2024, the market value stood at USD 33.35 billion.

The market is expected to exhibit a CAGR of 7.9% during the forecast period of 2025-2032.

The traction with machine room led the market by product type owing to smooth and convenient operations.

Growing real estate market and urbanization to boost the demand for elevators.

Otis Elevators, KONE Corporation, Thyssenkrupp Elevator, Schindler are few of the top players in the market.

Asia Pacific dominated the revenue market share in 2024 accounting for more than half of the market.

High-rise buildings account for significant revenue market share as a result of increased land constraints, expanding urban areas, growing demand for luxury homes, and increasing standard of living.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us