Sandwich Panel Market Size, Share & Industry Analysis, By Type (Polystyrene, Polyurethane (PUR), Polyisocyanurate (PIR), Mineral Wool, Phenolic foam, and Others), By Outer Material (Steel, Aluminum, and Others), By Application (Residential and Non-Residential), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

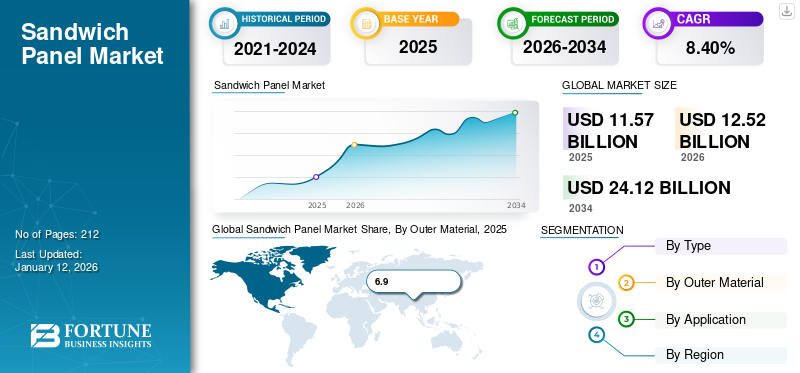

The global sandwich panel market size was valued at USD 11.57 billion in 2025. The market is projected to grow from USD 12.52 billion in 2026 to USD 24.12 billion by 2034, exhibiting a CAGR of 8.40% during the forecast period. Asia Pacific dominated the sandwich panel market with a market share of 49% in 2025.

A sandwich panel is a modern building material used to provide structural efficiency. It is a combination of composite materials that bind together. The growing need for fast-paced construction in various applications, such as residential, cold storage, and commercial buildings, will positively influence product demand. Similarly, industrialization and urbanization in developing and developed nations create an opportunity for the construction sector, which ultimately drives the demand for these panels. Key players in the market are heavily investing in innovation to provide lightweight materials for modern infrastructure construction. This, in turn, is likely to boost market growth during the forecast period. Kingspan Group, Rautaruukki Corporation, Sintex Tata Steel, ArcelorMittal, and DANA Group of Companies are the key players operating in the market.

Sandwich Panel Market Trends

Global Emphasis on Energy Efficiency and Sustainable Construction Practices is a Key Market Trend

The primary opportunity for the market lies in the global emphasis on energy efficiency and sustainable construction practices. With growing awareness of environmental concerns and the need to minimize carbon footprints, there is a greater demand for building materials that provide improved insulation and contribute to energy conservation.

Products with thermal insulation qualities are an ideal alternative for designing energy-efficient buildings. As governments and companies across the globe implement stricter construction norms and regulations aimed at sustainability, the demand for these panels is likely to increase.

Manufacturers in the market can capitalize on this trend by emphasizing the eco-friendliness of their products and connecting with the larger push toward green and sustainable construction technologies. The drive toward energy efficiency represents a huge and ongoing potential for the sandwich panel market to fulfill the changing needs of the building sector and environmentally conscious customers.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Growing Demand from Non-Residential Applications to Drive Market Growth

The growth of the non-residential sector, including cold storage facilities, industrial buildings, and institutional buildings, is a primary driving factor for the market. Non-residential sectors prefer these products due to their sustainability and cost-effectiveness. The composition of the outer and insulating core materials in the panels offers excellent insulation and makes it an ideal product for cold storage facilities. The cold storage facilities focus on maintaining and increasing the shelf life of fresh agricultural products, frozen foods, and seafood. In addition, consumers prefer to purchase these products from online platforms. Such factors increase the need for cold storage facilities, ultimately driving market growth.

MARKET RESTRAINING

Low Fire Performance of Sandwich Panel to Restrict Market Growth

Few products have very poor fire resistance compared with other construction materials, and this is likely to hinder market growth. The lightweight panel designs are always lacking in fire performance. Although they offer excellent thermal insulation, they exhibit poor fireproofing performance. On the other side, fireproofing products increase the weight and cost, reducing their demand in lightweight applications. Therefore, poor fire resistance will restrain the product demand during the forecast period.

Market Opportunities

Rapid Infrastructural Development across the Globe to Augment Market Growth

Infrastructural growth is expected to augment the sandwich panel market growth during the forecast period. These panels offer effective properties, such as durability, lightweight, and insulation. Such properties make them a modern construction material in infrastructural development. In addition, rapid industrialization and urbanization in developing and developed economies are important factors propelling the demand for the product. China and India are witnessing rapid urbanization due to the exponentially growing population in these countries. This factor will lead to a rise in government and consumer spending on residential and non-residential infrastructure. Such infrastructural development trends are projected to create growth opportunities for the market during the forecast period.

Market Challenges

High Initial Cost is a Challenging Factor for Market Growth

The high initial cost is a well-documented challenge restraining market growth, especially in cost-sensitive sectors and emerging economies. While sandwich panels deliver superior thermal efficiency, durability, and rapid installation, they require substantial upfront investment due to expensive raw materials (steel, polyurethane, and mineral wool), advanced manufacturing processes, and the need for skilled logistics and installation.

This high initial cost serves as a significant barrier for products, especially in markets or segments with tight budgets or where long-term benefits are less valued at the point of purchase.

Trade Protectionism and Geopolitical Impact

Protectionist Policies and Trade Barriers to Restrict Market Growth

Accelerated tariffs on imported building materials, including steel, aluminum, and insulation foams, are significantly increasing production and procurement costs for the sandwich panel market, especially in the U.S. and select European markets. These cost increases affect end-user pricing and project viability, causing higher bids and execution delays in large-scale infrastructure and commercial developments.

Furthermore, escalating geopolitical tensions such as sanctions and cross-border trade restrictions are triggering raw material shortages and price volatility, especially in steel and specialty insulation imports essential to high-performance panels.

Research And Development (R&D) Trends

Material Innovation and Manufacturing Advances to Create Opportunities for Market Growth

Core material R&D emphasizes high-performance polyurethane (PU) and polyisocyanurate (PIR) foams, mineral wool, and expanded polystyrene (EPS) with enhanced fire safety, insulation, and recyclability. Bio-sourced cores, closed-loop recycling processes, and lower embodied carbon raw materials are being developed to meet green building standards and regulatory mandates.

The integration of smart sensors, digital twin design, and modular workflows enables new applications such as structural health monitoring and tailored building envelope solutions. Additionally, customized panels for cold storage, clean rooms, and advanced industrial applications are being developed to achieve subzero insulation, fire-proofing, and process-specific functionality.

Segmentation Analysis

By Type

Polyurethane Segment Accounted for the Dominant Market Share Owing to its Adequate Properties

Based on type, the market is segmented into polystyrene, Polyisocyanurate, polyurethane, mineral wool, Phenolic foam, and others. In 2024, the polyurethane segment dominated the market with a share of 68.05% in 2026, and will maintain its dominance during the forecast period. This product offers lucrative properties, such as lightweight, strong corrosion resistance, high density, and cost-effectiveness. End-users prefer polyurethane panels for their durability and economical pricing.

The mineral wool type segment is expected to register positive growth during the forecast period due to its superior fire-resistant properties.

By Outer Material

Steel Segment to Hold Major Market Share Owing to Rising Demand from Non-residential Applications

In terms of outer material, the market is segmented into steel, aluminum, and others. Among these, the steel segment is expected to hold a major share contributing 75.56% globally in 2026. Steel offers strong fire resistance and cost-effectiveness, making it a preferred choice in non-residential applications where fire safety is required. The aluminum segment is also growing significantly due to its properties, such as lightweight and flexibility.

To know how our report can help streamline your business, Speak to Analyst

By Application

Non-residential Segment to Hold Substantial Share Owing to Rising Demand from Cold Storage Facilities

Based on application, the market is segmented into residential and non-residential. Non-residential segment is anticipated to hold the dominant sandwich panel market share during the forecast period. Cold storage facilities, institutional buildings, industrial buildings, and commercial infrastructure are considered in this segment. Growing cold storage needs from various industries will drive the segment’s growth during the forecast period. Commercial buildings prefer the product owing to its easy installation and cost-saving attributes. However, growing residential buildings are also contributing to market growth accounting for 92.25% market share in 2026

Sandwich Panel Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Sandwich Panel Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific leads the market, driven by rapid urbanization, significant infrastructure investment, and expanding manufacturing hubs in China, India, Southeast Asia, and Australia. Panel adoption is rising across high-rise housing, modular developments, cold chain expansion, and both residential and commercial construction. The region’s focus on speed, cost efficiency, and expanding middle-class housing sustains robust demand and the highest projected growth rates by 2032. The Japan market is projected to reach USD 0.88 billion by 2026, the China market is expected to reach USD 3.14 billion by 2026, and the India market is projected to reach USD 1.02 billion by 2026.

Global Sandwich Panel Market Share, By Outer Material, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

North America benefits from advanced construction standards, extensive cold storage needs, and infrastructure modernization. Key drivers include sustainability certification, fire and energy codes, and government incentives for green building solutions, particularly in the U.S. and Canada. Major applications feature logistics, data centers, and commercial warehouses, with rapid expansion in the food, pharmaceutical, and technology sectors supporting panel adoption. The U.S. market is projected to reach USD 2.07 billion by 2026.

Europe

Europe holds a significant share due to stringent energy efficiency mandates, environmental regulations, and mature renovation activities, especially in Western Europe. The region highly values premium insulated panel systems for both the refurbishment of older structures and new energy-positive buildings. The UK market is expected to reach USD 0.36 billion by 2026, while the Germany market is projected to reach USD 0.44 billion by 2026.

Middle East & Africa and Latin America

Latin America gradually uptakes products, especially in Brazil, Mexico, and Chile, where industrial, commercial, and logistics construction is intensifying. While regulatory pressure is comparatively lower, public infrastructure investment and modernization, such as retail, warehousing, and affordable housing, spur demand for advanced insulation and fast-assembly solutions. Adoption rates continue to climb as the benefits for speed, cost, and energy savings become more widely recognized.

Competitive Landscape

Key Companies Focus on Innovation to Gain Prominence

The market is highly fragmented and has become saturated, with manufacturers offering almost identical products. The market has witnessed limited innovation over the years, making it difficult for any single player to gain prominence. The competitive landscape of the market includes major companies, such as Kingspan Group, Rautaruukki Corporation, and Sintex. Major players in the market have been actively consolidating their position to reduce overall competition. Several other companies, such as Tata Steel, ArcelorMittal, Areco, Assan Panel A.S., Building Components Solutions LLC, and DANA Group of Companies, are other active participants in the market.

LIST OF KEY Key Sandwich Panel COMPANIES PROFILED

- Kingspan Group (Ireland)

- Tata Steel (India)

- Sintex Group (India)

- ArcelorMittal (Europe)

- Areco Group (Europe)

- Assan Panel A.S. (Turkey)

- Building Component Solutions LLC (Saudi Arabia)

- DANA Group (UAE)

- Rautaruukki Corporation (Europe)

KEY INDUSTRY DEVELOPMENTS

- October 2024– Invespanel, a part of Kingspan (Kingspan | Invespanel), launched a new sandwich panel product line using ArcelorMittal’s Xcarb, a recycled and renewably produced steel. This development fits with the increasing demand for lower-carbon building materials. The company is using recycled steel and renewable energy in the production of steel, then utilizing it in sandwich panels, which reduces the embodied carbon.

- March 2024– Tata Steel launched the Tata Steel TABB Limited subsidiary to produce lightweight, aluminum honeycomb-cored composite panels, completing a trial order in FY 2023-24. This initiative targets the Indian Railways and aims to expand into construction, infrastructure, automotive, and marine sectors.

- October 2022- Kingspan Group acquired Invespanel. Invespanel is a mineral wool-based sandwich panel producer. The company's product portfolio of panels includes extruded polystyrene (XPS) and expanded polystyrene (EPS)-core refrigeration panels. Invespanel continually develops new panels for various applications. Such an acquisition would help the company to make a strong product portfolio.

- December 2020- ArcelorMittal Construction acquired a Llentab company. The acquisition included the Kungshamn panel production line in Sweden, which produces mineral wool (MiWo) panels for steel buildings. This acquisition would help the company increase its manufacturing capability in the region.

- November 2023 - Dana Steel received an environmental product declaration for pre-painted aluminium and galvanized steel coils. The EPD, which has been published in the prestigious Environmental Footprint Institute, reinforces Dana Steel’s commitment to environmental sustainability and transparency in its operations. It also enhances trust in the “skin” materials of sandwich panels, which is a quality assurance step relevant to panel buyers.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on crucial aspects, such as leading companies, types, outer materials, and applications. Additionally, it offers insights into the latest market trends and highlights vital industry developments. The report encompasses various factors contributing to the market's growth in recent years. It further includes historical data and forecasts revenue growth at global, regional, and country levels. The report analyzes the industry's latest market dynamics and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Outer Material, By Application, and By Region |

|

By Type |

· Polystyrene o Expanded Polystyrene (EPS) o Extruded Polystyrene (XPS) · Polyurethane (PUR) · Polyisocyanurate (PIR) · Mineral Wool · Phenolic foam · Others |

|

By Outer Material |

· Steel · Aluminum · Others |

|

By Application |

· Residential · Non-Residential |

|

By Region |

· North America (By Type, By Outer Material, By Application, By Country) o U.S. (By Application) o Canada (By Application) · Europe (By Type, By Outer Material, By Application, By Country) o Germany (By Application) o U.K. (By Application) o France (By Application) o Italy (By Application) o Spain (By Application) o Rest of Europe (By Application) · Asia Pacific (By Type, By Outer Material, By Application, By Country) o China (By Application) o Japan (By Application) o South Korea (By Application) o Australia (By Application) o New Zealand (By Application) o Vietnam (By Application) o Laos (By Application) o Cambodia (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Type, By Outer Material, By Application, By Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Type, By Outer Material, By Application, By Country) o Saudi Arabia (By Application) o South Africa (By Application) o Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 11.57 billion in 2025 and is projected to reach USD 24.12 billion by 2034.

In 2025, the Asia Pacific market size stood at USD 5.67 billion.

Registering a CAGR of 8.40%, the market will exhibit steady growth during the forecast period (2026-2034).

The non-residential segment is likely to lead the market.

Rising support from governments to expand modular infrastructural developments is anticipated to drive market growth.

Kingspan Group, Rautaruukki Corporation, Sintex, Tata Steel, ArcelorMittal, Areco, Assan Panel A.S., Building Components Solutions LLC, and DANA Group of Companies are a few of the major players in the market.

Asia Pacific dominates the market in terms of share in 2025.

Rising demand for cold storage facilities from end-users is expected to augment market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us