Security Robots Market Size, Share & Industry Analysis, By Type (Unmanned Aerial Vehicle, Unmanned Ground Vehicle, and Unmanned Marine Vehicle), By Application (Surveillance & Monitoring, Intrusion Detection, Explosive Detection & Disposal, Fire & Hazard Detection, Transportation, and Others), By End User (Defense & Military, Commercial & Residential Security, Industrial Security, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

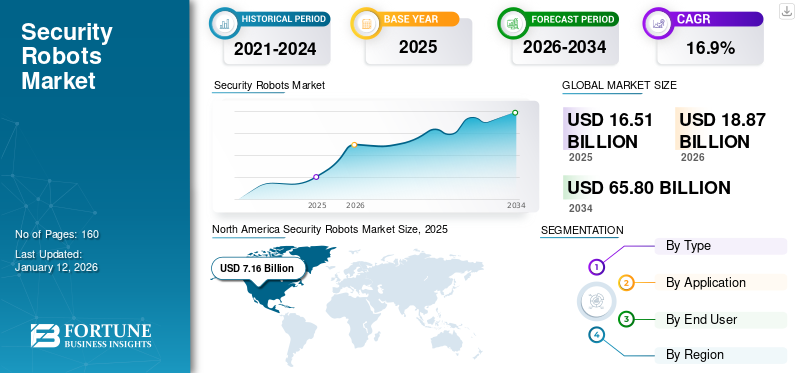

The global security robots market size was valued at USD 16.51 billion in 2025 and is projected to grow from USD 18.87 billion in 2026 to USD 65.80 billion by 2034, exhibiting a CAGR of 16.9% during the forecast period. North America dominated the security robots market with a market share of 43.4% in 2025.

Security robots are also known as patrolling robots or surveillance robots. It is an autonomous machine that is designed to increase safety and security measures in various industries such as military & defense, industrial security, and commercial security applications. It is enabled with advanced technologies such as cameras, sensors, artificial intelligence, machine learning, and computer vision technologies to provide real-time surveillance and detect potential threats in industrial premises. It can be used for patrolling, monitoring, and threat detection in shopping malls, industrial facilities, and warehouses.

Key players such as Boston Dynamics, SMP Robotics, Northrop Grumman, Qinetiq Group Plc, and AeroVironment Inc. are offering new robots for security purposes, which fuels the market growth. For instance, in September 2024, Boston Dynamics signed a collaboration with ASSA ABLOY to provide a spot dog robot for patrolling, environment monitoring, and security applications.

Rising crime cases, terrorism, and security threats across the globe create the demand for autonomous security robots for detection and monitoring premises, which fuels the growth of the market. An increase in investment in military & defense and industrial facility sectors, which, in turn, creates the demand for unmanned aerial vehicles to detect potential threats and improve security among government, residential, and commercial facilities, bolsters the growth of the market. In addition, there is a surging demand for autonomous systems in commercial, residential, and airports. For instance, according to the source of USAFacts, the government of the U.S. planned to invest around USD 820.3 billion in the military sector, which increased by 13.3% in 2023 as compared to 2022.

Download Free sample to learn more about this report.

The COVID-19 pandemic had a significant impact on the global market owing to accelerated demand for robotic security systems and rising demand for remote monitoring solutions in the military, defense, and commercial premises. This provides lucrative opportunities for manufacturers in the security robots market.

IMPACT OF TECHNOLOGY ON MARKET

Integration of Advanced Technologies to Bolster Market Growth

An adoption of technologies such as artificial intelligence, machine learning, IoT, and LiDAR & sensor technology in the security robots to enhance the safety and security across military, defense, residential, and commercial premises. Also, the integration of 5G technology, cloud integration, and integration with existing security infrastructure creates more threat detection capabilities across numerous verticals, increasing the demand for such robots. Tech advanced security robots are able to operate autonomously, which are designed for performing tasks such as patrolling large areas, analyzing huge amounts of data, and detecting threats, and provide alerts to end-users. By integration of advanced technologies, AI based robots detect suspicious activity and send an alert to end-users.

SECURITY ROBOTS MARKET TRENDS

Technological Advancements in Security Robots to Fuel Market Growth

Key players such as Boston Dynamics, SMP Robotics, Northrop Grumman, and BAE Systems Plc engaged in the market are adopting new technological advancements such as Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT) in such robots to provide real-time monitoring system and provide capability of threat detection which are used in security and safety application. For instance, in February 2025, SMP Robotics introduced a new Argus S5 series of security robots at the International Security Conference held during 2-4 April, 2025 in the U.S. These robots are used for military and defense security applications and offer 3600 operations, dual camera, smart control, 24/7 operations, using 4G or Wi-Fi controls. In such a way, technological advancement in such a system drives market growth.

MARKET DYNAMICS

Market Drivers

Increasing Investments Globally in Military and Defense Globally Triggers Market Growth

Rising investments in the expansion of the military and defense sector across China, Japan, the U.S., and others have a surge in demand for autonomous patrolling systems and autonomous security systems. In addition, the adoption of security robots is increasing in military bases, borders, ammunition depots, army bases, air force stations, and coast guards, due to rising threats from seafarers, pirates, and terrorists across marine and defense borders. Additionally, the market witnesses a rising adoption of unmanned aerial vehicles, unmanned marine vehicles, and unmanned ground vehicles across underwater security threats and surface security threats. For instance, in 2023, the government of UAE planned to invest around USD 23.20 billion in the defense and military sectors, which enhanced the demand for such robots and fueled the security robots market growth.

Market Restraints

High Capital Investment Costs to Restrict Market Growth

Security robots are enabled with advanced sensors, robotics, artificial intelligence, and machine learning technology, which requires more cost to design, purchase, and maintain. These robots are adopted in security operations, which require upfront investment as compared to human security guards. In addition, they increase the cost needed for charging stations to charge security robot batteries, which, in turn, impedes market growth. The fee required for these robots ranges from USD 20,000 to USD 1,00,000, which varies from size parameters. Such significant cost is not bearable for small as well as medium-scale enterprises, which hinders market growth.

Market Opportunities

Growth in Smart Cities and Infrastructure Development to Provide Lucrative Opportunities

There is a high demand for unmanned aerial and marine vehicles as the market has observed significant investments for the construction of smart cities and infrastructure development across India, China, U.K, and other countries. Moreover, government and local authorities are planning to invest in providing robotic solutions for traffic control, security management, and disaster alert programs. Rising demand for security robots for surveillance, patrolling, and emergency response in smart cities and industrial premises, also supports market growth. For instance, according to the International City Management Association (ICMA), in 2022, the U.S. government planned to invest around USD 500 billion for the construction of smart city projects. Similarly, the government of South Korea, plans to invest around USD 2,240 million in the public and private sector by 2030 for deployment of around one million robots for various industrial and public sectors. Such enormous investments for smart city projects across the world offer firms thriving opportunities while simultaneously supporting market growth.

SEGMENTATION ANALYSIS

By Type

Unmanned Aerial Vehicles Dominate owing to Rising Demand from Military and Defense Sector

Based on type, the market is classified into unmanned aerial vehicle, unmanned ground vehicle, and unmanned marine vehicle.

As per our analysis, the unmanned aerial vehicle segment dominated the market in terms of revenue share by 66.61% in 2026, and is expected to grow at a substantial rate. The segment’s growth is attributed to the rising demand for UAVs in the military & defense sectors across China, Japan, the U.S., and Australia. Rising investments allow adoption of unmanned aerial vehicles or drones across military bases and battlefields for maintaining safe ground stations. For instance, according to the source of India Briefing, the Indian government plans to invest around USD 23.0 billion by 2030 for the manufacturing of drones and UAVs across India. Such an investment positively supports the growth of the market.

The unmanned ground vehicle segment is anticipated to grow at a moderate rate during the forecast period, owing to their rising demand from civilian sectors, such as nuclear, oil & gas, power plant premise, and firefighting. These vehicles are helpful in combat support, surveillance, threat detection, and inspection applications.

The unmanned marine vehicles segment is projected to grow decently during the forecast period, owing to rising demand for marine surveillance, underwater sea navigation, and expanding offshore oil & gas exploration.

To know how our report can help streamline your business, Speak to Analyst

By Application

Surveillance & Monitoring Application Leads Due to Rising Demand for Security Robots across Several Facilities

Based on application, the market is classified into surveillance & monitoring, intrusion detection, explosive detection & disposal, fire & hazard detection, transportation, and others. The others segment consists of rescue operations and underwater security.

As per our analysis, the surveillance & monitoring segment dominated the market in 2024 and is anticipated to grow at a substantial rate during the forecast period. Surveillance & monitoring offers 24/7 operation enabled with sensors and intelligent cameras. It allows to store & analyze huge amounts of surveillance data. Security robots have significant applications across commercial sites, manufacturing facilities, educational institutes, and military bases.

Intrusion detection and explosive detection & disposal applications are projected to grow steadily, owing to factors such as rising awareness about security concerns among military bases, airports, and industrial facilities. In addition, government funding for the defense sector's implementation of autonomous devices drives market growth. The intrusion detection segment is expected to dominate the market share of 21% in 2025.

The explosive detection & disposal segment is anticipated to exhibit a CAGR of 15.80% during the forecast period.

The fire & hazard detection and transportation sub-segments are anticipated to grow moderately during the forecast period. In recent times robots are majorly observed for firefighting, environmental monitoring, and threat detection across airports, train stations, industrial plants, and military camps. They can detect fire and explosive activities and send alerts to end-users. Furthermore, these robots are able to perform tasks at locations under toxic gases and dangerous spaces where human inspection is harmful.

The others segments include rescue operations and underwater security applications. It is projected to depict a moderate growth during the forecast period owing to rising demand for security robots for patrolling, environmental monitoring, and inspection of ship hulls for marine and defense sectors. Also, in underwater security, such robots are utilized for inspection of underwater pipelines, cables, and critical infrastructure.

By End User

Defense & Military Segment Leads Due to Rising Demand for UAV and UGV for Inspection and Monitoring

Based on end user, the market is classified into defense & military, commercial & residential security, industrial security, and others.

As per our analysis, the defense & military segment dominated in terms of market share in 2024 and is also projected to depict the highest growth rate during the forecast period. This sub-segment is the leading end-user due to increasing threats from surface and underwater attacks and the rising demand for counter drones to detect and neutralize unauthorized aerial vehicles. In addition, security robots are widely used in military bases, coast guards, and marine applications. The segment is expected to dominate the market share of 46.53% in 2026.

The commercial and residential security is projected to grow steadily during the forecast period, owing to the benefits of robots, such as operating 24/7 to prevent intrusion and detect threats. In addition, rising safety and security concerns over personal and public assets, including finance, healthcare, and the government sector, drives the demand for such robots.

Industrial security is anticipated to grow moderately, owing to moderate demand for performing applications such as indoor surveillance, environment hazard detection, perimeter monitoring, and threat detection among manufacturing plants, oil & gas, renewable energy, and automotive sectors. These robots offer features such as enhanced security, cost-effective solutions, increased efficiency, and reduced risk to human personnel, which supports the security robots market share. This segment is anticipated to exhibit a CAGR of 15.47% during the forecast period.

The others sub-segment consists of the transportation and infrastructure sector. The segment’s growth is anticipated to be decently driven by growing demand for security robots at airports, railway stations, roadways, bridges, and intelligent transportation systems to detect potential threats, patrol operations, and provide emergency alerts in transportation-related incidents.

SECURITY ROBOTS MARKET REGIONAL OUTLOOK

The market covers five major regions, mainly North America, Europe, Asia Pacific, the Middle East & Africa, and South America. North America dominated the market in terms of revenue in 2024.

North America

North America Security Robots Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds the dominating position in the market and accounted for the largest market share in 2025 with a size of USD 7.16 billion, owing to factors such as rising security concerns across military, industrial, and commercial spaces in the U.S. and Canada. In addition, the strong presence of major players such as AeroVironment Inc., Knightscope Inc., Boston Dynamics, and Northrop Grumman, among others, in the U.S., Canada, and Mexico, subsequently raising the demand for such robots, supports the region’s market growth. For instance, in March 2025, Telerob, a subsidiary of Aerovironment Inc., planned to provide 41 uncrewed ground vehicles to a German army camp. These vehicles offer enhanced patrolling capacity and detection of fire hazards across German military stations.

U.S. to Dominate Regional Market through Higher Adoption of Robots in Military and Defense Infrastructure

The U.S. is renowned for its military and defense infrastructure. The country’s exorbitant investments in military & defense and commercial and industrial infrastructure results in a larger number of security robots for patrolling and surveillance application. For instance, according to the Department of Defense U.S., the U.S. government plans to invest around USD 849.8 billion in defense infrastructure in 2025, which increased by 4.2% as compared to previous year. The U.S. market size is expected to hit USD 6.28 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is anticipated to account for the second-highest market size of USD 4.87 billion in 2026, exhibiting the second-fastest growing CAGR of 14.38% during the forecast period. Europe is projected to grow steadily during the forecast period, owing to rising spending on military infrastructure and rising smart city initiatives across Germany, France, and Russia, among others. In addition, growth in the tourism and hospitality sector across Europe, enhances the deployment of security robots for security and safety applications. The market value in U.K. is expected to be USD 0.93 billion in 2026.

On the other hand, Germany is projecting to hit USD 1.33 billion in 2026 and France is likely to hold USD 0.62 billion in 2025.

Asia Pacific

Asia Pacific is projected to be USD 4.25 billion in 2026 as the third-largest market region and to grow moderately owing to increasing safety and security concerns, geopolitical instability, and technological advancements in security robots. These aspects have created a surge in demand for threat detection capabilities and enhanced country border security. In addition, substantial investments in smart cities across South Korea, India, and China have boosted the demand for security. For instance, according to a study by the United Nations Educational, Scientific, and Cultural Organization (UNESCO), investment in smart cities across the Asia Pacific is projected to reach USD 320.0 billion by 2025. The market value in China is expected to be USD 1.60 billion in 2026.

On the other hand, India is projecting to hit USD 0.46 billion and Japan is likely to hold USD 0.86 billion in 2026.

Middle East & Africa

The Middle East & Africa region is to be anticipated as the fourth-largest market with USD 1.00 billion in 2026. The Middle East & Africa is projected to depict a moderate growth during the forecast period, owing to investment in the expansion of military and commercial infrastructure. The rise in the demand for such systems for patrolling and border inspection services fuels the market growth. Moreover, industries such as oil & gas, manufacturing plants, and the renewable energy sector require constant monitoring, which creates the demand for such products, further supporting the region’s market growth. The GCC market is expected to hold USD 0.60 billion in 2025.

South America

South America is anticipated to grow decently during the forecast period owing to factors such as increasing crime rates across surface and underwater and increasing security concerns across military, defense, and transportation operations, which increases the demand for such robots.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leading Companies Adopt Strategies such as Product Launches, Acquisitions, and Partnerships to Strengthen Position

Market players such as Boston Dynamics, Aerovironment Inc, Qinetiq Group Plc, and others are engaged in adopting acquisition, product launch, and partnership as strategic moves to strengthen the market competition and to improve the geographical presence of security robots. For instance, in September 2023, BAE System Plc signed a collaboration with Cellula Robotics for the launch of an Autonomous Underwater Vehicle (AUV) named XLAUV for providing security, surveillance, and patrolling services for military and defense camps.

List of Key Security Robot Companies Profiled

- Boston Dynamics (U.S.)

- SMP Robotics (U.S.)

- Northrop Grumman (U.S.)

- AeroVironment Inc (U.S.)

- Qinetiq Group Plc (U.K.)

- BAE Systems Plc (U.K.)

- Thales Group (France)

- Teledyne Technologies (U.S.)

- Elbit Systems Ltd (Israel)

- Kongsberg (Norway)

- Knightscope Inc (U.S.)

- IJM Corporation Berhad (China)

- Cobalt Corporation (U.S.)

- Bluebotics (Switzerland)

- Lockheed Martin (U.S.)

- Segway Robotics (China)

- Gamma 2 Robotics (U.S.)

- Proytec (U.S.)

- Yokogawa Electric Corporation (Japan)

- ReconRobotics Inc (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2024: Northrop Grumman launched a new autonomous underwater vehicle named Mantra Ray, which offers inspection of underwater activities. It is used for patrolling and inspecting activities underwater. It is largely adopted by the marine and defense sectors. It offers features such as lower cost, operation in hazardous and risky environments, and increased payload capacity.

- September 2023: AeroVironment Inc. acquired Tomahawk Robotics, which is based in the U.S. and deals in integrated communication systems, controllers, and edge systems required for the defense and military sectors. The acquisition was done for around USD 120.0 million to improve the product portfolio of security robots and related systems.

- May 2023: Boston Dynamics opened a new sales and services office in Frankfurt, Germany to provide sales, services, and aftermarket services required for robots offered by companies across Europe.

- April 2022: SMP Robotics signed a partnership with 1ST Technologies LLC based in the U.S., which deals in service provider companies for security robots. The basic aim of the partnership was to improve the product portfolio of robots used for patrolling areas with 24/7 operation across the U.S. and Mexico.

- April 2022: Teledyne Flir Defense, a subsidiary of Teledyne Technologies, signed an agreement with Boston Dynamics to provide a spot robot for performing threat detection and patrolling services across the industrial and public sectors.

REPORT COVERAGE

The global security robots market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, type, application, and end user. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.9% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, Application, End User, and Region |

|

Segmentation |

By Type

By Application

By End User

By Region

|

|

Key Market Players Profiles in the Report |

Boston Dynamics (U.S.), SMP Robotics (U.S.), Northrop Grumman (U.S.), AeroVironment Inc (U.S.), Qinetiq Group Plc (U.K.), BAE Systems Plc (U.K.), Thales Group (France), Teledyne Technologies (U.S.), Elbit Systems Ltd (Israel), and Kongsberg (Norway). |

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 16.51 billion in 2025.

In 2034, the market is expected to reach USD 65.80 billion.

The market is projected to grow at a CAGR of 16.9% during the forecast period.

The unmanned aerial vehicle segment is expected to lead the market over the forecast period.

Increasing investments in the military and defense sector across the globe, triggers market growth.

Boston Dynamics, SMP Robotics, Northrop Grumman, AeroVironment Inc, Qinetiq Group Plc, BAE Systems Plc, Thales Group, Teledyne Technologies, Elbit Systems Ltd, and Kongsberg are the leading companies.

North America is projected to hold the largest market share.

Smart cities & infrastructure development across the globe to provide lucrative opportunity for the market’s growth.

Based on end-user, the defense & military segment is projected to lead the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us