Soy Protein Ingredients Market Size, Share & Industry Analysis, By Ingredient Type (Soy Protein Concentrate, Soy Protein Isolate, Soy Flour, and Textured Soy Protein (TSP)), By Category (Organic and Conventional), By Form (Dry and Liquid), By Application (Food {Meat Alternatives, Dairy Alternatives, Snacks, Breakfast Cereals, Bakery Products, and Others) and Feed {Cattle, Swine, Poultry, Aquafeed, and Others}), and Regional Forecast, 2026-2034

Soy Protein Ingredients Market Size and Future Outlook

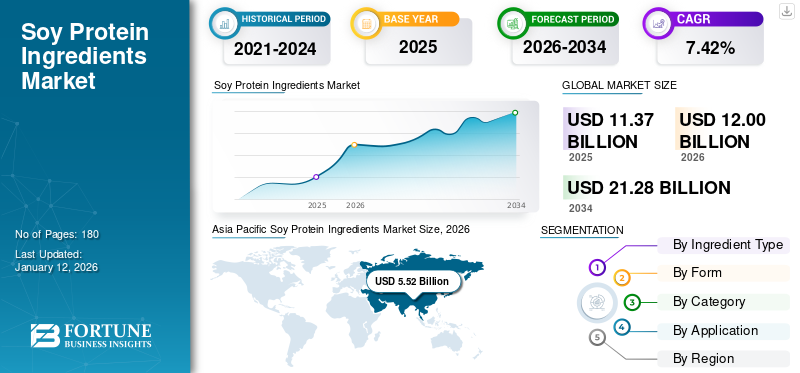

The global soy protein ingredients market size was valued at USD 11.37 billion in 2025. The market is projected to grow from USD 12.00 billion in 2026 to USD 21.28 billion by 2034, exhibiting a CAGR of 7.42% during the forecast period. Asia Pacific dominated the soy protein ingredients market with a market share of 45.65% in 2025.

Soy protein is an essential protein that provides essential amino acids required for complete human nutrition. Soy protein is derived from soybeans through extrusion and crushing of soybeans. The major forms of such products include soy flour, soy protein concentrate, and soy protein isolates and such ingredients have wide applications in the food and feed industry.

Impact of COVID-19

The COVID-19 pandemic had a multifaceted impact on soybean and soybean ingredient production and consumption. The pandemic had a significant impact on the production and supply of soybean, which is the main ingredient required for soy protein ingredient manufacturing. For instance, as per data provided by the National Oilseed Processors Association, farmers incurred around USD 4.7 billion loss between the months of January and June in 2020. Hence, the raw materials supply was negatively affected during the pandemic, causing a shortage in their availability. On the other hand, the demand and application of such products in food ingredient production increased significantly during the pandemic. The growing demand for meat alternatives mainly drove these, innovative dairy alternatives, meat alternatives, and other food products among consumers during the pandemic. Hence, suppliers and food manufacturers had to recalibrate their supply chain and production process to minimize supply chain bottlenecks and also curb the spread of any disease among workers, and maintain food safety and quality during the pandemic.

Global Soy Protein Ingredients Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 11.37 billion

- 2026 Market Size: USD 12.00 billion

- 2034 Forecast Market Size: USD 21.28 billion

- CAGR: 7.42% from 2026–2034

Market Share:

- Asia Pacific dominated the soy protein ingredients market with a 45.65% share in 2025, driven by rising demand for plant-based protein, health-conscious consumers, and strong soybean cultivation in countries like China, India, and Japan.

- Soy flour held the highest market share among ingredient types due to its wide application in protein bars and baked products and its ability to enhance shelf life and protein content in processed foods.

Key Country Highlights:

- China: Major soybean producer expanding capacity to reduce import dependence and boost soy protein production for food and feed applications.

- India: Strong growth in soybean processing and use in functional foods and beverages, driven by health-conscious dietary trends.

- U.S.: Increasing demand for plant-based meat and dairy alternatives is accelerating soy protein usage, supported by abundant domestic soybean supply.

- Brazil: High soybean production supports feed applications; growing opportunity for increased use in food products.

- Germany: Rising adoption of vegan diets fuels demand for soy protein concentrates and isolates in processed food and beverage manufacturing.

Soy Protein Ingredients Market Trends

Adoption of Advanced Technologies for Soy Protein Ingredient Manufacturing to Support Increased Application

Advancements in the manufacturing process had a positive impact on the application and functionality improvement of soy protein ingredients. With the advancement in technology, such products are available in a wide range of formats, which include extruded flakes, powders, chunks, and chips that enhance the versatility of the products and improve their performance. Texture and the taste of the products have been improved, which has enabled manufacturers to add more such products in the final products without affecting the taste of the final products. Thus, the improved properties and functionality of the products will help consumers opt for products that contain more soy protein and thus create an opportunity for growth in the food sector.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Growing Demand for Sustainable Ingredients in Food Products to Support Market Growth

The consumer interest in plant-based protein products in the global market is increasing rapidly. As demand for sustainable products among consumers is increasing due to health and growing environmental concerns, the sales of such products are increasing rapidly. As per data provided by the U.S. Soy organization, ensuring a protein and vitamin-enriched diet is a primary concern among 70% of U.S. consumers. Moreover, soy protein is the only plant protein available in the market, which has a US FDA health claim.

Evolving Food Manufacturing and Dietary Needs to Escalate Market Growth

Food manufacturing processes are becoming more advanced keeping in pace with the evolution and growth in the demand for innovative food products among consumers. Natural ingredients are becoming popular and their adoption for manufacturing tasty and innovative food products is growing rapidly. They are expected to play a crucial role in the future to fuel the growth of healthy food product manufacturing. Due to the versatile nature of such products, soy ingredients are used in a wide range of food products. It helps to bind ingredients, help retain moisture, enhance food texture and food quality, and boost the protein content. Therefore, they find application in the production of meat and dairy alternatives, bakeries, processed food products, and others. Such growth in their adoption rate is expected to fuel the global soy protein ingredients market growth globally.

Market Restraints

Complex Manufacturing Process to Limit Market Growth

The cost of production depends on the production prices, the grade and quality of raw materials, and the labor cost required for the production of soy protein ingredients. Although soy protein powder is economical, certain soy protein powders with high protein concentrates are expensive compared to the other forms of product with lesser protein content. Hence, the price of food products such as meat, bakery, dairy alternatives, and other products where high soy protein concentrates are used will have higher prices compared to other products with lesser soy protein contents.

Market Opportunities:

Expansion in the Identification of Potential Application Areas Can Offer Immense Growth Opportunities to the Sector

New areas of application of such ingredients create immense opportunities for manufacturers to explore and expand their sales and market presence. One of the most rapidly evolving application areas is plant-based food manufacturing. As the global demand for plant-based food products is increasing, ingredients that act as an alternative to animal-based products and as a suitable alternative can be used for manufacturing new products.

Market Challenges:

Deforestation and Loss of Biodiversity Due to Soybean Cultivation May Hinder Market Growth

One of the major challenges affecting the production and supply chain of these products is the sustainable production and availability of raw materials. Conventional soy cultivation from which such ingredients are derived is associated with deforestation, biodiversity, and wildlife habitat loss. This is a major area of concern for environment-conscious consumers who prefer products that are produced sustainably. Hence, manufacturers need to adopt steps to address such issues associated with conventional soy bean farming and adopt practices to limit deforestation and also maintain a steady supply of raw materials for production.

SEGMENTATION ANALYSIS

By Ingredient Type

Soy flour Accounts for the Highest Market Share Owing to Its Wider Application in the Food and Feed Sector

Soy protein ingredients are available in different forms in the market. Based on the ingredient type, the market can be categorized into soy protein concentrate, soy protein isolate, soy flour, and textured soy protein (TSP).

Soy flour accounts for the highest market share USD 6.57 billion in 2026 and accounting for 54.75%. It is used for the production of protein bars and baked products where it is used to enrich the food with protein and also extend the shelf life of the products. It also has a high protein content and hence, can be used as an ingredient for manufacturing protein rich processed food products.

Soy protein concentrates, on the other hand, contain 65% of protein by weight and are used for manufacturing meat products and are also used as an emulsification agent in soups and sauces.

Soy protein isolates have the highest concentration of protein. They are used for the production of high-concentration protein products such as protein drinks and shakes, infant formulas, and meat products, where it is added to improve the texture of such products.

Textured Soy Protein (TSP) held 7% of market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Form Analysis

Dry Form Accounts for Largest Market Share as It Is Economical Compared to Other Form

Soy protein ingredients are used in the manufacturing of different traditional soy food products and other nontraditional food items. Based on the form, the market is categorized into dry and liquid.

Among these, the dry form accounts for the largest global soy protein ingredients market share of 87% in 2025. This form of product is economical compared to liquid form and is used for manufacturing a wide range of food and feed products. This product form is versatile and affordable source of protein which can be included in vegetarian and vegan diets and has application in feed industry as well.

Liquid form of product is comparatively expensive due to the high production and storage costs associated with their manufacturing. Specialized production process and manufacturing equipment’s are required to extract such ingredient which further adds to the production cost. This segment is anticipated to exhibit a CAGR of 5.88% during the forecast period (2025-2032).

By Category Analysis

Conventional Products Accounts for Largest Market Share as It Is the Most Widely Used Method for Farming

Based on category, the market is segmented into organic and conventional products.

Conventional products account for the largest market share and CAGR of 71.67% during the forecast period (2026-2034), as the majority of the farmers still use conventional practices for farming purposes. Hence the price of such products is less compared to the organic produce and due to their high protein content they are included in a wide range of food and food products.

The organic segment takes the highest growth rate with a share of 28% in 2025, owing to the increasing demand for organic food products among consumers. As organic farmers adopt sustainable practices for raw materials production and such products are perceived to have higher health benefits compared to conventional products, the demand for such products is increasing rapidly in the global market.

By Application

Food Accounts for the Highest Market Share Due to the Growing Product Usage in Manufacturing Various Food Products

Based on application, the market is classified into food and feed.

Food application accounts for the highest market share of 66.17% in 2026 and is set to register the highest growth during the forecast period. Among the food applications, these ingredients are used for manufacturing meat products, dairy products, processed food products, beverages, and others. Among the food applications, meat products account for the highest market share as a wide range of ingredients, namely soy protein concentrates and isolates are used to improve the protein content and vitamin content and also enhance the flavor and texture of meat products.

The products are also used in dairy alternatives where such ingredients are used as a substitute for milk. It is used to replace milk powder and is used for non-dairy milk production.

Other processed food products include pasta products, which it is used for improving the product's color and volume and extending the shelf life of such products.

Feed ingredients account another prominent segment, exhibiting a CAGR of 6.26% during the forecast period (2025-2032), where soy protein ingredients are used for providing nutrition to the animals. Soy bean is associated with high protein content, which provides essential amino acids to the animals. Such products are helpful in supporting animal growth, health, reproduction, and other functions. Moreover, products such as soy flour are easily absorbed by animals such as cattle, pigs, poultry, and even in pet food, resulting in increased usage in the animal feed industry.

Global Soy Protein Ingredients Market Regional Outlook

Geographically, the global market report covers analysis across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Soy Protein Ingredients Market Size, 2026 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific market size amounted to USD 5.52 billion in 2026 and accounts for the largest market share among all the regions globally. In Asia Pacific, soy products have been popular since ancient times. The rapid urbanization and advances in the food processing sector have further boosted the processing of soybeans for developing advanced and nutritious food products, including soy protein ingredients. Countries, such as China, India, and Japan are some of the largest manufacturers of soybeans. Hence, these countries have easier access to raw materials required for soy protein ingredient manufacturing. As health consciousness among consumers continues to increase, demand for such products for manufacturing functional foods and beverages will continue to increase in the region.

China is one of the leading manufacturers and exporters of soybeans in the global market with a value of USD 3.86 billion in 2026. China is investing in expanding its production capacity to meet the surging demand for such products in the food industry at domestic and international levels. It is one of the net importers of soybean products, and the Chinese government is proactively working to reduce its reliance on the imports. Hence, the government is investing in expansion and modernization initiatives to improve the production of soy protein products for both food and feed use. India is expected to reach a market value of USD 0.63 billion in 2026, while Japan is projected to be valued at USD 0.14 billion in the same year.

North America

North America is the second largest market with a valuation of USD 3.19 billion in 2026, exhibiting a CAGR of 26.57% during the forecast period (2026-2034). The demand for plant-based protein products in the North American market, especially the U.S. and Canada, is increasing rapidly. Products, such as soy protein concentrates and soy protein isolates, are being used for manufacturing processed meat products, bakery and snack products, and others. Textured vegetable proteins, which help to manufacture products that mimic the texture of animal protein products, especially meat, are gradually being used by plant meat manufacturers to develop and launch new products in the market.

The demand for such products in the U.S. is increasing as it is growing to become one of the foremost ingredients necessary for food innovation and nutrition. Manufacturers are competing with each other to develop healthy and plant-friendly food products for the consumers are playing a vital role in innovation. As the country is one of the prominent manufacturers of soybeans, it has access to a wide range of domestic raw material supply at affordable price points to meet the market demand. The U.S. market is poised to be valued at USD 2.82 billion in 2026.

Europe

Europe is the fourth largest market with a valuation of USD 1.08 billion in 2026. In the European market, the growth in the demand for soy protein ingredients is mainly driven by the evolution in the dietary patterns of the consumers in the region. The U.K. market is increasing and is expected to capture a share of USD 0.12 billion in 2026. As a significant number of consumers are adopting vegan diets, plant-based ingredients are becoming vital for manufacturing food products that suit the diets of such consumers. These are, thus, some of the major products that have found wide industrial applications, especially in the food and beverages sector in Europe. The market is expected to grow further in the region. Germany is expected to reach a market value of USD 0.16 billion in 2026, while France is projected to be valued at USD 0.13 billion in the same year.

South America

South America is the third largest market with a share of USD 1.74 billion in 2025. Although the production of soybeans in South America, especially in Brazil, is high, their consumption in the food industry is still limited. Products, such as soy flour, are not popular in the region compared to other regions, leading to a tremendous potential for the manufacturers to develop and market their products among the consumers in the region.

Middle East & Africa

Soybean products are used in the Middle East & African region mainly for the production of animal feed products. Their adoption rate in the food sector is low, but it is expected to increase in the future. Products, such as soy flour and textured soy protein, which are gradually being used for the production of meat products, are expected to grow in the future in the region due to the evolving dietary preferences of the people. The UAE is anticipated to capture a share of USD 0.05 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Investments in New Products and Market Development to Support Market Growth

The global market is a semi-fragmented market where the domestic players and multinational companies are competing with each other and adopting strategic initiatives, such as mergers and acquisitions, new product launches, and others to expand their market presence either globally or in untapped markets. These companies considerably influence the competitive landscape through wide product offerings, wider reach in the market, innovation, market expansion, and other strategies.

Major Players in the Soy Protein Ingredients Market

To know how our report can help streamline your business, Speak to Analyst

ADM, Wilmar International, Cargill Incorporated, Bunge SA, and International Flavors and Fragrances Inc. are some of the largest players in the market. The global market is semi-fragmented, with the top 5 players accounting for around 45% of the global market share..

List of Key Soy Protein Ingredient Companies Profiled:

- ADM (U.S.)

- Wilmar International Limited (Singapore)

- Cargill, Incorporated (U.S.)

- International Flavors and Fragrances Inc. (U.S.)

- CHS Inc. (U.S.)

- BRF Global (Brazil)

- Fuji Oil Holdings Inc. (Japan)

- Bunge Global SA (U.S.)

- The Scoular Company (U.S.)

- Crown Soya Protein Limited (China)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Amfora launched new soy-based products in the global market. Some of the major offerings of the company include soy flour, texturized vegetable protein and crisps. The company manufactured such products using conventional methods as well as their proprietary technology.

- December 2022: Bunge Limited invested USD 550 million in its U.S. facility to develop soy protein concentrates for the U.S. market. The facility can process 4.5 million bushels of soybean per year.

- November 2022: International Flavors & Fragrances launched soy soy-based protein ingredient named “Supro Tex” in the market. This product can be used in plant-based food products which include burgers, chicken nuggets, and other meat alternatives.

- April 2022: Benson Hill acquired ZFS Creston LLC, a well-established manufacturer of food-grade soy flour products, for USD 102 million. This acquisition helped the company diversify its improved protein ingredients sector and expand its market footprint.

- March 2021: Cargill Inc. invested USD 475 million to end and modernize the production of soy-based ingredients. Such products are aimed to meet the growing application of soy ingredients in the food sector.

Investment Analysis and Opportunities

The soy protein ingredients market report provides comprehensive investment analysis and opportunities aimed at providing investors and business leaders with actionable insights. The global market overview report highlights the various opportunities that have the potential for investments, including new product launches, technological advancements, mergers & acquisitions, and geographic expansions.

REPORT COVERAGE

The soy protein ingredients market report analyzes the market in-depth and highlights crucial aspects such as global market analysis, prominent companies, grade analysis, form, category, and application. Besides this, the global market statistics report also provides insights into the market trends and highlights significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.42% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Ingredient Type

|

|

By Form

|

|

|

By Category

|

|

|

By Application

|

|

|

By Region North America (by Ingredient Type, by Form, by Category, By Application, and by country)

Europe (by Ingredient Type, by Form, by Category, by application, and by country)

South America (by Ingredient Type, by Form, by Category, by Application, and by country)

Middle East & Africa (by Ingredient Type, by Form, by Category, by Application, and by country)

|

Frequently Asked Questions

The global soy protein ingredients market size was valued at USD 11.37 billion in 2025. The market is projected to grow from USD 12.00 billion in 2026 to USD 21.28 billion by 2034.

At a CAGR of 7.42%, the global market will exhibit steady growth over the forecast period.

By ingredients, soy flour is expected to dominate the market throughout the forecast period.

Growing demand for sustainable ingredients in food products to propel market growth.

ADM Group, Wilmar International, and Cargill, Incorporated are the leading companies worldwide.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us