Sternal Closure Systems Market Size, Share & Industry Analysis, By Product (Closure Devices and Bone Cement), By Procedure (Median Sternotomy, Bilateral Sternotomy, and Hemisternotomy) By Material (Stainless Steel, Titanium, and PEEK) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

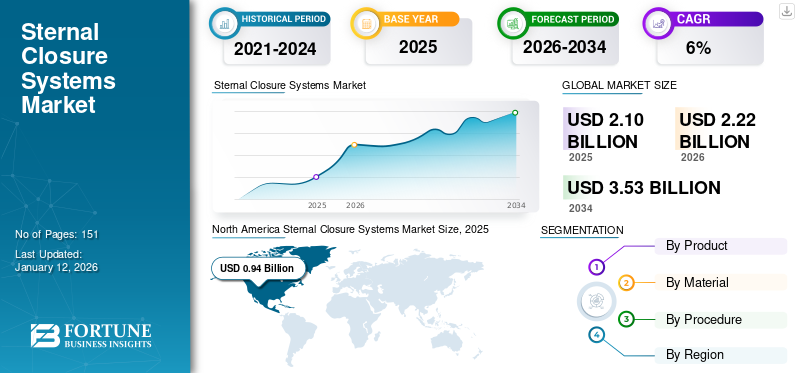

The global sternal closure systems market size was valued at USD 2.10 billion in 2025. The market is projected to grow from USD 2.22 billion in 2026 to USD 3.53 billion in 2034, exhibiting a CAGR of 6.00% during the 2026-2034 period. North America dominated the sternal closure systems market with a market share of 45.00% in 2025.

The global impact of COVID-19 has been unprecedented and staggering, with sternal closure devices witnessing a negative demand shock across all regions amid the pandemic. Based on our analysis, the global market will exhibit a huge decline of -27.80% in 2020. The sudden rise in the CAGR of this market is attributable to the potential launch of new products by 2023.

Sternal closure devices are orthopedic devices that are used to stabilization and fixation of the sternum after a sternotomy. Sternotomy is a procedure where the chest cavity is surgically opened to access the organ beneath the breast bone or sternum. This cardiac surgery is performed majorly to treat and manage cardiovascular disease. However, trauma caused during accidents are also addressed through sternotomy. The increasing prevalence of cardiovascular disease worldwide has led to associated increase in the number of open heart surgeries. This factor is projected to significantly boost the adoption of sterna closure devices in the future.

Delay in Elective Surgeries to Impact Market amid COVID-19

The COVID-19 pandemic which is analyzed to be originated from China has significantly impacted the orthopedic devices industry. Government guidelines, to delay elective surgeries have tremendously affected the revenue generated by the market. In response to the COVID-19 outbreak, the American Society of Anesthesiologists in July 2020 recommended a significant postponement of elective surgeries till the active cases of the virus infection decreases. The high burden experienced by the hospitals owed to the outbreak has led to a considerable decline in sales of orthopedic products.

Global Sternal Closure Systems Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.10 billion

- 2026 Market Size: USD 2.22 billion

- 2034 Forecast Market Size: USD 3.53 billion

- CAGR: 6.00% from 2026–2034

Market Share:

- North America dominated the sternal closure systems market with a 45.00% share in 2025, driven by the higher prevalence of cardiovascular diseases and increased adoption of advanced orthopedic devices across the region.

- By product type, sternal closure devices held the largest market share due to technological advancements, new product launches, and the growing number of open-heart surgeries globally.

Key Country Highlights:

- United States: Market growth is propelled by a high volume of open-heart surgeries, rising prevalence of coronary artery diseases, and the adoption of technologically advanced sternal closure devices.

- Europe: Increasing development in public healthcare infrastructure, a growing number of day-care surgeries, and a higher focus on obtaining CE mark approvals by key market players are key factors boosting market expansion.

- China: Rapid improvements in healthcare spending, a large patient pool undergoing cardiac surgeries, and efforts to enhance access to advanced treatment options are driving market growth.

- Japan: An aging population leading to a rising burden of cardiovascular diseases, along with increased investments in healthcare facilities, is expected to support the demand for sternal closure systems in the coming years.

LATEST TRENDS

Download Free sample to learn more about this report.

Focus on Mergers, Acquisitions, and Collaborations by Key Players to Surge Demand

Sternal closure devices have significant market growth potential in the forthcoming years owing to the increasing incidence of cardiovascular diseases and trauma injuries. Sternal closure market potential is recognized by key players and they are actively engaging in mergers, acquisitions, and collaborations. For instance, Zimmer Biomet is highly focusing in acquisition of private orthopedic device manufacturers to establish itself as a major market player. Since the merger of Zimmer and Biomet the company collaboratively are aiming to increase their product portfolio by acquiring other smaller businesses.

DRIVING FACTORS

Rise in the Prevalence of Cardiac Diseases to Augment Market Growth

The global sternal closure systems market is driven by various factors, however the predominant aspect that is estimated to drive the market is the global rise in cardiovascular diseases (CVD). The burden of cardiovascular disease is also increasing. According to the World Health Organization (WHO), around 71.9 million people died in the globally due to CVD.

The subsequent increase in the open heart surgeries have propelled the demand for such devices in the past years. According to the Warren Alpert Medical School of Brown University, currently there are about 500,000 open heart surgeries performed each year in the U.S. The growing trend of prevalence of open heart surgeries is cumulatively expected to account for the demand for sternal closure products in the forthcoming years.

Launch and Approval of Innovative Products to Propel Market

Key players operating in the market are focusing on launching innovative sternal closure systems to improve their competitive position. Potential launch and approvals of such technologically advanced sternal closure systems market are anticipated to positively influence the growth of the market during the forecast period. For instance, in March 2020, A&E Medical Corporation received U.S FDA approval for their Sternal Cable System. This innovative cable system is an alternative to the traditional wires used for sternal closure after a sternotomy.

RESTRAINING FACTORS

Increasing Adoption of Minimally Invasive Surgeries to Hamper Market Growth

Scientific advancements have led to the significant technological innovation in cardiovascular surgeries. Minimally invasive and non-invasive surgeries are increasing adopted in treatment and management of chronic diseases. This rise in trend of adoption of minimally invasive surgeries, coupled with growing number of surgical procedures are estimated to negatively hamper the sternal closure market. Minimally invasive surgeries involve lower complications, lower recovery time, and significantly lesser hospital stays. According to the Texas Heart Institute, around 200,000 minimally invasive coronary bypass surgeries are performed each year in the U.S.

SEGMENTATION

By Product Analysis

To know how our report can help streamline your business, Speak to Analyst

Sternal Closure Devices Held Highest Market Share in 2024

On the basis of product, the sternal closure systems market with a share of 67.57% in 2026 is bifurcated into sternal closure devices and bone cement.

The sternal closure devices dominated the market. The technological advancement and new product launches are estimated to propel the market growth in the foreseeable years.

To know how our report can help streamline your business, Speak to Analyst

The bone cement segment holds a smaller share in the market. The segment is estimated to show slower growth which is mainly attributed to higher adoption of sternal closure devices in the market. However, the product type is considerably adopted in developing countries in Latin America and the Middle East and Africa.

By Material

Titanium Material to Garner Maximum Share

Based on the segmentation of material, the market is categorized into titanium, PEEK and stainless steel.

The titanium products held a significant share contributing 46.84% globally in 2026 in the market in owing to factors such as higher biocompatibility, new product launches in the device type, and corrosion resistance, among others. The segment is also estimated to exhibit significant growth rate in the coming years owing to higher focus of key market players in developing sternal closures with the material.

The PEEK segment is estimated to show significant adoption in the forthcoming years. Higher investment in research and development and technological advancements are estimated to propel the segment growth during the forecast period.

By Procedure Analysis

Median Sternotomy Dominated Market in 2024

Based on procedure, the market has been segmented into median sternotomy, bilateral sternotomy, and hemisternotomy.

The median sternotomy segment dominated the global market, accounting for 53.14% market share in 2026. The growth of the segment is influenced by the growing geriatric population. Higher adoption of the procedure among healthcare professionals due to lower postoperative infections is another major factor driving the growth of the segment.

REGIONAL INSIGHTS

North America Sternal Closure Systems Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America market generated a revenue of USD 895.7 million in 2024 and will witness significant sternal closure systems market growth during the forecast period. The growth is attributable to the higher prevalence of cardiovascular diseases and higher adoption of advanced orthopedic devices. According to the Center of Disease and Infection (CDC), currently around 18.2 million Americans aged 2 years and above suffer from coronary artery disease in the country. The U.S. market is projected to reach USD 0.91 billion by 2026.

Europe

The growth of the market in Europe is influenced by various factors such as increasing development in the public healthcare sector, higher focus of companies to target CE mark approval, rising day care surgeries among others. Additionally, the increasing prevalence of osteoarthritis, growing demand for joint implants, and rising day-care surgeries is estimated to drive the market in the region. Furthermore, an increase in healthcare expenditure by the European Commission is anticipated to fuel the growth of the market in the region. The UK market is projected to reach USD 0.09 billion by 2026, while the Germany market is projected to reach USD 0.15 billion by 2026.

Asia Pacific

The market in Asia Pacific is anticipated to witness the highest growth trends and forecast. Factors such as the presence of a large patient pool and increasing healthcare infrastructure and spending are supplementing the market growth in Asia Pacific. According to the 2019 Revision of World Population Prospects, the proportion of individuals aged 65 and older in Japan is estimated to increase to 38 percent in 2050 from the current 28 percent. This, in turn, is projected to considerably increase the number of cardiovascular related diseases. Thus, driving the market of sternal closure systems in the forthcoming years. The Japan market is projected to reach USD 0.15 billion by 2026, the China market is projected to reach USD 0.11 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

Latin America and the Middle East & Africa

The countries of Latin America and the Middle East & Africa are constantly engaging in enhancing the access to treatment option to their citizens. Significant improvements in public and private healthcare sector is anticipated to boost the market growth in these regions.

KEY INDUSTRY PLAYERS

Semi-Consolidated Structure of Market Exhibiting Moderate Competition

The sternal closure systems market exhibits moderate competition in the market with key players such as DePuy Synthes (part of Johnson and Johnson Services Inc.,), Zimmer Biomet, and KLS Martin Group dominating the market. Focus on mergers and acquisitions and innovative product launches are predominant strategies adopted by these key players to secure higher customer reach. Other players included in the market are Acute Innovations, B Braun Medical, Idear S.R.L, and Kinamed Incorporated, among others.

LIST OF KEY MARKET PLAYERS PROFILED:

- Johnson and Johnson Services Inc., (U.S)

- Zimmer Biomet (U.S)

- KLS Martin Group (Germany)

- B Braun Medical (Germany)

- Stryker (U.S)

- Jace Medical, LLC (U.S)

- Kinamed Incorporated (U.S)

- Idear S.R.L (Argentina)

- Acute Innovations (U.S)

- Other Predominant Players

KEY INDUSTRY DEVELOPMENTS:

- June 2021: Able Medical Devices announced the launch of Valkyrie Thoracic Fixation System. It is the first single use radiolucent plating system which was designed to span the osteotomy and close the sternum after open heart surgery.

- March 2021 – Abyrx Inc.'s pipeline medical product of Montage Bone Putty, a settable, re-absorbable hemostatic bone putty, is currently in the Phase 2 of clinical trials which studies the effects of montage putty plus conventional wires versus the outcome of conventional wires only within the post-operative recovery of cardiac patients with medical sternotomy.

- January 2019: A&E Medical Corporation announced that they received 510(k) clearance from the U.S. FDA for Thorecon Rigid Fixation System. This device is used to stabilize and fix fractures of anterior chest wall which includes sternal fixations followed by sternotomy.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The sternal closure systems market report provides qualitative and quantitative insights into the sternal closure industry and a detailed analysis with market size and growth rate for all possible segments in the market. Along with this, the report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights provided in the report are the number of key orthopedic surgeries by key regions, key industry trends, new product launches, technological advancements in sternal closures, analysis of COVID-19 on the global market among others

Report Scope & Segmentation

|

ATTRIBUTES |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Segmentation

|

By Product

|

|

By Procedure

|

|

|

By Material

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 2.10 billion in 2025 and is projected to reach USD 3.53 billion by 2034.

In 2025, the North American market stood at USD 0.94 billion.

The market will exhibit a stunning growth of 6.00% during the forecast period (2026-2034).

The sternal closure devices dominated the global market in 2025.

Key drivers include the rising prevalence of cardiovascular diseases, increasing number of open-heart surgeries, and technological advancements such as FDA-cleared cable systems and biocompatible materials like titanium.

Johnson and Johnson Services Inc., Zimmer Biomet, and KLS Martin Group are the major players in the global market.

Recent trends include mergers and acquisitions, FDA approvals of innovative products, and increased focus on single-use and radiolucent plating systems.

Technological advancements and new product launches are expected to drive the adoption of sternal closure products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us