Threat Detection Systems Market Size, Share & Industry Analysis, By Product Type (Explosive and Narcotics Detectors, Radiation Detectors, Photo Ionization detectors, Chemical and Biological Detectors, Laser and Radar Systems, Video Surveillance Systems, and Others), By End Use Industry (Defense, Public Infrastructure, Commercial, Industrial, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

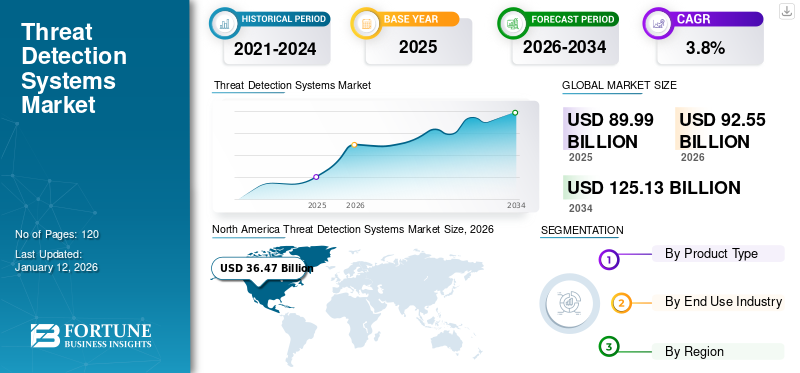

The global threat detection systems market size was valued at USD 89.99 billion in 2025. The market is projected to grow from USD 92.55 billion in 2026 to USD 125.13 billion by 2034, exhibiting a CAGR of 3.8% during the forecast period. North America dominated the global market with a share of 39.4% in 2025.

Threat detection systems are widely used across various industries including military, commercial, and other public infrastructures. The ongoing advancement of technology, coupled with stringent government regulations on security devices, have led to an increased adoption of threat-detection products. These include explosive and narcotics detectors, personal radiation detectors, dosimeters, survey meters, identifiers, photo-ionization detectors (PID), air samplers, chemical agent detectors, biological agent detectors, radar systems, video surveillance systems, perimeter intrusion detectors, wide-band wireless communication systems, biometric systems, among others.

Increasing terrorism and geopolitical tensions among countries in several parts of the world are driving the market growth. These systems are essential for protecting military assets, public infrastructures, commercial, industrial, and institutional facilities. Systems such as video surveillance systems and cameras play a crucial role in safety and monitoring. Several large public infrastructures such as airports, railways, and ports are increasingly adopting the product to enhance security measures and mitigate risks. Risk distribution would further bolster the market share.

Global Threat Detection Systems Market Overview

Market Size:

- 2025 Value: USD 89.99 billion

- 2026 Value: USD 92.55 billion

- 2034 Forecast Value: USD 125.13 billion

- CAGR: 3.8% from 2026 to 2034

Market Share:

- Regional Leader: North America dominated the global market with a share of 39.4% in 2026.

- Product Segment Leader: Video surveillance systems dominated in 2024

- End-Use Leader: Public infrastructure is projected to deliver the highest growth rate across end-use categories

Industry Trends:

- Rising investments in infrastructure are driving demand for advanced threat detection solutions

- Increasing deployment of video-based systems for perimeter security, surveillance, and incident management

- Shift toward integrated systems combining hardware appliances, video analytics, and alert management

Driving Factors:

- Growing global infrastructure development and heightened security requirements in public and private sectors

- Rising adoption of video surveillance platforms for proactive threat mitigation

- Demand driven by expanding government investments to secure critical facilities, transit hubs, and public spaces

The COVID-19 pandemic temporarily impacted airports, airlines, public transport, and other industries. It also significantly hampered the global economy, including the market for detection systems. The outbreak caused disruptions in supply chains, temporary shutdowns of manufacturing facilities, and a decline in product demand due to travel restrictions and reduced activity in essential infrastructure sectors. Slow growth due to the pandemic crisis in construction and commercial projects further contributed to a drop in revenue for the detection systems market.

THREAT DETECTION SYSTEMS MARKET TRENDS

Increasing Security Initiatives By Authorities to Increase Product Demand

The rise in the availability of weapons, radiological materials, and the illicit trafficking of explosives are fostering advancements in security technologies. Furthermore, security organizations are urged to improve their security strategies. This proactive security planning entails the implementation of anti-explosive detectors and scanners across various sectors, including aviation, offshore oil and gas transportation, air cargo logistics, and maritime operations. Consequently, the strengthened security initiatives by authorities are anticipated to propel market expansion throughout the forecast period.

MARKET DYNAMICS

Market Drivers

Growing Investment and Infrastructure Development to Bolster Industry Growth

Proposed government infrastructure projects and investments in critical sectors including railways, power, data centers, and defense are generating huge revenue growth for the detection systems market. For instance, the Indian government announced that public infrastructure investment would go up to 5.87% of the GDP in 2023-24. Increasing investment in infrastructure development, government capital expenditure, and other engineering projects are projected to boost the demand for threat detection systems.

Threat detection equipment plays a crucial role in ensuring security within correctional facilities by identifying weapons, contraband, and other unauthorized items. This technology helps reduce violence among inmates and enhances safety for facility personnel and inmates alike. The installation of such equipment is vital for safeguarding critical assets in industries, ensuring security, and reducing potential risks which could further propel the market growth.

Market Restraints

Privacy Concerns in Detection Systems to Limit Market Growth

The primary factor limiting the expansion of the threat detection systems market is a concern over privacy violations. Vast amount of data collection, unauthorized data access, and third-party data sharing might pose challenge for the threat detection systems market growth.

Market Opportunities

Threat Detectors Integrated with Software Solutions to Bring Strong Market Opportunities

Artificial intelligence and other technologies are immensely enhancing the detection system capabilities of detection systems. Software-enabled threat detectors allow remote and real-time monitoring of threats with increased safety of personnel. Several countries are applying emerging technologies for radiation detection in nuclear security. For instance, according to the International Atomic Research Agency, Indonesia has been working on portable radiation detectors using open-source software for nuclear security.

SEGMENTATION ANALYSIS

By Product Type

Video Surveillance Systems Segment to Dominate the Market owing to Rising Need For Real-Time Monitoring

By product type, the market is segmented into explosive and narcotics detectors, radiation detectors, photo ionization detectors, chemical and biological detectors, laser and radar systems, video surveillance systems, and others. Other segments include biometric systems, wireless communication systems, and intrusion detection systems.

Video surveillance systems to capture the highest threat detection systems market share throughout the forecast period. Investing in advanced security solutions will help safeguard assets, provide ongoing monitoring of facilities, and enhance employee safety. The rise in regulations and compliance requirements regarding surveillance in commercial environments further contributes to this growth.

The integration of artificial intelligence and analytics into surveillance systems enhances their operational efficiency, making them particularly well-suited for commercial applications. The rising need for real-time monitoring, theft, and vandalism are few of the prominent factors surging the growth of video surveillance systems across geographies. The segment is expected to gain 45% of the market share in 2025.

Chemical and biological detectors, narcotics, and explosive detectors are witnessing considerable growth amid volatile geopolitical scenarios across diverse geographic regions. Manufacturing companies are strongly focusing on new product launches integrated with software to develop precise and efficient detection systems for various fields of applications. Several industries utilizing these systems include military, public transport, and ports.

Explosives and narcotics segment is set to grow with a considerable CAGR of 5.60% during the forecast period (2025-2032).

By End Use Industry

To know how our report can help streamline your business, Speak to Analyst

Public Infrastructure Segment Led Owing To Investments in Public Infrastructure

On the basis of end-use industry, the market is segmented into defense, public infrastructure, commercial, industrial, and others.

Other segments include institutional and residential. Public infrastructure segment dominated the market for detection systems in 2024. Key players in the market are expanding their presence by offering new products at newly developed ports and public infrastructure. Significant investment in new ports and increasing regulatory standards impact the growing demand for threat detection systems in public infrastructure. For instance, Saudi Arabia’s General Authority of Civil Aviation has confirmed in January 2025 an investment of about USD 100 billion for critical aviation projects including airports, airlines, cargo logistics, and ground services at the World Economic Forum. This segment held 47% of the market share in 2025.

THREAT DETECTION SYSTEMS MARKET REGIONAL OUTOOK

Based on the region, the market is studied across North America, Europe, Asia Pacific, South America, and Middle East & Africa.

North America

North America Threat Detection Systems Market Size, 2026 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North American market held the revenue share of USD 35.48 billion in 2025 and USD 36.47 billion in 2026. Growing public infrastructure, industrial, and commercial facilities are bolstering the growth of threat detection systems market. Increased security concerns across borders, real-time threat

monitoring, and stringent regulations are generating strong demand for detection systems. The adoption of advanced technologies and growing security threats are generating huge demand for threat detectors in North America including video surveillance systems, explosives, and narcotics detectors. Growing concerns about crime, cross-border tensions, and geopolitical pressures are further surging the demand for threat identification solutions.

North America is significantly investing in public infrastructure and the construction sector contributing to strong growth for threat detectors across the region. According to the U.S. Census Bureau, construction spending totaled more than USD 0.75 billion in January 2025, driven by factors such as urbanization, infrastructure, and technological advancements. As a result, North America accounted for the highest market share in the global region in 2024.

Download Free sample to learn more about this report.

The market demand across the region is being supported by advanced technologies, existing surveillance capabilities, along with real-time threat detection. Investment in advanced security solutions will safeguard assets, provide ongoing monitoring of facilities, and enhance safety, further propelling market growth in the U.S. The rise in regulations and compliance requirements concerning surveillance in commercial environments also contributes to this market growth. The integration of artificial intelligence and analytics into surveillance systems enhances their operational efficiency, making them particularly well-suited for commercial applications. The U.S. market is poised to stand at USD 2.5 billion in 2025.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific region to witness highest growth rate among all regions owing to stringent policies and increasing investment in public infrastructure. Increased border security threats, geopolitical pressures, and cross-border tensions are pushing strong investment in detection systems. Significant initiatives by governments are being proposed owing to unstable relations with border countries. For instance, in October 2023, the Indian government ordered the installation of radiation detection equipment at eight land crossing points. China is foreseen to reach a market value of USD 10.94 billion in 2026. These crossing points include Pakistan, Bangladesh, Myanmar, and Nepal. Furthermore, rising public infrastructure and expanding port development are further projected to grow the market demand for threat detection systems. The rising frequency of terrorist activities globally necessitates that airports implement threat detectors, as these facilities are critical hubs of significant human and financial resources. India is estimated to acquire USD 5.17 billion in 2026, while Japan is likely to hold USD 2.98 billion in the same year.

As safety regulations become more stringent and are revised, it is important for airports to remain proactive in safeguarding the security. Advanced bomb detection technologies, such as explosive trace detection systems, can assist airports in consistently meeting compliance standards.

Europe

Europe is the second leading region projected to hold USD 27.62 billion in 2026, exhibiting a CAGR of 3.50% during the forecast period (2026-2034). Threat detection systems in the European region are witnessing steady growth due to increasing demand from countries with ongoing conflicts. The U.K. market is anticipated to be worth USD 5.3 billion in 2026. Stringent regulations and standards across the region are further pushing the adoption of threat detection systems. For instance, in November 2023, Greenpeace Germany, Greenpeace Central and Eastern Europe, and Ukrainian environmental groups installed radiation detection sensors. Germany is set to be valued at USD 7.77 billion in 2026, while France is projected to reach USD 4.8 billion in the same year.

South America

South America is the fourth largest market expected to be valued at USD 2.5 billion in 2025.Several new initiatives are being introduced to address national security threats in the region owing to transnational crime and violence. Economic influence and political differences among certain countries might further generate steady market growth. South America is expected to witness steady growth in threat detection systems across countries including Argentina, Brazil, and others.

Middle East & Africa

The rising use of explosives and narcotics amid ongoing conflicts in the Middle East is driving the market for detection systems. Government associations are increasing shipments and installations of detection sensors across the aviation sector and ports. For instance, in November 2020, a U.S. company shipped an explosive and narcotics detection system named Duoscan to an African airline company. The GCC market is forecasted to reach a valuation of USD 0.5 billion in 2025.

Competitive Landscape

KEY INDUSTRY PLAYERS

Investment in New Product Launches and Collaboration Strategies to Strengthen the Presence of Market Players

The presence of a considerable number of players in the market has led to moderate market consolidation. Several prominent market participants are focused on innovative products and upcoming infrastructure projects. These participants are further widening their market presence across several end users through new product launches specific to industries and strategic collaborations. End users, especially in public infrastructure, are increasingly focused on improving safety and security, which is driving strong market demand for threat detection systems across diverse regions.

List of Key Threat Detection Systems Companies Profiled

- ELP GmbH (Germany)

- Thermo Fischer Scientific (U.S.)

- Rapiscan Systems (U.S.)

- Smiths Group Plc (U.K.)

- Safran SA (France)

- FLIR Systems Inc. (U.S.)

- Thales SA (France)

- Honeywell International Inc. (U.S.)

- Chemring Group Plc (U.K.)

- ChemImage Sensor Systems (U.S.)

- Mirion Technologies Inc. (U.S.)

- Axis Communication AB (Sweden)

- Gammadata Instrument AB (Sweden)

- Elbit Systems (Israel)

- Drägerwerk AG & Co. KGaA (Germany)

- MSA Safety (U.S.)

- Hi-Tech Detection Systems (France)

- Analogic Corporation (U.S.)

- L-3 Technologies (U.S.)

- Cobham plc (U.K.)

KEY INDUSTRY DEVELOPMENTS

- April 2024: Smiths Detection launched an X-ray Diffraction (XRD) technology scanner for several end users including airports, customs control points, and express forwarding facilities.

- November 2023: Smiths Detection in collaboration with the European Union is focusing on developing a customs border screening system (BAG-INTEL) that aids in detecting narcotics in passenger baggage.

- October 2023: Teledyne Technologies Inc. announced a portable chemical detector named Griffin G510x designed and manufactured for the identification of explosives and narcotics.

- September 2023: Fraport AG has announced the procurement of portable explosives and narcotics detectors 220 DE-tector flex. The newly designed detection systems have been developed for the aviation industry.

- April 2021: NanoSniff Technologies developed an Explosive Trace Detector (ETD) named NanoSniffer using microsensor technology. The newly developed product is designed and manufactured in India.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product in the end-user industries. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.8% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type, End Use Industry, and Region |

|

Segmentation |

By Product Type

By End Use Industry

By Region

|

|

Key Market Players Profiled in the Report |

Rapiscan Systems (U.S.), Smiths Group Plc (U.K.), FLIR Systems Inc. (U.S.), Thales SA (France), Thermo Fischer Scientific (U.S.), Chemring Group Plc (U.K.), ChemImage Sensor Systems (U.S.), Mirion Technologies Inc. (U.S.), Elbit Systems (Israel), and Drägerwerk AG & Co. KGaA (Germany) |

Frequently Asked Questions

The market is projected to reach USD 125.13 billion by 2034.

In 2026, the market was valued at USD 92.55 billion.

The market is projected to grow at a CAGR of 3.8% during the forecast period.

By product type, the video surveillance system is likely to dominate the market.

Growing investment and infrastructure development is a key factor bolstering the growth of the market.

Smiths Group Plc, FLIR Systems Inc., Thales SA, Thermo Fischer Scientific, and Elbit Systems are the top players in the market.

North America led the market in terms of highest revenue market share.

By end use industry, the public infrastructure to lead the market throughout the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us