U.K. Cloud Computing Market Size, Share & Analysis, By Type (Public Cloud, Private Cloud, and Hybrid Cloud), By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT and Telecommunications, Government, Consumer Goods and Retail, Healthcare, Manufacturing, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

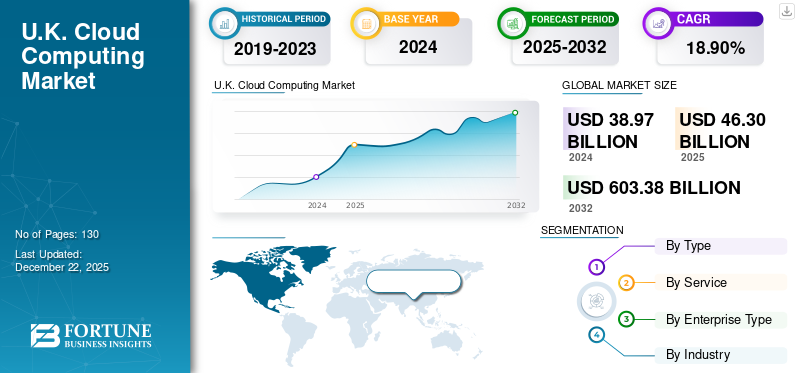

The U.K. cloud computing market size was valued at USD 38.97 billion in 2024. The market is projected to grow from USD 46.30 billion in 2025 to USD 603.38 billion by 2032, exhibiting a CAGR of 18.90% over the forecast period.

The U.K. cloud computing market is becoming a key player in Europe’s digital transformation. It shows strong adoption from businesses and a developing ecosystem of service providers. In the U.K., cloud technology has evolved from a supporting role to a crucial foundation for innovation, scalability, and business flexibility. With increasing investments from both the public and private sectors, the U.K. is creating a strong environment for hybrid cloud, AI integration, and solutions tailored to specific industries. This progressive mindset, along with a competitive tech landscape, puts the U.K. in a leading position to influence the future of cloud infrastructure services in finance, healthcare, government, and more.

U.K. Cloud Computing Market Trends

Adoption of Hybrid and Multi-Cloud Strategies to be Key Driver for Market Growth

U.K. businesses are increasingly turning to hybrid and multi-cloud strategies to break free from relying on just one cloud provider. This change offers them more flexibility, better cost management, and greater resilience by using multiple cloud environments. Moreover, rising concerns about data sovereignty and changing regulations are prompting companies to explore locally governed cloud providers. This way, they can stay compliant while still enjoying the advantages of advanced cloud technologies. Overall, these strategies enable organizations to strike a balance between innovation, security, and regulatory requirements in the ever-evolving cloud landscape.

- According to Cloud Computing News, In the U.K., the adoption of hybrid multi-cloud models is expected to grow from 19% currently to 26% within the next three years, while the use of multiple public clouds is projected to rise significantly from 11% to 46%.

Key takeaways· The U.K. cloud computing market is projected to be worth USD 603.38 billion in 2032. · By type segmentation, public cloud accounted for around 54.1% of the U.K. Cloud Computing Market in 2024. · In the by service segmentation, Infrastructure as a Service (IaaS) is projected to grow at a CAGR of 15.5% during the forecast period. · In the enterprise type segmentation, Large Enterprises accounted for around 62.1% of the market in 2024. |

U.K. Cloud Computing Growth Factors

Rapid Growth of Hyperscale and Regional Data Centers to Boost Market Growth

The rapid growth of hyperscale and regional data centers fostered by cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Oracle is helping to accelerate cloud consumption across the U.K. Their investments are improving local infrastructure, lowering latency, and enhancing performance for businesses across the U.K., and creating the availability of in-country data centers that enable compliance with data residency and privacy legislation (which makes cloud solutions more attractive to sectors such as values with meaningful regulations, including health care, financial services, and government). It mainly builds confidence around cloud services and promotes wider adoption, resulting in U.K. cloud computing market growth.

- In October 2024, four major U.S. tech companies, including CyrusOne, ServiceNow, CloudHQ, and CoreWeave are investing USD 6.9 billion in U.K. data centers. This investment boosts the country's digital infrastructure to support rising demand for AI and cloud services. It brings total data center investment in the U.K. to over USD 27.3 billion, reflecting strong government backing and growing global confidence in the U.K. tech landscape.

U.K. Cloud Computing Market Restraints

Changing Regulatory for Cloud Computing Limits Market Growth

The changing regulatory landscape post-Brexit in the U.K. creates challenges for cloud providers. The new U.K. GDPR, NIS2, and specific financial and healthcare regulations all require strict compliance with residency, lawful processing, and cybersecurity criteria. The challenge is exacerbated for organizations not headquartered in the U.K., which need to ensure that sensitive data is contained within the boundaries of the U.K. and comply with access and privacy regulations wherever located.

- The U.K.'s National Security and Investment Act 2021 can restrict cloud-related acquisitions if they pose national security risks. Non-compliance may lead to penalties or the deal being blocked, affecting cloud M&A activity.

U.K. Cloud Computing Market Segmentation Analysis

By Type

Based on type, the market is divided into public, private, and hybrid.

While public cloud services hold the majority share for their affordability and quick setup, there's a clear trend toward hybrid cloud solutions due to which hybrid cloud solutions are expected to grow with the highest CAGR. In the U.K., this shift is largely influenced by stricter data protection regulations, such as the U.K. GDPR, as well as specific compliance requirements for various industries. Companies are beginning to see the benefits of hybrid models, which enable them to merge the security and control of private infrastructure with the scalability and innovation offered by public cloud platforms.

By Service

Based on service, the market is segmented into infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS).

SaaS continues to hold a majority in U.K. cloud computing market share, partially driven by organizations wanting plug-and-play applications that simplify operations and improve collaboration. In the meantime, IaaS is expected to grow with the highest CAGR as organizations seek more reliable and customizable computing resources to support multifaceted workloads and digital transformation efforts.

By Enterprise Type

Based on enterprise type, the market is segmented into Large Enterprises and SMEs.

Large companies hold a majority share in the market due to early customer adoption of the cloud in the U.K., as the generation of scale for IT infrastructure and improvement of operational efficiency were necessary. Currently, these companies are migrating toward next-generation cloud technologies so as to innovate and maintain agility for competition in the landscape evolution. The minor businesses are quickly adapting to cloud solutions with their low subscription prices and straightforward installation processes. However, cloud revenues from large firms remain the dominant contributor. Still, the increasing adoption by SMEs will become the backbone of the growth of the U.K. cloud computing ecosystem in the future.

By Industry

Based on industry, the market is segmented into BFSI, IT and telecom, government, consumer goods, healthcare, manufacturing, and others.

The IT and telecommunications sector continues to holds the majority in the cloud adoption in the U.K. by using cloud infrastructure to manage large volumes of data, modernize outdated systems, and develop innovative services. Meanwhile, the healthcare sector is expected to be one of the fastest-growing users in terms of CAGR. This growth mainly comes from the rising need for secure and scalable solutions that support electronic health records, telehealth services, and strict regulatory compliance. As cloud providers offer more tailored solutions for the healthcare industry, other traditionally slow sectors are starting to adopt cloud services too. This shift is helping to expand the U.K. cloud computing market overall.

List of Key Companies in the U.K. Cloud Computing Market

The U.K. cloud computing market has a lively mix of local providers that are establishing unique roles in a landscape traditionally dominated by global companies. Firms including Bytemark, Pulsant, Hosting Services, and Content Guru are gaining ground by providing customized, local cloud solutions that emphasize data sovereignty, specific industry needs, and customer support. These companies use their strong grasp of regional compliance and business requirements to assist sectors such as government, healthcare, and telecommunications. Their increased focus on edge computing, hybrid cloud setups, and secure hosting helps them serve mid-sized businesses and public sector clients looking for flexible and compliant digital infrastructure.

LIST OF KEY COMPANIES STUDIED

- Bytemark (U.K.)

- Content Guru (U.K.)

- Hosting Services, Inc. (U.K.)

- Pulsant (U.K.)

- Krystal Hosting Ltd (U.K.)

- Centerprise International Limited (U.K.)

- CloudM (U.K.)

- Redcentric Plc (U.K.)

- Databuzz Ltd (U.K.)

- Littlefish (U.K.)

- Transparity (U.K.)

- cloud (U.K.)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Oracle announced a USD 5 billion investment over the next five years to expand its cloud infrastructure in the U.K. The move supports the U.K. government's AI-driven vision and will boost access to Oracle’s services including sovereign cloud, multicloud, and generative AI.

- November 2024: SAP launched its Sovereign Cloud in the U.K., offering secure, locally hosted cloud solutions for the public sector and regulated industries. Designed to meet U.K. data protection and security standards, it supports key SAP services including S/4HANA and SuccessFactors. This move strengthens SAP’s commitment to U.K. data sovereignty and digital transformation.

REPORT COVERAGE

This report provides an in-depth analysis of the U.K. cloud computing market, highlighting the evolving role of domestic providers in a landscape traditionally led by global hyperscalers. It examines how companies such as Bytemark, Pulsant, Hosting Services, and Content Guru are carving out competitive niches by offering localized solutions tailored to data sovereignty, sector-specific compliance, and customer-centric support. The study explores the growing adoption of edge computing, hybrid cloud architectures, and secure hosting environments, particularly among mid-sized enterprises and public sector organizations. Additionally, the report assesses the regulatory environment, market segmentation by industry verticals, and emerging technology trends that are reshaping the U.K.’s digital infrastructure.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 18.90% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Public Cloud · Private Cloud · Hybrid Cloud |

|

By Service · Infrastructure as a Service (IaaS) · Platform as a Service (PaaS) · Software as a Service (SaaS) |

|

|

By Enterprise Type · SMEs · Large Enterprises |

|

|

By Industry · BFSI · IT and Telecommunications · Government · Consumer Goods and Retail · Healthcare · Manufacturing · Others |

Frequently Asked Questions

Fortune Business Insights says that the U.K. cloud computing market was worth USD 38.97 billion in 2024.

The market is expected to exhibit a CAGR of 18.90% during the forecast period of 2025-2032.

By industry, the IT and Telecommunications industry is set to lead the market.

Bytemark, Content Guru, Hosting Services, and Pulsant are the leading players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us