U.S. Bubble Tea Market Size, Share & COVID-19 Impact Analysis, By Type (Black Tea, Green Tea, Oolong Tea, and White Tea), By Flavor (Fruit Flavor, Original Flavor, Chocolate Flavor, Coffee Flavor, and Others), 2025-2032

KEY MARKET INSIGHTS

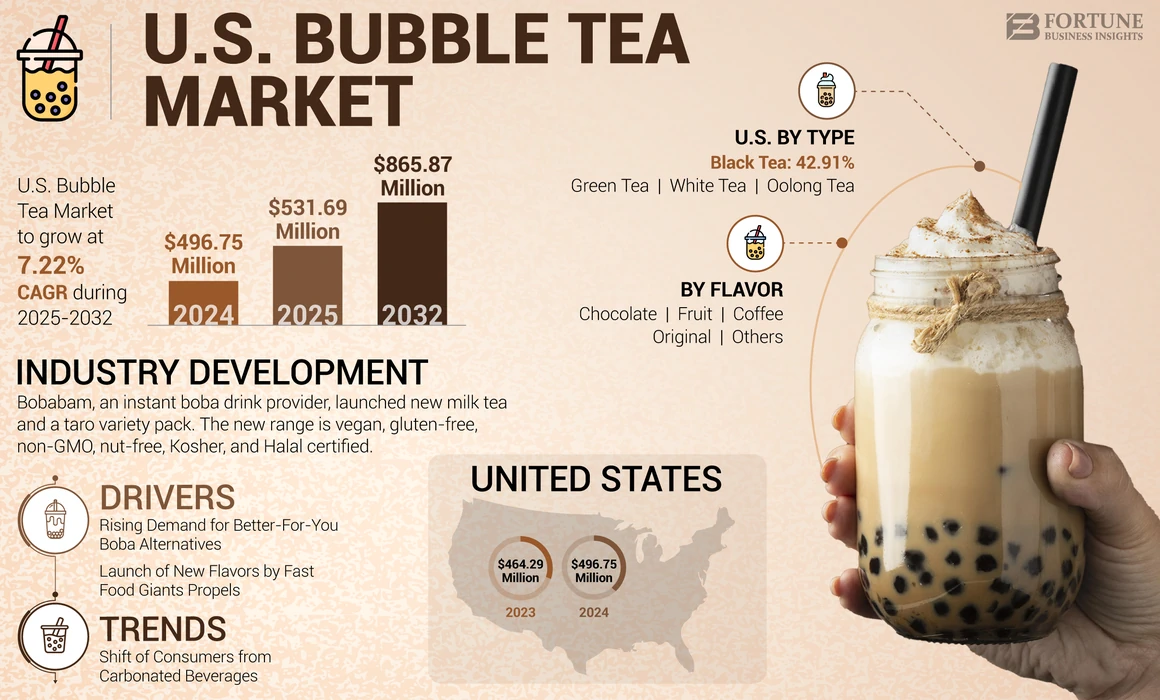

The U.S. bubble tea market size was valued at USD 496.75 million in 2024. The market is projected to grow from USD 531.69 million in 2025 to USD 865.87 million by 2032, exhibiting a CAGR of 7.22% during the forecast period.

The growing popularity of milk tea and coffee as nootropic beverages among millennials, paired with the busy lifestyles of individuals, is a key driver for the market expansion. The rising consumption of flavored bubble tea paired with the availability of products in the vegan category will pave the way for market growth. The U.S. is expected to emerge as a lucrative market owing to the presence of key market players and the growing popularity of pearl milk tea.

U.S. Bubble Tea Industry Landscape Overview

Market Size & Forecast:

- 2024 Market Size: USD 496.75 million

- 2025 Market Size: USD 531.69 million

- 2032 Forecast Market Size: USD 865.87 million

- CAGR: 7.22% from 2025–2032

Market Share:

- The black tea segment is expected to hold a significant share of the U.S. bubble tea market in 2025, supported by rising consumer health awareness regarding the anti-obesity and hypolipidemic benefits of black tea.

- The fruit flavor segment dominates the U.S. bubble tea market, driven by high consumer preference for fruity varieties such as strawberry, passion fruit, and mango, with ongoing flavor innovation supporting continued growth.

Key Country Highlights:

- United States: The market is driven by increasing health consciousness, demand for low-calorie and no-sugar beverages, and the launch of innovative products like BUBLUV's ready-to-drink teas.

- The popularity of bubble tea is further accelerated by fast food chains like Baskin-Robbins entering the space with Asian milk tea-inspired offerings such as Tiger milk bubble tea.

COVID-19 IMPACT

Supple Chain Bottlenecks to Hinder the Market Growth Amid COVID-19

In the U.S., during the pandemic, the bubble tea supply chain was disrupted as it faced significant delays due to bottlenecks in Asian counties. However, several prominent players in the country proposed various initiatives and investments in order to overcome product shortages and establish a competitive advantage during the pandemic. As a result, the market exhibited positive growth during the pandemic.

LATEST TRENDS

Download Free sample to learn more about this report.

Shift of Consumers from Carbonated Beverages to Healthy Alternatives Boosts the Market

Carbonated soft drinks, such as Coke, Pepsi, Sprite, and Fanta, contribute significantly to sugar intake, and it may lead to several health-associated issues, including obesity, diabetes, and body overweight. Thus, users are shifting to alternative beverages, including tea based drinks with low fat and low calorie content. The increasing health consciousness among consumers is an influencing factor driving the product demand. For instance, in September 2022, Fong Ding Enterprise, a Taiwan-based bubble tea company, introduced its innovative chewy boba made from natural and locally sourced raw materials. The consumers' demand for natural and healthy alternatives led the company to introduce such ingredients as a base ingredient. The boba tea trend is on a continuous rise throughout the world and also in the U.S., which further helped such companies boost the market.

DRIVING FACTORS

Rising Demand for Better-For-You Boba Alternatives to Drive the Market

Consumers in the U.S. are gradually increasing their consumption of bubble milk tea due to their high dependency on caffeinated drinks. However, the product is a sugar-dense beverage; most sugar is from added sweeteners, fruit syrups, and flavorings. According to the U.S. Department of Agriculture (USDA), a 16oz cup of boba or bubble milk tea contains 40g of sugar, exceeding the recommended added sugar intake and potentially harming consumers' health. Therefore, the rising demand from consumers to seek alternative sugar beverages with several health benefits led manufacturers to introduce innovative drinks in the market. For instance, in April 2022, BUBLUV, Inc., a New York-based start-up, launched its first ready-to-drink, better-for-you bubble tea with no artificial ingredients, no added sugar, and less than 50 calories per bottle. The new range is gluten-free, keto-friendly, and available in three flavors, passionfruit oolong guava, black milk tea, and matcha soy latte.

Launch of New Flavors by Fast Food Giants Propels the U.S. Bubble Tea Market Growth

Since boba tea is emerging as a popular drink among consumers owing to its taste and appeal. Various fast-food giants from regional as well as international markets including Asia Pacific and Europe are entering the segment by introducing products on their menus to serve their consumers. For instance, in May 2022, Baskin-Robbins, an American multinational chain of ice cream and cakes, introduced a sweet new addition to their menu inspired by Asian milk teas - Tiger milk bubble tea. It is designed as tiger stripes using bubble layers of flavor and streaks of brown sugar syrup.

RESTRAINING FACTORS

Availability of Alternative Products in Caffeinated Beverages Category may Impede the Market Growth

Although there is rising demand for pearl milk tea drinks, there is a wide availability of other caffeinated drinks such as coffee, dairy beverages, energy drinks, and others. Coffee and tea are the most consumed beverage across the U.S. Furthermore, according to the National Coffee Association report 2020, 62% of American adults drink a cup of coffee daily. Moreover, the availability of alternatives such as canned coffee, cold brew coffee, and others also influences the consumption trends of consumers. Such availability of alternatives to pearl milk tea may hamper the market growth.

SEGMENTATION

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Consumers Rising Health Awareness Related to Black Tea Boosts the Product Demand

Based on type, the market is classified into black tea, green tea, oolong tea, and white tea. The black tea segment is expected to hold a significant share of the U.S. boba tea market. According to the International Journal of Tea Science, black tea extracts exhibit anti-obesity and hypolipidemic effects. Therefore, the rising consumers' health awareness related to black tea led manufacturers to introduce new products in the market. For instance, in October 2021, Del Monte Foods, Inc., an American food production and distribution company, announced Joyba Bubble Tea's launch in select markets, available in four flavors, strawberry lemonade green tea, raspberry dragon fruit black tea, mango passionfruit green tea, and cherry hibiscus tea.

By Flavor Analysis

High Consumer Preference for Fruity Flavor to Boost Fruit Flavor Segment

Based on flavor, the market is classified into fruit flavor, original flavor, chocolate flavor, coffee flavor, and others. The fruit flavor segment is expected to hold a significant U.S. bubble tea market share. The growth is majorly contributed owing to the variety of fruit flavors, including strawberry, green apple, passion fruit, and mango, available in bubble milk tea. Furthermore, introducing new blends and flavors in the range of teas would also propel the demand for the product.

The coffee flavor segment is expected to grow at a high CAGR in the forecast period. Coffee-flavored drinks are among the most preferred beverages by consumers owing to their aroma and caffeine content. Therefore, consumers would opt for such flavored pearl milk tea beverages primarily due to their ease of consumption and aid in relaxation.

COUNTRY INSIGHTS

Consumers in the U.S. tend to purchase more lactose-free products owing to increased self-diagnosed cases of lactose intolerance among consumers. Moreover, according to the U.S. National Library of Medicine, lactose intolerance is prevalent in adults, and around 30 million adults in the U.S. suffer from lactose intolerance symptoms by the age of 20 years. Therefore, the country’s rising inclination toward lactose-intolerant products led the manufacturers to introduce vegan bubble tea options. For instance, in June 2022, Peet's Coffee, a speciality coffee roaster and retailer, introduced vegan boba tea that includes vegan options, brown sugar cold brew oat latte, iced brown sugar matcha oat latte, and brown sugar milk tea.

KEY INDUSTRY PLAYERS

Growing Innovative Franchise Model to Further Accelerate the Business

Bubble tea is a rapidly growing category in the beverage space. Consumers seeking to enjoy experiences from different varieties of boba tea have received a broader acceptance in the U.S. Furthermore, the developments in the product’s business have brought very tight competition, leading manufacturers to adopt the bubble milk tea franchise model. For instance, in March 2022, Gong cha, an international beverage franchise, announced its rapid U.S. expansion by signing three new master franchisees. The company would open 60 locations across Louisiana, Colorado, and Michigan and grow its U.S. store count by nearly double digits. The company’s global appeal and strength with the rapidly increasing product popularity in the U.S. would bring opportunities for potential franchisees.

LIST OF KEY COMPANIES PROFILED:

- Quickly (U.S.)

- Tiger Sugar (U.S.)

- Gong Cha (U.S.)

- Kung Fu Tea (U.S.)

- Sharetea (U.S.)

- The Boba Guys (U.S.)

- Tapioca Express (U.S.)

- Bubbles Tea & Juice Company (U.S.)

- Brew Tea Bar (U.S.)

- Happy Lemon (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2023: Bobabam, an instant boba drink provider, launched new milk tea and a taro variety pack. The new range is vegan, gluten-free, non-GMO, nut-free, Kosher, and Halal certified.

- October 2022: Inspire Food Company, a supplier of boba fruit pearls, tapioca pearls, and other boba tea products, launched a new U.S. webshop for premium bubble tea products. The product range would include popping boba fruit pearl sizes and flavors, tapioca pearls, and tea powders.

- August 2022: Bobacino, a next-generation robotic boba bar, partnered with Boba Guys, a San Francisco-based chain of boba cafes. The partnership was formed to accelerate the development of Bobacino’s technology and increase boba tea sales with future collaboration opportunities.

REPORT COVERAGES

Request for Customization to gain extensive market insights.

The research report provides qualitative and quantitative insights into the market and a detailed analysis of the U.S. market share, market size, market segmentation, and growth rate for all possible segments in the market. The report also provides an elaborative industry analysis of different country markets. The report provides various key insights, the overview of related markets, market dynamics, swot analysis, recent industry developments such as mergers & acquisitions, the regulatory scenario in key countries, key market trends, and the competitive landscape.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.22% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

By Type |

|

|

By Flavor |

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market was USD 496.75 million in 2024 and is projected to reach USD 865.87 million by 2032.

Growing at a CAGR of 7.22%, the market will exhibit robust growth during the forecast period (2025-2032)

The black tea segment is expected to hold a significant share in the forecast period.

Rising demand for better-for-you boba alternative and fast food giants introducing new flavors to the menu are the key driving factors of the U.S. market.

Lollicup USA, Inc., Gong Cha, Sharetea, Happy Lemon, and Kung Fu Tea are some of the key players in the market.

The fruit flavor segment is expected to hold the dominant share in the U.S. market.

Introducing novel product option with plant-based or vegan claims is the key trend shaping the industry growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us