U.S. Cloud Computing Market Size, Share & Analysis, By Type (Public Cloud, Private Cloud, and Hybrid Cloud), By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT and Telecommunications, Government, Consumer Goods and Retail, Healthcare, Manufacturing, and Others) and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

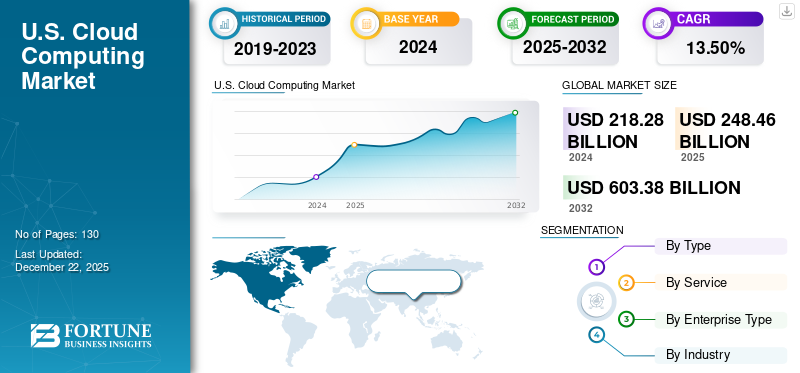

U.S. cloud computing market size was valued at USD 218.28 billion in 2024. The market is projected to grow from USD 248.46 billion in 2025 to USD 603.38 billion by 2032, exhibiting a CAGR of 13.50% over the forecast period.

Cloud computing is a global leader in the U.S., with a large commercialization engine for modernization, automation, and smarter digital infrastructure. Cloud evolved from a back-office function to be core, defining business operations and driving speed of innovation, scale, and operational resiliency. The U.S. technology ecosystem and willingness to invest in new capabilities from both buyers and cloud providers fuel the momentum in the cloud. The U.S. will continue to set the pace and direction for cloud transformation within industries.

- According to 99Firms, around 71% of Americans rely on cloud storage platforms such as Dropbox and iCloud for storing and accessing their digital files.

U.S. Cloud Computing Market Trends

Serverless Computing to be Key Driver for Market Growth

Serverless computing is rapidly growing to define the future of cloud computing. Serverless computing allows developers to write and deploy code without having to manage servers or worry about the underlying infrastructure. It relieves developers of the heavy lifting of provisioning, maintaining, and scaling servers, which typically uses a substantial number of resources and time.

- In May 2022, DigitalOcean launched DigitalOcean Functions, a serverless computing service that lets developers run code without managing servers. This cost-effective solution addresses growing demand, with 25% of cloud buyers planning to adopt serverless in the next year. The service is available across multiple global regions.

Key takeaways· The U.S. Cloud Computing Market is projected to be worth USD 603.38 billion in 2032. · In the by type segmentation, public cloud accounts for around 54.1% of the U.S. Cloud Computing Market in 2024. · In the by service segmentation, Infrastructure as a Service (IaaS) is projected to grow at a CAGR of 15.5% in the forecast period. · In the enterprise type segmentation, Large Enterprises accounted for around 62.1% of the market in 2024. |

U.S. Cloud Computing Growth Factors

Digital Transformation Across Various Industries to Boost Market Growth

The rapid digital transformation across all industries is one of the strongest drivers of growth in the U.S. cloud computing market. Organizations in healthcare, finance, retail, and manufacturing sectors are quickly adopting cloud technology to modernize their IT infrastructure and business processes. Cloud computing in these industries serves to simplify processes, make data more accessible, and improve decision-making with real-time data. For healthcare, their benefits include better patient data management and better telemedicine services; for finance, it means faster transaction processing and more powerful fraud detection; for retail, it allows for enhanced personalization and optimized inventory management; while manufacturing enables cloud-based solutions for IoT and automation.

- According to Backlinko, more than half (58%) of companies in the U.S. and U.K. plan to boost their investments in digital transformation initiatives.

U.S. Cloud Computing Market Restraints

Environmental Concerns Due to Cloud Computing Limit Market Growth

Environmental issues are becoming a growing problem for the U.S. cloud computing industry. Data centers use massive amounts of electricity to run and cool the systems, often from non-renewable energy sources that generate carbon emissions. Data centers also consume a large volume of water, which can stress local ecosystems, especially in areas prone to drought. In what is an underserved capacity for linearly increasing demand for AI and data-heavy applications, the environmental footprint from uCloud operations is set to expand.

- According to the World Economic Forum, cloud computing and data centers are now among the largest sources of carbon emissions in the tech industry, accounting for about 1.8% of total electricity consumption in the U.S.

U.S. Cloud Computing Market Segmentation Analysis

By Type

Based on type, the market is divided into public cloud, private cloud, and hybrid cloud.

The public cloud has the highest share due to its mature ecosystem and extensive range of services. Nevertheless, the hybrid cloud is also expanding significantly. The hybrid cloud market is expected to grow with the highest CAGR driven primarily by organizations’ fundamental desire to retain sensitive on-premise data for compliance-related reasons while tapping into the flexibility of cloud services.

By Service

Based on service, the market is trifurcated into infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS).

The software as a service (SaaS) segment continues to hold the majority in U.S. cloud computing market share, partially driven by organizations wanting plug-and-play applications that simplify operations and improve collaboration.

In the meantime, IaaS is expected to grow with the highest CAGR as organizations seek more reliable and customizable computing resources to support multifaceted workloads and digital transformation efforts.

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

Large enterprises hold the majority share in the market. In the U.S., the initial base of cloud computing mostly consisted of large corporations that were seeking to increase their infrastructure. Those large cloud-centered companies are starting to move toward more modern and advanced cloud technologies, fostering innovation and agility.

At the same time, small and medium sized enterprises (SMEs) are expected to grow with the highest CAGR due to having flexible payment structures and user-friendly cloud services. Although big enterprises continue to dominate, the increased momentum of SMEs will likely boost a significant projected U.S. cloud computing market growth.

By Industry

Based on industry, the market is segmented into BFSI, IT and telecommunications, government, consumer goods and retail, healthcare, manufacturing, and others.

The IT and telecommunications sector holds the majority share and continues to boast the most advanced rates of cloud adoption by leveraging cloud platforms to manage vast data sets, modernize their networks, and create new services.

Meanwhile, the healthcare sector is expected to grow with the highest CAGR, largely in response to the unique data resiliency needs of secure patient data management, telehealth solutions, and regulatory compliance. While the healthcare sector was once relatively slow to enter the cloud space, as cloud providers develop more point-specific solutions, other historically slower adoption sectors are joining the hosting space, allowing broader market expansion.

List of Key Companies in the U.S. Cloud Computing Market

The cloud computing market in the U.S. is dominated by three leading players, Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, each influencing the market differently in key ways. AWS still retains its market-leading position, fueled by mature infrastructure and a comprehensive ecosystem of developers. Microsoft Azure remains a strong competitor, especially with enterprise users, due to its lack of friction when using Microsoft tools and services. Google Cloud is driving momentum, consolidating its gained market share through Artificial Intelligence (AI), machine learning (ML), and big data analytics.

Outside of the top 3, other players such as IBM, Oracle, and Salesforce are also enhancing their cloud portfolios. They are leveraging their vertical focus, AI/ML platforms, and new use of local data centers in response to increased demand.

LIST OF KEY COMPANIES STUDIED

- Amazon Web Services, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- Google LLC (U.S.)

- Oracle Corporation (U.S.)

- Salesforce, Inc. (U.S.)

- Adobe Inc. (U.S.)

- Lumen Technologies (U.S.)

- Rackspace Technology (U.S.)

- ZYMR (U.S.)

- Box (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: HCLTech and AMD formed a strategic alliance to accelerate enterprise digital transformation globally through advanced AI, cloud, and computing solutions. The partnership includes joint innovation labs, development centers, and workforce training programs. By integrating AMD’s high-performance processors with HCLTech’s digital expertise, the companies aim to deliver customized, future-ready solutions that enhance operational efficiency and customer experience.

- December 2024: CDW has acquired Mission Cloud Services, a leading AWS Premier Tier Partner, to expand its cloud, AI, and managed services offerings. The acquisition enhances CDW’s Digital Velocity division and establishes a dedicated AWS practice. Mission brings expertise in cloud strategy, AI/ML solutions, and data security, especially for small and mid-sized businesses.

REPORT COVERAGE

The U.S. cloud computing market report offers a comprehensive overview of the industry’s current landscape, highlighting major growth drivers, evolving market dynamics, and strategic developments across key players. It examines critical factors such as the increasing shift toward AI-integrated cloud infrastructure, rising capital flow into hyperscale data centers, and the rapid adoption of hybrid and multi-cloud environments. The report also explores how these trends are reshaping cloud demand across sectors such as finance, healthcare, and retail. Additionally, it provides valuable insights into market movements, including partnerships, technological innovations, and emerging use cases driving the next phase of cloud growth in the U.S.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 13.50% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Service

|

|

|

By Enterprise Type

|

|

|

By Industry

|

Frequently Asked Questions

Fortune Business Insights says that the market was worth USD 218.28 billion in 2024.

The market is expected to exhibit a CAGR of 13.50% during the forecast period.

By industry, the IT and telecommunications industry is set to lead the market.

Amazon Web Services, Microsoft Corporation, Google Cloud, and IBM Corporation are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us