U.S. Eyewear Market Size, Share & Industry Analysis, By Product Type (Spectacles {Frames and Lens}, Sunglasses {Plano and Prescription}, and Contact Lens {Toric, Multifocal, and Sphere}), By Distribution Channel (Retail Stores, Online Stores, and Ophthalmic Clinics), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

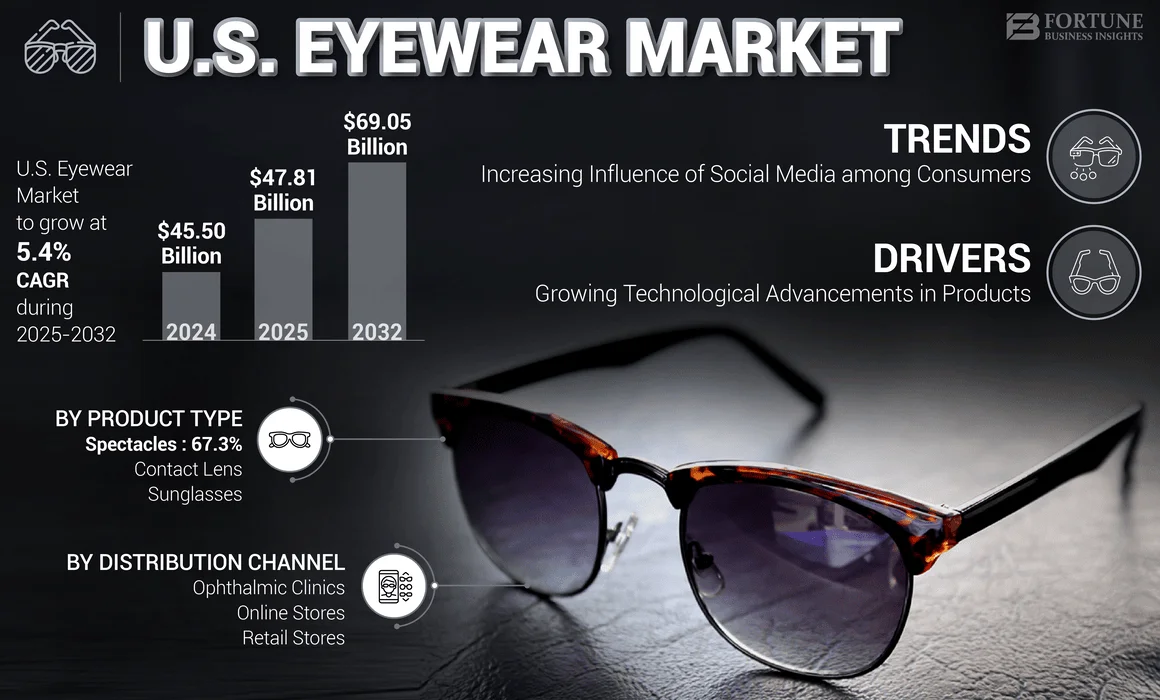

The U.S. eyewear market size was valued at USD 45.50 billion in 2024. The market is expected to grow from USD 47.81 billion in 2025 to USD 69.05 billion by 2032, exhibiting a CAGR of 5.4% during the forecast period.

Eyewear includes products such as sunglasses, contact lenses, and spectacles. The market is highly influenced by changing customer preferences and the growing adoption of luxurious accessories among the adult population. In addition, the high prevalence of vision abnormalities and rising awareness regarding ocular diseases leading to the growing need for vision correction have increased the demand for corrective eyewear among the U.S. population.

- For instance, according to the 2024 statistics published by the Centers for Disease Control & Prevention (CDC), it was reported that about 12 million people aged 40 years and above have vision impairment in the U.S.

The increasing prevalence of vision impairment among the patient population has allowed the key players to focus on R&D initiatives to develop and introduce innovative products in the market. EssilorLuxottica, Johnson & Johnson Services Inc., The Cooper Companies Inc., and Alcon, among others, are a few well-known companies operating in the market. These brands are expected to expand in the market owing to their growing focus on product launches, acquisitions, and collaborations, thus contributing to the U.S. eyewear market size.

The market is poised for continued growth, driven by health needs, fashion trends, and technological advancements. Companies that adapt to consumer preferences, embrace innovation, and navigate regulatory landscapes effectively are likely to succeed in this dynamic market.

Market Dynamics

Market Drivers

Increasing Prevalence of Ocular Disorders to Boost Market Growth

There is an increasing prevalence of eye disorders such as presbyopia, myopia, and others among the patients in the country. The increasing prevalence of these ocular disorders is resulting in the growing demand for vision correction among these patients in the market. As per a report published by the Centers for Disease Control and Prevention (CDC), refractive errors are the most common eye disorders in the U.S. In addition, age-related macular degeneration in adults is the primary cause of blindness.

- For instance, according to the 2023 data published by the National Center for Biotechnology Information (NCBI), approximately 13.0 million people in the U.S. have high myopia.

This factor is expected to increase the volume of eye exams. Additionally, the growing focus on initiatives to raise awareness about vision correction among national government agencies and key players is likely to support the adoption rate of vision correction products in the U.S.

- For instance, according to the 2023 statistics published by the Vision Council, about 75% of people in the U.S. use different vision correction.

Furthermore, the rise in adoption of multifocal lenses among the elderly population is estimated to drive the product’s demand, particularly in developed U.S. states such as New York, Los Angeles, and Chicago, thus supporting the U.S. eyewear market growth.

Market Restraints

Stringent Regulatory Laws Restrain Market Growth

The U.S. Food and Drug Administration (FDA) has classified spectacle frames, sunglasses, spectacle lenses, and magnifying spectacles as Class 1 medical devices. These products are manufactured, imported, and sold in the U.S. and need to comply with all the guidelines of the FDA 21 CFR. However, if the requirements are not fulfilled, it may result in the detention of the device at the U.S. port of entry.

Furthermore, specific errors while choosing the right strength for OTC glasses and the presence of alternative treatment options, such as LASIK surgery and others, may reduce the adoption rate of these products in the U.S. to a certain extent. Products such as contact lenses offer short-term benefits to users. However, the long-term use of contact lenses is associated with a number of side effects. These factors are shifting the preference of patients who have vision impairment and refractive errors toward alternative products for vision correction. These alternatives include LASIK surgery and others. The LASIK surgery is often regarded as a transformative solution for vision correction among the patient population. Moreover, technological advancements are continuously refining the procedure of LASIK procedures, making them safer, more precise, and capable of addressing a wider range of visual impairments.

- For instance, according to the data provided by Marietta Eye Clinic in September 2023, about 70,000 LASIK surgical procedures are being carried out every single year in the U.S.

Market Opportunities

Growing Technological Advancements in Products is an Emerging Trend in the Market

Major players in the market are increasing their R&D investment to develop and introduce advanced products for vision correction and cater to the unmet needs of the population suffering from refractive errors, resulting in the rising adoption of these products.

- For instance, according to the 2024 annual report of Cooper Companies Inc., Cooper Vision increased its R&D expenses from USD 73.4 million in 2023 to USD 82.9 million in 2024. The increase was primarily for the development of these products, manufacturing technology, and process enhancements.

Moreover, the manufacturers are also focusing on developing technologically advanced products, including smart contact lenses, hi-vision spectacles, among others, for the treatment of various ocular conditions and vision correction.

Hence, the increasing patient population with vision impairment and the growing demand for these products for aesthetic purposes is fueling the demand for technologically advanced products such as sunglasses, contact lenses, and others. Additionally, the increasing focus of market players on introducing novel technologies in these products is anticipated to fuel the demand and, subsequently, propel the growth of the market during the forecast period.

Market Challenges

Limited Reimbursement for Products to Hamper Market Growth

Users are purchasing products such as contact lenses and spectacles from out-of-pocket expenses. The majority of insurance providers do not cover eyeglasses and contact lenses in medical insurance policies.

- For instance, the U.S. Centers for Medicare and Medicaid Services (Medicare) does not offer coverage for eyeglasses and contact lenses. It only provides partial coverage for corrective lenses if the patient has undergone cataract surgery to implant an intraocular lens.

Additionally, the increasing costs associated with these products and solutions, as compared to other vision correction options, including surgery and others, are among the major factors hampering the adoption of these products among the general population. Additionally, according to 2024 statistics published by Overnight Glasses, the average pair of glasses costs around USD 351.0 without insurance in the U.S.

Other Prominent Challenges

Market Consolidation: Key players such as EssilorLuxottica have significant market control, which leads to concerns about reduced competition and higher prices for consumers. In October 2024, EssilorLuxottica faced consumer lawsuits claiming monopolistic practices, which the company has denied.

Counterfeit Products: The proliferation of counterfeit products poses risks to consumer safety and affects the brand reputation, challenging companies to implement effective anti-counterfeiting measures.

U.S. Eyewear Market Trends

Increasing Influence of Social Media among Consumers is an Emerging Market Trend

The industry has undergone a tremendous transformation with the advent of the internet and a boom in social media. Platforms such as Instagram, Snapchat, and Facebook have become the new runway for fashion that aids in understanding the ongoing trends through consumer surveys and others. Celebrities, influencers, and the youth are using these platforms to showcase their style, thereby influencing the sales of these products. Moreover, key players are collaborating with influencers to promote products in the market, thus supporting the rising adoption rate for these products.

This strategy has proven to be effective in driving the sales of major brands and influencing consumer behavior. For instance, in February 2022, Zyloware Corporation announced a partnership with iconic fashion brand HALSTON to launch the H Halston Collection including sunglasses and others in the market.

Other Prominent Trends

Digital Eye Strain: The widespread use of digital devices has led to an increase in digital eye strain, prompting consumers to seek vision corrective solutions that lessen discomfort and protect vision.

Fashion Integration: The optical industry has evolved beyond corrective purposes and has become a fashion accessory. Consumers are now seeking stylish frames that complement their style, leading to a fusion of functionality and fashion in these products designs.

E-commerce Expansion: The rise of online shopping has transformed the retail landscape. Consumers appreciate the convenience of virtual try-on features and home delivery, prompting traditional retailers to enhance their online presence.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic negatively impacted the market in 2020. This industry heavily relies on supply chains, particularly from manufacturing hubs such as China. Moreover, many factories operated at reduced capacity due to health concerns, labor shortages, and closures during the pandemic. This resulted in delays in production and supply chain disruptions that further exacerbated the availability of these products in different countries, leading to a decline in market growth.

Furthermore, the market players reported a significant decline in revenue during the COVID-19 pandemic. It had a considerable impact on day-to-day lives, including wearing sunglasses, spectacles, and wearing contact lenses.

- For instance, Alcon Inc. generated a net revenue of USD 6,736.0 million in 2020, witnessing a decline of 8.5% compared to USD 7,362.0 million in 2019.

Trade Protectionism

The market is influenced by international trade policies, including tariffs and import regulations, which can affect the pricing and availability of these products. Trade disputes and protectionist measures may lead companies to reconsider their supply chains and manufacturing strategies to mitigate potential risks.

Segmentation Analysis

By Product Type

Increasing Number of Product Launches Led to the Dominance of Spectacles Segment

The market is divided into sunglasses, spectacles, and contact lenses based on product type. The sunglasses segment is further categorized into plano and prescription, the spectacles segment into frames and lenses, and the contact lens segment into toric, sphere, and multifocal.

The spectacles segment dominated the U.S. eyewear market share in 2024. The growing prevalence of ocular disorders such as myopia and others, increasing development of healthcare infrastructure, and growing product launches for plano sunglasses, prescription glasses, and others among key players are some of the major factors supporting the growth of the market.

- For instance, as of May 2024, the Centers for Disease Control and Prevention (CDC) stated that nearly 6.8% of children under 18 in the U.S. have been diagnosed with eye and vision conditions, and nearly 3.0% of them with blindness or vision impairment. This is propelling the use of spectacles among customers, contributing to the segment’s growth.

The sunglasses segment is projected to register slower growth during the forecast period. Increasing demand of sunglasses particularly among millennials and Gen Z consumers and growing technological advancements in these products has contributed to its adoption in the market. This, along with a growing number of key players focusing on acquisitions and mergers among the other players to strengthen their presence is projected to spur the segment’s growth in the forthcoming years.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel

Availability of Various Options for these Products at Retail Stores Leads to Segmental Growth

Based on distribution channel, the market is segmented into retail stores, online stores, and ophthalmic clinics.

The retail stores dominated the market in 2024. The growth is due to the availability of a wide variety of options, including budget-friendly choices and premium designer brands for optical frames and lenses in retail locations in the U.S. This variety allows consumers to find the products that meet their specific needs and preferences, which are further expected to drive sales of products in the U.S. These factors are anticipated to boost the segment’s growth.

The online stores segment is also expected to grow at the fastest growth rate during the forecast period. There is an increasing trend of purchasing these products through online channels owing to certain benefits such as discounts, return policies, among others. This trend is projected to drive the number of products sold in online stores over the forecast period of 2025-2032. Furthermore, players in the optical industry are focused on partnerships with optical retailers to provide consumers with a new and more thoughtful way to shop for these products.

- In January 2024, Pair Eyewear, the direct-to-customer customizable optical brand reimagining the industry, partnered with National Vision, Inc., to introduce customizable, stylish, and accessible products in the U.S.

Competitive Landscape

Key Industry Players

The market is highly fragmented with numerous players operating in the market. EssilorLuxottica dominated the market owing to a growing focus on product launches to strengthen its presence in the market. Also, the rising focus of the company on participation in healthcare conferences to showcase data related to its product is an additional factor that strengthens its position in the market.

- In August 2023, EssilorLuxottica launched Essilor's Varilux XR Series, an innovative eye-responsive lens powered by AI, aiming to set new standards in visual clarity, comfort, and adaptability.

On the other hand, the strategic acquisitions and collaborations between the players, including Alcon Inc., Johnson & Johnson Services, Inc., and Bausch + Lomb, are contributing to the growing market share of the companies. For instance, in January 2024, Johnson & Johnson Vision Care, Inc. partnered with Captain Jason Chambers to share his ACUVUE contact lens journey with his social followers to increase the brand reputation of its product.

List of Key U.S. Eyewear Companies Profiled

- Johnson & Johnson Services, Inc. (U.S.)

- Alcon (Switzerland)

- Carl Zeiss Meditec AG (Germany)

- Fielmann AG (Germany)

- EssilorLuxottica (France)

- SAFILO GROUP S.P.A. (Italy)

- The Cooper Companies, Inc. (U.S.)

- Bausch + Lomb (Canada)

- HOYA Corporation (Japan)

Key Industry Developments

- July 2024 – The Cooper Companies Inc. launched its new Clariti 1 Day Multifocal 3 Add contact lenses in the U.S. to provide all-day comfort, ease of fit, and optimal visual acuity at all distances for all levels of presbyopia. This expanded the company’s portfolio of products in the market.

- July 2024 – Fielmann AG announced the completion of its previously announced acquisition of Shopko Optical to expand its business in the U.S. market.

- May 2024 – Bausch + Lomb launched Zenlens ECHO Scleral Lenses in the U.S., promoting the company’s product portfolio.

- September 2023 – SAFILO GROUP S.P.A. and Amazon launched new Carrera Smart Glasses featuring Alexa technology, combining Italian design with innovative functionality. The glasses utilize open-ear audio for discreet sound delivery and offer up to six hours of media playback on a full charge.

- April 2023 – Johnson & Johnson Vision Care, Inc. showcased 30 new sets of scientific data on Myopia, Refractive Technologies, IOLs, and more at the Association for Research in Vision and Ophthalmology 2023 meeting, expanding its product range through R&D.

REPORT COVERAGE

The report provides a comprehensive overview and analysis of the market. It focuses on key aspects, such as a statistical overview of the epidemiology of ocular diseases and new product launches. Furthermore, it includes market insights into key industry developments, new product launches, and the impact of the COVID-19 pandemic on the market. Furthermore, it also analyzes the market dynamics and other key industry trends. The report also studies various factors that have contributed to the market’s growth in recent times.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.4% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says the U.S. market was worth USD 45.50 billion in 2024.

The market is expected to exhibit a CAGR of 5.4% during the forecast period of 2025-2032.

By product type, the spectacles segment was the leading segment in the market.

EssilorLuxottica, Alcon (a part of Novartis AG), and Johnson and Johnson Services, Inc. are the top players in the market.

The retail segment leads and dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us