Uterine Fibroid Drugs Market Size, Share & Industry Analysis, By Drug Class (GnRH Antagonists, GnRH Agonists, and Others), By Type (Intramural Fibroid, Submucosal Fibroid, and Others), By Route of Administration (Oral and Parenteral), By Application (Shrinkage, Pain Management, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies & Drug Stores, and Online Pharmacies), and Forecasts, 2026-2034

KEY MARKET INSIGHTS

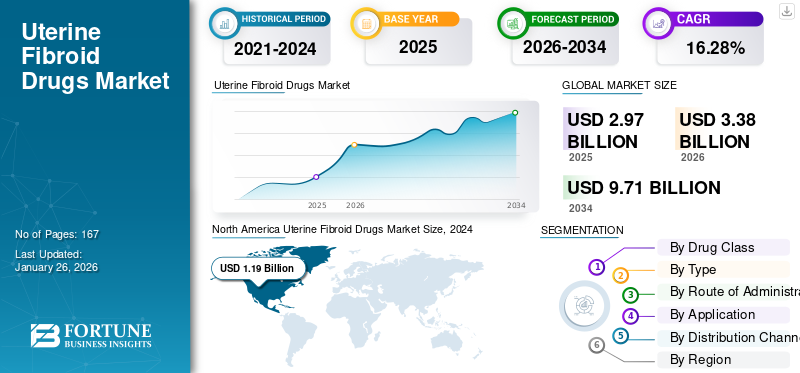

The global uterine fibroid drugs market size was valued at USD 2.97 billion in 2025 and is projected to grow from USD 3.38 billion in 2025 to USD 9.71 billion by 2034, exhibiting a CAGR of 16.28% during the forecast period. North America dominated the global uterine fibroid drugs market with a market share of 45.56% in 2025.

Uterine fibroids, also known as leiomyomas or myomas, are benign, non-cancerous growths of smooth muscle and connective tissue that develop in or on the walls of the uterus. These uterine fibroids can be either symptomatic or asymptomatic. When symptomatic, they can cause heavy menstrual bleeding, pelvic pain or pressure, anemia, urinary problems, and fertility issues.

The global uterine fibroid drugs market is expected to grow due to the rising prevalence of the condition. Increasing sedentary lifestyle, obesity, and late onset of menopause and metabolic diseases are some of the prevailing risk factors causing fibroids. These factors are driving the global growth of the uterine fibroid drugs market. Many patients and clinicians prefer medical approaches to manage symptoms and shrink fibroids non-invasively. Advances in molecular biology, such as gene therapy, are opening pathways to more targeted, safer therapies, thus fueling investment in the market.

- For instance, in April 2025, Vanderbilt University Medical Center conducted a multi-center study that identified multiple new genes associated with benign tumors (fibroids) of the uterus, which could enable next-generation therapies and personalized medicine in this space.

Furthermore, many key industry players, such as AbbVie Inc., Neurocrine Biosciences, Inc., and Sumitomo Pharma Co., Ltd., operating in the market, are focusing on developing various pipeline candidates to support the rising demand for effective therapeutics for diverse disease indications.

MARKET DYNAMICS

MARKET DRIVERS

Rising Burden of Uterine Fibroids to Drive Market Growth

The rising burden of uterine fibroids is a major growth driver, as it directly increases the pool of women requiring medical intervention. Fibroids are among the most common gynecological conditions, affecting up to 70–80% of women by age 50, with particularly high prevalence in women of reproductive age. The growing incidence of symptomatic cases, such as heavy menstrual bleeding, anemia, pelvic pain, and infertility, has heightened the need for effective drug therapies beyond surgical options.

As more women seek uterus-preserving and fertility-friendly solutions, demand for pharmacological management continues to expand. This growing patient base widens the addressable market and accelerates the adoption of newer, more tolerable drug classes, fueling the global uterine fibroid drugs market growth.

- For instance, in April 2020, NIH published a study titled Epidemiology and management of uterine fibroids’ that reported fibroids affect up to 70.0 % and 80.0 % in white women and women of African ancestry, respectively, during their lifetime. Approximately 30.0% of these women are expected to present with severe symptoms, which can include abnormal uterine bleeding, anemia, pelvic pain and pressure, back pain, urinary frequency, constipation, or infertility, requiring medical intervention. Such a high prevalence leads to the uterine fibroid drugs market expansion.

MARKET RESTRAINTS

Severe Adverse Effects Affecting Adherence to Treatment and Restricting Market Growth

Severe adverse effects act as a major restraint in the uterine fibroid drugs market, as they reduce patient adherence and limit treatment duration. Side effects such as bone density loss, hot flashes, and cardiovascular risks often lead to early discontinuation of therapy. These safety concerns also restrict regulatory approvals to shorter usage periods, thereby narrowing the potential market size. In addition, physicians are cautious in prescribing drugs with significant adverse profiles, especially for women of reproductive age. Collectively, these factors hinder long-term adoption and restrict overall market growth.

- For example, in 2021, AbbVie reported that in the pivotal ELARIS UF-1 and UF-2 trials of ORIAHNN, developed for heavy menstrual bleeding associated with fibroids, about 10.0% of women discontinued treatment due to adverse reactions.

MARKET OPPORTUNITIES

Increasing Research Initiatives to Offer Lucrative Growth Opportunities for Market Growth

Increasing research initiatives are creating lucrative opportunities in the uterine fibroid drugs market by driving innovation and expanding the treatment pipeline. Academic collaborations, government funding, and biotech pharma partnerships are accelerating the discovery of novel targets and drug classes. Multiple pharmaceutical companies are investing in next-generation gonadotropin-releasing hormone gnrh agonists, selective progesterone receptor modulators, and novel hormonal combinations, thereby broadening the therapeutic arsenal beyond currently approved options.

- For instance, in May 2022, researchers at Duke and North Carolina Central University collaborated to offer a more convenient, minimally invasive procedure for treating uterine fibroids. The research aimed to create an effective injectable alternative for the treatment regimen.

GLOBAL UTERINE FIBROID DRUGS MARKET TRENDS

Strategic Collaborations among Key Players to be a Prominent Trend in the Uterine Fibroid Drugs Market

Strategic collaborations among key players to support the increasing uterine fibroid drugs market demand is a prominent trend in the global uterine fibroid drugs market. These collaborations allow companies to pool resources to accelerate R&D, expand market reach, and reduce development risks. Partnerships between biotech innovators and big pharma players allow faster advancement of novel candidates through clinical trials. In addition, collaborations enhance commercialization capabilities, enabling quicker patient access across multiple geographies. By combining R&D expertise with established marketing networks, firms can shorten time-to-market for promising therapies. These alliances also help overcome high costs and regulatory hurdles in women’s health drug development. Overall, such collaborations enhance pipeline productivity and fuel the rising demand for differentiated fibroid treatments.

- For instance, in December 2020, Myovant Sciences collaborated with Pfizer Inc. to develop and commercialize relugolix, a once-daily, oral gonadotropin-releasing hormone (GnRH) receptor antagonist in the U.S. and Canada. The collaboration enabled Pfizer Inc. to commercialize relugolix in oncology outside the U.S. and Canada.

MARKET CHALLENGES

Risk Associated with Safety and Stringent Regulatory Scenario to Restrict Market Growth

The uterine fibroid drugs market faces a stringent regulatory environment, as women’s health therapies require robust long-term safety data, especially for fertility and hormonal balance. Regulatory agencies closely scrutinize risks such as bone density loss, liver toxicity, or cardiovascular events, which have previously led to delays, additional trial demands, or even rejections of candidates. These strict requirements increase development costs and prolong timelines, making it harder for smaller biopharma firms to compete. As a result, regulatory stringency limits the pace of innovation and slows patient access to novel treatments, acting as a key restraint on market growth.

- For instance, in July 2022, Kissei Pharmaceutical Co., Ltd. commenced composition proceedings for its GnRH antagonist linzagolix, followed by a review application of New Drug Application (NDA) linzagolix for uterine fibroids.

Download Free sample to learn more about this report.

Segmentation Analysis

By Drug Class

Strong Demand from Regulatory Bodies for GnRH Agonists to Drive the Growth of the Segment

Based on drug class, the market is divided into GnRH antagonists, GnRH agonists, and others.

[aKIuSXZZQR]

The GnRH agonists segment captured the dominant witha share of 54.18% in 2026. The dominant share of the segment is attributed to the increasing number of cases associated with uterine fibroids in females and the wide availability and adoption of these drugs globally for rapid fibroid shrinkage and bleeding control.

The GnRH antagonists are expected to grow with a significant CAGR during the forecast timeframe. This is due to the expanding pipelines from major pharma companies ensure sustained investment and rapid development, subsequently followed by approval from regulatory bodies to support the rising demand.

- For instance, in September 2024, Kissei Pharmaceutical Co., Ltd. licensed out its technology for YSELTY, a GnRH receptor antagonist, for the treatment of uterine fibroids made its first commercial sale in Germany.

By Type

Growing Prevalence of Intramural Fibroids to Drive Growth of the Segment

By type, the market is segmented into submucosal fibroids, intramural fibroids, and others.

The intramural fibroid segment captured the largest share of 53.40% market in 2026 and is anticipated to dominate in 2025 with a 53.2% share. Intramural fibroids, which grow within the uterine wall, are the most common type and account for the majority of symptomatic cases. They are strongly associated with heavy menstrual bleeding, pelvic pain, and fertility complications, making them a major driver of therapeutic demand and representing the largest patient pool.

- For instance, in September 2024, NIH published a report titled ‘A Multicenter Retrospective Cohort Study Assessing the Incidence of Anemia in Patients Associated With Uterine Fibroids ’ which reported the prevalence of intramural fibroids, submucosal, and subserosal fibroids at 72.0%, 3.0%, and 25.0% respectively, in the studied population. Such a high prevalence of intramural fibroids is expected to drive segmental growth.

The submucosal fibroid segment is set to grow at a rate of 14.14% during the forecast period.

By Route of Administration

Growing Uptake of Injectables Propelled the Growth of the Parenteral Segment

Based on the route of administration, the market is segmented into oral and parenteral. The parenteral segment held the dominating position in 2026 with a share of 72.72%. The increasing adoption of injectables and the proven efficacy of sustained-release formulations are increasing the acceptance of parenteral formulations worldwide.

The oral segment is set to grow at a rate of 29.5% during the forecast period. The dominance of the segment is attributed to easy administration and higher adherence to the treatment regimen. Key player in the global uterine fibroids market are focusing their resources on commercializing these advantages with new product offerings.

- For instance, in May 2020, AbbVie collaborated with Neurocrine Biosciences, Inc., and received approval from the U.S. FDA for ORIAHNN, indicated for a treatment duration of up to 24 months. ORIAHNN is a non-surgical, oral medication designed for the management of heavy menstrual bleeding associated with uterine fibroids in pre-menopausal women.

By Application

Shrinkage Segment to Dominate due to its Ability to Reduce Symptomatic Relief

Based on application, the market is segmented into shrinkage, pain management, and others.

In 2026, the market was dominated by the shrinkage application segment with a share of 56.42% in 2026. The segment is poised to dominate the market as therapies that actively reduce fibroid volume deliver both symptomatic relief and underlying disease modification, making them more clinically and commercially valuable. Shrinkage-focused agents tend to reduce reliance on surgery and offer longer treatment potentials. Thus, the clinical focus on the key companies while developing new products is set upon the shrinkage of these uterine fibroids. Furthermore, the segment is set to hold a 56.4% share in 2025.

- For instance, in July 2025, NIH published a study titled ‘Linzagolix – new perspectives in the pharmacotherapeutic management of uterine fibroids and endometriosis’. The study reported that Linzagolix therapy proved to be effective in reducing the volume of both the dominant fibroid. After 24 weeks of treatment, in the group receiving LGX 200 mg without ABT, the fibroid volume decreased by an average of 45% in the PRIMROSE 1 trial and 49% in the PRIMROSE 2 trial.

The pain management segment is projected to grow at a CAGR of 14.92% during the study period.

By Distribution Channel

Wide Accessibility and Convenience of Retail Pharmacies & Drug Stores Led the Segment’s Growth

Based on distribution channel, the market is segmented into hospital pharmacies, retail pharmacies & drug stores, and online pharmacies.

In 2024, the global uterine fibroid drugs market was dominated by the retail pharmacies & drug stores. The dominance is attributed to their role in ensuring the availability of all approved GnRH antagonists and other outpatient prescription distribution. Their wide accessibility and convenience make them the primary channel for patients requiring chronic medication management. Furthermore, the segment is set to hold a 43.1% share in 2025.

- For instance, in February 2025, Walmart Canada launched its first pharmacy clinic in St. Catharines, Ontario. The development is anticipated to maximize the potential of professional pharmacists by enabling them to provide direct consultations and healthcare services. Such developments are expected to propel the growth of the hospital pharmacies segment during the forecast period.

The hospital pharmacies segment is projected to grow at a CAGR of 13.33% during the study period. With increasing hospital stays due to uterine fibroids, the segment is expected to witness significant growth.

Uterine Fibroid Drugs Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and Middle East, and Africa.

North America

North America Uterine Fibroid Drugs Market Size, 2024 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2025, valued at USD 1.35 billion, and also took the leading share in 2026, with USD 1.54 billion. The uterine fibroid drugs market in North America is expected to grow strongly due to a combination of clinical, economic, and demographic factors. The region has witnessed an increasing prevalence of uterine fibroids requiring medical intervention. Its sound healthcare infrastructure assists in better diagnosis and effective treatment access. Additionally, strategic collaborations among key companies for distribution and marketing are improving product availability and market penetration.

Furthermore, pharmaceutical investment and clinical trial activity in the U.S. remain high, ensuring a steady pipeline of new drugs that drive both physician confidence and market expansion. In 2026, the U.S. market is estimated to reach USD 1.46 billion.

- For instance, in January 2024, Sumitomo Pharma Canada, Inc., partnered with Pfizer Canada ULC to supply MYFEMBREE (relugolix 40 mg, estradiol 1 mg, and norethindrone acetate tablets 0.5 mg) in Canada. This drug is indicated for the management of moderate to severe pain associated with endometriosis in pre-menopausal women, as well as for the management of heavy menstrual bleeding associated with uterine fibroids in pre-menopausal women. Such developments reinforce the region’s dominance in the global market.

Europe

Europe are anticipated to witness a notable growth in the coming years. During the forecast period, the European market is projected to record a growth rate of 12.82%, which is the second-highest amongst all the regions, and reach the valuation of USD 0.87 billion in 2026. Growth in the region is attributed to increasing awareness and diagnosis of fibroid-related symptoms, supported by strong public health programs. Increasing adoption of advanced oral therapies, combined with favorable reimbursement policies, is expanding patient access. Backed by these factors, countries including the U.K. are expected to record the valuation of USD 0.19 billion, Germany to record USD 0.21 billion in 2026, and France to record USD 0.15 billion in 2025.

Asia Pacific

The market in Asia Pacific is estimated to reach USD 0.7 billion in 2026 and secure the position of the third-largest region in the market. In the region, India and China are both estimated to reach USD 0.09 and 0.25 billion, respectively, in 2026.

Latin America and the Middle East & Africa

Over the forecast period, Latin America and the Middle East & Africa regions would witness a moderate growth in this market. The market in Latin America in 2026 is set to record USD 0.15 billion in its valuation. Improving access to advanced therapeutics, rising prevalence of symptomatic cases, expanding healthcare infrastructure, awareness initiatives, and government investments in reproductive health are expected to drive market growth in these regions further. In the Middle East & Africa, GCC is set to attain the value of USD 0.05 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Focus on Strategic Expansion Opportunities by Key Players to Propel Market Progress

The global uterine fibroid drugs market holds a semi-consolidated market structure, constituting prominent players such as AbbVie Inc., Neurocrine Biosciences, Inc., Sumitomo Pharma Co., Ltd., and Pfizer Inc. The significant share of these companies in the market is due to numerous strategic activities such as key mergers and acquisitions for robust product offerings, collaboration among operating entities for advancing, along a focus on research and development to enhance their market positions.

- For instance, in June 2025, Altin Biosciences received a Notice of Allowance for a Composition of Matter patent from USPTO for ABC-105/ABC-205, its lead drug candidate, a non-hormonal, oral treatment for uterine fibroids.

Other notable players in the global market include Kissei Pharmaceutical Co., Ltd., ObsEva SA., and TiumBio Co., Ltd. These companies are anticipated to prioritize new product launches and collaborations to boost their global uterine fibroid drugs market share during the forecast period.

LIST OF KEY UTERINE FIBROID DRUGS COMPANIES PROFILED

- AbbVie Inc. (U.S.)

- Sumitomo Pharma Co., Ltd. (Japan)

- Pfizer Inc. (U.S.)

- Kissei Pharmaceutical Co., Ltd. (Japan)

- ObsEva SA (Switzerland)

- Neurocrine Biosciences, Inc. (U.S.)

- TiumBio Co., Ltd. (South Korea)

- Daewon Pharmaceutical Co., Ltd. (South Korea)

KEY INDUSTRY DEVELOPMENTS

- October 2025: Knight Therapeutics Inc. relaunched MYFEMBREE (relugolix/estradiol/norethindrone acetate) in Canada. MYFEMBREE is indicated for the treatment for the management of heavy menstrual bleeding associated with uterine fibroids.

- October 2025: Searchlight Pharma Inc. collaborated with Apotex Inc. to secure exclusive Canadian rights to linzagolix, an oral treatment for uterine fibroids. The collaboration enables the company to pursue marketing authorization in Canada, following regulatory approval.

- February 2022: Theramex collaborated with ObsEva SA to commercialize and launch Linzagolix, an oral GnRH antagonist indicated for uterine fibroids.

- February 2025: Kissei Pharmaceutical Co., Ltd. submitted a new drug application for approval of manufacturing and marketing in Japan for the GnRH antagonist "Linzagolix" indicated for uterine fibroids.

- December 2024: Theramex received approval from the European Commission for an extended indication for Yselty (linzagolix), an oral gonadotropin-releasing hormone (GnRH) antagonist for the symptomatic treatment of endometriosis in adult women of reproductive age with a history of previous medical or surgical treatment for their endometriosis.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.03% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Drug Class, Type, Route of Administration, Application, Distribution Channel, and Region |

|

By Drug Class |

· GnRH Antagonists · GnRH Agonists · Others |

|

By Type |

· Intramural Fibroid · Submucosal Fibroid · Others |

|

By Route of Administration |

· Oral · Parenteral |

|

By Application |

· Shrinkage · Pain Management · Others |

|

By Distribution Channel |

· Hospital Pharmacies · Retail Pharmacies & Drug Stores · Online Pharmacies |

|

By Geography |

· North America (By Drug Class, Type, Route of Administration, Application, Distribution Channel, and Country) o U.S. o Canada · Europe (By Drug Class, Type, Route of Administration, Application, Distribution Channel, Distribution Channel, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (Drug Class, Type, Route of Administration, Application, Distribution Channel, and Country/Sub-region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Drug Class, Type, Route of Administration, Application, Distribution Channel, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (Drug Class, Type, Route of Administration, Application, Distribution Channel, and Country/Sub-region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.38 billion in 2025 and is projected to reach USD 9.71 billion by 2034.

In 2025, the market value stood at USD 1.35 billion.

The market is expected to exhibit a CAGR of 16.28% during the forecast period (2026-2034).

The GnRH agonists segment led the market by drug class.

Rising prevalence, strategic collaborations, research and development initiatives are some of the key factors driving the market.

AbbVie Inc., Pfizer Inc., F. Hoffmann-La Roche Ltd, and Genentech, Inc. are the major players in the global market.

North America dominated the uterine fibroid drugs market with a market share of 45.56% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us