Vanadium Market Size, Share & Industry Analysis, By Type (Ferrovanadium, Vanadium Oxide, and Vanadium Metal), By Application (Steel, Alloys, Chemicals, and Batteries), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

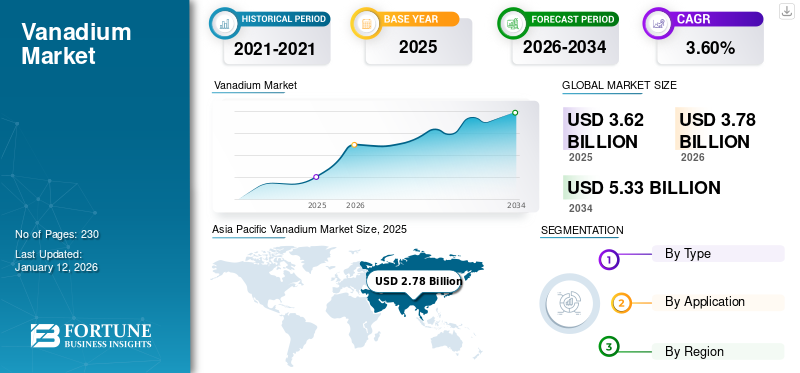

The global vanadium market size was valued at USD 3.62 billion in 2025 and is projected to grow from USD 3.78

billion in 2026 to USD 5.33 billion by 2034, exhibiting a CAGR of 4.40% during the forecast period. Asia Pacific dominated the vanadium market with a market share of 2.65 % in 2025.

Vanadium is a versatile transition metal known for its role in enhancing steel alloys by improving strength and resistance to wear and corrosion. It is found naturally in fossil fuel deposits and several minerals, with titanomagnetite being the major source of metal. It is a critical metal in various industrial applications, including the aerospace, automotive, and construction industries. In addition to this, the product’s ability to improve energy storage efficiency has led to an increased usage of Vanadium Redox Flow Battery (VRFB), a promising technology for large-scale energy storage systems that is essential for renewable energy integration. As industries continue to develop, the product’s unique properties are expected to drive further innovations and applications, making it crucial in modern technology and infrastructure development.

The COVID-19 pandemic significantly impacted the market, disrupting supply chains, causing price volatility, and altering demand patterns. Lockdowns and restrictions led to temporary disruptions in mining and processing operations and the product supply. Additionally, logistical challenges and transportation restrictions hindered the movement of products. The slowdown in the construction and automotive industries that consume steel further limited the product demand. The reduced economic activities disrupted the production and supply of the product, leading to high volatility in prices. However, as the world has recovered from the pandemic, the demand for the product has increased and is anticipated to continue to rise during the forecast period.

GLOBAL VANADIUM MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 3.62 billion

- 2026 Market Size: USD 3.78 billion

- 2034 Forecast Market Size: USD 5.33 billion

- CAGR: 4.40% from 2026–2034

Market Share:

- Asia Pacific led the global concrete admixtures market in 2025 with a commanding share of 2.65 %, driven by rapid infrastructure expansion and urbanization across China, India, and Southeast Asia. The region saw an increase from USD 13.38 billion in 2023 to USD 14.71 billion in 2024.

- By type, water reducing admixtures held the largest share in 2024 due to their ability to enhance concrete strength, durability, and workability.

- By application, the residential segment dominated the market in 2024, supported by rising single-family housing demand and improving credit access. The infrastructure segment is projected to hold a 13.1% share in 2024.

Key Country Highlights:

- China: Infrastructure segment expected to hold a 13.3% market share in 2024, driven by expansive government investments in smart cities and transport systems.

- United States: Market projected to reach USD 3.08 billion by 2032, fueled by demand for high-performance concrete and ongoing infrastructure renewal programs.

- India: Witnessing robust demand from both residential and infrastructure sectors due to urban migration and housing initiatives.

- Germany: Emphasis on sustainable construction materials is driving adoption of low-VOC admixtures across commercial and industrial applications.

- Brazil & Mexico: Government-backed infrastructure development and growing consumer construction demand are boosting market growth.

- Saudi Arabia & UAE: Mega construction initiatives, including NEOM and Vision 2030 projects, are creating significant opportunities for admixture applications.

Vanadium Market Trends

Rising Demand for Reliable Energy Storage Solutions in Renewable Energy Sector to Create Growth Opportunities

Vanadium Redox Flow Battery (VRFB) is emerging as a promising large-scale energy storage technology, particularly for grid-scale applications and renewable energy integration. As the world transitions toward a more sustainable energy future, the demand for efficient and reliable energy storage solutions is rapidly increasing. VRFB offers several advantages over traditional battery technologies, including long service life, high discharge capacity, and the ability to decouple energy capacity, making them highly scalable. The key component of these batteries is the electrolyte solution, which contains vanadium ions in different oxidation states.

The unique metal chemistry allows the batteries to be rapidly charged and discharged, making them ideal for applications that require frequent battery cycle rates. As the global demand for renewable energy sources, such as solar and wind power continues to grow, the need for large-scale energy storage solutions becomes increasingly critical. VRFB can effectively store excess energy generated during periods of high renewable output and release it back into the grid when demand peaks, ensuring a stable and reliable energy supply. This capacity has driven significant interest in these batteries from utilities, grid operators, and renewable energy developers, consequently creating new growth opportunities. Asia Pacific witnessed a vanadium market growth from USD 3.12 billion in 2023 to USD 2.53 billion in 2024.

Download Free sample to learn more about this report.

Vanadium Market Growth Factors

Growing Demand for Specialized Steel Alloys in Various Industrial Applications to Drive Market Growth

The product’s versatile properties make it an irreplaceable alloying element in the production of various steel grades, significantly driving its demand globally. High-strength low-alloy steels, which incorporate product, offer exceptional strength-to-weight ratios, enabling the production of lighter and more durable components for the construction and automotive industries, among others. The addition of the metal enhances the steel’s resistance to fatigue, wear, and corrosion, making it suitable for applications requiring high-performance materials. Moreover, the product’s ability to improve the strength of steel has led to its widespread use in the production of tool steels, which are crucial for manufacturing cutting tools, dies, and other industrial equipment.

The increasing demand for specialized alloy steels in sectors, such as aerospace, heavy machinery, and construction further fuels the demand for metal as an alloying element. As urbanization and infrastructure development continue to drive construction activities globally. The demand for product-based steels is expected to increase, making the product an essential component in meeting the evolving requirements of modern engineering and manufacturing, driving the vanadium market growth.

RESTRAINING FACTORS

Concentrated Production Could Lead to Supply Constraints, Hampering Market Growth

Supply chain constraints can significantly limit the demand for the product in various industries. Its production is heavily concentrated in China, Russia, and South Africa. The disruptions in these major producing countries due to geopolitical tensions, trade disputes, or natural disasters could lead to supply shortages in the global market. Moreover, the depletion of existing reserves or the lack of new discoveries could intensify supply constraints in the long term.

Vanadium is primarily obtained as a co-product from the mining and processing of other minerals, such as iron ore, uranium, and bauxite. As these primary resources become less accessible, the availability of products could be constrained, potentially driving up prices and limiting its use in various applications. This could also incentivize the use of alternative materials and alloying elements, limiting the demand and hampering market growth.

Vanadium Market Segmentation Analysis

By Type Analysis

Ferrovanadium Segment to Hold Dominant Share Owing to Its Increased Demand from Steel Manufacturing

Based on type, the market is categorized into ferrovanadium, vanadium oxide, and vanadium metal. The ferrovanadium type segment is projected to dominate the market with a share of 89.68% in 2026 and is likely to continue its dominance over the forecast period. The steel industry is the primary consumer of ferrovanadium, as it is used in the production of high-strength low-alloy steels, tool steels, and specialized alloy steels. The growth in construction activities, infrastructure development, and expanding automotive manufacturing are expected to drive the segment growth.

Vanadium oxide is a versatile and important compound that has several industrial applications. Among these, the chemical industry uses it as a catalyst to produce chemicals such as sulfuric acid, maleic anhydride, and phthalic anhydride. These chemicals are essential for various industries, including fertilizers, plastics, and pharmaceuticals. The rising demand from these industries fuels demand and drives market growth. Pure vanadium metal has limited uses and is primarily used in the production of super alloys typically used in the aerospace industry.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Steel Segment Leads with Rising Demand for Alloyed Steel across Various Industries

On the basis of the application, the market is segmented into steel, alloys, chemicals, and batteries. The steel application segment is expected to lead the market, accounting for 89.68% of the total market share in 2026, and is expected to continue this trend during the forecast period. The steel industry’s demand for the product is driven by its use in high-strength low-alloy steels, tool steels, and specialized alloy steels. The growth of economies, particularly in developing countries, drives the demand for infrastructure projects, construction activities, and automotive production, all of which are expected to surge the product adoption in alloyed steel.

The batteries segment is expected to witness the highest CAGR during the forecast period. As the world moves toward renewable energy sources, such as wind and solar, the need for efficient and reliable energy storage systems has become increasingly important. VRFB is emerging as a promising large-scale energy storage solution and is anticipated to drive segment growth. The alloys segment is expected to hold a 6% share in 2024.

REGIONAL INSIGHTS

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Vanadium Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific accounted for a dominant market share in 2024. The demand for products in Asia Pacific is driven by the rapid industrialization and infrastructure development in economies, such as China and India, among other East Asian countries. China, in particular, is the largest steel producer and consumer globally, especially high strength rebar and structural steel. The country has a high demand for alloyed steel used in construction projects, such as high-rise buildings and critical infrastructure. The addition of the product enhances steel’s strength, durability, and corrosion resistance. In addition to this, the region is also rapidly adopting renewable energy sources and energy storage solutions. China is at the forefront of developing and deploying VRFBs. As the region transitions toward sustainable energy, the demand for such batteries is expected to rise, driving market growth. The Japan market is valued at USD 0.16 billion by 2026, the China market is valued at USD 1.99 billion by 2026, and the India market is valued at USD 0.32 billion by 2026.

- In China, the alloys segment is estimated to hold a 5.7% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

Europe

Product demand in Europe is fueled by its commitment to the green energy transition. The region is at the forefront of the global push toward renewable energy and carbon neutrality. The European Union’s ambitious goals to cut greenhouse gas emissions by at least 55% by 2030 and achieve climate neutrality by 2050 are driving investments in renewable energy sources, such as wind and solar power. The intermittent nature of these energy sources requires efficient and scalable energy storage solutions to ensure grid stability and reliability. To overcome these challenges, solutions, such as VRFBs are being increasingly used for large-scale energy storage projects across the region, driving market growth. The UK market is valued at USD 0.01 billion by 2026, and the Germany market is valued at USD 0.06 billion by 2026.

North America

The market in North America is driven by the rising demand for high-strength steel in infrastructure projects. Product is used as an alloying element in steel, particularly in rebar for construction. In the region, infrastructure projects, such as bridges, highways, and buildings require materials that can withstand high stress and enhance structural integrity. The product-based alloyed steel is favored in such construction activities due to its ability to reduce weight while maintaining strength and durability. The government in the U.S. over the past few years has been investing consistently through the implementation of initiatives and laws such as the Bipartisan Infrastructure Law to rebuild the country’s deteriorating infrastructure, driving demand for construction materials. This includes high grade alloyed steel. This fuels product demand and drives market growth. The U.S. market is valued at USD 0.29 billion by 2026.

Latin America is experiencing substantial investments in infrastructure, including transportation networks, energy projects, and residential construction. The product’s incorporation into high-strength steel makes it crucial for these projects, ensuring buildings and infrastructure meet safety standards. In addition to this, these alloyed steel components also enhance the longevity of structures, requiring less frequent repairs and replacements. Thus, resulting in cost savings over the lifecycle of the infrastructure. As the countries in the region, especially Mexico and Brazil, witness rapid industrialization and infrastructure development, demand for high-strength alloyed steel is expected to rise, driving market growth.

The Middle East & Africa is experiencing population growth, leading to urban expansion and the need for robust infrastructure. Major countries in the region are expanding rapidly, necessitating strong, durable construction materials, including product alloyed steel. For instance, the UAE and Saudi Arabia, are investing in mega-construction projects such as NEOM, Oxagon and Trojena, among others. These projects are likely to prompt high demand for high-strength alloyed steel, driving market growth.

KEY INDUSTRY PLAYERS

Highly Consolidated Nature of Market Prompt Intense Competition among Existing Players

The market is highly consolidated with intense competition. Primarily, the concentration of key players is within China, Russia, and South Africa. These countries engage in price competition, especially during periods of oversupply or economic downturn, to improve their market share. A few of the prominent players operating in the market include Bushveld Minerals, Ansteel Group Corporation Limited, EVRAZ plc, HBIS GROUP, and Glencore. Additionally, the development of new applications for the product, such as energy storage, can intensify competition as existing players strive to capture emerging market opportunities.

List of Top Vanadium Companies:

- Australian Vanadium Limited (Australia)

- Bushveld Minerals (South Africa)

- Ansteel Group Corporation Limited (China)

- EVRAZ plc (U.K.)

- HBIS GROUP (China)

- Glencore (Switzerland)

- Atlantic (Australia)

- TREIBACHER Industrie AG (Austria)

- YILMADEN HOLDING INC. (Turkey)

- Hickman Williams & Company (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Australian Vanadium Ltd acquired Technology Metals Australia Ltd. The move is part of the company’s strategy to achieve vertical integration for the development of vanadium flow batteries that can provide an energy storage solution for expanding renewable energy sources.

- August 2021: EVRAZ plc announced its plans to build a new vanadium slag processing plant in the Tula region of Russia with an approximate investment of USD 228 million. The operations of the plant are expected to commence by 2025, providing cost efficiency in the processing stages from slag to final product.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, applications, and products. The report also offers market insights into key trends and highlights vital industry developments. In addition, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.40% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 143.87 billion in 2025 and is projected to reach USD 199.55 billion by 2034.

The market will register a CAGR of 3.60% during the forecast period (2026-2034).

In 2025, the Asia Pacific market value stood at USD 55.71 billion.

The steel segment is the leading application in the market.

Rising demand for specialized steel alloys in various industrial applications to drive market growth

Asia Pacific held the highest share of the market in 2025.

Bushveld Minerals, Ansteel Group Corporation Limited, EVRAZ plc, HBIS GROUP, and Glencore are the leading players in the market.

Rising demand for reliable energy storage solutions in the renewable energy sector is driving product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us