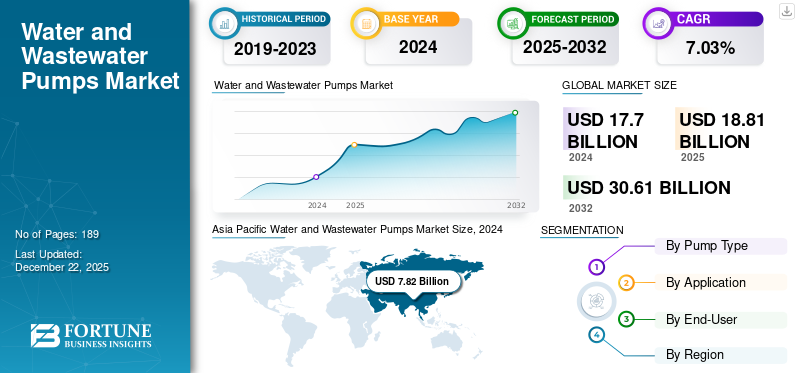

Water and Wastewater Pumps Market Size, Share & Industry Analysis, By Pump Type (Centrifugal Pumps and Positive Displacement Pumps), By Application (Water Supply and Distribution, Irrigation, Desalination, Sewage Treatment, Sludge Handling, and Others), By End-User (Municipal, Industrial, Agriculture, and Residential and Commercial) and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global water and wastewater pumps market size was valued at USD 17.70 billion in 2024. The market is projected to grow from USD 18.81 billion in 2025 and is expected to reach USD 30.61 billion by 2032, exhibiting a CAGR of 7.03% during the forecast period.

The demand for water and wastewater pumps is growing due to increasing urbanization, rising water reuse initiatives, and expanding infrastructure for municipal and industrial water treatment. Population growth leads to higher water consumption and wastewater generation, which in turn requires new pipelines, pumping stations, and treatment plants. The water and wastewater pumps market is growing in the industrial sector due to rising water consumption, strict discharge regulations, and the rising need for efficient water recycling and treatment in industries such as chemicals and power generation.

Rapid urban expansion further drives the demand for reliable and efficient pump systems to support water supply, sewage networks, and treatment facilities. Municipal water and wastewater end-users currently account for the largest market share worldwide. The rising demand for clean water is a key driver, supported by increasing urbanization, rising population, and growing need for safe drinking water. In addition, the use of variable frequency drives in water and wastewater pumps is growing, as these technologies improve energy efficiency and optimize pump performance.

Xylem Inc., Pentair plc, and Sulzer Ltd are the major vendors in the market. These companies hold strong positions due to their extensive product portfolio, global presence, technological innovations, and strong involvement in large-scale municipal and industrial water infrastructure projects.

MARKET DYNAMICS

MARKET DRIVERS

Rising Urbanization and Industrialization to Drive Market Growth

Rising urbanization and industrialization are driving the water and wastewater pumps market growth due to increased demand for process water supply, wastewater treatment, and efficient fluid handling systems. Key sectors such as chemicals, food and beverages, pharmaceuticals, and power generation rely on continuous water management, which further supports market expansion.

In March 2023, Kirloskar Brothers Limited (India) introduced the DB xe end suction pump designed for industrial use. The pump complies with EN733 & DIN24255 standards and incorporates a back pull-out design, broad interchangeability with a dry shaft, and cylindrical and conical stuffing box options. The pump features sealed bearings, a temperature handling range of -10° to 90°C, and can withstand suction pressures up to 5 kg/cm2. Furthermore, the pump can be made from various impeller materials, such as bronze, cast iron, CF8M, and CF8, to meet diverse industrial requirements.

MARKET RESTRAINTS

High Initial Investment to Restrain Market Growth

High initial investment costs are a key restraint in the water and wastewater pumps market. The expense of advanced, energy-efficient systems and installation costs often deters adoption, especially among small utilities and organizations in developing regions. Smart pumps and automated systems have higher upfront costs despite long-term savings.

Limited budgets in developing regions are restraining the water and wastewater pumps market, as financial constraints hinder investment in advanced pumping systems, infrastructure upgrades, and long-term maintenance.

MARKET OPPORTUNITIES

Growing Urbanization in Emerging Economies to Create Significant Opportunities for Market Growth

Urbanization in emerging economies creates opportunities for growth in the water and wastewater market by increasing demand for reliable water supply, sewage infrastructure, and modern treatment systems to support rapidly growing populations and cities. New urban developments need reliable pumping solutions for water distribution and wastewater management.

In June 2023, a new water treatment facility in Emmaboda, Sweden, began recycling process water from Xylem's production facility. Xylem's water reuse technology allows the plant to maintain a constant, safe water supply, even during periods of scarcity. With 1,200 workers creating over 170,000 pumps annually, Xylem's Emmaboda facility is the biggest wastewater pump manufacturer in the world. The factory's on-site water treatment facility, which opened in 2022, can treat 20 million liters of water annually. The recycled water is used to dilute cutting fluids in machining operations, cooling in the foundry, and supplying pump test tanks.

WATER AND WASTEWATER PUMPS MARKET TRENDS

Adoption of Smart and IoT-Enabled Pumps to Support Market Expansion

The adoption of smart and IoT-enabled pumps drives the water and wastewater pumps market by enabling real-time monitoring, predictive maintenance, and improved energy efficiency, thereby reducing operational costs and system downtime.

In September 2024, Franklin Electric Co., Inc., announced improvements to its FPS Submersible Wastewater Pump portfolio. These included the introduction of new NC Series solids-handling pump models, along with a design improvement to its well-liked IGP Series Retrofit Kit for grinder pumps. The upgrades provide wastewater experts with additional tools for handling the most challenging operating conditions.

Download Free sample to learn more about this report.

SEGMENTATION Analysis

By Pump Type

Ability for Handling Large Volume of Water Boosts Centrifugal Pumps Segment Growth

By pump type, the market is segmented into centrifugal pumps and positive displacement pumps. Centrifugal pumps are the dominating market segment due to their efficiency, reliability, and suitability for handling large volumes of fluid. These pumps are ideal for water supply, sewage treatment, irrigation, and industrial processes. The increasing focus on improving water infrastructure, urbanization, and the growing need for efficient wastewater management further drives demand.

Positive displacement pumps are the fastest-growing segment of the market due to their ability to handle high-viscosity fluids, maintain consistent flow rates, and operate efficiently under varying pressure conditions.

By Application

Increasing Demand for Clean Water Encourages the Water Supply and Distribution Segment Growth

The market is segmented by application into water supply and distribution, irrigation, desalination, sewage treatment, sludge handling, and others. Water supply and distribution is the dominating segment in the market, due to increasing demand for clean water and expanding infrastructure.

Irrigation is the second-dominating segment in the market due to increasing agricultural activities, growing demand for efficient water usage, and government support for promoting modern irrigation systems.

By End-User

Rising Urbanization and Surging Demand for Clean Water & Sanitation Support Municipal Segment Growth

By end-user, the market is categorized into municipal, industrial, agriculture, and residential and commercial. The municipal segment captures the key water and wastewater pumps market share due to increasing urbanization, rising demand for clean water and sanitation, and significant government investments in public water infrastructure and wastewater treatment facilities.

The industrial segment is growing rapidly due to increasing demand for process water, wastewater treatment, and strict environmental regulations across manufacturing, chemical, and power generation industries.

WATER AND WASTEWATER PUMPS MARKET REGIONAL OUTLOOK

The market has been analyzed geographically in North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

Asia Pacific

Asia Pacific Water and Wastewater Pumps Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the dominating region in the market. Emerging economies such as China, India, Indonesia, and Vietnam are investing heavily in water supply and wastewater infrastructure, including municipal treatment plants, sewer systems, irrigation networks, and flood control projects, requiring large pumps. The region contributes nearly half of global manufacturing output, with fast-growing industrial sectors in China, India, Southeast Asia, and Australia driving demand for centrifugal and specialized industrial pumps across industries such as oil & gas, chemicals, and pharmaceuticals.

North America

The North American water and wastewater pump market is growing due to several key factors, including infrastructure upgrades, environmental regulations, and technological advancements. North America's water and sewage infrastructure is over 50 years old, requiring urgent upgrades and replacements, especially for pumps used in municipal water supply and wastewater treatment. The choice of raw materials such as stainless steel, cast iron, and specialized alloys plays a critical role in pump performance, durability, and corrosion resistance, especially in harsh and chemically aggressive environments.

U.S.

The U.S. water and wastewater pump is growing due to increasing infrastructure modernization efforts, stricter environmental regulations, and rising demand for efficient water management across municipal and industrial sectors. The U.S. government has announced billions in federal infrastructure investments, including the Bipartisan Infrastructure Law, which allocated over USD 50 billion to water and wastewater systems. Programs such as the EPA’s WIFIA (Water Infrastructure Finance and Innovation Act) are further supporting large-scale municipal upgrades, driving pump demand.

Europe

Europe invests heavily in upgrading aging municipal and industrial water systems in countries such as Germany, France, and Italy. These projects are fueling demand for pumps in the water supply and wastewater treatment applications. EU directives such as the Urban Waste Water Treatment Directive, Drinking Water Directive, Eco‑design, and Energy Efficiency Directive mandate high-efficiency pump designs (e.g., MEI compliance). These regulatory pressures accelerate the replacement of older, inefficient pumps. The demand for high-efficiency water and wastewater pumps in Europe is also increasing due to rising energy costs and the growing need for sustainable water management solutions.

Latin America

Latin America's water and wastewater pumps market is growing due to rising demand for efficient water supply and wastewater management systems. Countries such as Brazil, Argentina, Colombia, and Venezuela are investing heavily in water treatment facilities and upgrading municipal systems, boosting demand for pumps in water and wastewater infrastructure. Regions facing drought and water stress are stepping up wastewater treatment and reuse systems. Stricter environmental mandates are further increasing reliance on advanced pump solutions in municipal and industrial applications. The adoption of IoT-enabled pumps, variable-speed drives, and solar-powered systems is also rising to improve energy savings and automation, particularly in remote and rural areas.

Middle East and Africa

The MEA region is extremely water-stressed, with only ~1% of the world’s freshwater resources serving over 6% of the global population. This scarcity drives government and private investment in desalination, water treatment, and distribution systems, creating strong demand for pumps. High-profile projects include Jordan’s Aqaba–Amman desalination and pipeline project (expected 300 million m³/year capacity) and Senegal’s Mamelles desalination plant, both relying on advanced pumping systems. Across MEA, the adoption of solar-powered pumps, variable speed drives, and IoT-enabled smart pumps is accelerating, especially in remote or rural settings.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Players Focus on Diversifying their Offerings to Expand their Product Portfolio

Industry leaders in the water and wastewater pumps are diversifying their offerings to provide more energy-efficient, reliable, and advanced pumping technologies, aligning with the growing demand for sustainable water management solutions.

- In June 2025, the Pittsburgh-based water and wastewater treatment solutions business Newterra, owned by the Chicago-based private equity firm Frontenac, was purchased by the Danish company Grundfos, a world leader in cutting-edge water solutions. In addition to Grundfos's strategic purchases in recent years, the agreement would expand the company's portfolio in water treatment.

List of Key Water And Wastewater Pumps Companies Profiled in the Report

- Xylem, Inc. (U.S.)

- Grundfos Holding A/S (Denmark)

- Sulzer Ltd. (Switzerland)

- Flowserve Corporation (U.S.)

- KSB SE & Co. KGaA (Germany)

- Ebara Corporation (Japan)

- Wilo SE (Germany)

- Pentair plc (U.S.)

- SPP Pumps Ltd. (U.K.)

- Franklin Electric Co., Inc. (U.S.)

- The Weir Group PLC (U.K.)

- Kirloskar Brothers Limited (India)

- Tsurumi Manufacturing Co., Ltd. (Japan)

- Torishima Pump Mfg. Co., Ltd. (Japan)

- Goulds Pumps (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In September 2024, Grundfos finalized the acquisition of Culligan's Commercial & Industrial (C&I) division in Italy, France, and the U.K. The purchase strengthens Grundfos's position in the European water treatment market by providing a complementary portfolio of products and technologies for industrial and commercial applications. This transaction follows a string of purchases made by Grundfos in water treatment, including Eurowater in 2020, MECO in 2021, and Water Works in 2022.

- In September 2024, the acquisition of Culligan's Commercial & Industrial (C&I) division in Italy, France, and the U.K. will be finalized by Grundfos. The purchase strengthens Grundfos's position in the European water treatment market by providing a complementary portfolio of products and technology for industrial and commercial applications. This transaction is the most recent in a string of purchases made by Grundfos in water treatment, including Eurowater in 2020, MECO in 2021, and Water Works in 2022.

- In September 2023, Sulzer invested in the U.S. water sector to support the development of an efficient water infrastructure across the country. The company committed more than USD 12 million to product production and testing facilities.

- In August 2023, the Wilo Group established a technologically advanced, environmentally friendly manufacturing facility in Kesurdi, India. The plant would produce high-quality pump systems to serve markets in India, the Middle East, Africa, and Southeast Asia.

- In March 2022, Flowserve Corporation, a leading provider of flow control products and services, entered into a non-exclusive partnership agreement with Gradiant. By integrating Gradiant's cutting-edge customized water treatment technology with Flowserve's flow control solutions and product portfolio, this partnership aimed to deliver comprehensive water treatment solutions to address the world’s most pressing water and wastewater challenges.

REPORT COVERAGE

The report provides a detailed analysis of the market, focusing on key aspects such as leading companies, product type, and competitive landscape. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.03% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Pump Type

|

|

By Application

|

|

|

By End-User

|

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 17.70 billion in 2024.

In 2024, the Asia Pacific market value stood at USD 7.82 billion.

The market is expected to exhibit a CAGR of 7.03% during the forecast period (2025-2032).

By type, the centrifugal pumps segment leads the market.

Rising urbanization and industrialization are key factors driving market growth.

Some of the top major players in the market are Xylem, Inc., Sulzer Ltd., Grundfos, and others.

Asia Pacific dominates the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us